- Into The Cryptoverse CEO forecasts Bitcoin’s future price movements.

- Increasing greed warrants caution.

As a seasoned researcher with years of experience in the crypto market, I can’t help but feel a mix of excitement and caution when it comes to Bitcoin’s future price movements. The upcoming weeks are indeed crucial, as we stand at a crossroads between historical trends and current market conditions.

With October, often referred to as ‘Uptober’, drawing to a conclusion, there’s just one topic that seems to be on everyone’s lips: What lies ahead for Bitcoin [BTC]?

It appears that Benjamin Cowen, the CEO and founder of Into The Cryptoverse, might hold the key insights. In his recent video, he underscored the significance of the upcoming final week of the current month, stressing its importance.

This upcoming week is likely to determine the direction Bitcoin will take for the remainder of Q4.

Down or up: Where will Bitcoin go?

Cowen explained that the ‘king coin’ (presumably Bitcoin) stands at a crucial juncture, where its trajectory could be influenced by either the cyclical perspective or the monetary policy perspective.

Historically, BTC has performed strongly in the fourth quarter of its halving years.

Absent any adverse economic trends, it’s likely that the current trajectory could cause prices to rise during Q4 2024. If the value of the coin manages to surpass $70,000 consistently, this suggests a positive cycle will continue.

Instead, if Bitcoin experiences a dip around the $70,000 price point, potentially falling to $64,000, the overall monetary policy perspective might hold sway.

From this standpoint, it seems consistent with past trends that Bitcoin might dip following its highs in April and August. This implication points towards a short-term reversal, with the major surge possibly postponed until early 2025.

Upcoming labor market report: A decisive factor?

However, it’s the labor market data that may determine the near-future trend of the King Coin, as suggested by the CEO.

It’s worth mentioning that, according to AMBCrypto, historically, periods of less job growth (fewer jobs being added) have tended to trigger Bitcoin price increases.

After the April employment data released in early May, it experienced a 6% increase due to the softening labor market. On the flip side, robust job reports in June and July coincided with drops in BTC’s price. If this trend continues, the upcoming report could significantly impact Bitcoin’s future outlook.

As an analyst, I’ve noticed that Cowen’s observation goes beyond just the movement of Bitcoin’s price. They point out that Bitcoin’s market dominance is approaching a significant 60% threshold. This dominance level, when reached, underscores its expanding influence over the market and could potentially trigger broader adjustments across the cryptocurrency landscape.

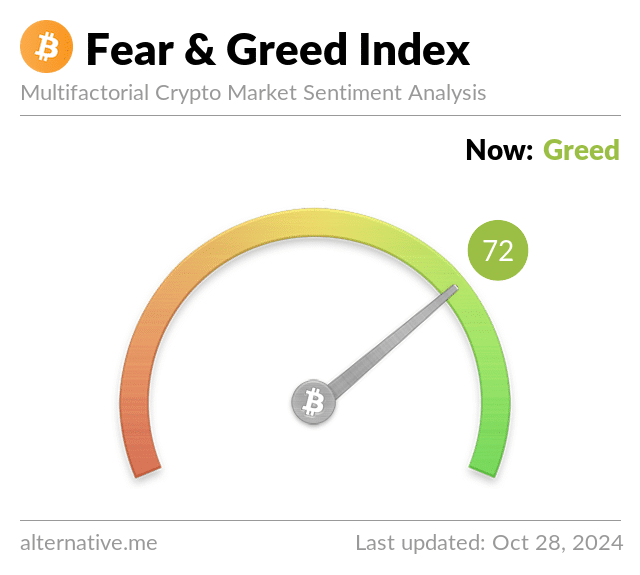

BTC’s greed rises

At the current moment, the Fear and Greed Index for Bitcoin stands at 72, contributing further excitement to the situation.

It’s important to point out that when there’s a high level of greed among investors, it usually means they anticipate further price increases, which strengthens their optimistic attitude, or bullishness.

As an analyst, I find myself pondering over the current market conditions, which, despite their promising growth, could potentially signal overheating. This is particularly true should any external elements like regulatory changes or economic indicators cause a shift in investor sentiment, leading to mass sell-offs.

