-

A Galaxy Digital report highlighted three different views on the impact of Bitcoin halving.

Arthur Hayes pinned institutional demand for BTC on sovereign bond market issues.

In just under two days, Bitcoin’s (BTC) fourth halving will occur, sparking much anticipation and controversy in the market. Some investors believe that this event will lead to a surge in Bitcoin’s price, making it a bullish prediction.

Another opposing section deems the halving event to be bearish, while others see it as negligible.

But most analysts agree on one thing — each halving is unique and different.

Looking back at the last two bull markets, Coinbase Institutional highlighted their distinctiveness in their recent statement.

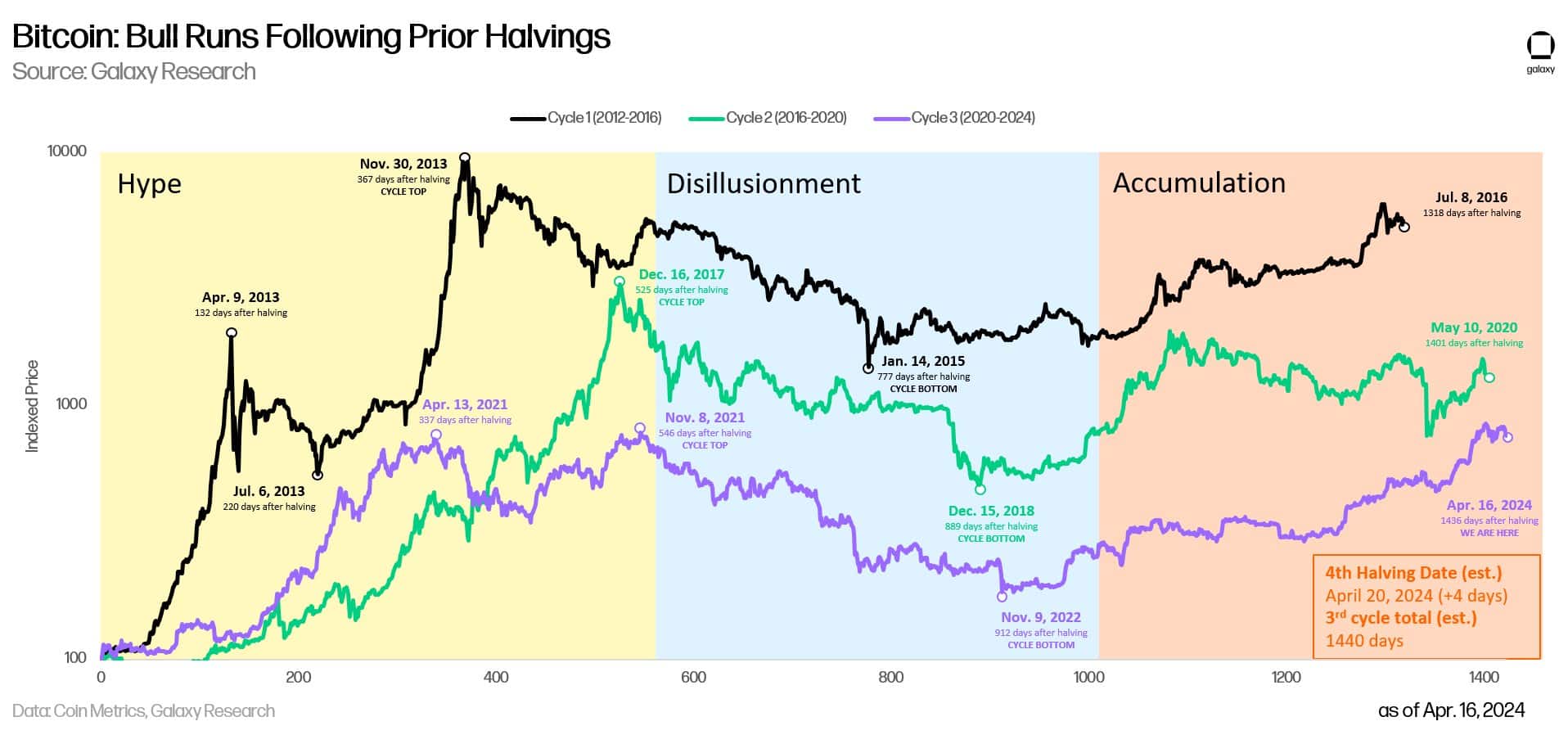

Cryptocurrency market uptrends vary. Previous uptrends continued for approximately 3.5 years each. We’ve been experiencing one now for around 1.5 years. Prices rose by about 113 times and 19 times during the last two uptrends. So far, prices have risen by a factor of 4 in this current trend.

BTC halving impact: Bullish, bearish, and neutral views

In a recent report, Galaxy Digital analyzed three perspectives on how Bitcoin’s (BTC) upcoming halving event might influence the cryptocurrency market.

In a optimistic scenario, the report pointed out that cutting block rewards in half (through a process called halving) results in less Bitcoin being released into circulation each day. This decrease in supply can lead to an increase in demand and ultimately cause prices to go up.

Additionally, miners’ sell pressure is reduced when their block rewards are slashed by half.

After the Bitcoin halvings in November 2012, July 2016, and May 2020, when mining rewards were cut in half, there was less selling pressure from the mining community. This reduction in sell pressure caused an uptick in Bitcoin’s value. Similar price increases may occur following the next halving event.

Instead of viewing the upcoming bitcoin halving as bullish, some believe it to be a “sell-before-the-event” situation. This marks a shift from previous cycles where bitcoin’s price was lower leading up to the halving.

So, the bearish group believes the halving has already been priced in. The report noted,

Before the last two price drops, Bitcoin had fallen more than 42% from its past record highs. In other words, the significant rallies of 2017 and 2020 hadn’t started yet in Bitcoin’s price history at this stage.

Furthermore, the bears argue that the post-halving event may negatively impact most miners and potentially weaken the network’s security.

Some analysts in the cryptocurrency community take a more laid-back approach towards Bitcoin’s halving event, viewing it as having little impact (neutral) on the digital currency’s price. According to this perspective, the BTC price is primarily influenced by market demand and larger economic conditions.

On the neutral view, the report read,

During a bull market after a Bitcoin halving event, the price increase is more likely influenced by shifts in demand rather than supply. Factors such as global financial liquidity, central bank interest rates, and larger economic trends may play a significant role in this correlation.

Arthur Hayes, the founder of BitMEX and CIO at crypto fund Maelstrom, holds a nuanced perspective on the matter.

In a recent interview, Hayes shared why institutions are investing in Bitcoin. He explained,

Institutional investors are drawn to Bitcoin for reasons beyond it being an existing cryptocurrency. The allure lies in the shifting financial landscape, specifically the potential demise of sovereign bond markets. This trend took root when the Fed initiated rate hikes in March 2022. Thus, investors choose to allocate resources to Bitcoin as part of a larger strategic move.

Put simply, there are various reasons that may have influenced the increase or decrease in Bitcoin’s price around the time of the halving event.

Instead of solely concentrating on price movements caused by cryptocurrency halvings, it could be more beneficial to consider other market factors as well in order to optimally position your trades or investments.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Rick and Morty Season 8: Release Date SHOCK!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-04-18 15:35