- Alas, Bitcoin has stumbled below the illustrious $100K, a decline of nearly 8% from its recent peak of glory.

- Yet, the steadfast long-term holders remain unmoved, as if they are waiting for a bus that never arrives, hinting at new market cycles on the horizon.

In the grand theater of cryptocurrency, Bitcoin [BTC] finds itself in a rather dramatic act of correction, having plummeted from its dizzying heights of over $109,000 last week to a humble abode below the $100,000 mark today. The audience gasps! 🎭

As the curtain rises, BTC has taken a 5% tumble in the past week, now trading at a mere $99,986—an impressive 7.9% drop from its all-time high achieved just last week. Oh, the tragedy! 😱

Major market players show restraint

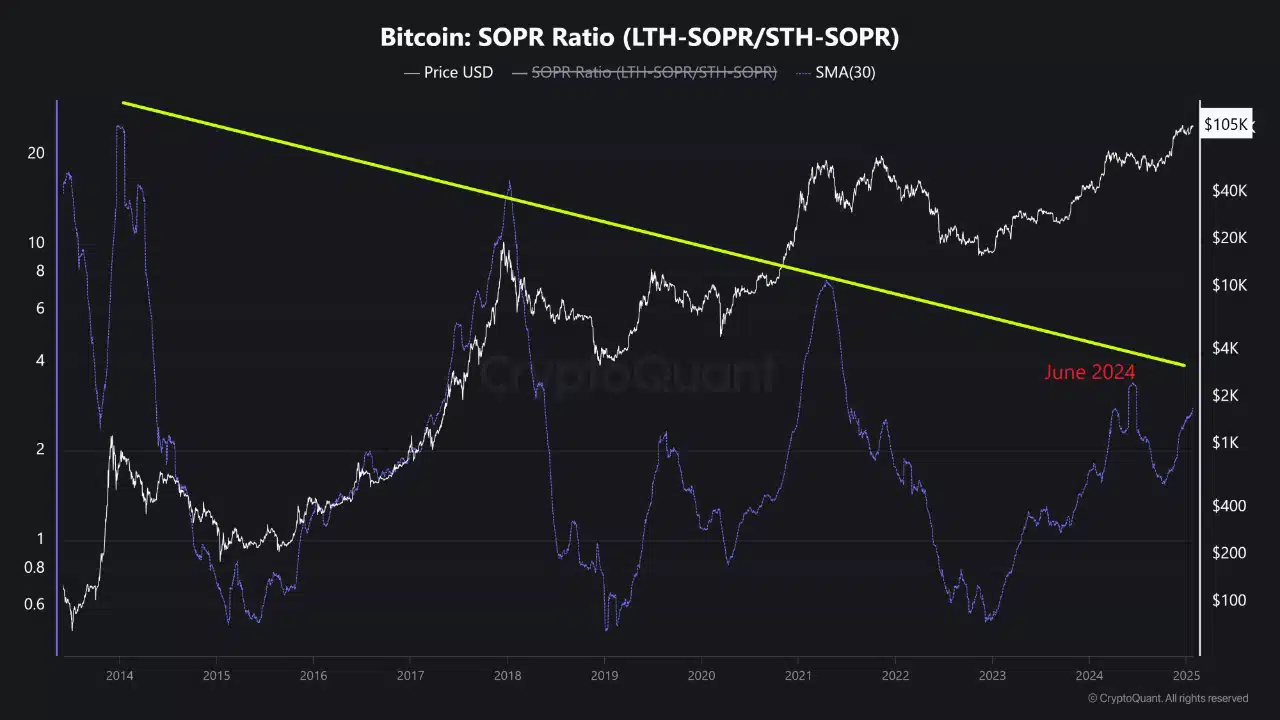

Amidst this ongoing drama, a CryptoQuant analyst has pointed out a curious trend among our long-term holders (LTH)—they seem to be playing the waiting game, as if they are at a train station with no trains in sight.

In a post on the CryptoQuant QuickTake platform, aptly titled “Major Market Players are Reluctant to Sell,” the analyst observed that the SOPR Ratio (LTH SOPR/STH SOPR) is growing slower than a tortoise in a marathon compared to previous cycles. 🐢

This ratio, which measures the realized profits of long-term holders against those of short-term holders, remains lower than the levels seen during Bitcoin’s price ascension in mid-2024. A curious case indeed!

As Bitcoin matures, it seems our long-term holders have adopted a more measured approach, distancing themselves from the wild antics of speculative trading. Perhaps they’ve finally learned that patience is a virtue? 🤔

Institutional participation has also reshaped the market dynamics, with more investors viewing Bitcoin as a long-term treasure rather than a mere trading instrument. The capital flowing into exchanges has decreased, as many long-term holders choose to keep their Bitcoin tucked away in their portfolios, like a squirrel hoarding nuts for winter. 🐿️

The implication? While the market may experience corrections, new cycles will likely emerge where Bitcoin is held for extended periods, reducing speculative selling and potentially stabilizing the market. A silver lining, perhaps?

On-chain data offers additional insights

In addition to the long-term holder behavior, we must consider other key metrics to grasp the full picture of BTC’s current escapades and where it may be headed in the near future.

Notably, data from CryptoQuant on BTC’s MVRV ratio reveals that this metric has been on the rise, much like a balloon at a birthday party, alongside BTC’s recent price action.

This increase has propelled BTC’s MVRV ratio from 2.2 on January 9 to a staggering 2.52 by January 21. 🎈

However, as of January 26, there has been a slight dip to 2.4, but fear not! The overall trend remains quite optimistic.

It is worth noting that the continued increase in the MVRV ratio points to a positive sentiment among holders and investors. A higher ratio typically indicates that the market is still willing to value Bitcoin above its realized price, signaling resilience and potential for recovery. 🌟

However, the slight pullback in MVRV could also serve as a cautionary tale, suggesting that the market might be approaching a period of consolidation. A cliffhanger, if you will!

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Elden Ring Nightreign Recluse guide and abilities explained

2025-01-27 15:39