- Bitcoin’s next significant demand zone was around $56,000.

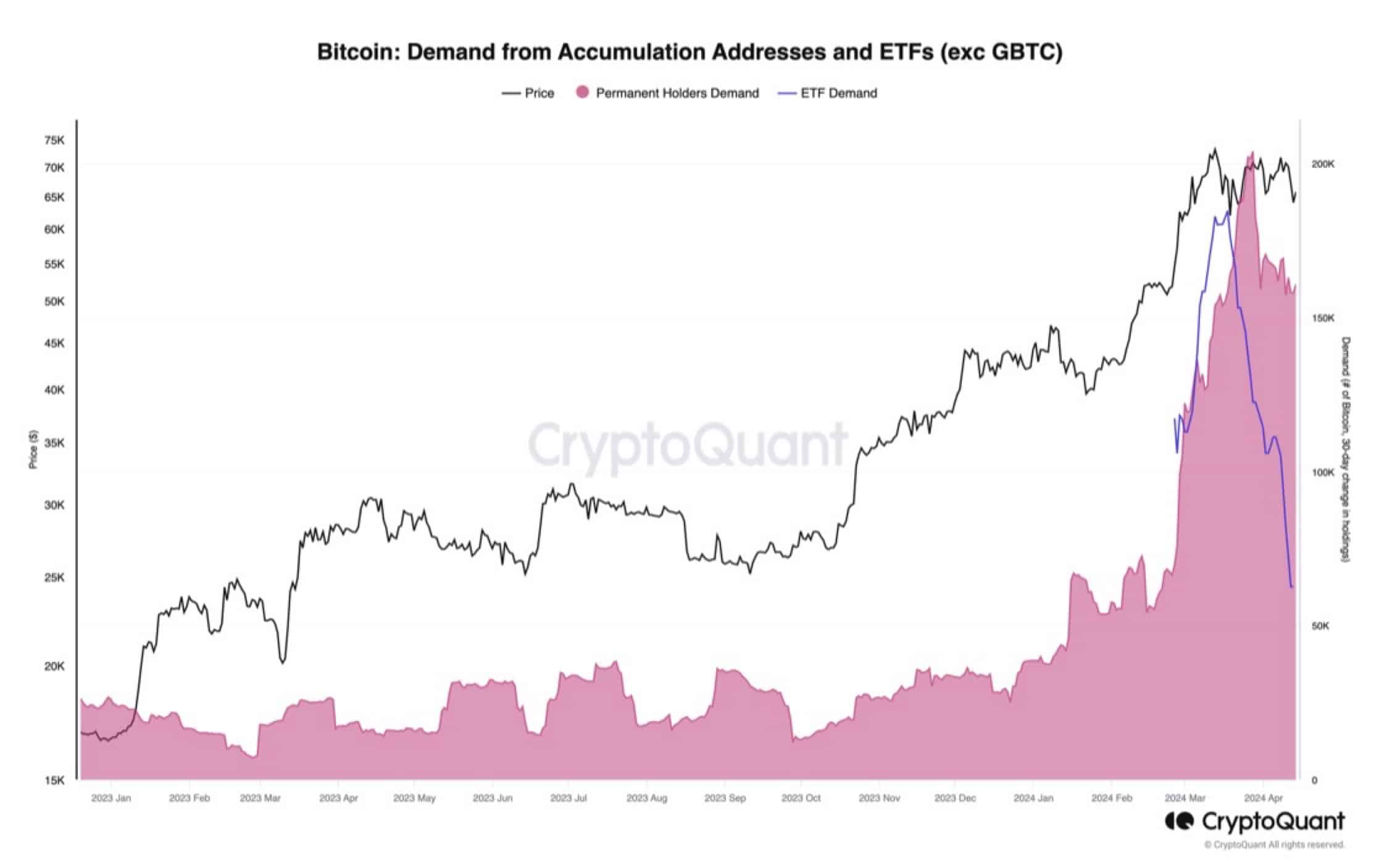

- Demand slowed down, both from new ETFs and existing holders.

Bitcoin’s price dropped by over 4% within the last 24 hours, reaching the $62,000 range based on data from CoinMarketCap. The trading activity saw a significant increase of approximately 5%, amounting to around $45 billion in total volume, indicating heightened market interest.

Will the slump continue?

It’s worth noting that the recent drop in Bitcoin’s price occurred at a significant buying area, based on data from IntoTheBlock, a leading on-chain analysis firm. Previous transactions revealed that over a million wallets had acquired BTC for an average cost of $64,300, making it a robust support level.

Now that the bears have broken through the support, the next major resistance area is approximately $56,000. If buying pressure fails to pick up, Bitcoin could potentially slide down to this point.

Was Bitcoin getting purchased or…?

