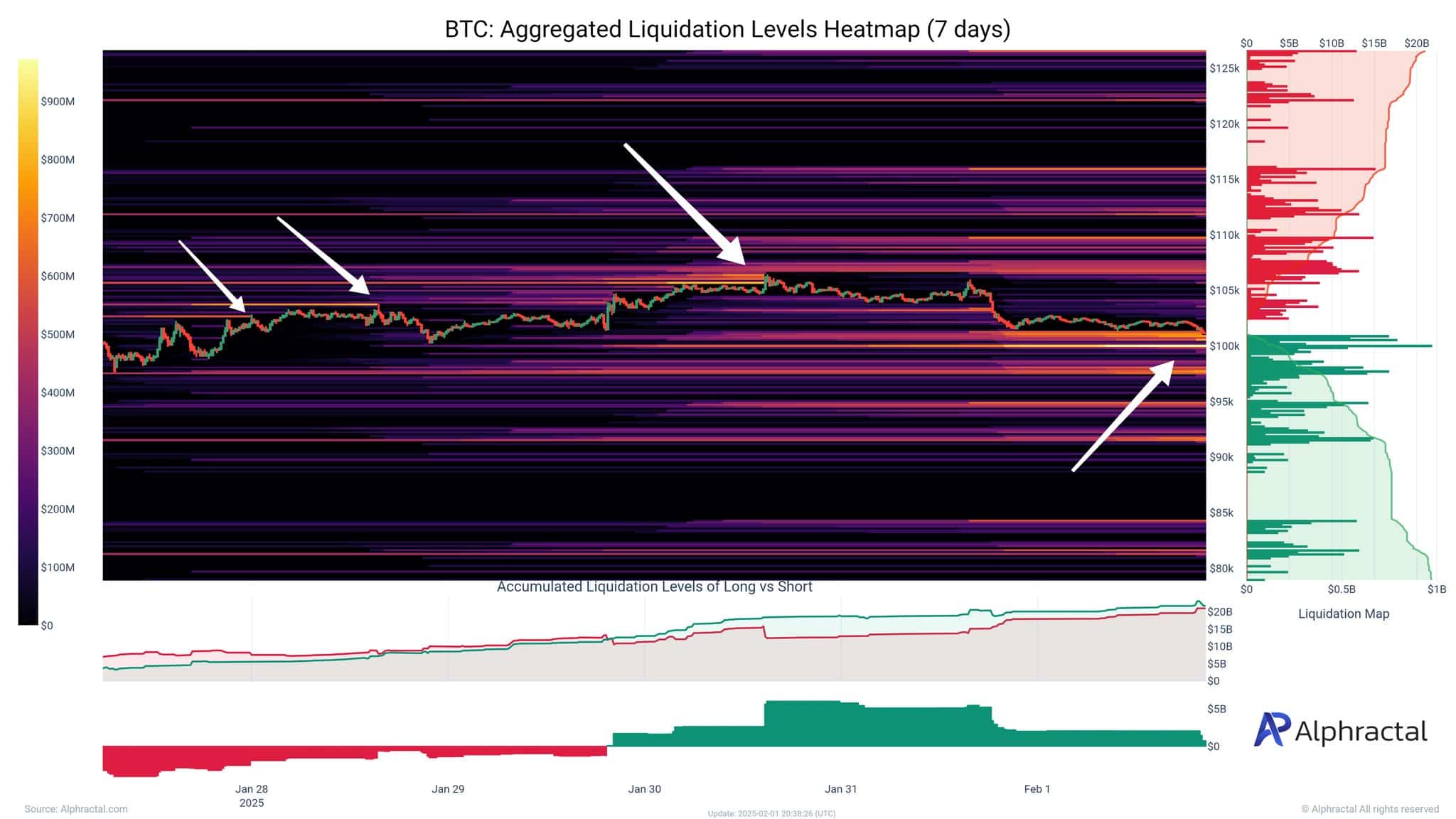

- The market has been a bloodbath, with liquidations hitting hardest between $101,500 and $99,800.

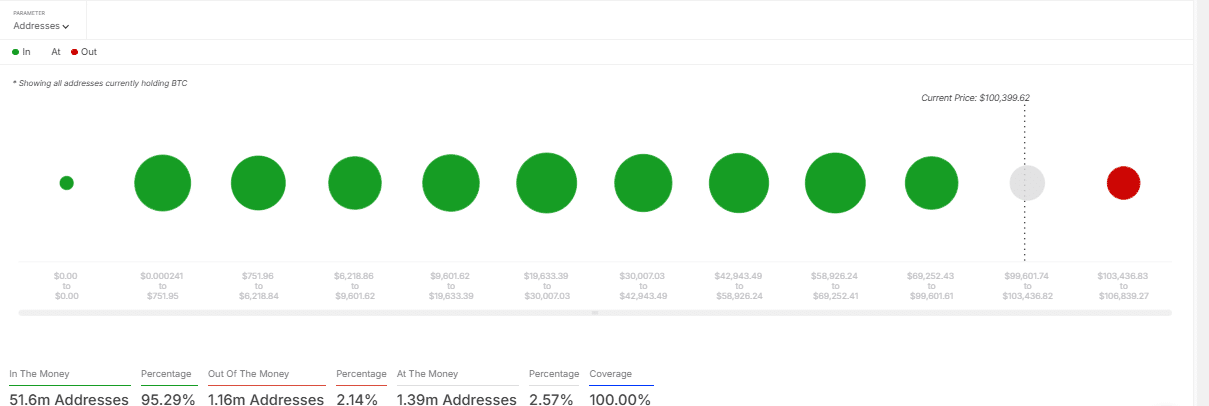

- Bitcoin’s holder distribution is like a crystal ball—if you squint hard enough, you might see the future.

