- Whale activity around Bitcoin has remained high over the last seven days

- Technical indicators hinted at a few low volatility days ahead

On April 19th, Bitcoin’s [BTC] value experienced a significant increase. But just hours after its anticipated 4th halving, Bitcoin turned red once more. During this time, large investors, known as whales, took advantage of the situation and boosted their Bitcoin hoardings, expanding on their previous holdings.

Bitcoin whales are active

Just prior to the cryptocurrency’s halving event, its market behavior grew bullish and pushed its worth above $65k. But things took a turn shortly afterwards.

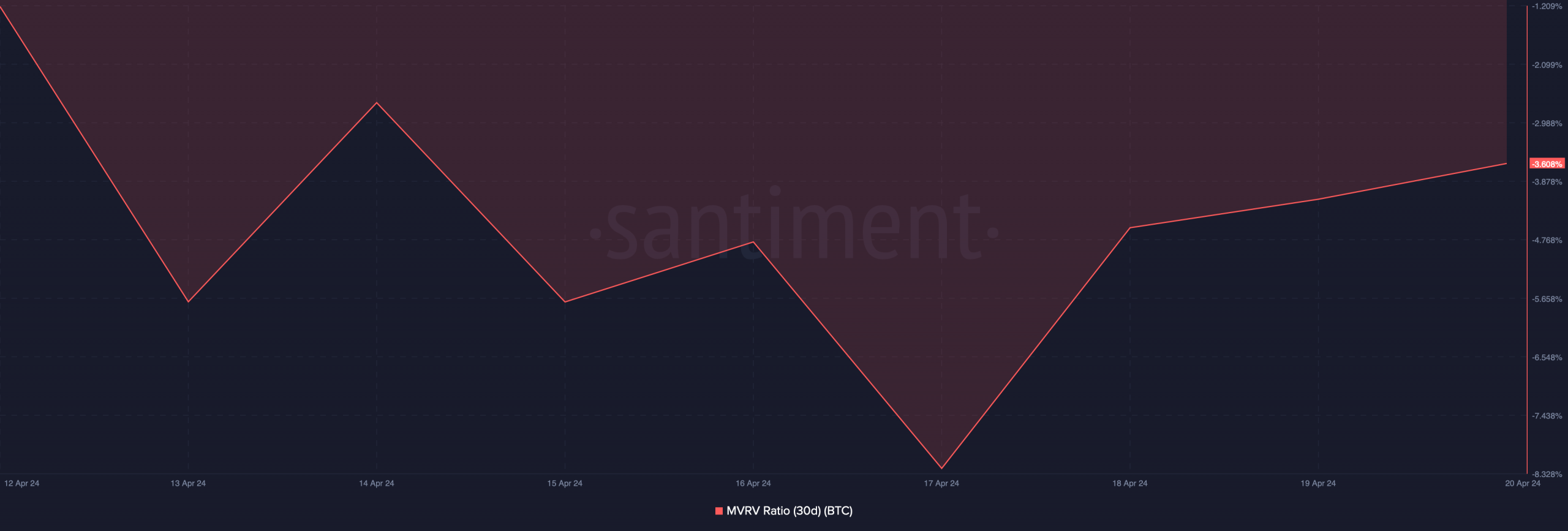

Currently, Bitcoin is priced at $63,777 per coin and has a market value exceeding $1.2 trillion. Notably, the Market Value to Realized Value (MVRV) ratio of Bitcoin has risen recently, indicating that an increased number of investors have made profits in their BTC investments.