Well, a few smart investors were using the market downside to load their Bitcoin bags.

According to Lookonchain’s on-chain tracker, a wealthy individual purchased approximately 244 Bitcoins, equivalent to around $15 million, within the past two days. Previous records indicate that this investor has amassed roughly 915 Bitcoins since late December 2023.

But was there a broader market accumulation trend?

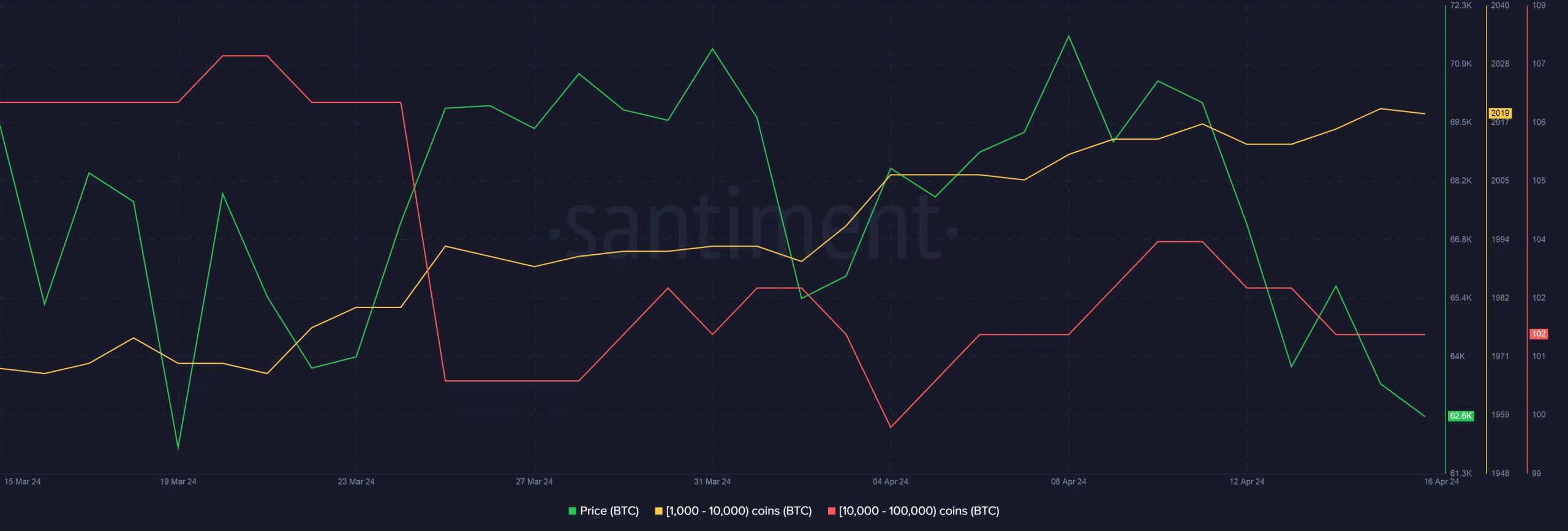

According to AMBCrypto’s interpretation of Santiment’s findings, whale investors showed no sense of urgency in buying large amounts of Bitcoin.

People with wallets containing between 1,000 and 10,000 coins didn’t experience much growth last week. In contrast, those holding between 100,000 and 1 million coins sold off their coins during that time.

According to Julio Moreno, the Head of Research at CryptoQuant, his research supported the previous results. Using data as evidence, he demonstrated that the desire for Bitcoin among new Exchange-Traded Funds (ETFs) investors and existing holders has noticeably decreased.

Derivatives markets still bullish on BTC

The worrying trends in Bitcoin’s price may lead to more decreases in the near future, causing anxiety among investors.

It’s intriguing that speculative traders weren’t jumping on this optimistic outlook based on AMBCrypto’s interpretation of Coinglass’ figures. The Longs/Shorts Ratio, as explained in AMBCrypto’s analysis, remained above 1 – an indication that the greater number of futures traders were anticipating a market recovery.

Read More

- WCT PREDICTION. WCT cryptocurrency

- PI PREDICTION. PI cryptocurrency

- Viola Davis Is an Action Hero President in the ‘G20’ Trailer

- EastEnders’ Balvinder Sopal hopes for Suki and Ash reconciliation: ‘Needs to happen’

- Has Unforgotten Season 6 Lost Sight of What Fans Loved Most?

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Michael Saylor’s Bitcoin Wisdom: A Tale of Uncertainty and Potential 🤷♂️📉🚀

- Michelle Trachtenberg’s Mysterious Death: The Unanswered Questions

- Upper Deck’s First DC Annual Trading Cards Are Finally Here

- Buckle Up! Metaplanet’s Bitcoin Adventure Hits New Heights 🎢💰

2024-04-16 13:11