On the second day of our dear Bitcoin ETF’s flirtation with net inflows, a sum of $76.42 million has graced the market.

Ah, what a delightful twist in the tale of institutional investors! Just last week, they were pulling their money out like it was a bad date. But now, it seems they’ve decided to give it another go. How romantic! 💔➡️❤️

Bitcoin Funds: A Love Story of Two Days

Yesterday’s cash influx, following Monday’s modest $1.47 million, suggests that some institutional players are dusting off their wallets, perhaps hoping for a brighter tomorrow. Or maybe just a better dinner? 🍽️

This gradual return of inflows into BTC ETFs hints at a rekindled faith in the coin’s long-term prospects, even as its short-term price volatility continues to send shivers down the spines of the faint-hearted. Brrr! ❄️

On Tuesday, BlackRock’s ETF IBIT, the belle of the ball, recorded the largest daily net inflow of $38.22 million, bringing its total cumulative net inflows to a staggering $39.64 billion. Quite the catch, isn’t it? 🎣

Meanwhile, Ark Invest and 21Shares’ ARKB, the second-best suitor, attracted $13.42 million, bringing its historical net inflows to a respectable $2.60 billion. Not too shabby for a Tuesday! 🥳

Bitcoin Price Dips, But the Optimists Persist

In a rather dramatic turn of events, the cryptocurrency market has experienced a noticeable dip in trading activity, with a $40 billion drop in total market capitalization. Oh, the humanity! 😱

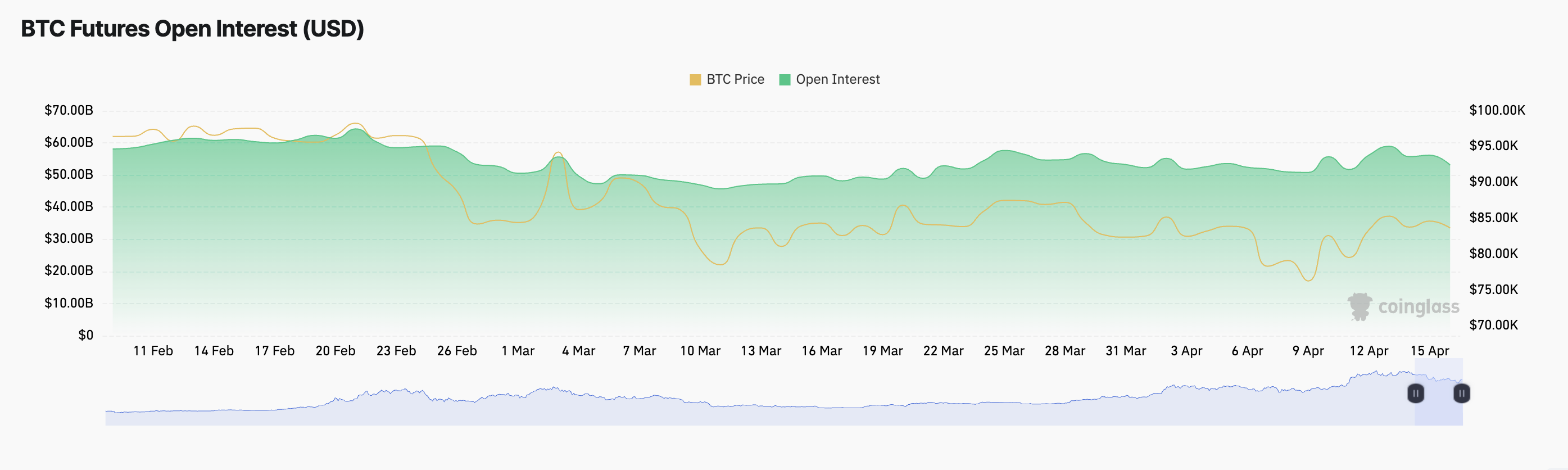

In line with this broader market pullback, BTC’s price has taken a 3% tumble, now trading at $83,341. This price dip has been accompanied by a 5% drop in the coin’s futures open interest, signaling that traders are retreating faster than a cat from a bath. 🐱💦

The decline in BTC’s open interest and price suggests that traders are closing their positions rather than opening new ones. A market in retreat, indeed! It’s like watching a game of musical chairs, but with more anxiety. 🎶

However, not all is lost in this tale of woe.