Bitcoin’s [BTC] recent price swings have traders clutching their wallets tighter than a miser with a gold coin. Volatility is the name of the game, and liquidations are the penalty for playing it wrong.

EUR/USD Turmoil Warning as Trump Escalates Trade Wars!

EUR/USD Turmoil Warning as Trump Escalates Trade Wars!

New research shows euro-dollar volatility about to spike — are you ready?

View Urgent ForecastAs the market dances to the tune of chaos, a few key factors are pulling the strings behind Bitcoin’s erratic moves.

Bitcoin’s Price: A Tale of Woe and Hope

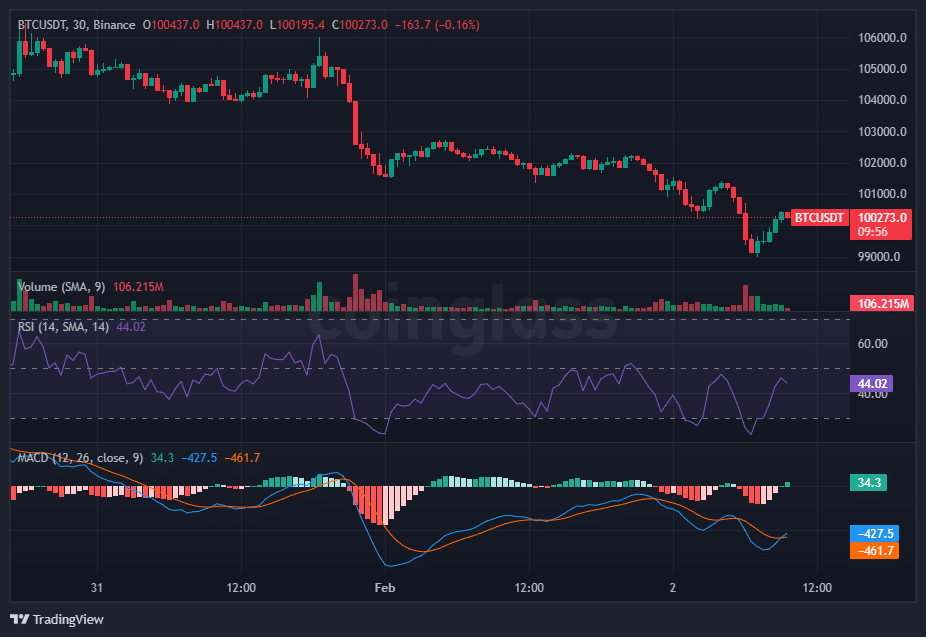

AMBCrypto’s peek at BTC’s price revealed a sad story: a downtrend, a tiny recovery, and a lot of tears. The price plummeted but tried to bounce back from $99,000, currently sitting at $100,273.

The RSI, at 44.02, is like a moody teenager—neutral but edging toward oversold. The MACD histogram is less negative, hinting at a possible bullish crossover, but the signal line is still sulking below zero.

Volume spiked during the sell-off but stayed low on the bounce. Overall, the trend is still bearish, but hey, at least it’s trying.

Trader Sentiment: Panic at the Crypto Disco

The market has been a liquidation fiesta, with the most pain concentrated between $101,500 and $99,800.

This zone is where dreams go to die, with both long and short positions getting wiped out faster than a meme coin.

SOURCE: Aphractal

The rapid unwinding of positions has turned the market into a circus, with traders scrambling to reassess their strategies.

As liquidity gets sucked up during these events, price swings become as unpredictable as a cat on caffeine. Risk management? More like risk roulette.

Investor Positioning: The Great Bitcoin Hold

Bitcoin’s holder distribution is a treasure trove of insights. At press time, 95.29% of Bitcoin addresses, or 51.6 million, are sitting pretty with profits.

Meanwhile, 1.16 million addresses are “out of the money,” and 1.39 million are “at the money.”

With most investors holding onto unrealized gains, market sentiment is stable—for now. But if profit-taking kicks in, selling pressure could turn Bitcoin’s frown upside down.

Read Bitcoin’s [BTC] Price Prediction 2025–2026

If a wave of profitable holders decides to cash out, Bitcoin could face more downward pressure, making support levels the new VIPs of the market.

Bitcoin’s price movements are as reactive as a teenager to a Wi-Fi outage, with liquidation patterns, volatility, and investor positioning calling the shots.

Read More

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- There is no Forza Horizon 6 this year, but Phil Spencer did tease it for the Xbox 25th anniversary in 2026

2025-02-02 15:08