- BTC flirted with $98K, then ghosted after Powell’s “slow and steady” Fed rate cut spiel. 🐢

- Demand for BTC? Meh. Macro uncertainty is the new buzzkill. 🥱

Bitcoin’s [BTC] early-week rally hit a wall at $98K, only to nosedive to $95K after Fed Chair Jerome Powell’s less-than-enthusiastic take on interest rate cuts. In his semi-annual monetary report to Congress on February 12th, Powell essentially said, “We’re not rushing this, folks.” His exact words?

‘Our policy stance is now less restrictive than it had been, and the economy remains strong. We do not need to be in a hurry to adjust our policy stance.’

Translation: “We’re chilling. You can wait.” For context, lower interest rates mean cheaper capital, which is usually a green light for risk-on assets like Bitcoin and stocks. But Powell’s “slow your roll” approach, combined with Trump’s tariffs, has left the market feeling bearish. 🐻

Will the January CPI Report Be BTC’s Savior or Executioner?

The Fed’s rate cuts hinge on U.S. labor markets and inflation. So, all eyes are on the January CPI (Consumer Price Index) report, set to drop on February 12th. According to Forex Factory, the forecasted monthly change for January’s CPI is 0.3%. If the actual CPI is higher, it’s bearish—meaning the Fed might keep interest rates unchanged longer. A lower CPI? Slightly bullish, but don’t get too excited. 📉📈

Interest traders are already pricing in a 95% chance of another rate pause in March’s FOMC meeting. So, will the CPI report change anything? Who knows. 🤷♂️

