- Whale activity around Bitcoin has remained high over the last seven days

- Technical indicators hinted at a few low volatility days ahead

On April 19th, Bitcoin’s [BTC] value experienced a significant increase. But just hours after its anticipated 4th halving, Bitcoin turned red once more. During this time, large investors, known as whales, took advantage of the situation and boosted their Bitcoin hoardings, expanding on their previous holdings.

Bitcoin whales are active

Just prior to the cryptocurrency’s halving event, its market behavior grew bullish and pushed its worth above $65k. But things took a turn shortly afterwards.

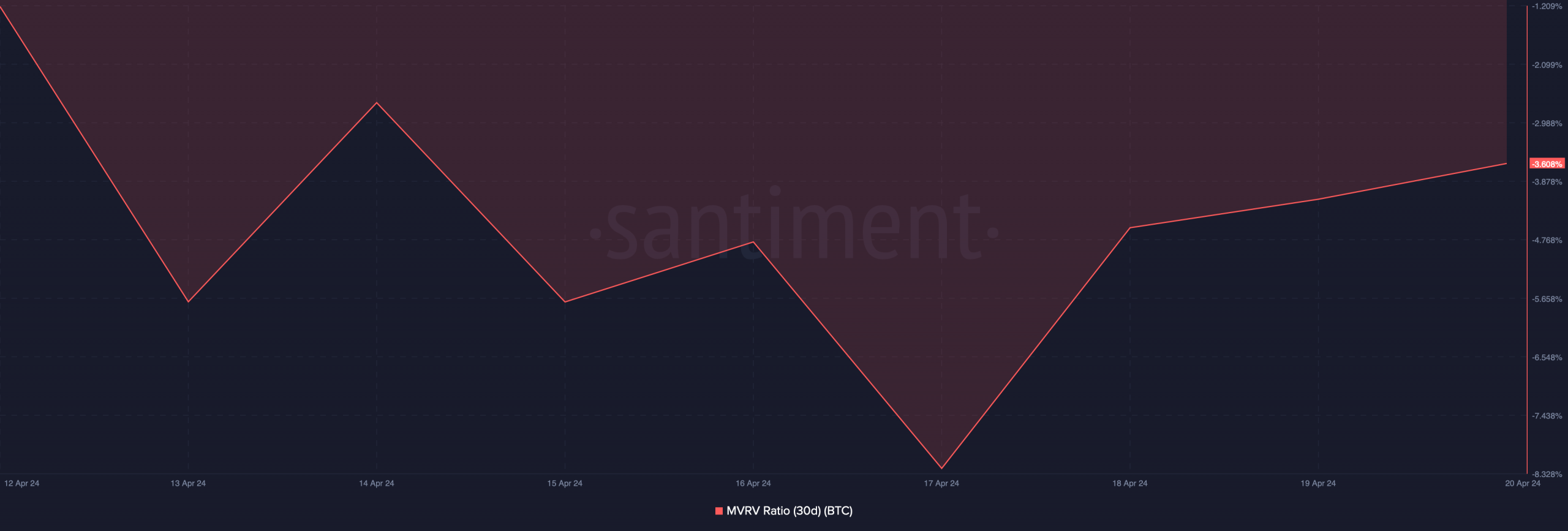

Currently, Bitcoin is priced at $63,777 per coin and has a market value exceeding $1.2 trillion. Notably, the Market Value to Realized Value (MVRV) ratio of Bitcoin has risen recently, indicating that an increased number of investors have made profits in their BTC investments.

