- Ah, the accumulation trend score of Bitcoin has risen above 0.1, a sign of potential buying interest, or perhaps just a mirage in the desert of despair.

- But let us not get ahead of ourselves; a convincing reversal still requires a demand that is more than just a fleeting fancy.

In a world where Bitcoin’s accumulation trend score has finally ticked above 0.1 for the first time since the 11th of March, one might think we are witnessing a miracle. Yet, it is but a modest shift in a landscape that resembles a gloomy winter’s day.

While the distribution remains firmly in control, this slight uptick hints at a flicker of buying interest, like a candle struggling against the wind, suggesting the early stages of renewed demand. Or is it just a cruel joke played by the market?

The key question now is whether this marks the beginning of a market reversal, or merely a temporary pause in the prevailing downtrend. A philosophical quandary, indeed!

Accumulation activity reawakens after prolonged lull

After a heavy wave of accumulation during the late Q4 rally — reflected in deep purple nodes on the chart, which, I must say, look rather lovely — sentiment turned decidedly risk-off as Bitcoin entered a distribution-dominant phase in early 2025. How poetic!

This transition is evident in the increasing frequency of yellow and orange markers, indicating widespread selling or perhaps a collective hesitation to buy. A true spectacle of human indecision!

However, March 2025 reveals a subtle but notable shift: accumulation scores are beginning to climb, with colors transitioning back toward purple. A renaissance of sorts, if you will.

While still modest, this change suggests renewed interest from longer-term holders or entities gradually rebuilding positions. Or maybe they just miss the thrill of the chase!

It may represent early positioning ahead of a potential trend reversal — or simply a short-lived deviation in an ongoing bearish cycle. The suspense is palpable!

Market sentiment and potential reversal

Bitcoin’s ongoing downtrend has been defined by extended distribution, with the ATS remaining below 0.5 – indicating dominant selling pressure. A classic case of “sell first, ask questions later.”

The recent climb above 0.1, though minor, signals the reemergence of accumulation — a pattern often seen during the early stages of recovery after major corrections. History, it seems, has a sense of humor.

Historically, such transitions have followed bear market bottoms, where accumulation slowly builds as confidence returns. A slow dance of hope and despair!

Currently, strategic moves by institutional players and expectations of regulatory clarity could be driving this subtle shift. Or perhaps they are just as confused as the rest of us!

However, for the trend to hold, accumulation must be sustained by continued institutional demand and supportive policy signals. Any abrupt regulatory setbacks or sharp volatility spikes could disrupt this nascent recovery. Ah, the unpredictability of life!

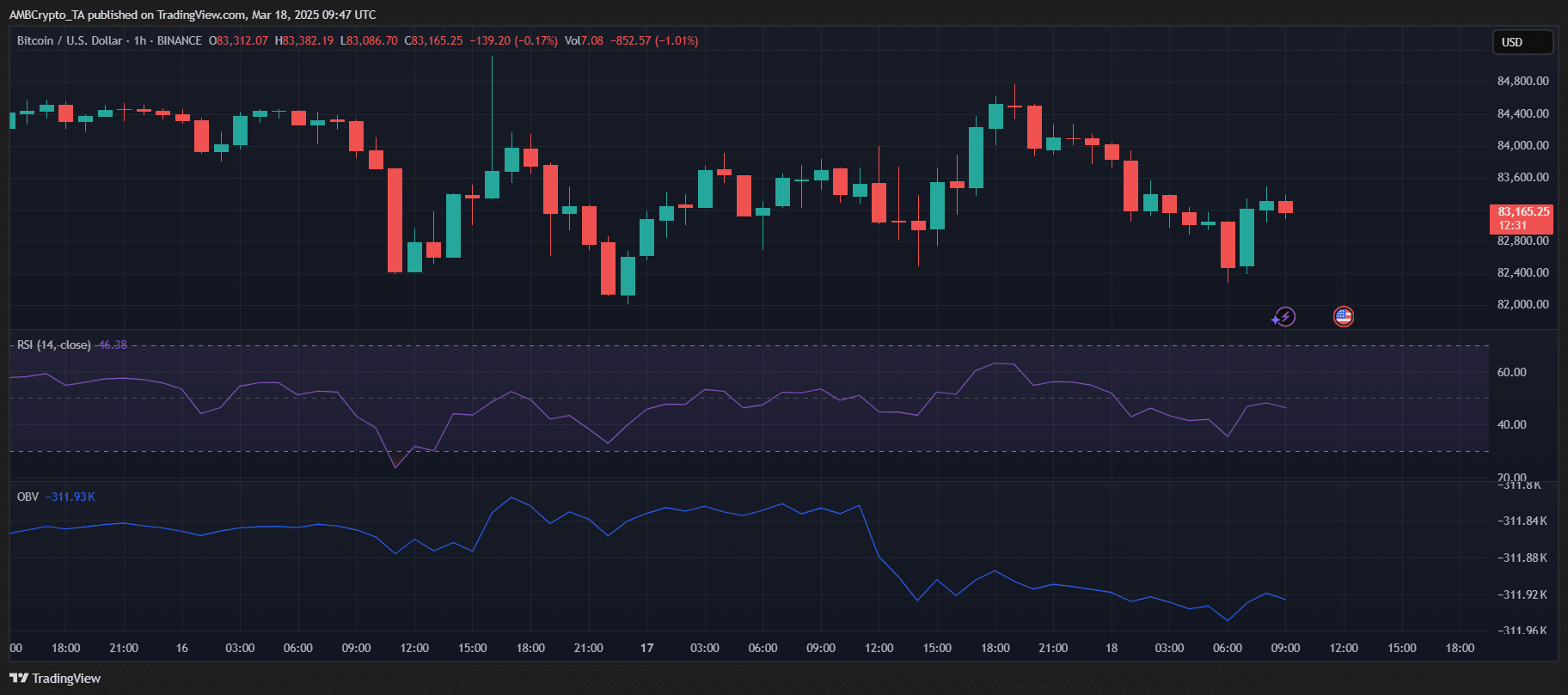

Bitcoin: Weak momentum, limited buy pressure

Bitcoin was at $83,165 at press time, down over 1% in the past 24 hours. The hourly chart revealed a struggle to reclaim upward momentum, with a pattern of lower highs persisting despite brief rebounds. A tragicomedy, if ever there was one!

The RSI sat at 46, reflecting weak bullish pressure and no clear signs of the asset being oversold. A state of limbo, perhaps?

Meanwhile, the OBV remained firmly negative at -311.93K, highlighting a lack of sustained buying activity. Taken together, these indicators pointed to cautious sentiment in the short term. A collective sigh of resignation!

For a convincing reversal to take shape, BTC would need to break above $84,000, accompanied by rising volume and an RSI push beyond the neutral 50 mark. A tall order, indeed!

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Flight Lands Safely After Dodging Departing Plane at Same Runway

- Elden Ring Nightreign Recluse guide and abilities explained

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

2025-03-18 18:20