- Long-term realized cap revealed a cooling trend and could signal breakout or deeper correction ahead

- Weak momentum and volume suggested downside risk still persists

Ah, Bitcoin’s price trajectory, that whimsical dance of digits, is once again teetering on the edge of a cosmic cliff. One particularly critical on-chain metric, which sounds far more important than it actually is, could very well dictate whether we all celebrate with confetti or weep into our wallets.

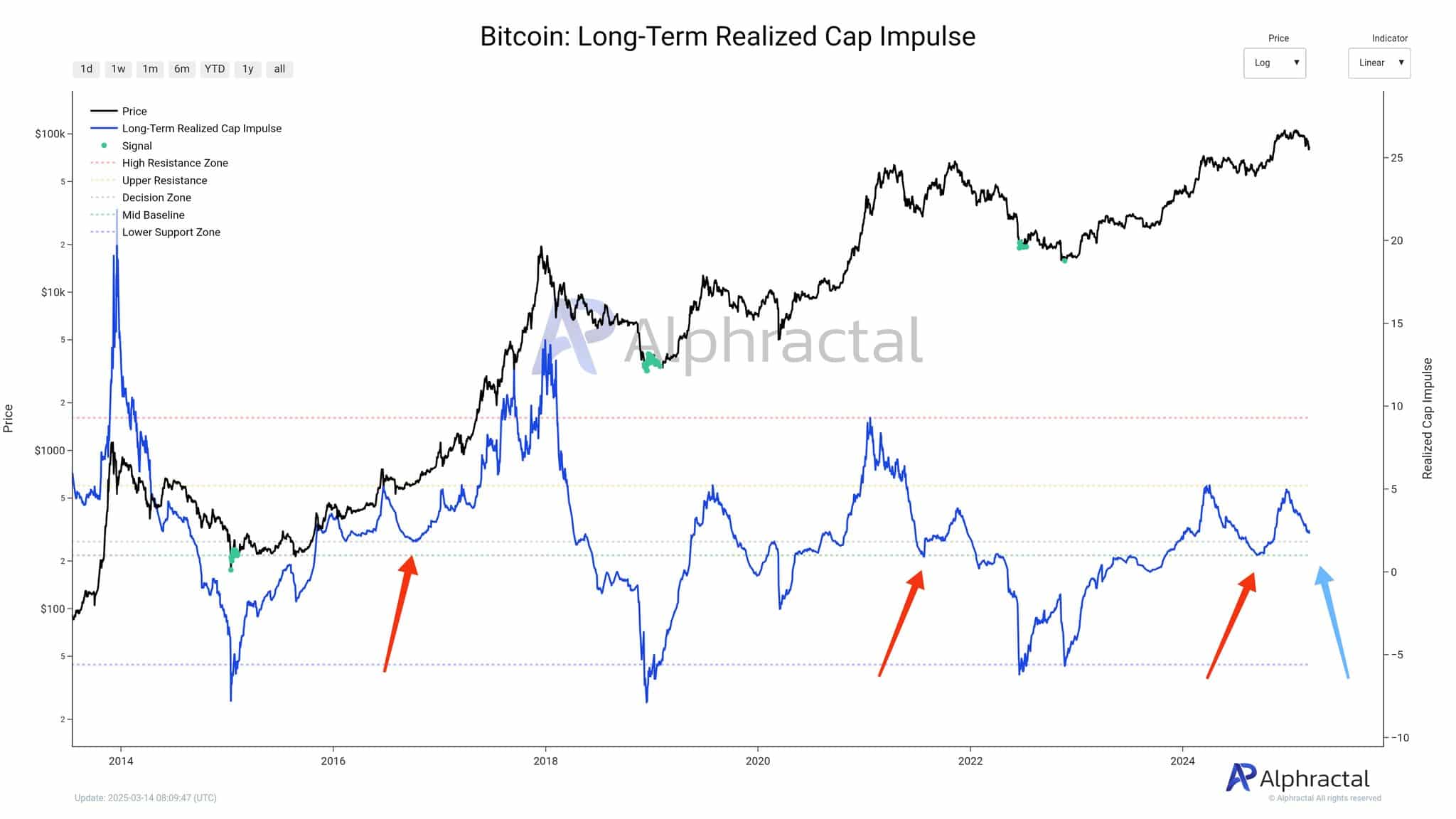

The long-term realized cap, a fancy term for a number that tells us how strong the market is (or isn’t), is approaching a threshold that has historically been about as reliable as a towel in a rainstorm. Analysts, those brave souls, are watching this zone like hawks, or perhaps more accurately, like confused pigeons, as holding it could reinforce confidence in the current cycle. But if it breaks down? Well, let’s just say it might signal a broader shift in market dynamics, which is a polite way of saying “panic!”

What is the long-term realized market cap?

