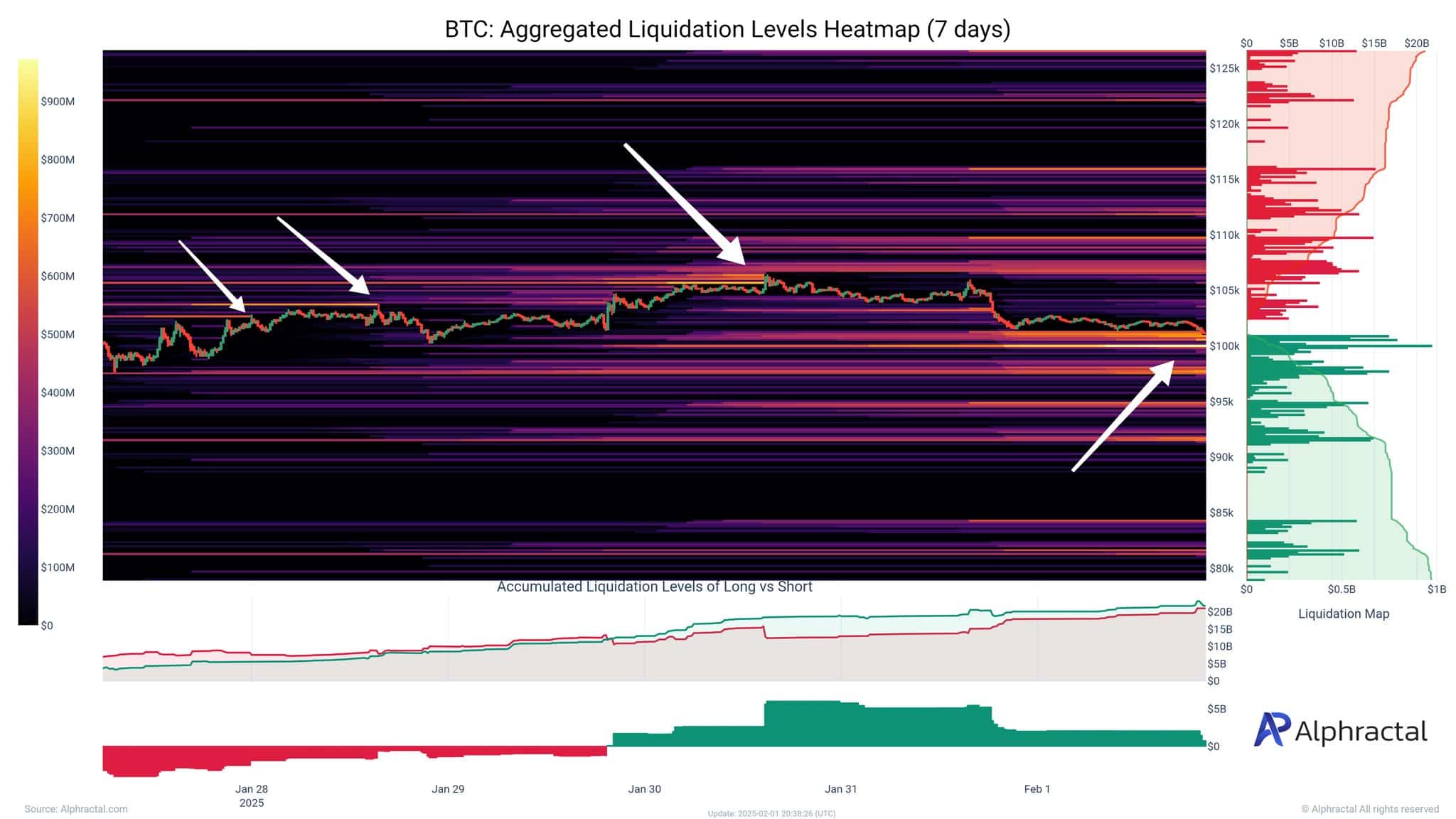

- The market has been a bloodbath, with liquidations hitting hardest between $101,500 and $99,800. 💸

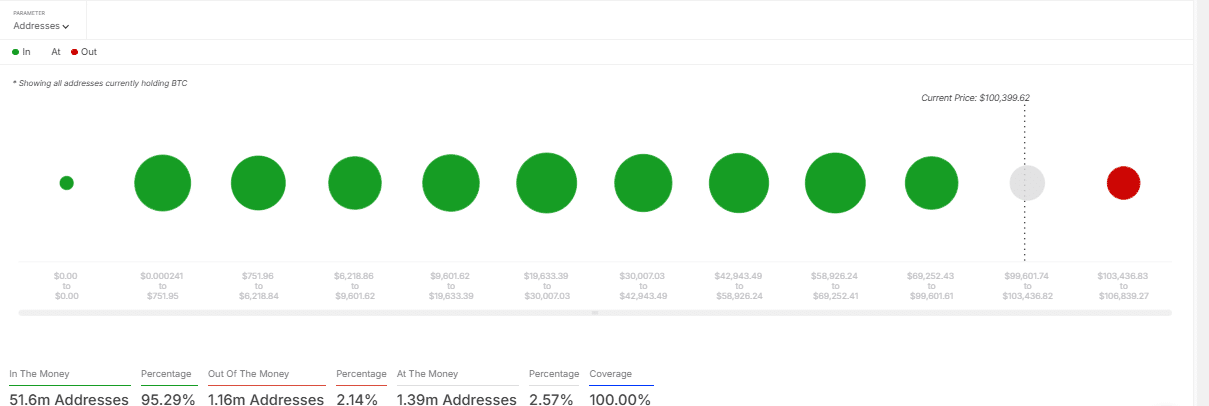

- Bitcoin’s holder distribution is like a crystal ball—if you squint hard enough, you might see the future. 🔮

