- Bitcoin holder loss trends showed that the bulls can be hopeful of a recovery

- If historical trends repeat themselves, an even deeper price correction might be due

As a researcher with experience in crypto markets, I’ve closely followed Bitcoin’s [BTC] loss trends and price movements. The recent rejection from the short-term range highs at $58.8k and the loss of the psychological $60k support have left traders fearful.

In simpler terms, the price of Bitcoin [BTC] attempted to break through the resistance level of $58,800 twice within a short timeframe but failed. Following the loss of the psychologically significant $60,000 support last week, there has been a prevailing sense of fear among investors.

As a crypto investor, I’ve noticed a glimmer of optimism despite current market challenges. The increasing accumulation trend score indicates that buyers are eager and ready to purchase. However, other metrics suggest that we might still experience some discomfort before seeing significant gains.

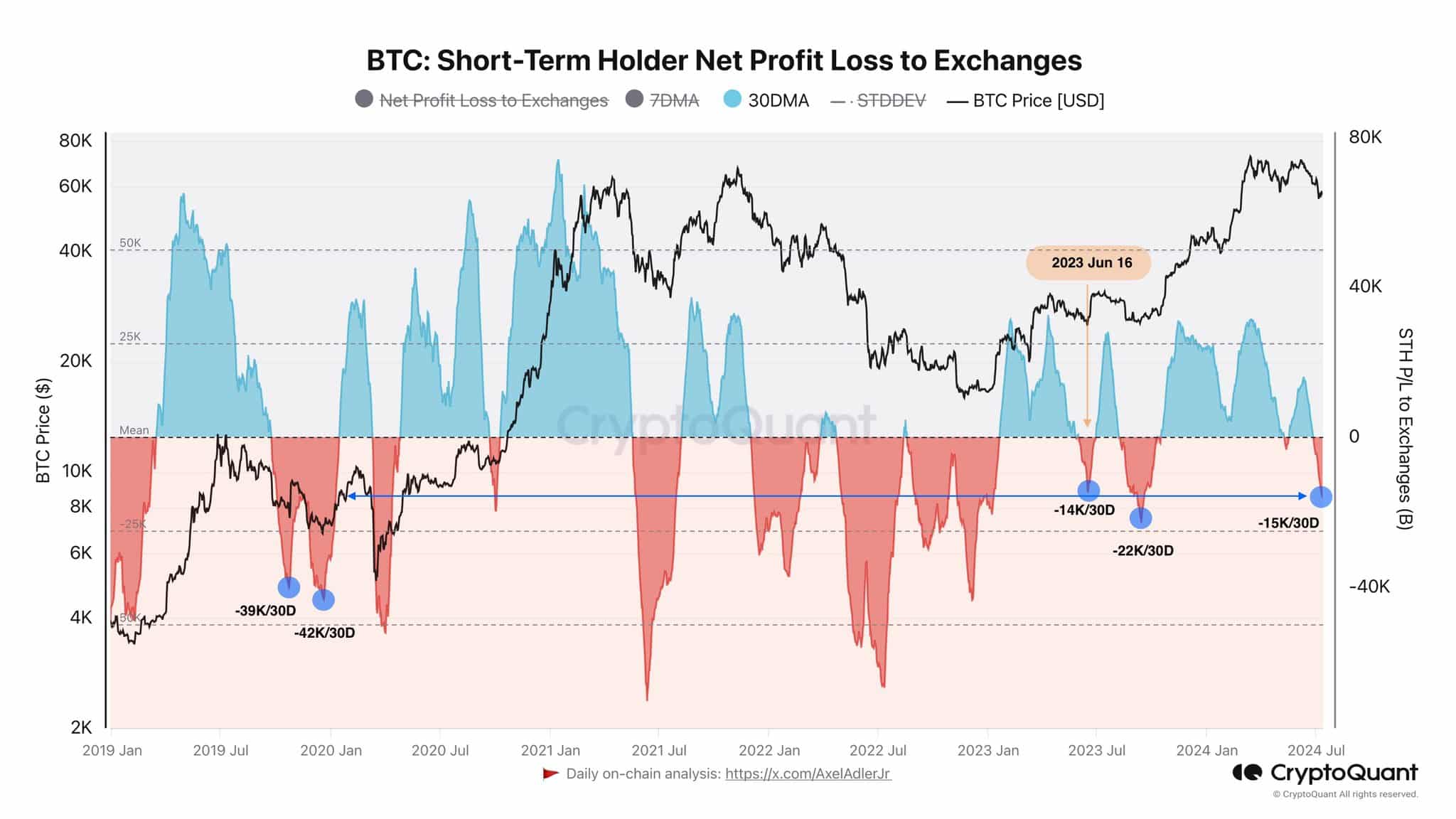

In a recent post on X, cryptocurrency analyst Axel Adler highlighted the presently averaged losses endured by short-term holders (STHs). These losses align with those experienced in June 2023, but their intensity is significantly less severe compared to the periods in 2021 and 2022.

