-

BTC liquidation levels and pwEQ could be key for potential bounces.

The 50 & 200-Day Moving Averages forming a Golden Cross.

As an analyst with over a decade of experience in analyzing financial markets, I find myself intrigued by the current state of Bitcoin [BTC]. The interplay between liquidation levels and pwEQ, combined with the golden cross formation of the 50-day and 200-day moving averages, suggests that we might be on the cusp of a significant bullish trend.

As a researcher, I’m constantly monitoring Bitcoin (BTC), the leading digital currency, as its value consistently captures my attention and warrants thorough examination.

In the present market climate, traders are aggressively looking for chances, particularly in areas where potential reward outweighs the risk significantly.

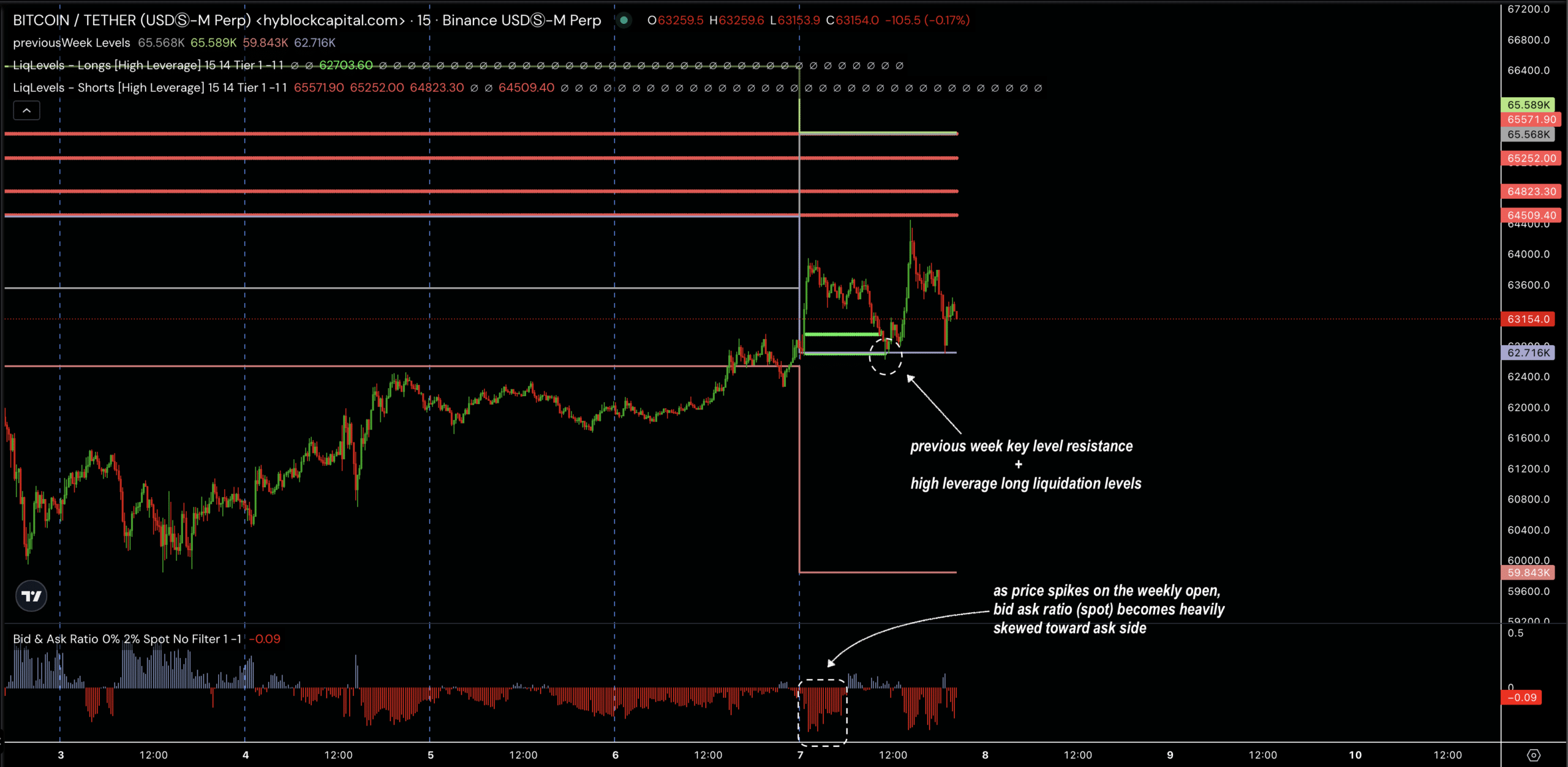

Lately, Bitcoin experienced a significant increase at the start of the week, resulting in two substantial long positions being liquidated because of high leverage. These liquidations coincided remarkably with the balance point (equilibrium) from the previous week (pwEQ).

As the demand-supply gap leaned significantly towards the ask (sell) side, the pump encountered resistance, resulting in a pullback. This action returned Bitcoin to crucial stages, where it might encounter support and potentially rebound at the liquidation points and pwEQ levels.

Currently, there’s an increase in the number of bids close to the present price compared to asks (offers), suggesting that demand might be outpacing supply, thus indicating a potential shift towards higher demand.

If Bitcoin maintains its current growth trend, it might yield substantial profits at entry points between approximately $62,000 and $63,000.

Looking further into BTC/USD price action, the $62K to $63K zone is emerging as a crucial level.

The 50-day and 200-day Moving Averages are about to create a ‘golden cross’, which is a positive sign suggesting an upcoming increase in the price trend.

As a researcher, I find that when this particular pattern aligns with the established liquidation levels and pwEQ alignment, it significantly bolsters my case for anticipating potential future profits.

Previously, a comparable ‘golden cross’ event took place around this same period last year, leading to a substantial increase in market value (bullish run). This suggests that another such surge might be imminent, given the potential for bulls to gain dominance once more.

