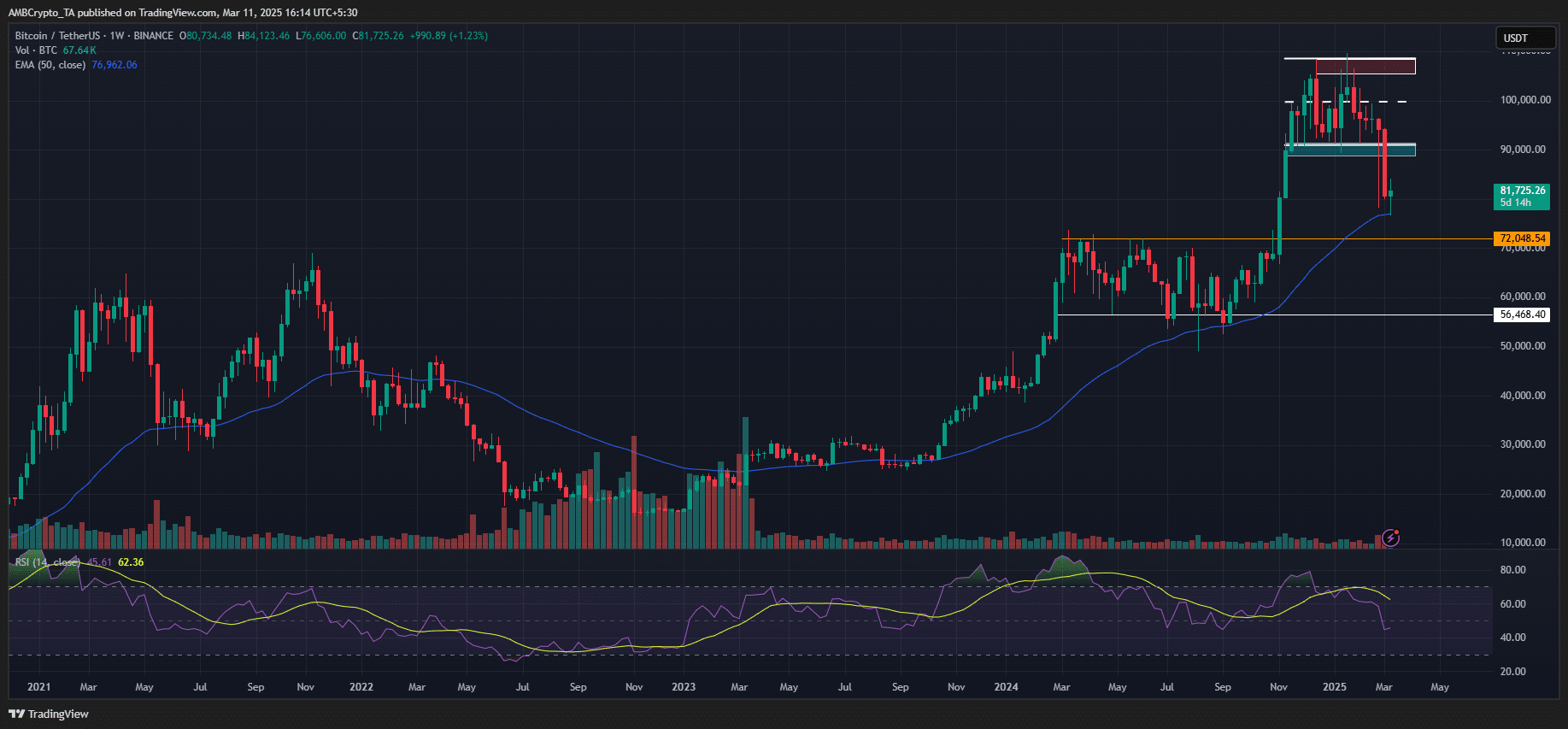

- Ah, the fickle nature of BTC, perhaps extending its losses to the nostalgic $72K of last November’s U.S. elections. How quaint!

- Cathie Wood, ever the optimist, predicts a brighter macro landscape in the second half of 2025. One can only hope! 🌤️

Bitcoin, that capricious creature, may soon slip below the $75K mark, as the specter of a U.S. recession looms ominously. Greg Madagini, the sage of crypto options at Amberdata, foresees a descent to $72K in the near future. How delightful! 🎢

Bitcoin’s Potential Dip to $72K

In his weekly market report, the ever-astute Magadini remarked,

“BTC prices appear to be mimicking a Bart Simpson pattern, aiming for a nostalgic return to $72K, the level of the Nov 5th elections.”

The Bart Simpson pattern, a curious phenomenon, involves a sharp rise, a brief pause for reflection, and then a swift retrace. Much like life, wouldn’t you agree?

If this pattern holds true, BTC might just revisit its last November election level, echoing the retracement seen in U.S. equities, as Magadini wisely noted.

“Given that the SPX (S&P 500 Index) has now retraced back to election price levels, I suspect this pattern for spot BTC could be in the cards.”

Meanwhile, the ever-pessimistic Peter Brandt, a technical analyst of some renown, suggests that BTC has reached its zenith and must reclaim $95K to restore any semblance of positive sentiment. How charmingly dramatic!

In the midst of these recessionary fears, Ark Invest’s Cathie Wood reassures us that the U.S. economy is poised for a ‘deflationary boom’ in the latter half of 2025. She proclaimed,

“In our view, the market is discounting the last leg of a rolling recession, which will grant the Trump Administration and the Powell Fed more freedom than investors anticipate, setting the stage for a deflationary boom in the second half of this year!”

On a brighter note, analysts have observed a robust correlation between BTC and the global money supply (M2). It seems BTC has been trailing behind M2, and the recent downturn mirrored M2’s decline last quarter. How poetic!

As the indicator surged in Q1 2025, one might hope for a BTC rebound if this correlation persists.

Jon Consorti, the head of growth at Theya Bitcoin, noted that with the BTC fear and greed index languishing at typical ‘bottom’ levels, the cryptocurrency might be on the verge of a recovery. How thrilling!

“Fear and greed index at 20, a value reached in bull markets when bitcoin is on its way to making a local bottom.”

As of this moment, BTC is valued at $81.6K after a brief flirtation with $76K. This level also represents a 50 Exponential Moving Average (EMA) on a weekly chart, a crucial support for past bull markets. Will it hold? Only time will tell, dear reader.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2025-03-11 22:20