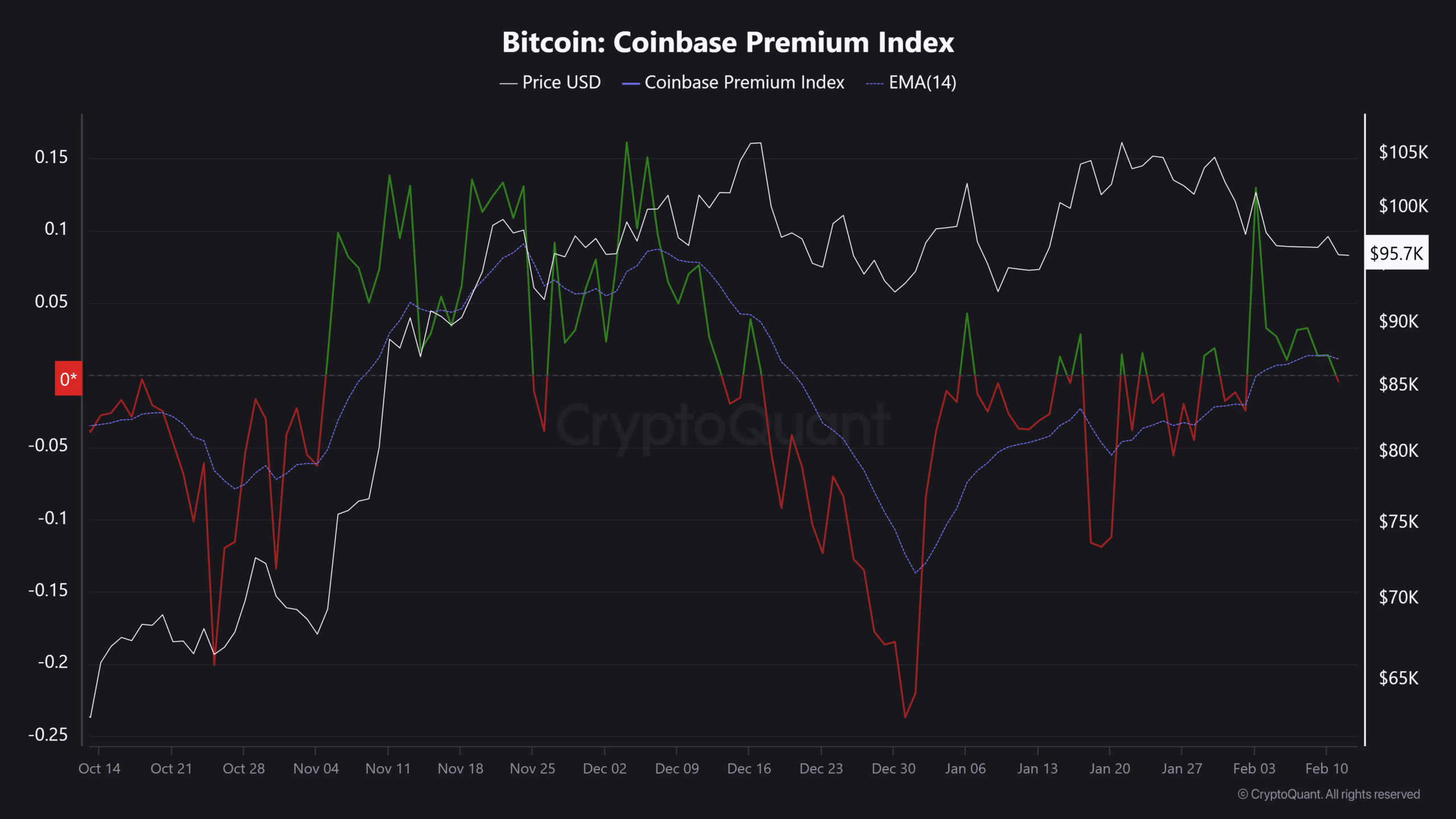

Meanwhile, the Coinbase Premium Index, which tracks U.S. investors’ appetite for BTC, has returned to neutral after a brief surge in early February. BTC, too, has retraced from $101K to $95K. Any further dip in the index could limit BTC’s short-term rebound, even with the OTC balance shrinking. 📉

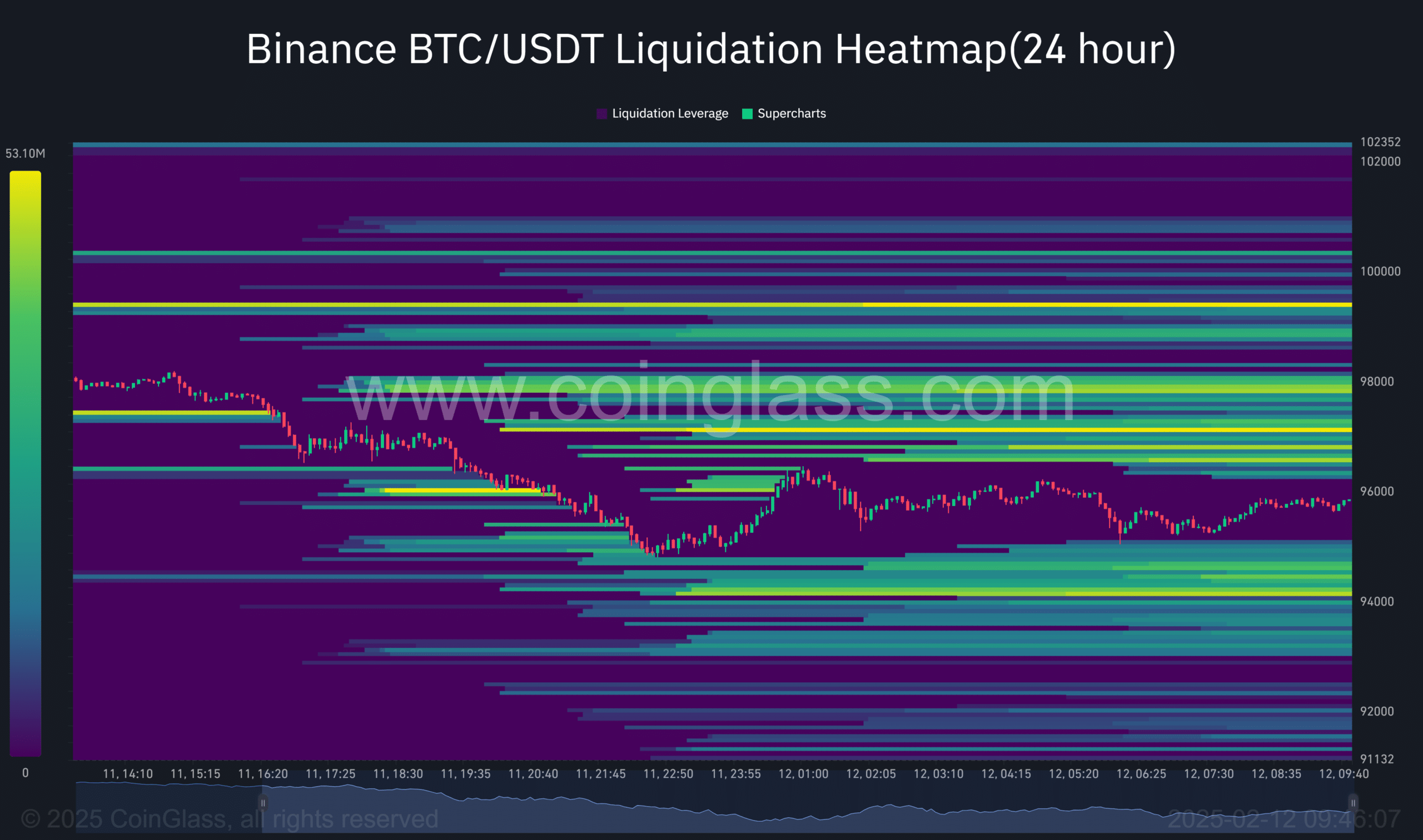

As for BTC’s choppy market, the Coinglass liquidation heatmap shows pockets of liquidity on either side of price action. Translation: BTC might keep bouncing between $94K and $100K for a while. 🎢

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2025-02-12 12:11