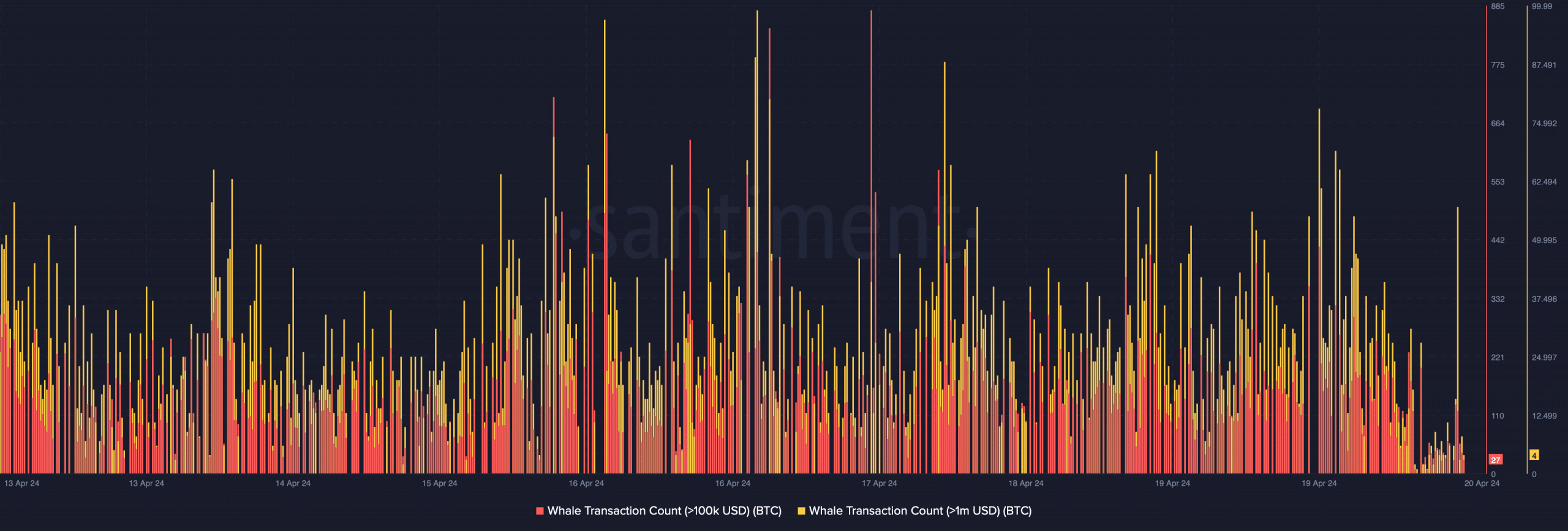

During periods of price instability in the crypto market, major players seized the chance to purchase more Bitcoin. According to IntoTheBlock’s latest tweet, the wealthiest Bitcoin owners, possessing around 0.1% of the total supply, acquired approximately 19,760 Bitcoins, with an average cost of $62,500 per coin.

According to AMBCrypto’s examination of Santiment’s findings, there was a significant increase in whale transactions involving Bitcoin.

Will buying pressure help BTC turn bullish?

