Ah, Bitcoin. The cryptocurrency that’s like that friend who promises to pay you back but never does. It seems we might be on the edge of a critical turning point, or as I like to call it, the “please let this be the bottom” moment. Recent market signals are suggesting a potential shift in momentum, which is just a fancy way of saying, “Hold onto your wallets!”

Now, let’s talk about the Adjusted Spent Output Profit Ratio (aSOPR). It’s been hanging out below 1 like a sad puppy at the shelter, indicating that many investors are selling at a loss. This is often linked to market capitulation, which sounds like a fancy term for “everyone’s panicking.”

Meanwhile, the Coinbase Premium Index is showing signs of recovery, which is great news unless you’re the one who just sold your Bitcoin at a loss. It’s like watching your neighbor’s garden flourish while yours is a barren wasteland. Is Bitcoin nearing a market bottom, or are we just in for more volatility? Stay tuned!

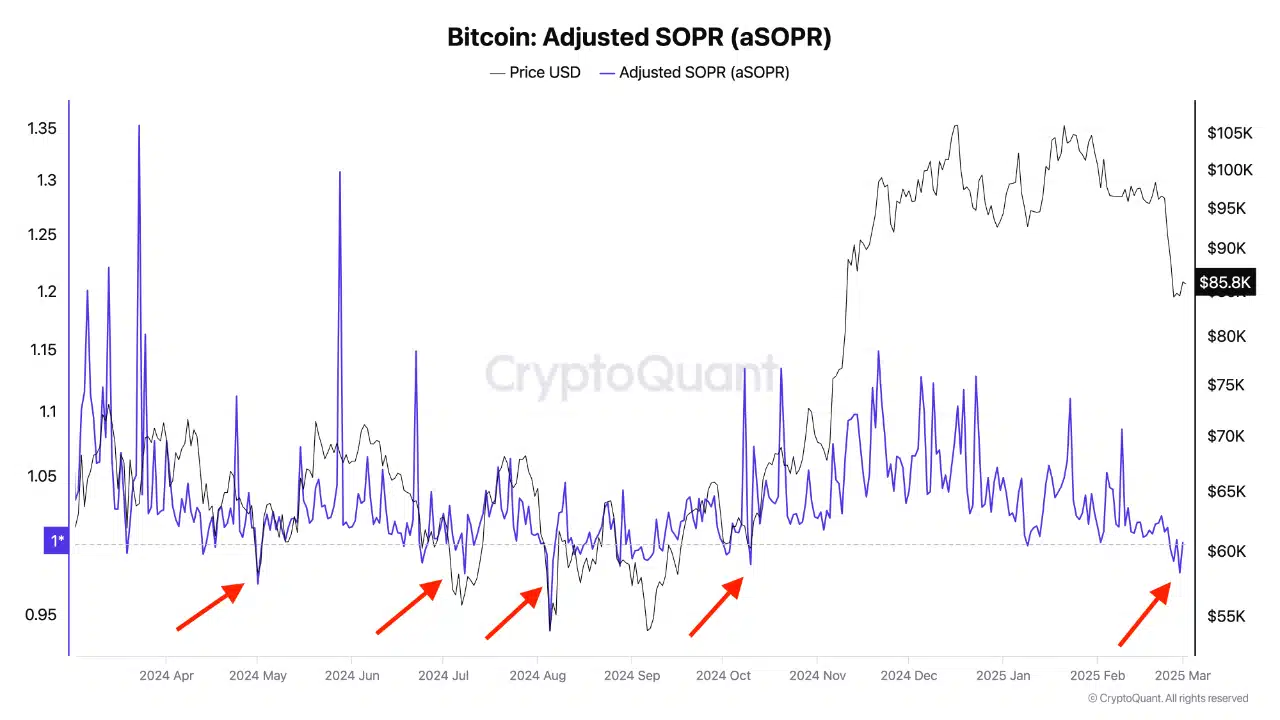

aSOPR and market bottom signals

So, what exactly is aSOPR? It’s a measure of whether Bitcoin investors are selling at a profit or a loss. A reading below 1 means the average seller is exiting at a loss, which is like saying, “I’m not crying, you’re crying!”

Historically, when aSOPR dips below 1 for an extended period and then recovers, it has signaled a shift in trend. It’s like that moment when you realize your favorite TV show is coming back for another season after a cliffhanger. Hope is alive!