The price movement indicated a possible local minimum, but it was essential for traders and investors to remain cautious and prepare for the possibility of a more significant price decline based on chart analysis.

Clues that Bitcoin’s local lows are behind us

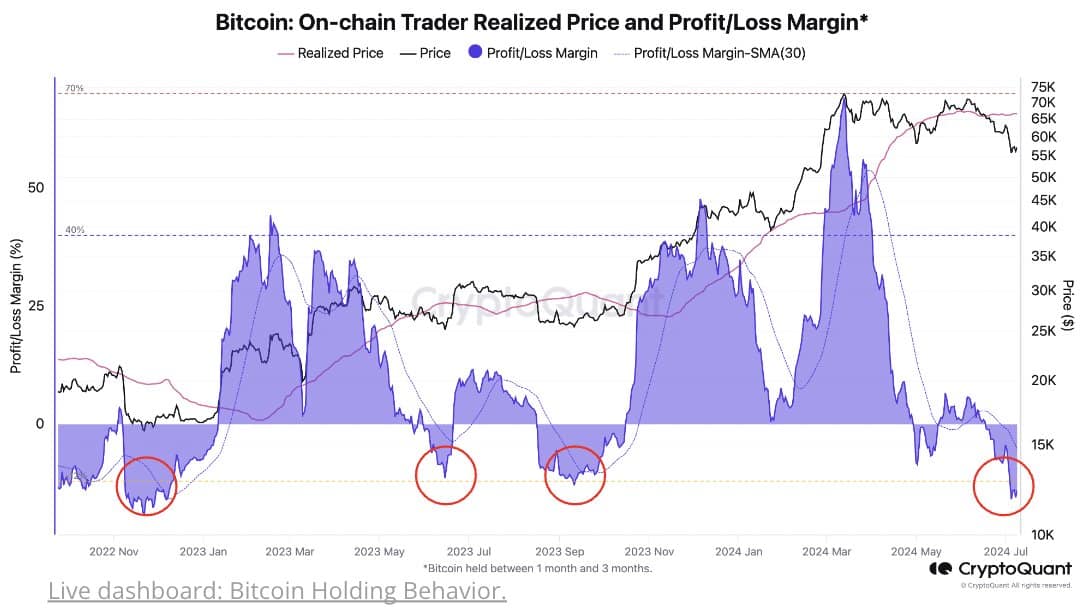

According to CryptoQuant’s analysis, a trader incurred a loss of approximately 17% on their Bitcoin investment. This loss magnitude aligns with the depths of the market downturns experienced over the previous two years, implying that Bitcoin may be more primed for an uptrend rather than a further decline.

