- Overleveraged traders engaging in JPY carry trade may have had their hands in the Bitcoin cookie jar.

- Direct and indirect exposure influenced crypto performance as BOJ hiked rates.

As a seasoned market analyst with over two decades of experience under my belt, I’ve witnessed numerous market cycles and have learned to read between the lines. The recent sell-off in Bitcoin and other cryptocurrencies left many scratching their heads, but I believe I’ve uncovered a plausible explanation.

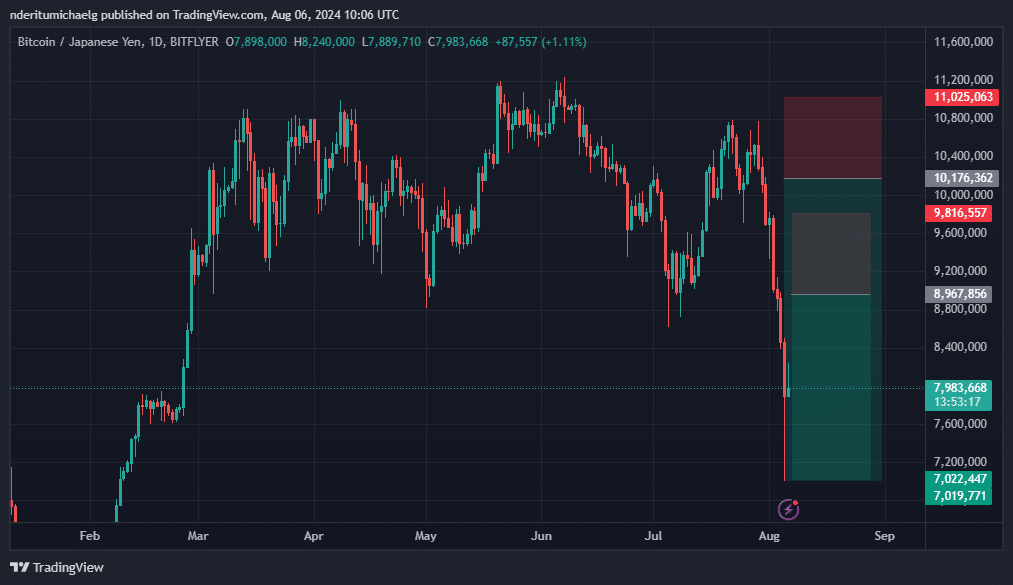

It seems that the heavy selling pressure for Bitcoin (BTC), which was observed last week and extended into the trading session on the 5th of August, has now subsided.

The markets have seen a slight recovery in the last 24 hours.

Due to the crash affecting more than just Bitcoin and cryptocurrencies, many people were puzzled, asking themselves what on earth was going on, metaphorically speaking.

Multiple market selloffs have sparked various explanations from analysts, and one compelling theory circulating online seems credible.

A carry trade on the Japanese Yen

A carry trade refers to a situation where investors take advantage of differences in interest rates by borrowing money in a currency with low interest rates, then using that borrowed money to purchase a higher-yielding currency and invest in assets within that currency.

In recent times, the Bank of Japan has garnered significant attention because they’ve been modifying their economic strategies. Among these adjustments is a switch from negative interest rates to positive ones.

In recent times, on July 31st, the Bank of Japan increased interest rates by 0.25%. This move strengthened the Japanese Yen compared to the U.S. dollar.

Consequently, heavily indebted investors who participated in the JPY carry trade found themselves needing to sell their assets to repay their loans.

Was Bitcoin exposed to the JPY carry trade?

There’s a possibility that certain investors who practiced carry trading may have had a direct investment in Bitcoin.

Here are entities and organizations who spotted a chance to obtain low-interest credit and invest in assets with high returns, possibly including Bitcoin as one of those assets.

An analyst proposes that the extensive presence across various sectors could be the reason behind the significant selling observed across diverse investment categories.

After the Bank of Japan raised interest rates, there might have been indirect effects on cryptocurrencies as well. Some investors who specialize in short-selling were anticipating this moment to exploit potential losses in the market.

In simpler terms, the panic caused by the stock declines further intensified the pessimism among investors. Since the 31st of July, Bitcoin has decreased up to 31% compared to the Japanese Yen, while its drop against the U.S. dollar was relatively smaller at 25%.

As an analyst, I’ve noticed that the same factors causing this current outbreak could prolong the recovery process. However, this downturn might also present itself as a promising opportunity to invest, given the potential for future growth.

That may not necessarily indicate that BTC and crypto, at large, are out of the woods yet.

Read Bitcoin’s [BTC] Price Prediction 2024-25

In July, Bitcoin received several pieces of positive news that boosted investor confidence (bullish sentiment). However, a potential adverse event could further impact cryptocurrency negatively in the coming weeks, potentially causing prices to drop.

Consequently, this ambiguity suggests a possible explanation for why Bitcoin’s rebound could take longer than anticipated, before the fear of missing out (FOMO) returns strongly.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

2024-08-06 17:11