- Bitcoin holders were still profitable, which threatened more selling pressure should the market uncertainty continue.

- The MVRV ratio’s predicted dip could take Bitcoin prices below the key $59k support level

In April, the interest for Bitcoin (BTC) decreased noticeably. The expansion of demand and Exchange Traded Fund (ETF) investments dropped, but during the current month, the Bitcoin ETF attracted a significant sum of $555 million in fresh investments.

The lack of movement in BTC brought doubt to investors’ minds.

Over the past week, there was an outflow of approximately $84 million from U.S.-listed Bitcoin exchange-traded funds (ETFs). As a result, the total assets managed by these Bitcoin funds experienced a decline of around 22%.

Two on-chain metrics indicated that we could be in for a major correction.

The theory of mean reversion and Bitcoin’s need to reset

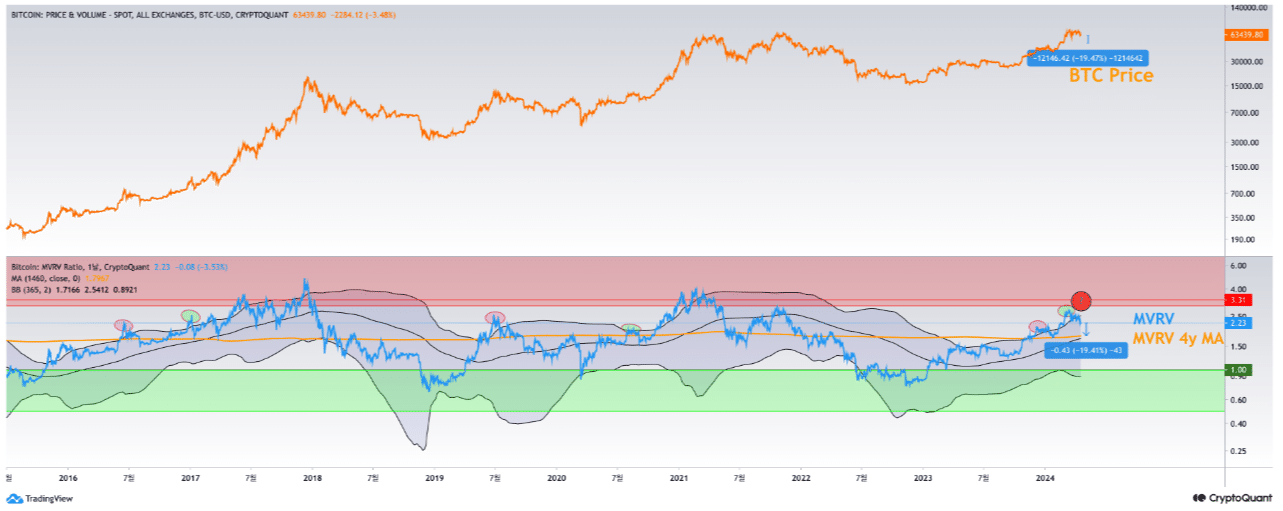

In simpler terms, a recent analysis from CryptoQuant’s Insights suggested that based on the MVRV (Moving Average Value Realized) indicator and Bollinger Bands, there might be a potential 20% drop in Bitcoin’s price. The user employed both the MVRV ratio available on CryptoQuant and the Bollinger Bands in their assessment.

The bands function as a mean reversion signal. Once the bands’ limits are exceeded, it generally (though not always) results in a price correction back towards the average.

The analyst noted on the graph that the chart’s upper limit had been surpassed more recently, yet the MVRV ratio had returned to its boundaries. This implied a potential drop towards the 365-day moving average.

A 20% decrease in Bitcoin’s price would result from such a reversal, making the MVRV ratio, currently at 2.23, move towards the normal range of around 1.7.

It could be the kind of reset that BTC has seen multiple times during bull markets.