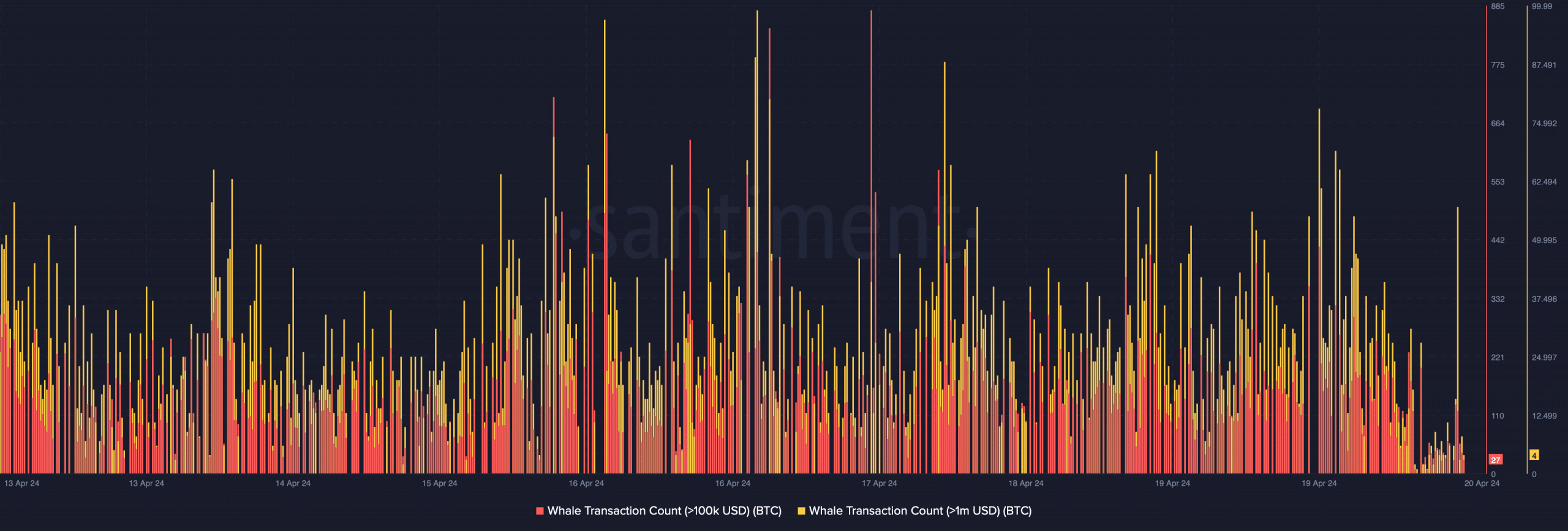

During periods of price instability in the crypto market, major players seized the chance to purchase more Bitcoin. According to IntoTheBlock’s latest tweet, the wealthiest Bitcoin owners, possessing around 0.1% of the total supply, acquired approximately 19,760 Bitcoins, with an average cost of $62,500 per coin.

According to AMBCrypto’s examination of Santiment’s findings, there was a significant increase in whale transactions involving Bitcoin.

Will buying pressure help BTC turn bullish?