BTC supply and momentum

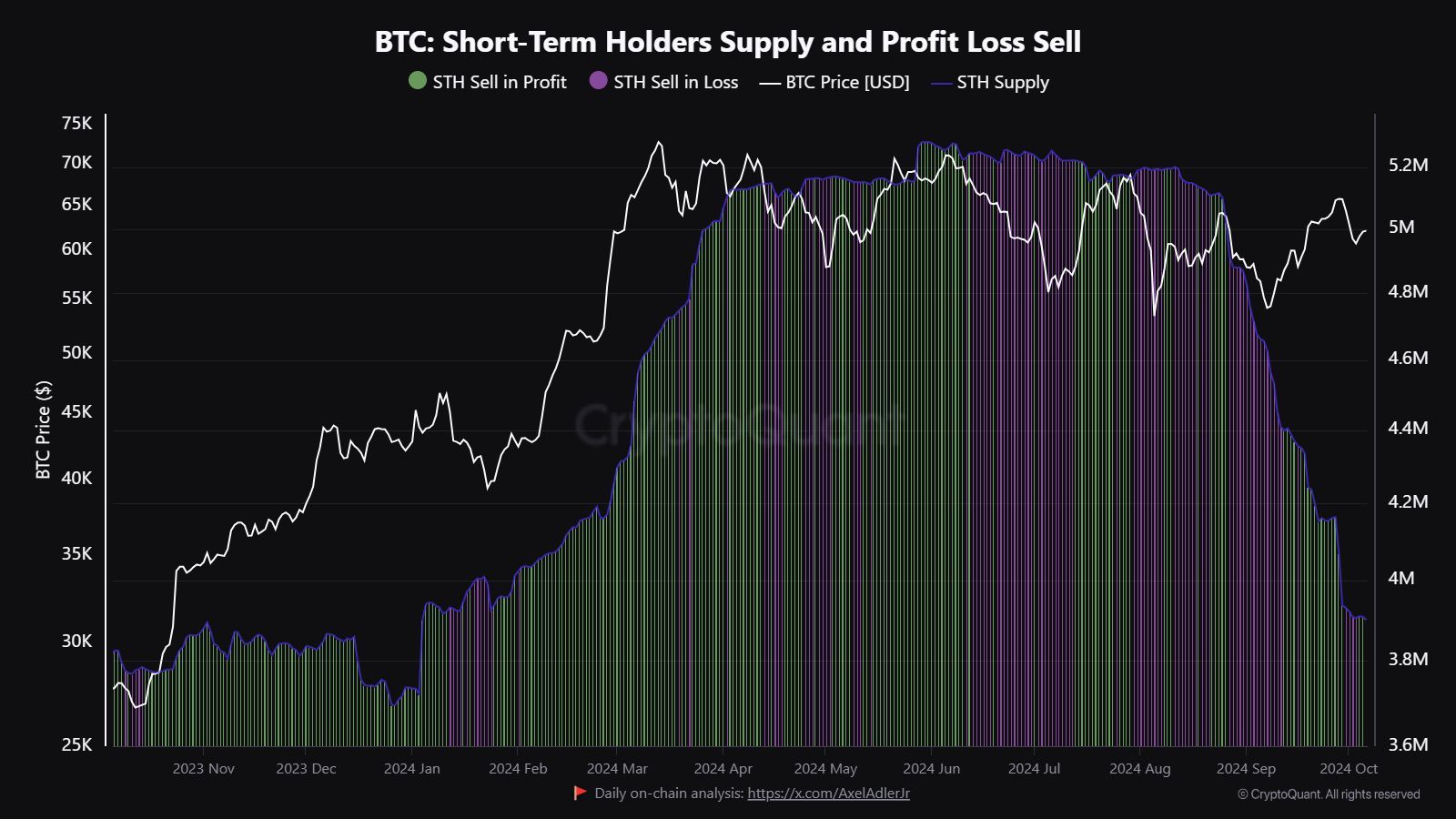

As a researcher delving into this fascinating realm, I’ve observed an interesting pattern regarding short-term Bitcoin holders. It appears that when the market takes a downturn, these weaker hands tend to exit the game prematurely. This panic-selling, more often than not, results in them realizing losses on their investments.

This can be interpreted as follows: The rise in the number of purple bars on the graph indicates periods of selling off, particularly during market drops. As less confident investors withdraw their holdings, Bitcoin may move towards more resilient investors, which could help to steady the market.

The amount of STH available for purchase has decreased noticeably, particularly following large-scale sell-offs, indicating that the demand to sell may be reducing.

The decrease in availability might foster circumstances beneficial for amassing, thereby underscoring the significance of the $62K to $63K range as a high-risk-to-reward potential hotspot.

