-

Per a crypto hedge fund founder, a BTC pullback to $52K or $45K would be normal.

Despite the BTC dump, cycle top indicators signaled more room for growth.

As a researcher with experience in the crypto market, I believe that the recent Bitcoin (BTC) pullback to below $55K is normal and expected. Although it has caused concern among some investors, the founder of Capriole Investments, Charles Edwards, argues that a 30-40% bull market pullback would be typical for BTC.

Bitcoin‘s price decreased by approximately 13% in the past week, causing it to fall beneath the $55,000 mark. The recent decline largely reversed the substantial progress Bitcoin made during Q1 following the U.S. approval of a spot BTC exchange-traded fund (ETF).

The plunge has worried the market, with some insinuating that the bull run could be over.

As a financial analyst, I’d rephrase that statement as follows: According to Charles Edwards, founder of Capriole Investments, the recent cryptocurrency market sell-off is a typical occurrence.

“$52K or $45K would be a normal 30-40% bull market pullback.”

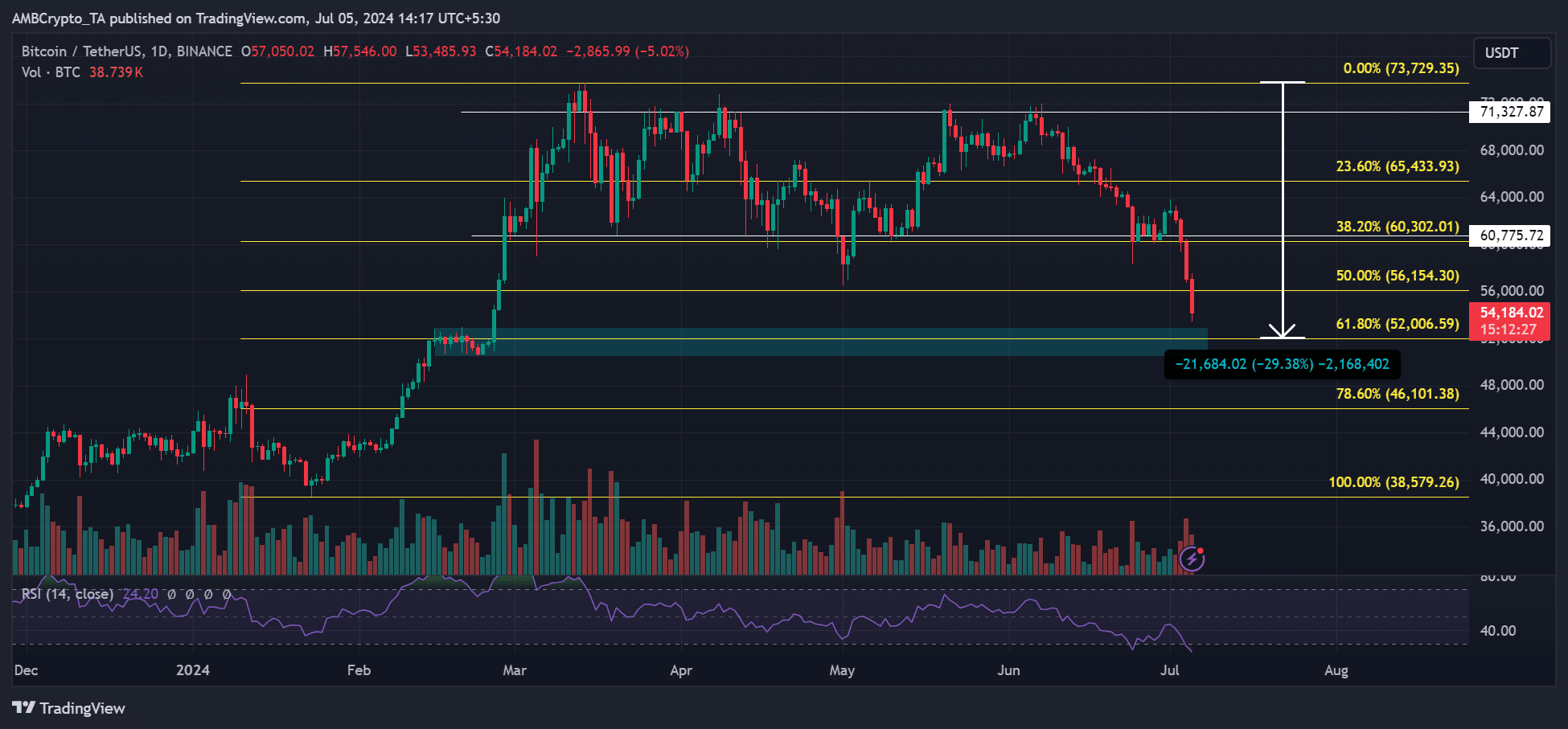

As a researcher studying the cryptocurrency market, I’ve observed that Bitcoin (BTC) experienced a significant price drop since its March peak of $73,700. Currently, BTC is trading at around $53,400, representing approximately a 26% decline from its previous high.

If the price falls once more into the designated consolidation area in February, represented by the cyan marking, it could result in a decline of approximately 30%.

In the realm of the stock market, a decline of 5-10% is typically viewed as a pullback. However, if the decrease surpasses this range, it becomes indicative of an ongoing downtrend.

