- Bitcoin’s leverage ratio climbed to a 2-year high, fueling fears of over-leveraging

- On the price charts, BTC appreciated by 10.21% over the past week

As a seasoned researcher with years of experience in the volatile world of cryptocurrencies, I’ve seen my fair share of market euphoria and subsequent corrections. The recent surge in Bitcoin’s price to an all-time high has been no exception. While it’s always exciting to witness such significant gains, a rise in leverage ratio should never be taken lightly.

Over the past week, Bitcoin reached a fresh all-time high (ATH) on price graphs, hitting a record peak of $77,270. This anticipated achievement ignited a wave of excitement within the market, leading to a broad rise in trading leverage.

A different type of ‘high’

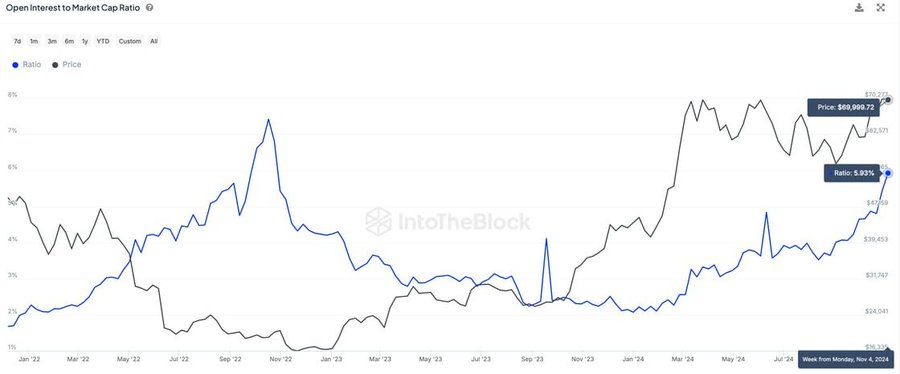

According to an analysis of IntoTheBlock, BTC’s leverage ratio climbed to a 2-year high recently.

Based on recent findings, the Open Interest for Bitcoin perpetual swaps, compared to its total market value, has risen to levels not seen since the fall of FTX in 2022.

Expressing it in a simpler manner: When we state that Bitcoin’s (BTC) leverage is at a two-year peak, it implies that more traders are trading BTC using borrowed funds than they have in the past two years. This ratio is calculated by comparing the Open Interest to the market cap of the crypto.

From my perspective as an analyst, a higher leverage ratio suggests that investors are growing more assured about the direction of Bitcoin’s price fluctuations. This confidence often escalates volatility, particularly when leverage is substantial. To put it simply, even minor price shifts can instigate liquidations, thereby amplifying market fluctuations.

It’s important to point out that in 2021, when the leverage ratio significantly increased, it led to a process called deleveraging which subsequently caused a market adjustment or correction. This is typically due to the fact that even small shifts can trigger more sell-offs, snowballing into larger market declines.

Translated more casually, an increase in the leverage ratio might signal an impending correction or adjustment in the market towards more balanced and stable conditions.