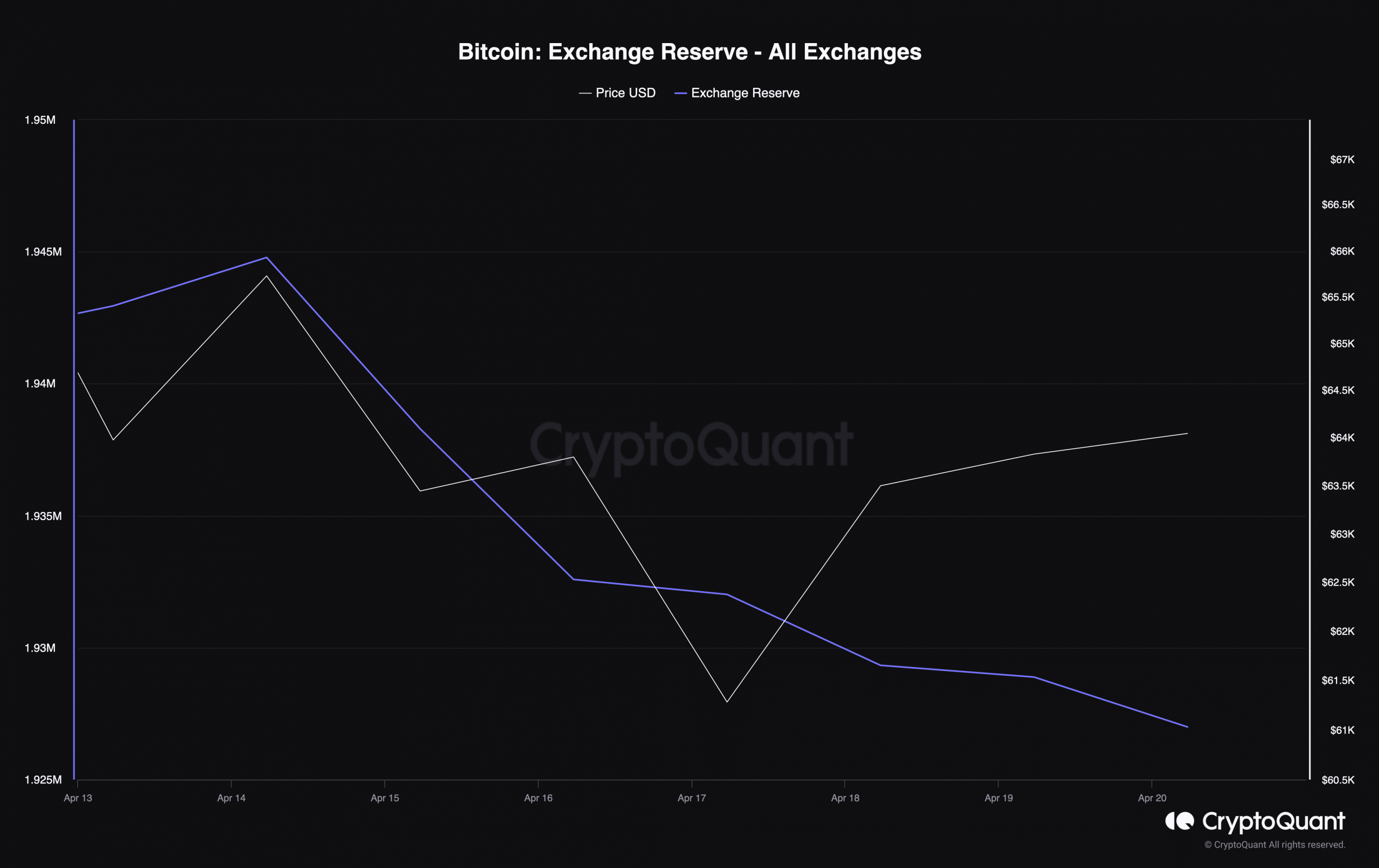

CryptoQuant’s data, examined by AMBCrypto, indicated a significant decrease in Bitcoin’s exchange reserves over the past week. This reduction suggests that there has been notable buying pressure for Bitcoin.

At press time, Bitcoin’s exchange reserves stood at 1.92 million BTC.

Furthermore, the Coinbase Buy Sentiment and Institutional Demand indicators for Bitcoin (BTC) showed positive signs, suggesting strong buying interest from U.S. retail and institutional investors. However, it may take some time before this increased demand triggers a bull market, as other key metrics exhibited bearish trends.

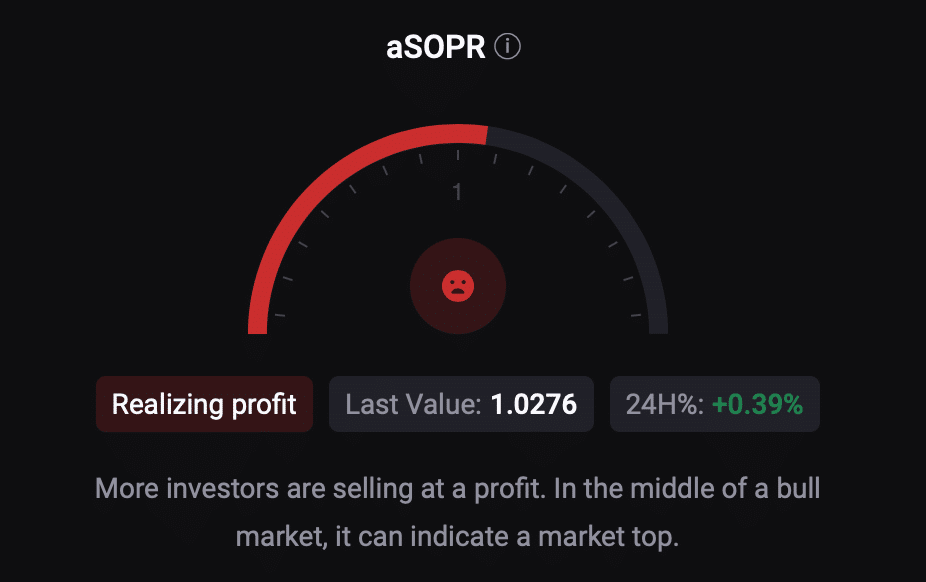

Investors holding Bitcoin (BTC) appear to be optimistic based on its Net Unrealized Profit and Loss (NUPL), which indicates substantial unrealized gains. Concurrently, the asset’s average Saransk Ratios Percentage Offset (aSORP) was in the red at the time of press. This finding suggests that a larger number of investors have recently sold their Bitcoin at a profit.

In the middle of a bull market, it can indicate a market top.