This metric isolates the cost basis of older UTXOs (unspent transaction outputs), which is a fancy way of saying it looks at how much people paid for their Bitcoin before they decided to hold onto it like a precious relic. These investors typically accumulate during bear markets (the sad times) and distribute in bull phases (the happy times).

A rising long-term realized cap suggests that capital is flowing in like a river of optimism, while a decline may point to profit-taking or a general sense of “meh” in the market. Historically, Bitcoin has reacted sharply whenever this metric has approached key levels – either launching new rallies or falling into a deep existential crisis.

What does the data say?

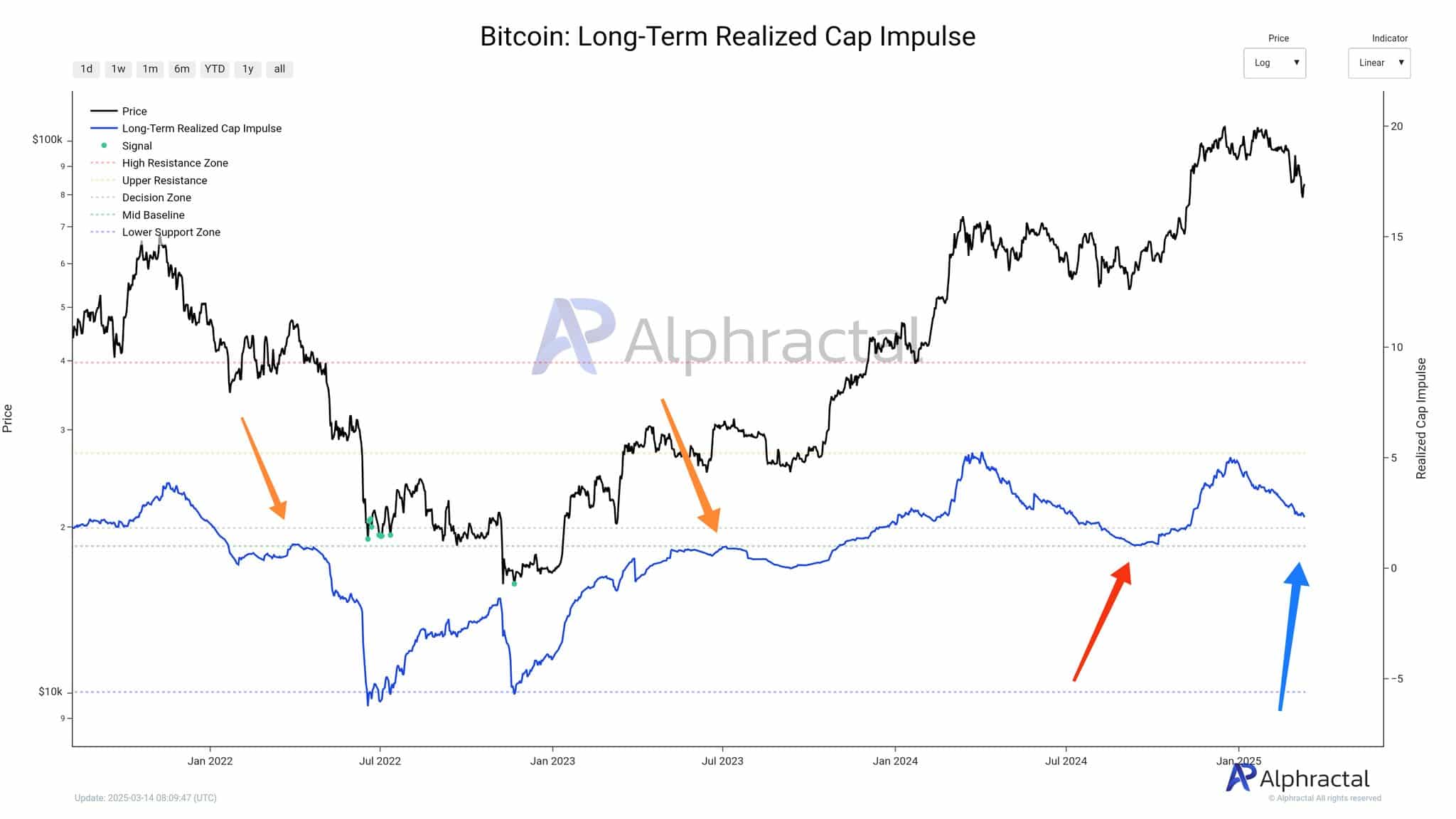

Latest data revealed a decline from local highs, with the metric drifting towards the mid-baseline like a lost tourist in a foreign city. This cooling trend could indicate that the market may be entering a pause after months of bullish momentum, which is just a fancy way of saying it’s taking a breather.

