Bitcoin, the digital gold that’s more volatile than my mood after a third cup of coffee, is apparently staging a comeback. Or at least that’s what the charts are whispering. Sellers, once as relentless as a telemarketer at dinnertime, are now showing signs of exhaustion. 🥱

Profit-taking has shrunk faster than a wool sweater in a hot wash, and market liquidity flows suggest that Bitcoin investors are regaining their confidence. Or maybe they’re just bored of watching their portfolios bleed red. Either way, BTC rallied 3.22% recently, which is like finding a $20 bill in your winter coat—small but satisfying.

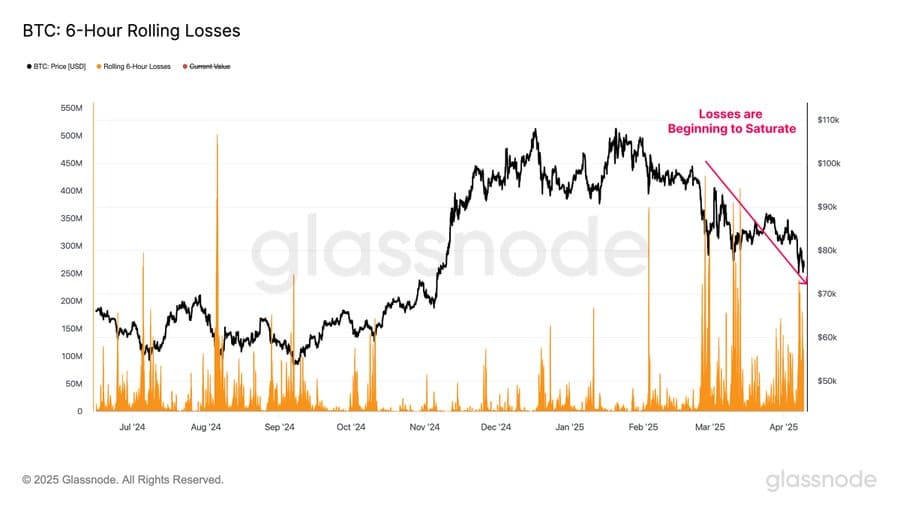

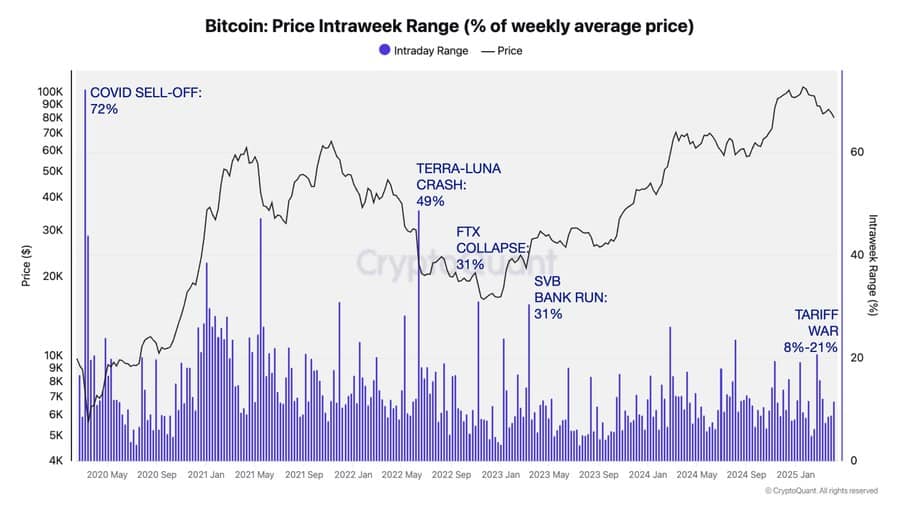

But wait, there’s more! Seller fatigue is setting in, which is crypto-speak for “they’re running out of steam.” This usually means a rebound is on the horizon, like a rainbow after a storm. Or, in this case, after a series of storms that included the U.S. tariffs, Covid-19, Terra-Luna, FTX, and the SVB banking scare. Honestly, Bitcoin has been through more drama than a reality TV show. 📉📈

