-

Popular analyst believes BTC’s potential to reach a new peak is based on historical data

Anticipated rally hinges on how well the crypto holds the $54,000 support level

As a seasoned researcher with over a decade of experience in the crypto market, I find myself intrigued by the latest analysis and predictions surrounding Bitcoin’s potential to reach new heights. The parallels drawn between the current market situation and the aftermath of the COVID-19 crash are interesting, to say the least.

Over the last seven days, Bitcoin‘s market trend has been slow and relatively unproductive, resulting in a 4.53% decrease as indicated by the charts. As I write this, the price of Bitcoin stands at approximately $58,371.56, and its market capitalization has also seen a minor reduction. Despite this, it’s important to note that its total value remains above one trillion dollars.

Even so, cautious sentiment still reigns supreme in BTC’s market, with many still hesitant about wanting to buy in.

Is Bitcoin going to reach a new all-time high?

According to crypto expert Moustache, Bitcoin may be at a crucial juncture currently, possibly pushing it beyond the $70,000 mark in the near future.

His evaluation draws upon the similarity between Bitcoin’s price movements following Japan’s stock market collapse, leading to a cryptocurrency slump in August, and the impact of the COVID-19 crisis.

Based on the graph, the plunge caused by COVID-19 propelled Bitcoin to a substantial surge, peaking at approximately $11,892.92. This situation might exhibit similar results again.

According to the analysts’ assessment, Bitcoin’s past patterns might suggest that the present price stability could be short-lived and pave the way for possible price increases in the future.

If Bitcoin follows the pattern of 2020, the present range offers the second most promising opportunity, as it currently represents a retest and not yet a breakthrough.

That being said, he cautioned that the stability of the $54,000 level is required for this upward trajectory to materialize. He added,

“$54,000 must hold for this [rally to a new high] to happen.“

Translating this into simpler terms, if the price falls below $54,000, it might lean the market toward pessimism, characterized by increased selling activity.

As I delve deeper into the current market scenario, my focus is squarely on the significant $54,000 mark for Bitcoin. I’m keen to understand whether this level will withstand the test of time and gauge the overall sentiment surrounding BTC at present.

Market sentiment – Will the $54,000 level hold?

According to IntoTheBlock’s data, about 8 out of every 10 Bitcoin owners are currently making a profit. This indicates that the general feeling among investors toward the market is positive.

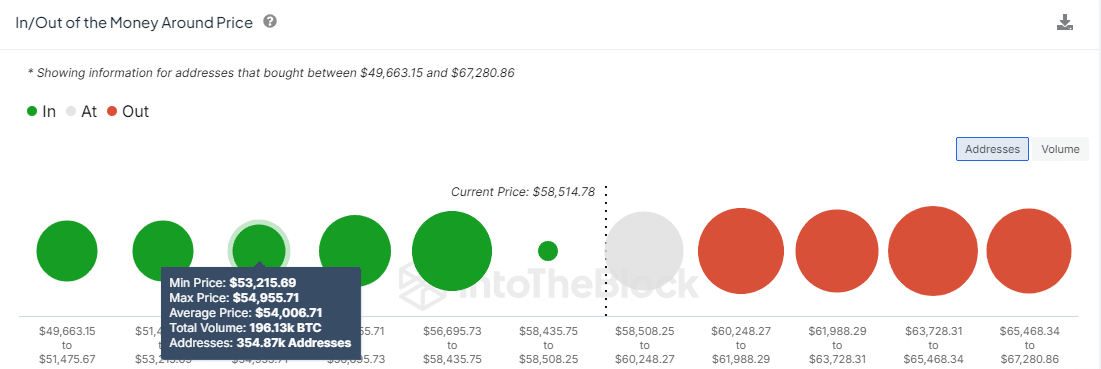

After examining the In/Out of the Money Around Price (IOMAP), it was found by AMBCrypto that the price point of $54,018.30 serves as a robust support level. This is due to approximately 355,000 addresses holding combined trading volumes surpassing $1 billion at this level.

As an analyst, I utilize the IOMAP tool to pinpoint areas where a significant number of holders have realized profits (in-the-money). These levels could act as strong supports, preventing any potential decline in price. On the flip side, it helps me locate regions where numerous investors find themselves out-of-the-money due to unrealized losses. When prices rise and approach these resistance levels, there’s a higher chance of sell-offs occurring, thus limiting any further price surges.

Given that Bitcoin’s current value is hovering around the notable $54,000 level I’ve highlighted, it seems poised to serve as a protective barrier against any potential further drops. This insight might just spark another upward trend in its price trajectory.

In summary, these three leading exchanges – Binance, OKX, and Bybit – have collectively seen a substantial outflow of $738.06 million in Bitcoin during the previous week, suggesting that more Bitcoin is being taken out of these platforms than put into them.

Generally speaking, this pattern tends to suggest that market players favor keeping or safeguarding their assets away from online platforms. Consequently, this could lead to a decrease in the amount of Bitcoin available on exchanges. If demand for Bitcoin continues at the same level or even increases, this scarcity could potentially boost Bitcoin’s price.

Read More

2024-08-17 02:16