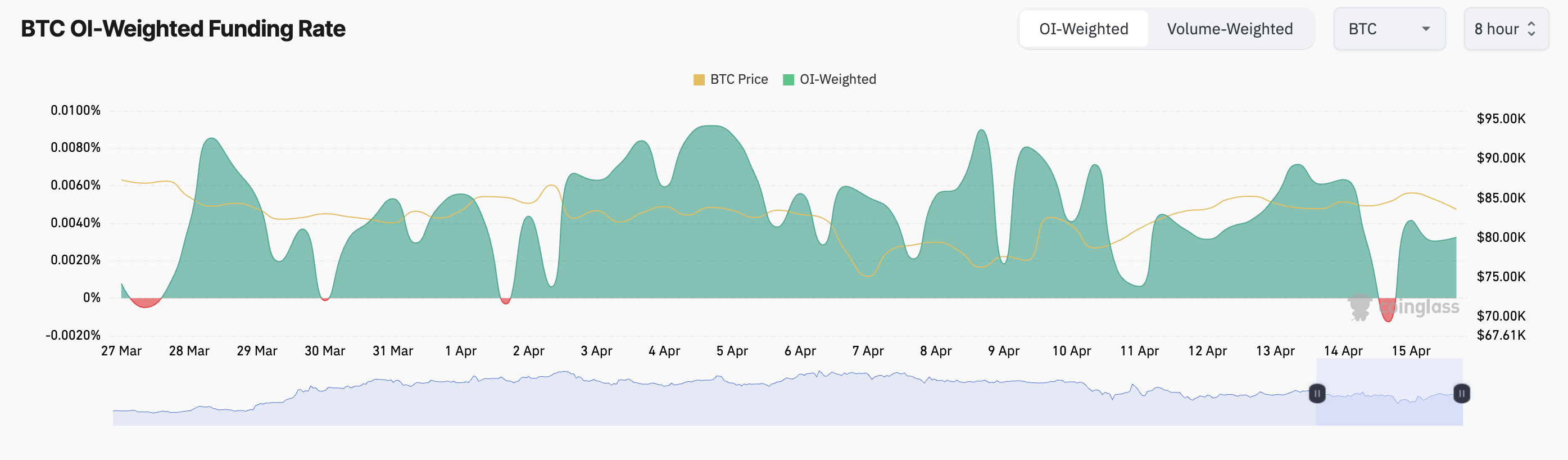

The coin’s funding rate has flipped back into positive territory, currently at 0.0032%. This signals that many futures traders are still opening long positions, perhaps with dreams of a recovery dancing in their heads. 🌈

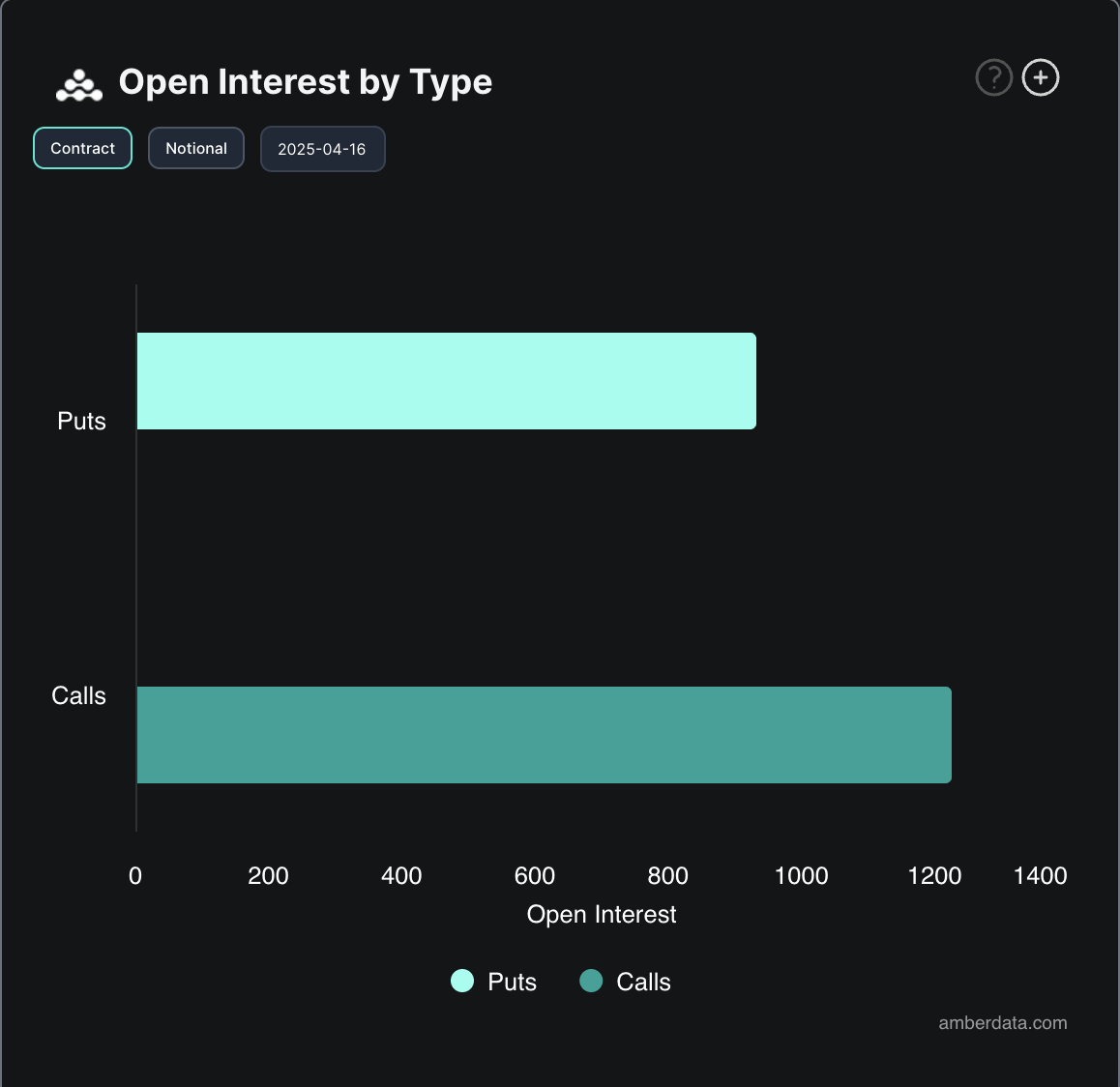

Notably, there are more calls than puts in the BTC options market today. A bullish sentiment among options traders, as call options are typically used to bet on upward price movement. It’s like a party where everyone is hoping for a happy ending! 🎉

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2025-04-16 09:52