Historically, a neutral or negative realized cap impulse has preceded consolidation phases – or, in some cases, market corrections. In the attached chart, the latest red arrow pointed to this risk, while a blue arrow hinted at the potential for a recovery, which is about as reassuring as a cat in a dog park.

Notably, in both 2016 and 2020, dips in this metric were followed by renewed bullish momentum and eventual all-time highs. If this pattern holds, Bitcoin could soon shift into an accumulation phase ahead of another breakout, or it could just as easily decide to take a long nap.

Still, while on-chain signals remain cautiously optimistic (which is a bit like saying a cat is cautiously optimistic about a bath), macro and market-specific factors will heavily influence the road ahead.

Bitcoin’s price outlook

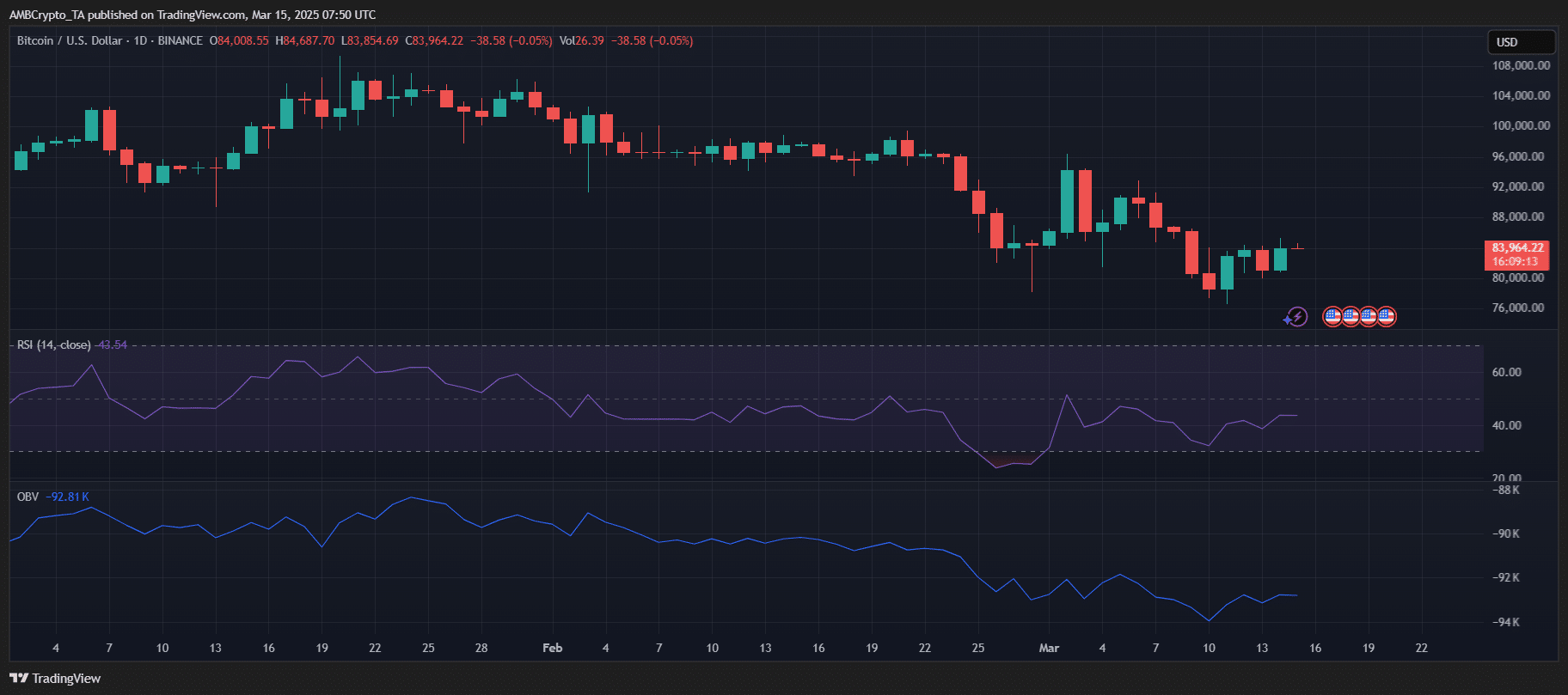

Bitcoin was trading at $83,964 at press time, following a minor decline of 0.05%. The RSI sat at 43.54, below the neutral 50 level – suggesting sellers still hold the upper hand, which is a bit like saying the cat is still in charge of the house.

The broader price structure has been bearish too, with a consistent pattern of lower highs and lower lows since February. A decisive break above $88,000 is needed to reverse this trend. Conversely, a drop below $82,000 could open the door to further downside, which is just delightful news for anyone who enjoys a good rollercoaster ride.

Until buyers regain control, Bitcoin might be likely to remain range-bound.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

2025-03-15 22:18