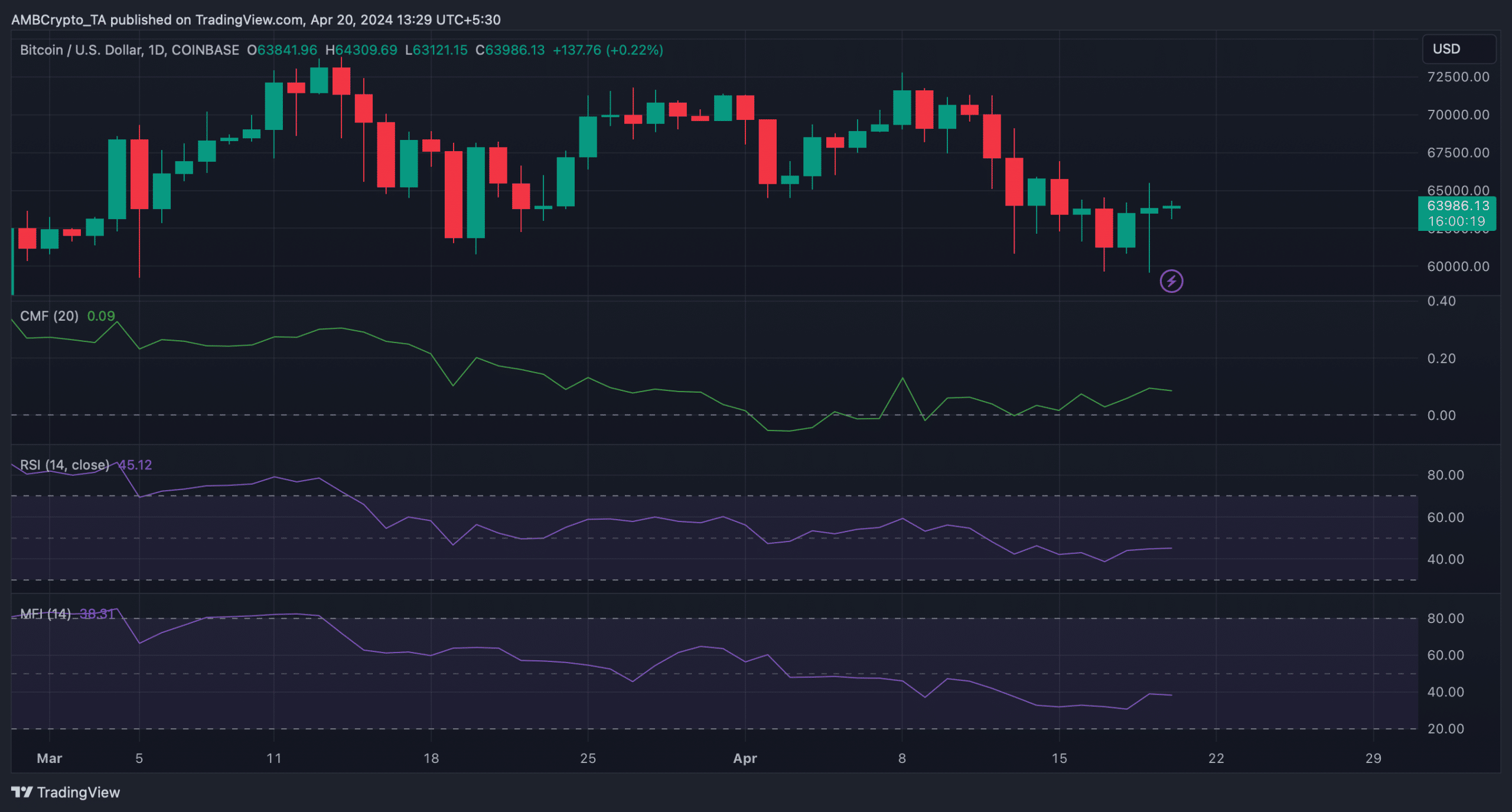

After examining Bitcoin’s daily chart provided by AMBCrypto, it appeared that the cryptocurrency might not display bullish signals imminently. The Relative Strength Index (RSI) and Money Flow Index (MFI), which are commonly used indicators, were moving horizontally below their equilibrium levels.

Additionally, the Chaikin Money Flow (CMF) registered a slight downtick as well.

Based on these signs, investors could anticipate some calmness in Bitcoin’s price movement before it becomes more unpredictable once again.

Read More

- LDO PREDICTION. LDO cryptocurrency

- JASMY PREDICTION. JASMY cryptocurrency

- Why iShares’ Bitcoin Trust stock surged 13% in 5 days, and what’s ahead

- Spot Solana ETF approvals – Closer than you think?

- Orca crypto price prediction: Buying opportunity ahead, or bull trap?

- Can Ethereum ETFs outperform Bitcoin ETFs – Yes or No?

- Chainlink to $20, when? Why analysts are positive about LINK’s future

- Citi analysts upgrade Coinbase stock to ‘BUY’ after +30% rally projection

- THETA PREDICTION. THETA cryptocurrency

- Crypto week ahead: Will Bitcoin, Ethereum hit new highs?

2024-04-21 05:11