In the chart, red arrows highlight previous instances where aSOPR fell below 1, aligning with local price bottoms before Bitcoin rebounded. It’s like a treasure map, but instead of gold, you find more Bitcoin. Who knew pirates could be so tech-savvy?

The most recent drop in early 2025 suggests a similar pattern, raising the question of whether Bitcoin is nearing another turning point. If selling pressure eases and demand strengthens, we might just see history repeat itself. Fingers crossed!

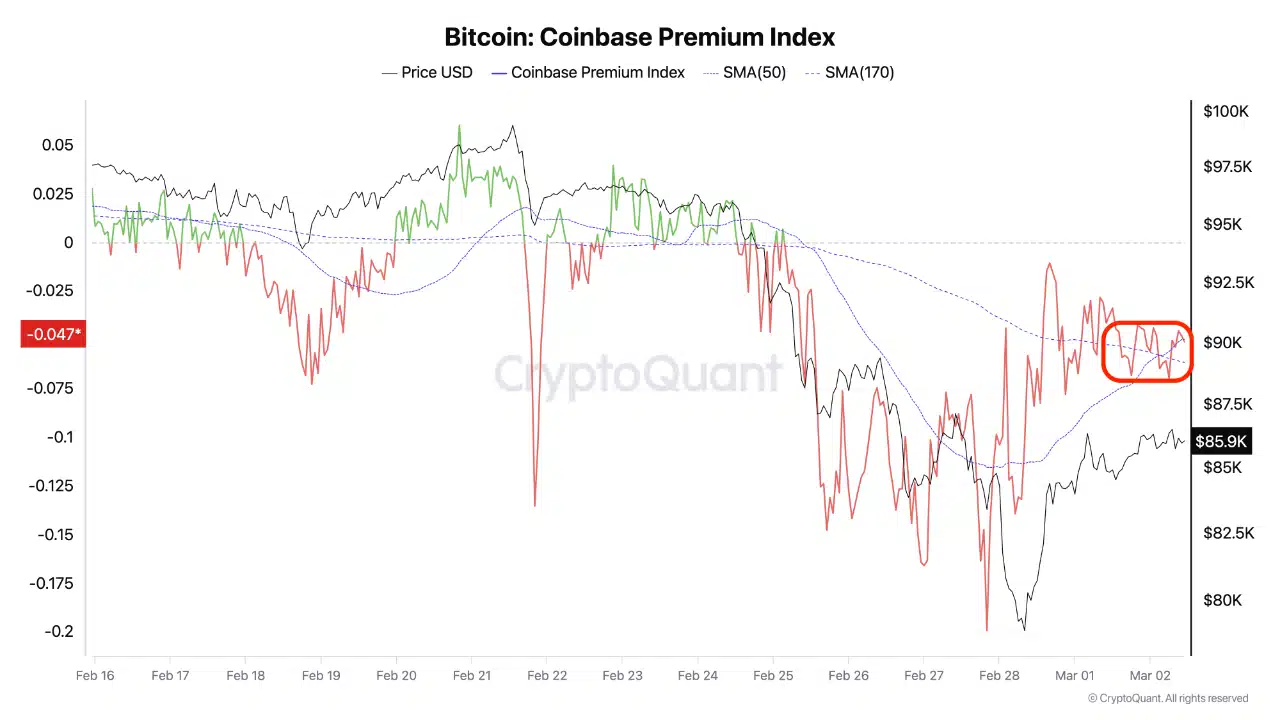

Coinbase premium index shows signs of stabilization

The Coinbase Premium Index, which measures the difference between Bitcoin’s price on Coinbase and other exchanges, has been recovering after a sharp decline. It’s like watching a toddler learn to walk—wobbly but getting there!

A negative premium often signals stronger selling pressure from U.S. investors, while a positive premium suggests demand from institutional buyers. It’s the financial equivalent of “who’s in charge here?”

In late February, the premium turned deeply negative as Bitcoin dropped below $85,000. However, recent movements show a stabilization near the $90,000 level, aligning with the 50-day Moving Average. It’s like finding a $20 bill in your winter coat pocket—unexpected but delightful!

While institutional demand isn’t aggressively pushing prices higher yet, selling pressure is easing. If the premium sustains positive territory, it could indicate renewed accumulation, supporting a potential Bitcoin rebound in the coming weeks. So, keep your eyes peeled and your wallets ready!

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2025-03-03 13:15