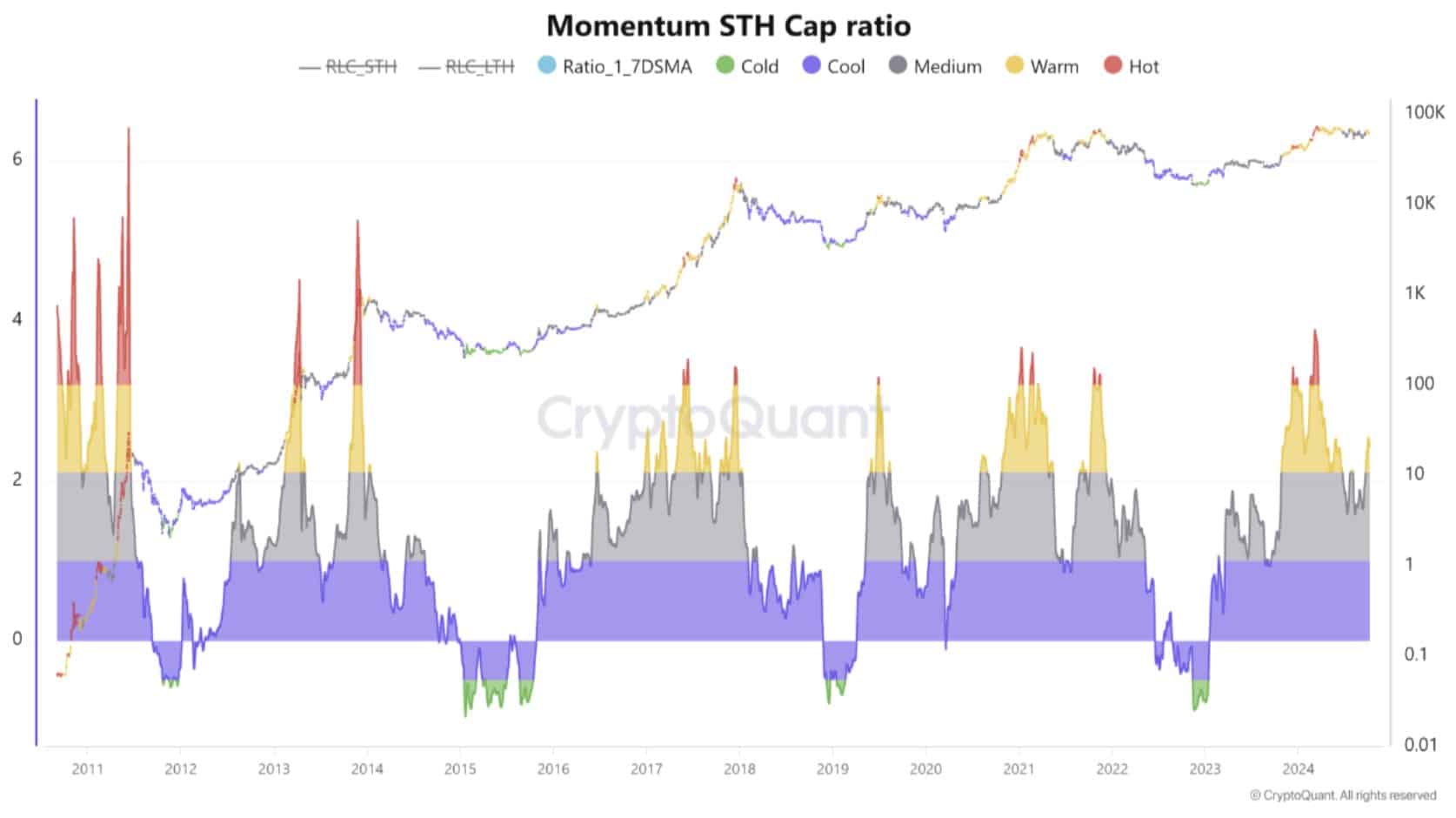

As an analyst, I’ve noticed a gradual improvement in the Momentum Short-Term Cap indicator for Bitcoin. This indicator calculates the variation between Bitcoin’s market capitalization and its realized capitalization over brief timeframes. The recovery, while not rapid, is a positive sign.

This ratio serves as a dependable signal for short-term investors, pointing out possible price levels that could act as significant barriers or turning points.

As the current ratio hints at a thawing market, broader economic elements and a gradual regaining of momentum imply that Bitcoin’s significant future shift might occur over an extended period.

If the prevailing conditions improve, there’s a strong possibility that momentum will swiftly pick up pace, which might cause Bitcoin’s price to surge and suggest the peak of this particular cycle.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

At present, Bitcoin’s prices show promising opportunities, particularly given robust technical signals such as the ‘golden cross’ and decreasing Short-Term Holder (STH) supply, which suggest a positive market trend.

With momentum building, BTC could see higher prices in the coming months.

Read More

- Gold Rate Forecast

- Discover Liam Neeson’s Top 3 Action Films That Will Blow Your Mind!

- OM PREDICTION. OM cryptocurrency

- Kanye West Praises Wife Bianca’s Daring Naked Dress Amid Grammys Backlash

- Nintendo Switch 2 Price & Release Date Leaked: Is $449 Too Steep?

- Netflix’s New Harlan Coben Series Features Star-Studded Cast You Won’t Believe!

- Meet the Stars of The Wheel of Time!

- Why Gabriel Macht Says Life Abroad Saved His Relationship With Family

- Where Teen Mom’s Catelynn Stands With Daughter’s Adoptive Parents Revealed

- EUR PKR PREDICTION

2024-10-08 21:44