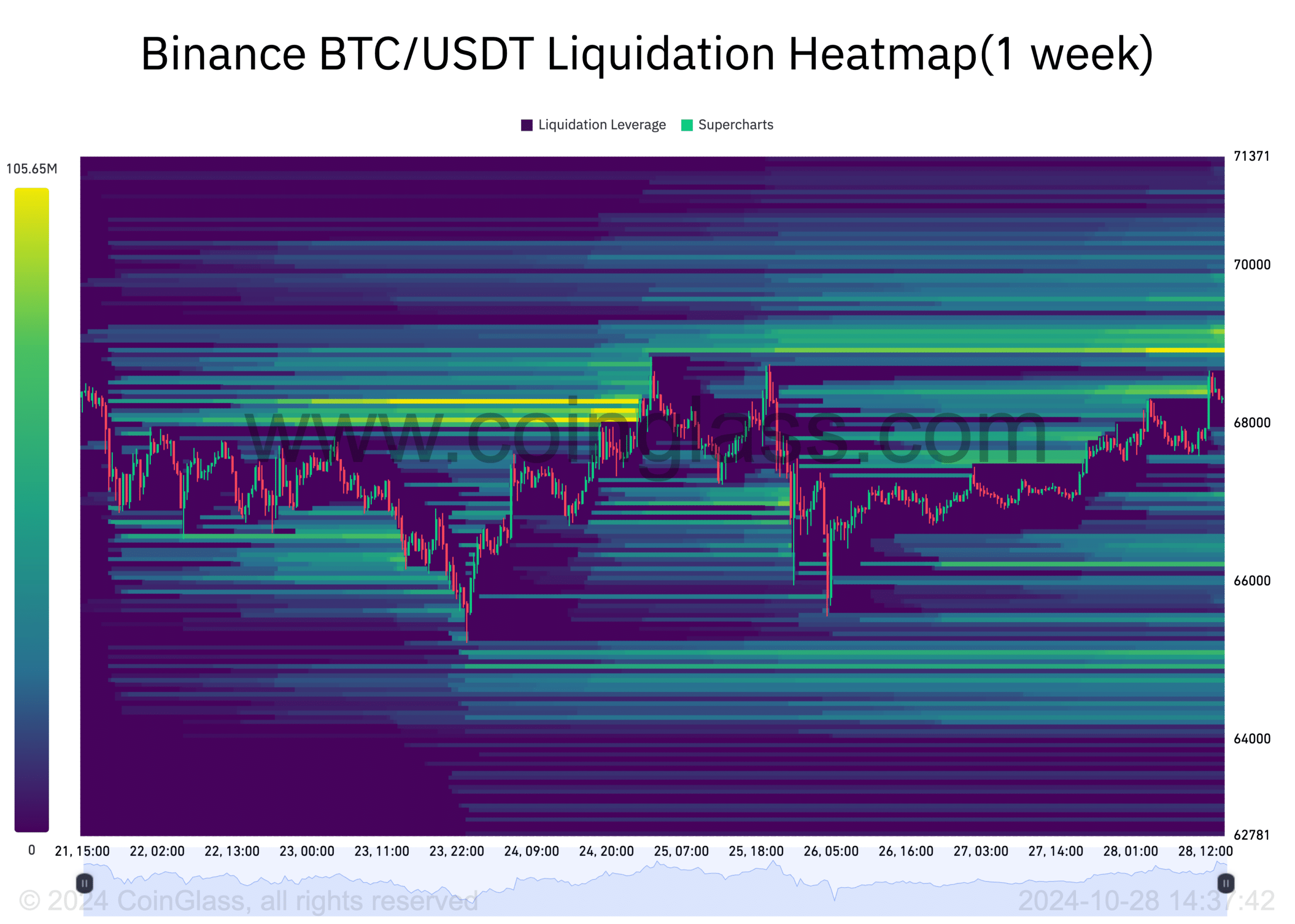

What does the liquidation heatmap say?

To explore BTC’s potential short-term path further, AMBCrypto analyzed the one-week liquidation heatmap from Coinglass.

The heatmap revealed a strong liquidity cluster at around $68,900. So, in the short term, a move toward this magnetic zone can likely materialize.

At this stage, the coin might experience either a refusal or a significant advance, both scenarios having potential consequences for the overall market.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Furthermore, AMBCrypto’s analysis suggested a potential decrease in supply, which might trigger substantial increase in prices, making the second option (upward price movement) more plausible.

Read More

2024-10-29 00:08