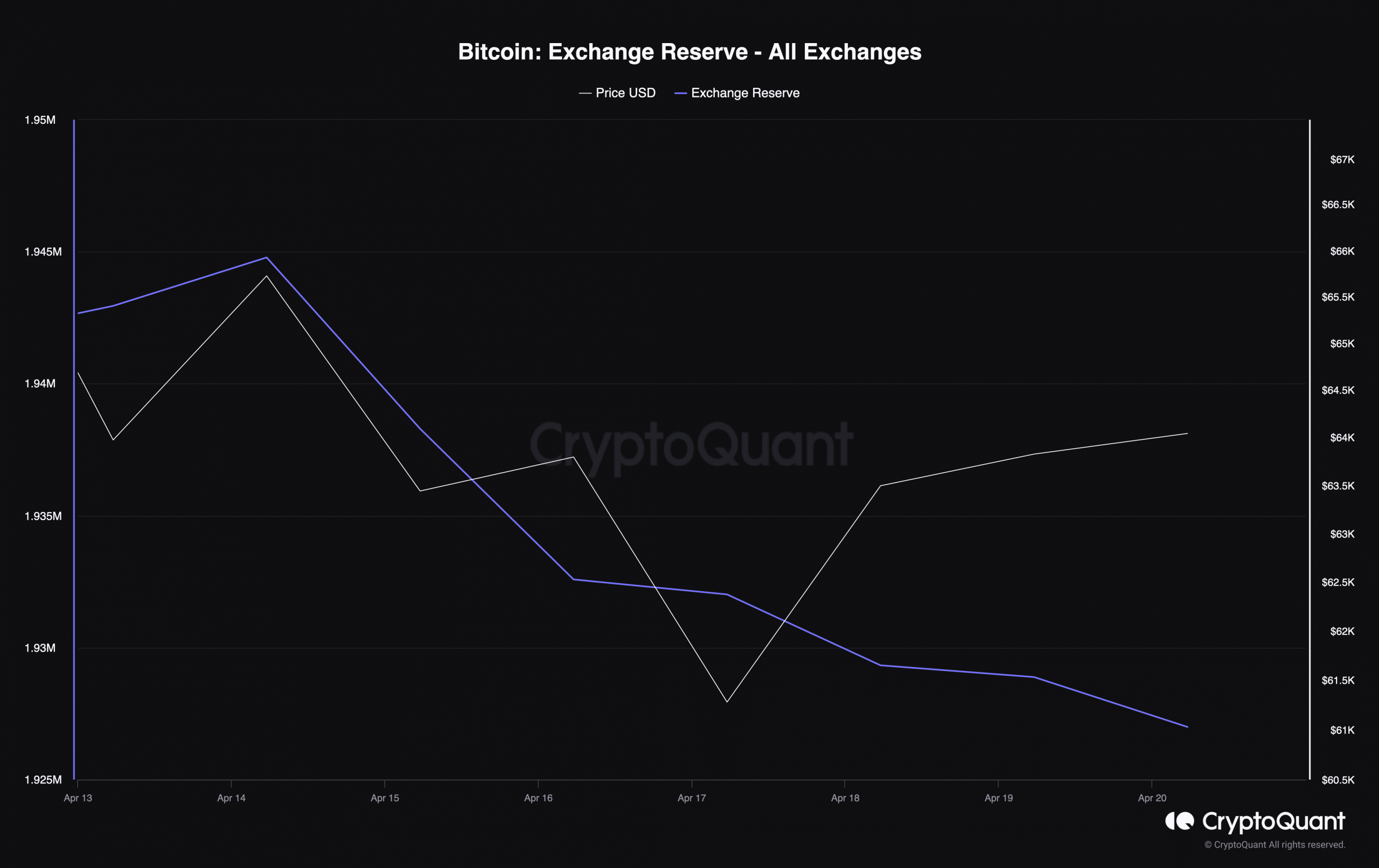

CryptoQuant’s data, examined by AMBCrypto, indicated a significant decrease in Bitcoin’s exchange reserves over the past week. This reduction suggests that there has been notable buying pressure for Bitcoin.

At press time, Bitcoin’s exchange reserves stood at 1.92 million BTC.

Furthermore, the Coinbase Buy Sentiment and Institutional Demand indicators for Bitcoin (BTC) showed positive signs, suggesting strong buying interest from U.S. retail and institutional investors. However, it may take some time before this increased demand triggers a bull market, as other key metrics exhibited bearish trends.

Investors holding Bitcoin (BTC) appear to be optimistic based on its Net Unrealized Profit and Loss (NUPL), which indicates substantial unrealized gains. Concurrently, the asset’s average Saransk Ratios Percentage Offset (aSORP) was in the red at the time of press. This finding suggests that a larger number of investors have recently sold their Bitcoin at a profit.

In the middle of a bull market, it can indicate a market top.