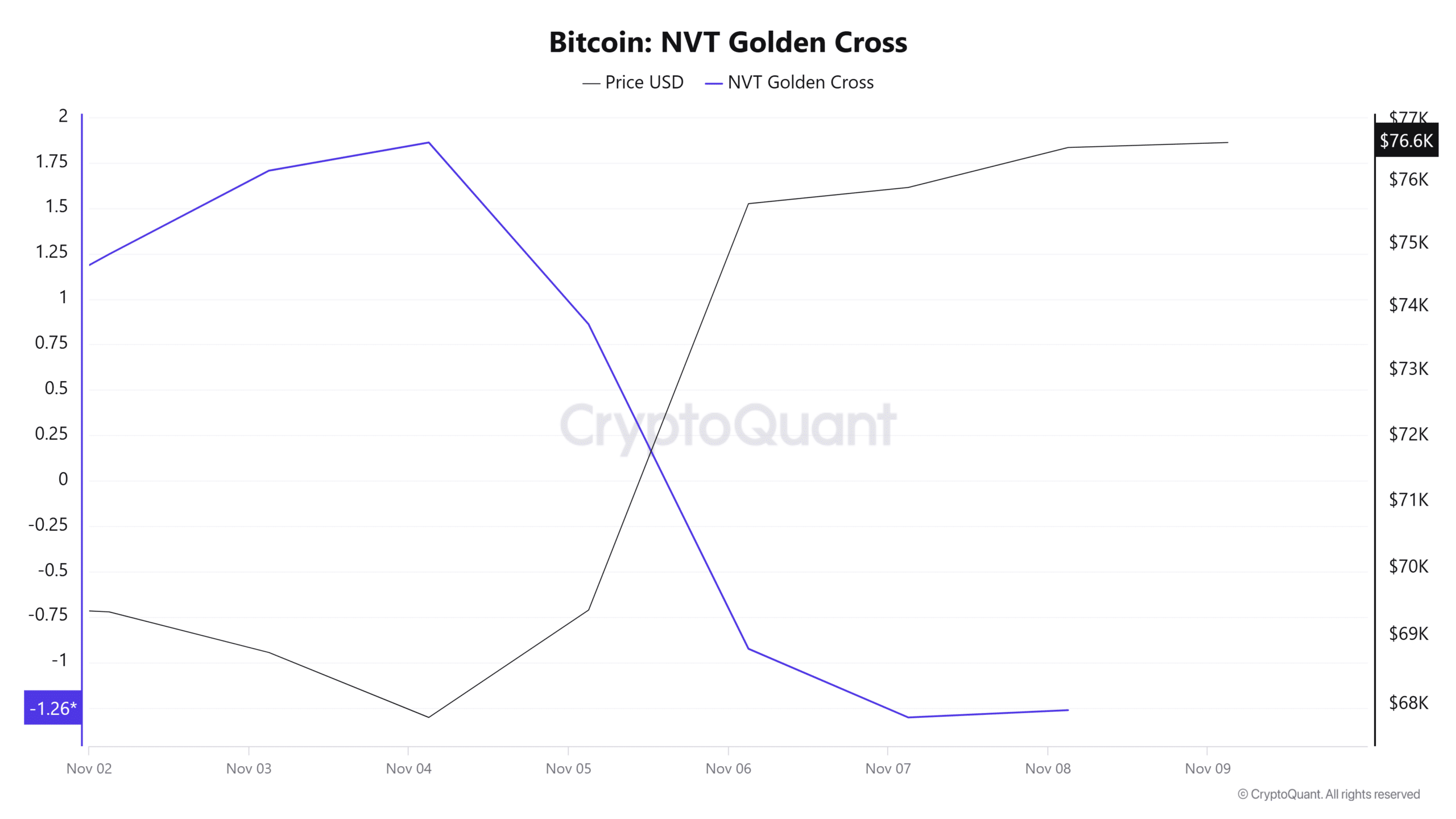

The possibility that the rally might not continue appeared to be reinforced by a decrease in the NVT Golden Cross indicator.

When a golden cross forms, it’s generally seen as a positive sign for the market. However, if the NVT Golden Cross is decreasing, this suggests that the current price increase could be more about speculative investments rather than robust network usage. Consequently, there’s a possibility that the asset might be overvalued in relation to its network activity.

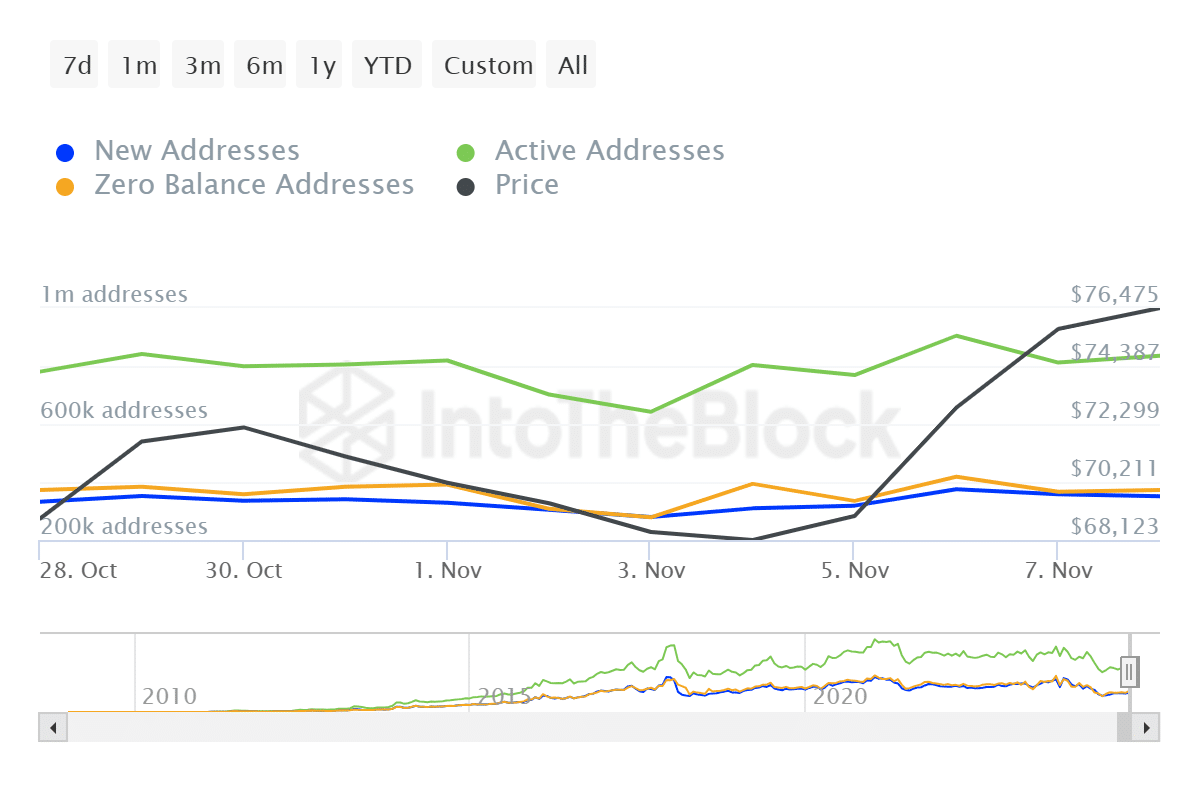

The decrease in the number of active addresses provides additional evidence for this occurrence. In fact, after reaching a high of 901 thousand, the number of active addresses dropped to 835 thousand, as reported by IntoTheBlock.

A decline in active addresses implies lower usage and network participation.

What it means for BTC’s price charts

Over-leveraging usually makes the market more sensitive to price changes.

If many investors in the market have borrowed too much money (over-leveraged), then even minor price decreases could prompt a series of forced sales (liquidations). This chain reaction might cause rapid selling and significant market fluctuations (high volatility). Under such conditions, Bitcoin’s value may experience a retreat to find stability around $73,600.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Rick and Morty Season 8: Release Date SHOCK!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-11-10 06:15