-

Key events that could impact BTC’s price are coming up this week.

BTC has lost some gains from its previous trading session.

As an experienced financial analyst, I closely monitor Bitcoin’s price movements and market trends. Based on recent developments, the upcoming events from the US Bureau of Labor Statistics (BLS) could significantly impact Bitcoin’s price.

In the past few days, Bitcoin‘s [BTC] price has experienced significant fluctuations. For instance, it dropped more than 3% on May 10th, causing its worth to drop to $60,000.

As an analyst, I’ve noticed some volatility in the markets lately, and it seems this trend might continue given the upcoming Federal Reserve meetings on the horizon.

Bitcoin investors await BLS events outcomes

Investors should keep an eye on the upcoming events arranged by the US Bureau of Labor Statistics (BLS), as these events could significantly influence their investment choices.

Based on historical records, the Federal Reserve’s announcements have been known to impact Bitcoin’s market value previously.

The speech by Federal Reserve Chair Jerome Powell, set for the 14th of May, carries great importance.

According to the Bureau of Labor Statistics (BLS), there are two significant upcoming releases: the Producer Price Index (PPI) is set for today, while the Consumer Price Index (CPI) is scheduled for May 15th.

As a crypto investor, I understand that there are two important inflation indicators used by economists to gauge price trends: the Producer Price Index (PPI) and the Consumer Price Index (CPI). The PPI reflects the changes in the prices that producers receive for their goods and services, while the CPI measures the changes in the prices that consumers pay for those same items. In simpler terms, the PPI shows how selling prices change from the producer’s perspective, while the CPI reveals how purchasing prices change from the consumer’s standpoint.

Two indices play crucial roles as economic barometers, providing valuable insights for investors to assess the economy’s current condition.

As a crypto investor keeping a close eye on economic indicators, I’ve noticed that the Bureau of Labor Statistics (BLS) has an upcoming event scheduled. This event revolves around employment claims and is expected to unfold towards the latter part of the week.

Macroeconomic occurrences have the potential to impact Bitcoin’s price fluctuations, making it essential for investors to stay informed and adapt their investment plans accordingly.