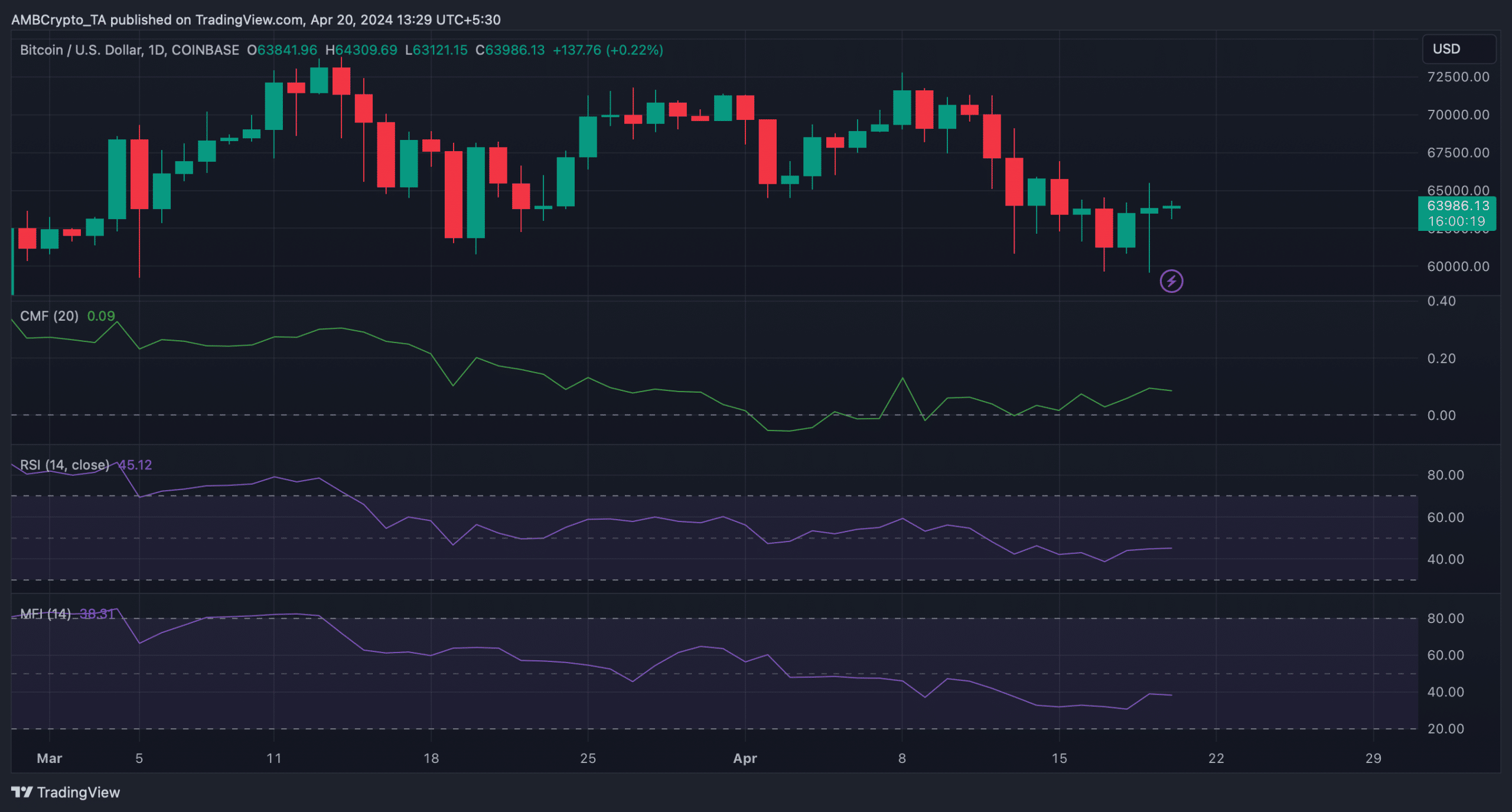

After examining Bitcoin’s daily chart provided by AMBCrypto, it appeared that the cryptocurrency might not display bullish signals imminently. The Relative Strength Index (RSI) and Money Flow Index (MFI), which are commonly used indicators, were moving horizontally below their equilibrium levels.

Additionally, the Chaikin Money Flow (CMF) registered a slight downtick as well.

Based on these signs, investors could anticipate some calmness in Bitcoin’s price movement before it becomes more unpredictable once again.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- This School Girl Street Fighter 6 Anime Could Be the Hottest New Series of the Year

- DOOM: The Dark Ages Debuts on Top of Weekly Retail UK Charts

- Solo Leveling Arise Tawata Kanae Guide

- Chainlink: Checking LINK’s 20% drop amid a 4x jump in fees

- Black State – An Exciting Hybrid of Metal Gear Solid and Death Stranding

- Marvel’s Spider-Man 2 PC Graphics Analysis – How Does It Stack Up Against the PS5 Version?

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- ANKR PREDICTION. ANKR cryptocurrency

2024-04-21 05:11