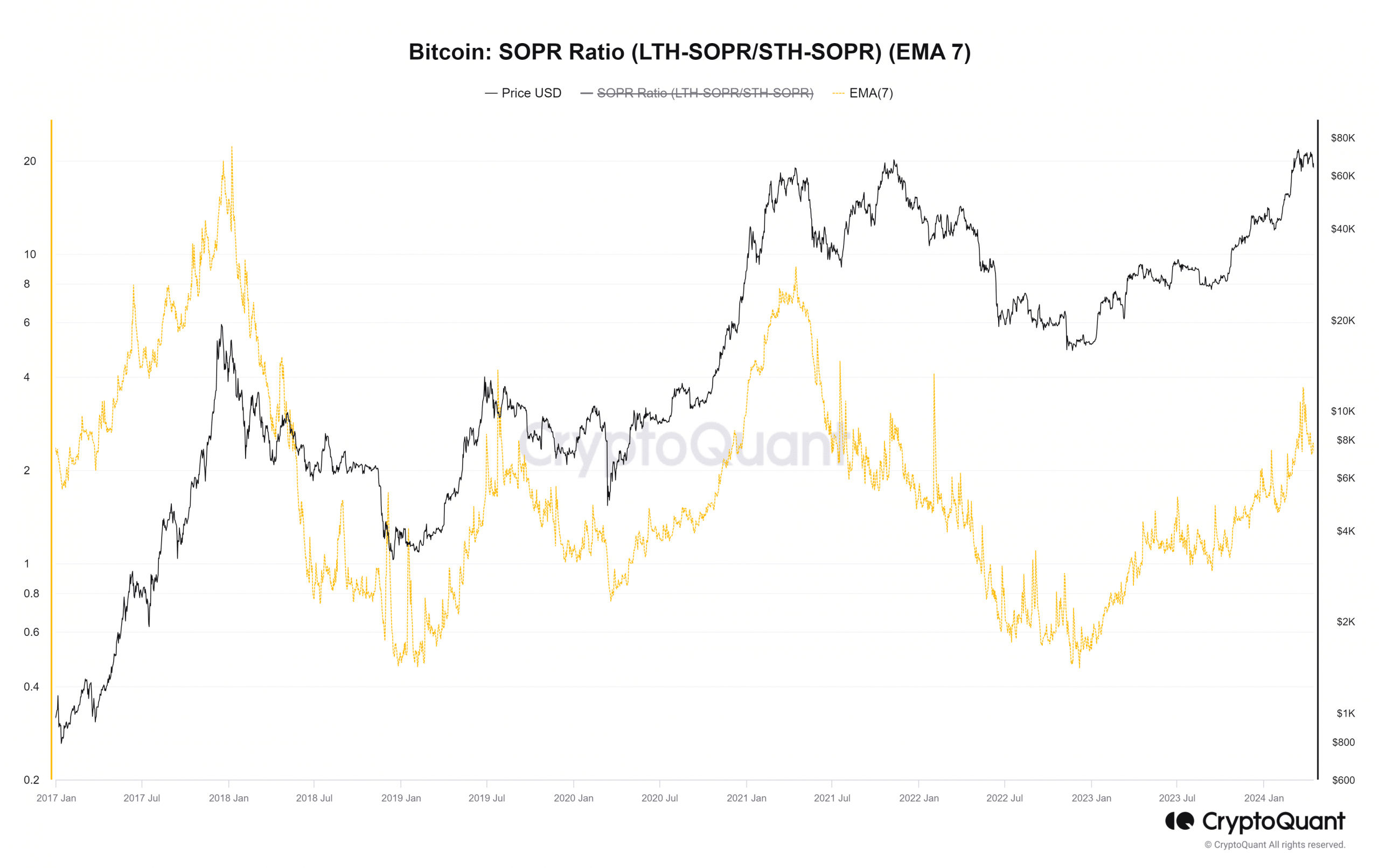

The SOPR underlined long-term holders were moving

The spent output profit ratio (SOPR) reflects the level of profits for market players. It reached a peak of 3.7 on March 23rd, but has seen a significant decrease since then as indicated by the seven-day moving average.

This showed that BTC holders were at a tidy profit, even after the recent selling pressure.

The current market value is roughly equivalent to where the Spent Output Price Ratio (SOPR) peaked in July 2019, at which point the market had been rejected following a SOPR reading of 4.2. However, it’s important to note that the present conditions are not identical to those in 2019.

Back then, a bear market rally had ended, while now we are witnessing a bull market beginning.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Another interpretation of the decline in the Spent Output Probability Ratio (SOPR) for Bitcoin is that it might signal a short-term peak. In this scenario, the market requires some breathing room to collect itself and deal with the selling pressure instigated by anxious investors and profit-takers.

This scenario, if it plays out, would go hand-in-hand with what the MVRV Bollinger bands signal.

Read More

- LDO PREDICTION. LDO cryptocurrency

- JASMY PREDICTION. JASMY cryptocurrency

- Chainlink to $20, when? Why analysts are positive about LINK’s future

- Citi analysts upgrade Coinbase stock to ‘BUY’ after +30% rally projection

- Why iShares’ Bitcoin Trust stock surged 13% in 5 days, and what’s ahead

- Spot Solana ETF approvals – Closer than you think?

- Orca crypto price prediction: Buying opportunity ahead, or bull trap?

- Can Ethereum ETFs outperform Bitcoin ETFs – Yes or No?

- How Potential Biden Replacements Feel About Crypto Regulation

- Why Shiba Inu’s 482% burn rate surge wasn’t enough for SHIB’s price

2024-04-18 10:15