- Ah, the strongest resistance for Bitcoin, a lofty $97,828, where 360,470 BTC were hoarded like precious gold!

- Bitcoin, that fickle friend, often finds solace at the 50-week moving average, currently lounging at $74,700.

In the grand theater of Bitcoin’s [BTC] cost basis distribution, two titanic levels emerge – the formidable resistance at $97,828 and the steadfast support at $64,078. At this resistance, a staggering 360,470 BTC were amassed, creating a psychological fortress that even the bravest bulls might hesitate to breach.

🌪️ Storm Brewing: EUR/USD Forecast Turns Chaotic Under Trump!

Discover why the next days could be critical for forex traders!

View Urgent ForecastHistorically, the price of Bitcoin has danced around these high-density accumulation zones, struggling to break free unless a surge in demand or a miraculous catalyst appears. Perhaps a bull cycle or a flood of ETF inflows could serve as the divine intervention needed for this breakout.

On the flip side, the $64,078 support level cradles 194,530 BTC, a sanctuary where buyers have heroically intervened to stave off further declines. It’s like a last stand in a dramatic novel, where the fate of many hangs in the balance.

As the price structure unfolds, Bitcoin has gallantly surged from $55,000 in September 2024 to soar above $108,000 in early 2025, showcasing a momentum that would make even the most seasoned traders weep with joy.

The relentless buying pressure in the $60,000 to just below $75,000 range suggests that many investors have eagerly snatched up BTC in this bracket. However, the crypto’s recent retreat from the heights near $100,000 has dragged it back towards the upper echelons of this high-support zone, like a hero returning from battle, weary yet determined.

If Bitcoin fails to reclaim the illustrious $97k, it risks a further descent towards $75k before it musters the courage to retest the $64k zone. A breach below this level would confirm a dark omen of further downside potential, possibly dragging BTC down to the depths of $55k.

Conversely, should a strong breakout above $97k occur, it could ignite a renewed uptrend, targeting new heights beyond $108k, as if the phoenix of cryptocurrency rises from the ashes!

Where will BTC strike first?

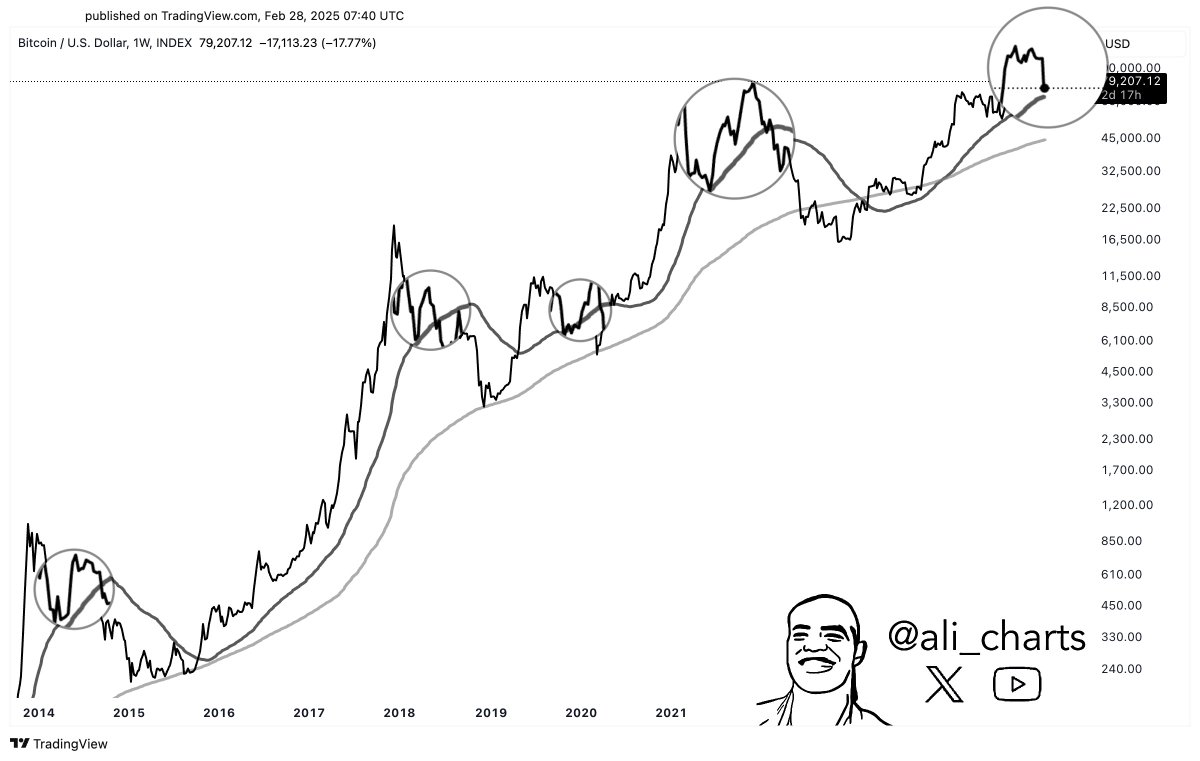

Further analysis reveals that Bitcoin’s historical trend often finds refuge at the 50-week moving average, currently resting at $74.7k. In fact, in each cycle, BTC has previously tested this moving average after a vigorous rally, before continuing its upward journey, much like a soldier returning to the front lines.

For instance, Bitcoin approached this moving average in 2015, 2019, and 2021, with each encounter leading to a significant price bounce. At the time of this writing, BTC had retraced from its recent high near $97,000, all while inching towards the $74,700 support zone, despite its valiant efforts at recovery.

If BTC manages to hold above its current level around $85k, a rebound and perhaps a retest of the $90k resistance could follow. However, should the crypto falter and lose this support, a deeper retracement towards $64k is likely – a level where vast amounts of BTC were hoarded like treasures in a dragon’s lair.

A break below $64k would shift market sentiment into a bearish spiral, potentially triggering a larger correction. Conversely, reclaiming $97k and holding it as support would increase the likelihood of new all-time highs beyond $108k, as if the heavens themselves have opened up to bless the faithful.

With Bitcoin historically bouncing at this key moving average, the next few weeks will be pivotal in determining whether it continues its bullish cycle or succumbs to a prolonged correction phase. The stage is set, the players are ready, and the audience holds its breath!

Read More

- Solo Leveling Season 3: What You NEED to Know!

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

- OM PREDICTION. OM cryptocurrency

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Captain America: Brave New World’s Shocking Leader Design Change Explained!

- Oshi no Ko Season 3: Release Date, Cast, and What to Expect!

- Gold Rate Forecast

- Meta launches ‘most capable openly available LLM to date’ rivalling GPT and Claude

- Fantastic Four: First Steps Cast’s Surprising Best Roles and Streaming Guides!

- How to Get to Frostcrag Spire in Oblivion Remastered

2025-03-01 16:11