What to expect from Bitcoin price moves

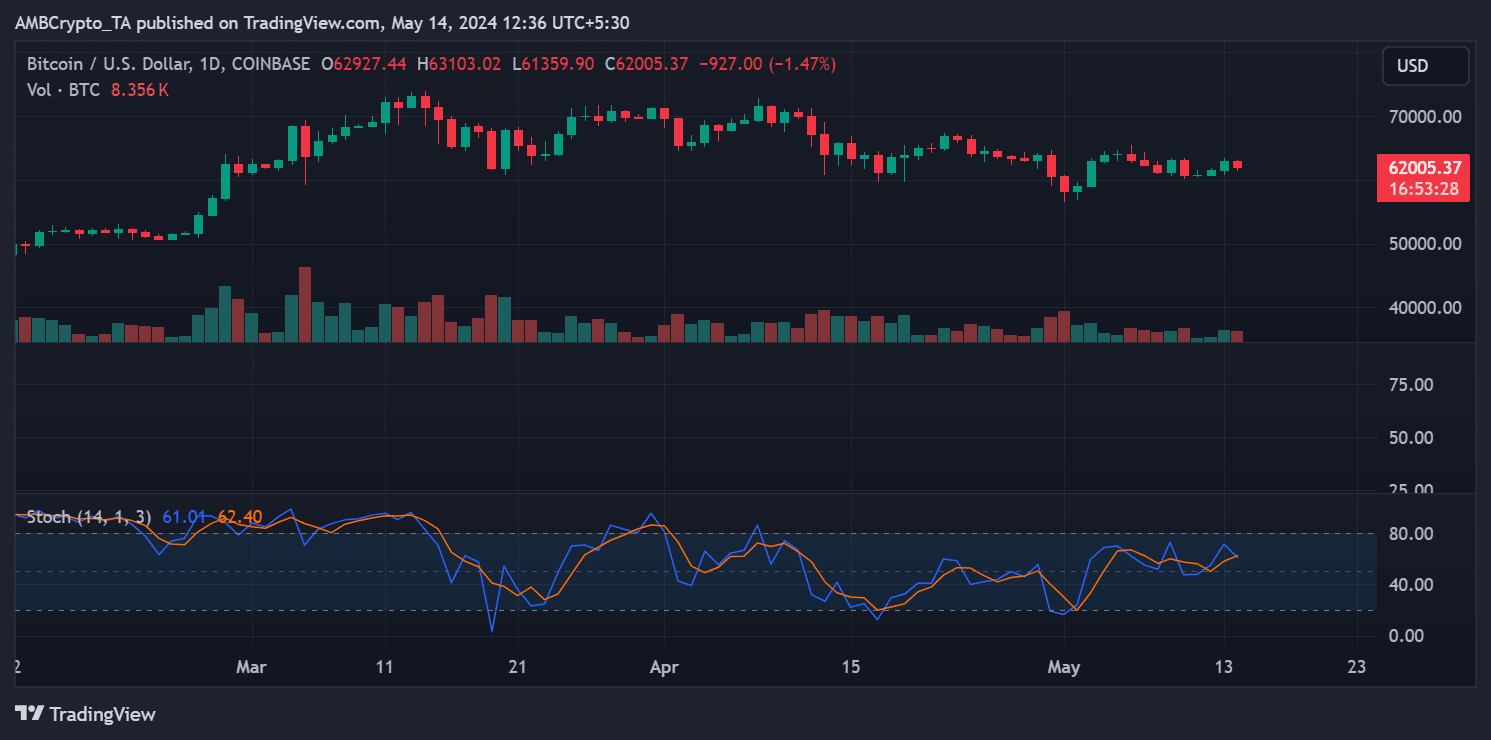

As a crypto investor, I’ve noticed that Bitcoin’s daily price chart, according to AMBCrypto’s analysis, has shown a less than stellar performance over the past few weeks.

As a researcher studying cryptocurrency prices, I observed that on the 10th of May, the price took a noticeable dive from approximately $63,000 to around $60,000. This equated to a substantial decrease of over 3%.

Since the 11th of May, Bitcoin has struggled to regain its footing, reaching a high of roughly $62,900. Currently, it is priced at approximately $62,000, representing a drop of more than 1% in value.

As an analyst examining the stochastic indicator, I observed signs of potential continued downturn. The crossover process was still in progress.

Based on current market trends, the price of $60,000 seems to be a significant support point. If the price falls, it’s possible that $57,000 could provide additional support and help limit any further price decreases.

Possible rise in BTC volume expected

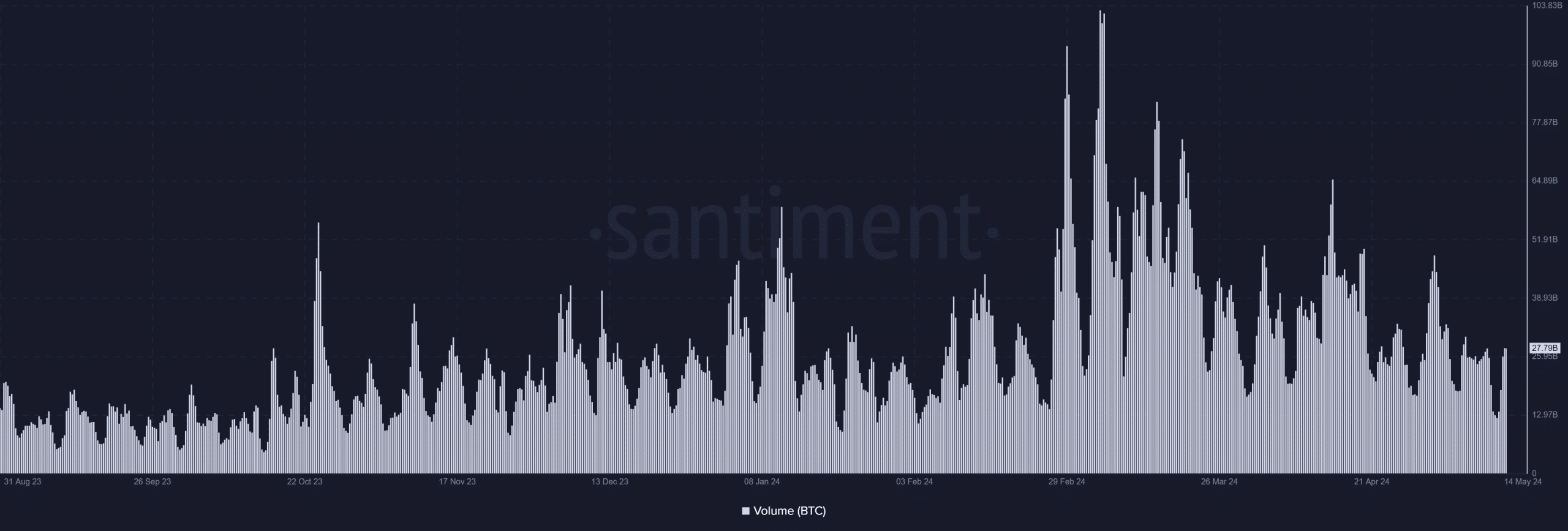

The volume metric for Bitcoin could experience increased activity if the price begins to decline.

During the past trading day, as the Bitcoin price surged, the trading volume reached around $25 billion.

Read Bitcoin’s [BTC] Price Prediction 2024-25

As a crypto investor observing the market at this moment, I’ve noticed that despite the recent decline in Bitcoin’s price, trading activity has significantly picked up. The daily trading volume has reached an impressive nearly $28 billion.

The surge in trading volume implies greater market activity, which could be a sign of intensified selling if the price keeps dropping.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- SOL PREDICTION. SOL cryptocurrency

- Gayle King, Katy Perry & More Embark on Historic All-Women Space Mission

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

2024-05-14 14:15