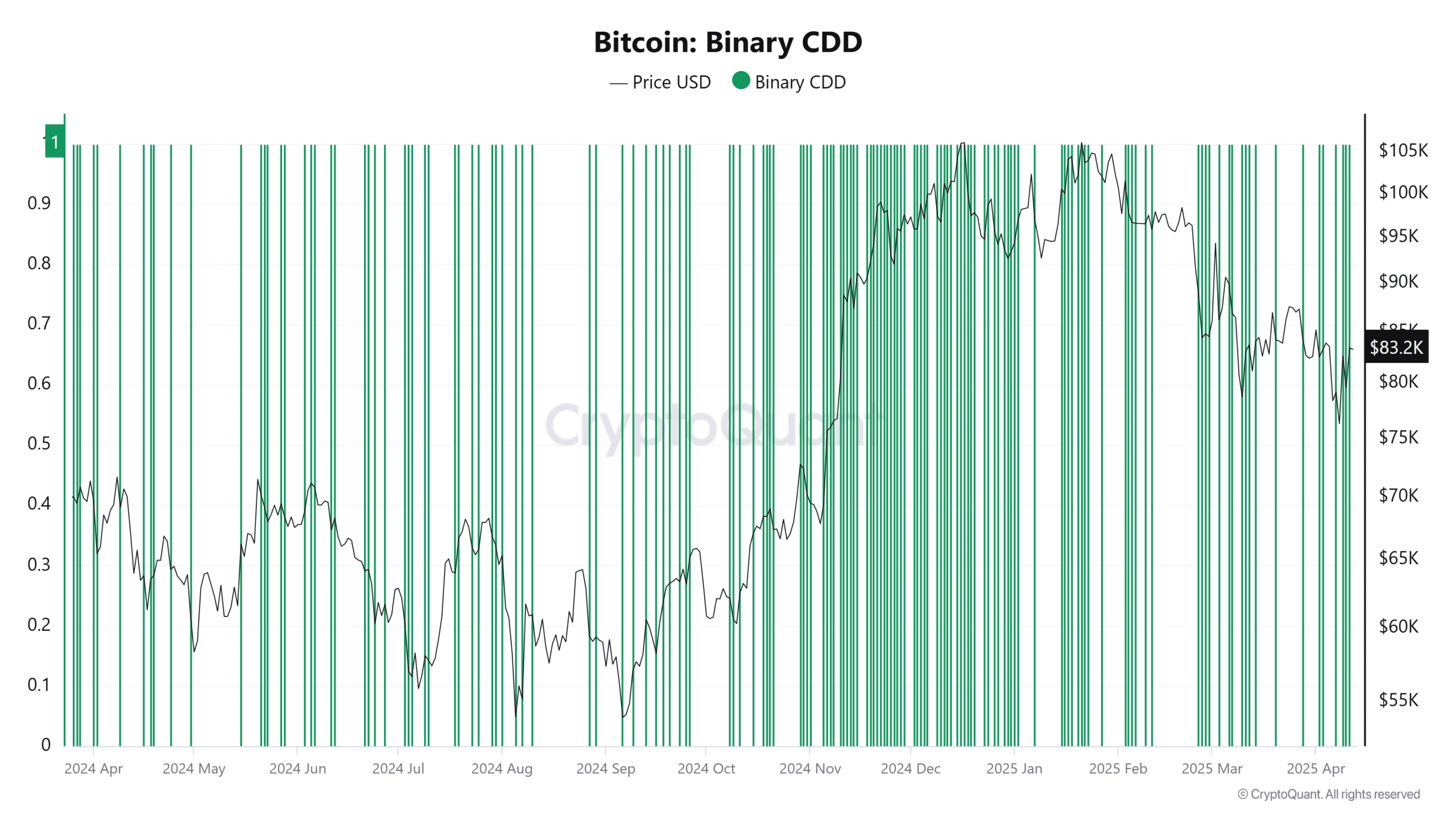

AMBCrypto, the Sherlock Holmes of crypto analytics, dug deeper and found that long-term holders—those stoic believers who’ve been holding onto their Bitcoin like it’s a family heirloom—are finally selling. The Binary Coin Days Destroyed (CDD) metric is flashing a reading of 1, which is basically the crypto equivalent of a white flag. 🏳️

But here’s the twist: when long-term holders sell, it’s often a sign of capitulation. They’re either locking in gains or cutting losses, which usually means the market is about to turn. Think of it as the calm before the storm, except this storm might actually be good for your wallet.

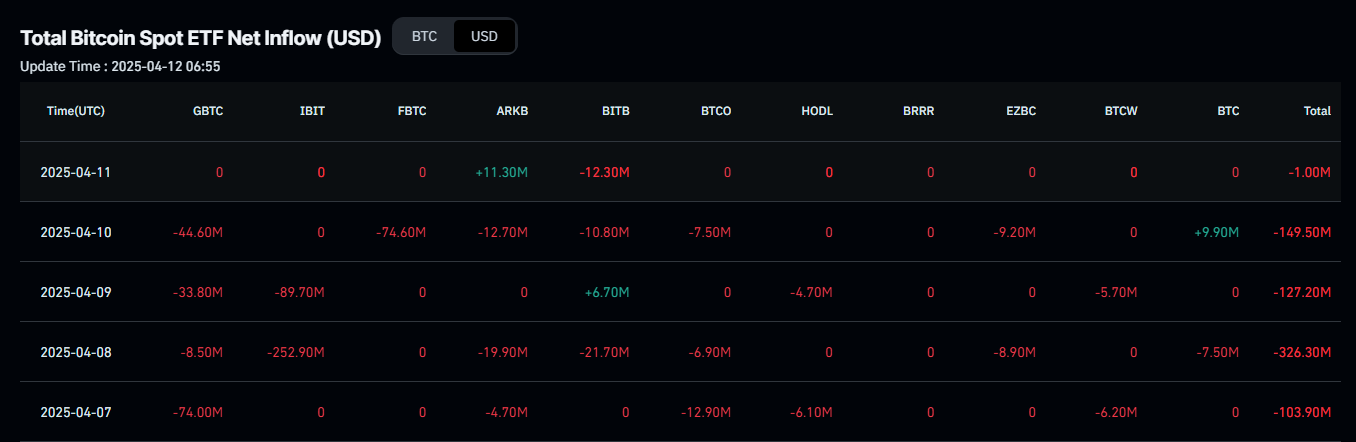

Institutional netflows have also dried up, with only $1 million in Bitcoin sold recently, down from a $176.72 million four-day average. That’s like going from a firehose to a leaky faucet. Big-money players are shifting gears, and their actions often dictate Bitcoin’s next move. 🏦

Meanwhile, in the spot market, netflows have flipped negative, which is crypto-speak for “bullish.” Bitcoin is being moved into private wallets faster than I move snacks into my mouth during a Netflix binge. So far, 1,959 BTC worth around $162 million have been scooped up at an average price of $83,000. If this pace continues, Bitcoin could break out sooner than expected. 🚀

So, what’s next? Seller fatigue is here, and a relief rally could be the next chapter in this never-ending crypto saga. Or, as I like to call it, “Bitcoin: The Comeback Tour.” 🎤

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2025-04-12 22:17