Bitcoin’s [BTC] recent price swings have traders clutching their wallets tighter than a miser with a gold coin. Volatility is the name of the game, and liquidations are the penalty for playing it wrong. 🎢

As the market dances to the tune of chaos, a few key factors are pulling the strings behind Bitcoin’s erratic moves. 🕺

Bitcoin’s Price: A Tale of Woe and Hope

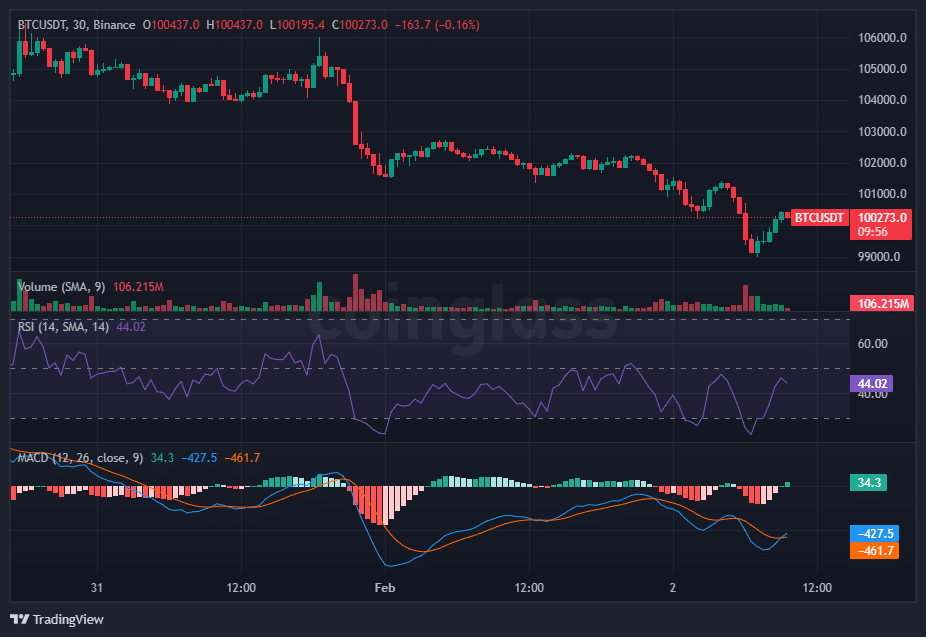

AMBCrypto’s peek at BTC’s price revealed a sad story: a downtrend, a tiny recovery, and a lot of tears. The price plummeted but tried to bounce back from $99,000, currently sitting at $100,273. 🎢

The RSI, at 44.02, is like a moody teenager—neutral but edging toward oversold. The MACD histogram is less negative, hinting at a possible bullish crossover, but the signal line is still sulking below zero. 📉

Volume spiked during the sell-off but stayed low on the bounce. Overall, the trend is still bearish, but hey, at least it’s trying. 🐻

Trader Sentiment: Panic at the Crypto Disco

The market has been a liquidation fiesta, with the most pain concentrated between $101,500 and $99,800. 🎉

This zone is where dreams go to die, with both long and short positions getting wiped out faster than a meme coin. 💀

SOURCE: Aphractal

The rapid unwinding of positions has turned the market into a circus, with traders scrambling to reassess their strategies. 🎪

As liquidity gets sucked up during these events, price swings become as unpredictable as a cat on caffeine. Risk management? More like risk roulette. 🎲

Investor Positioning: The Great Bitcoin Hold

Bitcoin’s holder distribution is a treasure trove of insights. At press time, 95.29% of Bitcoin addresses, or 51.6 million, are sitting pretty with profits. 🤑

Meanwhile, 1.16 million addresses are “out of the money,” and 1.39 million are “at the money.” 🎰

With most investors holding onto unrealized gains, market sentiment is stable—for now. But if profit-taking kicks in, selling pressure could turn Bitcoin’s frown upside down. 😬

Read Bitcoin’s [BTC] Price Prediction 2025–2026

If a wave of profitable holders decides to cash out, Bitcoin could face more downward pressure, making support levels the new VIPs of the market. 🚨

Bitcoin’s price movements are as reactive as a teenager to a Wi-Fi outage, with liquidation patterns, volatility, and investor positioning calling the shots. 📱

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Gold Rate Forecast

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- Despite Bitcoin’s $64K surprise, some major concerns persist

2025-02-02 15:08