According to Edwards’ perspective, Bitcoin’s behavior may differ from what is generally assumed. Therefore, keeping an eye on the $50,000 threshold as a significant potential milestone becomes important.

Is bull run over as Bitcoin plunges towards $50K?

Market experts found it intriguing that the pessimistic investor attitude could be attributed to incidents like Mt. Gox’s issues and German Bitcoin sell-offs.

Some view the recent stock sales as beneficial, as they help reduce the excessive inventory buildup, potentially leading to stronger momentum in Q3 2024.

By the end of Q3 or Q4, factored in are the usual seasonal trends and the influence of elections, with crypto markets likely experiencing improved liquidity. This means that the prolonged oversupply issues that have significantly impacted the market for several years will no longer be a major concern.

It appears that the distribution of assets from Mt. Gox may be postponed. A recent announcement on July 5th revealed that certain creditors might have to wait an extended period for their repayments.

As a researcher studying the recent developments in the cryptocurrency market, I’ve come across some intriguing information regarding a defunct Japanese exchange. This exchange currently holds approximately 141,600 Bitcoins, valued at around $7.6 billion based on current prices. On July 5th, they executed a significant transaction, transferring roughly $2.7 billion in Bitcoin to Bitbank. Furthermore, they also forwarded an additional $148 million worth of Bitcoin during this transaction.

It’s unclear whether the market will experience relief if Mt. Gox postpones repayments to its other creditors.

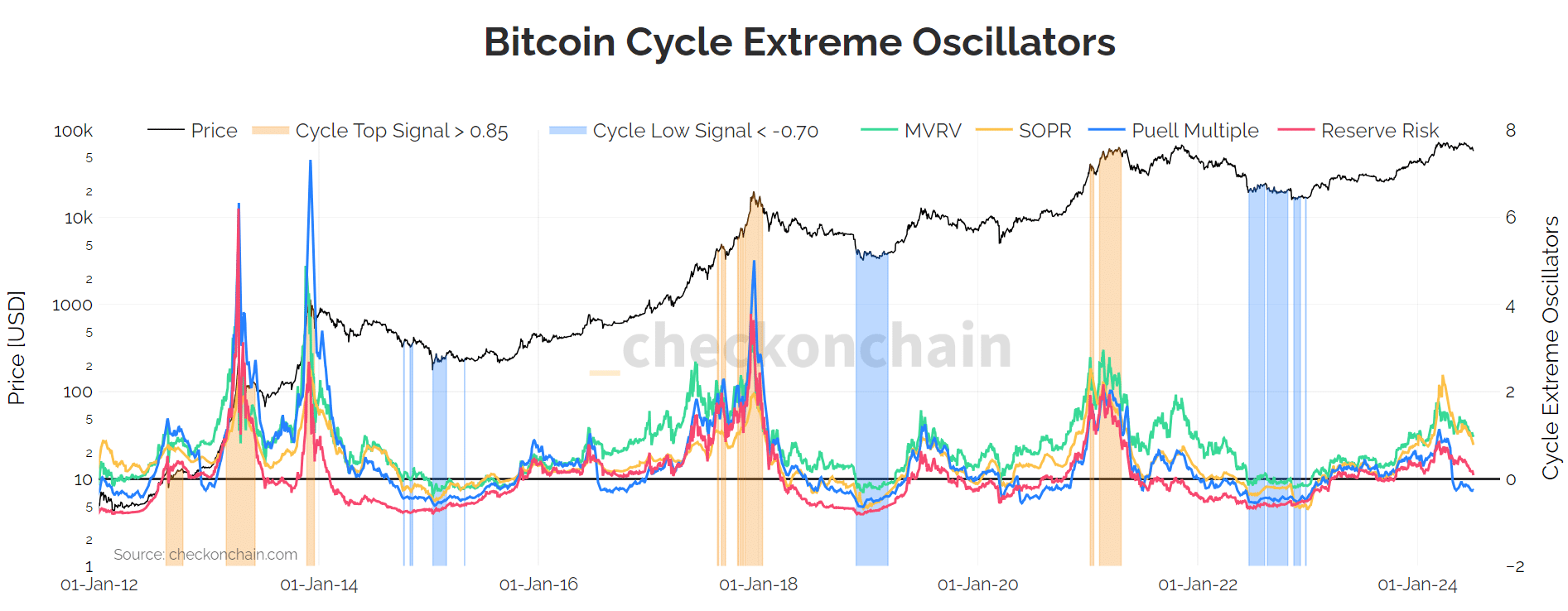

As a researcher studying the Bitcoin market, I’ve noticed some pessimism regarding its current state. However, I’ve also discovered from historical price chart data that a potential market peak might occur around late 2025. Therefore, despite the prevailing negative sentiment, there is still potential for BTC to experience growth until then.

Additionally, a group of significant Bitcoin peak warning signs hadn’t activated, suggesting the peak had not yet been reached.

The metrics like MVRV (Market Value to Realized Value) and Puell Multiple, which indicate miner profitability, were not showing any extreme readings. This implied that Bitcoin still had some potential for further price increases.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- SOL PREDICTION. SOL cryptocurrency

- Solo Leveling Arise Tawata Kanae Guide

2024-07-06 02:16