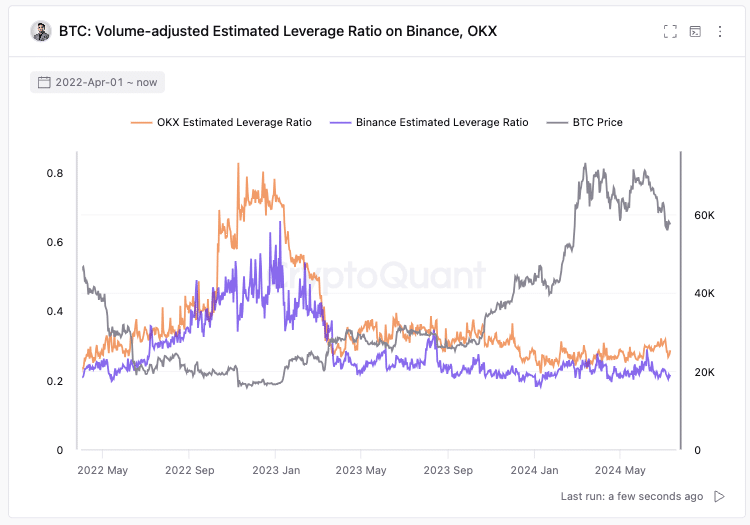

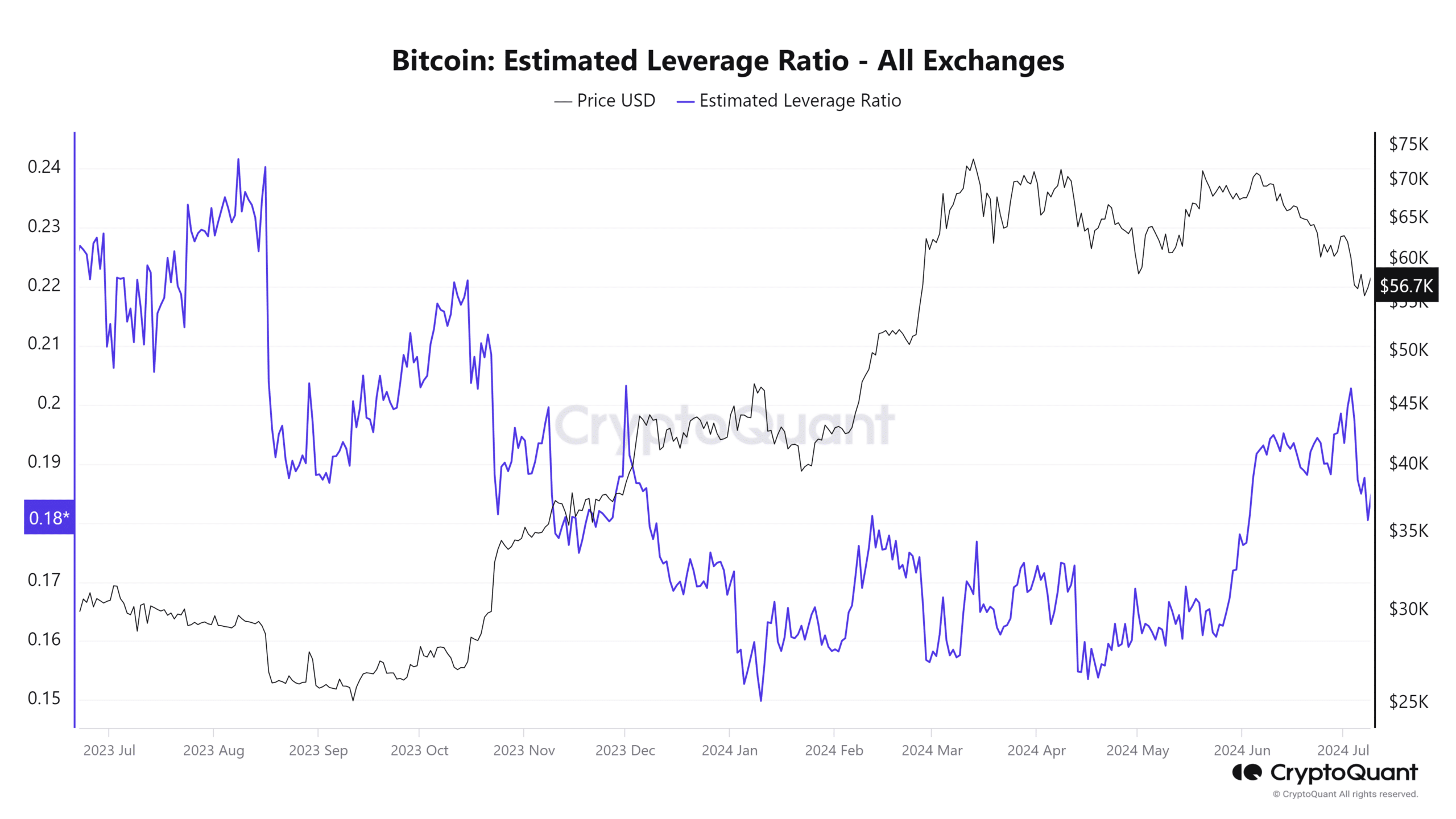

Based on the remarks of Ki Young Ju, the founder and CEO of CryptoQuant, it is common practice among whales to employ leverage at the cyclical low points of the market. This behavior can result in an excessively leveraged market, ultimately triggering another price decline.

At the current moment, whales had not taken on excessive debt positions, potentially paving the way for a more significant price drop below $50,000.

Traders were humbled after trying to catch the breakout and ATH

Between late May and early July, the projected leverage ratio on cryptocurrency exchanges experienced a significant upward trend. Coincidentally, Bitcoin’s price fluctuated around the $67,000 to $69,000 mark during this period. When Bitcoin’s price dipped below $66,000, traders attempted to capitalize on the potential market bottom by increasing their leverage, resulting in a further rise in the leverage ratio.

As a researcher observing the cryptocurrency market over the last week, I’ve noticed that Bitcoin (BTC) took a turn for the worse, dampening the enthusiasm of investors. Concurrently, the leverage ratio in the market saw a decrease, which could potentially be a positive sign, promoting market stability.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Overall, it is hard to say with certainty that Bitcoin has formed a bottom.

As a researcher observing the market, I’ve noticed that several bottom signals have appeared. The selling pressure could be easing up, but it’s crucial for investors to remain cautious and prepare a response if the price dips below $50k.

Read More

2024-07-14 06:15