Ah, Bitcoin, that elusive creature of the digital realm, lingered at a rather impressive $109,319 as of June 11, 2025. It seems to have developed a certain resilience, much like a cat that always lands on its feet, even as the market cools its fervor. With a market capitalization of $2.17 trillion and a trading volume of $32.03 billion in the last 24 hours, it danced between the modest bounds of $108,633 and $110,237.

Bitcoin

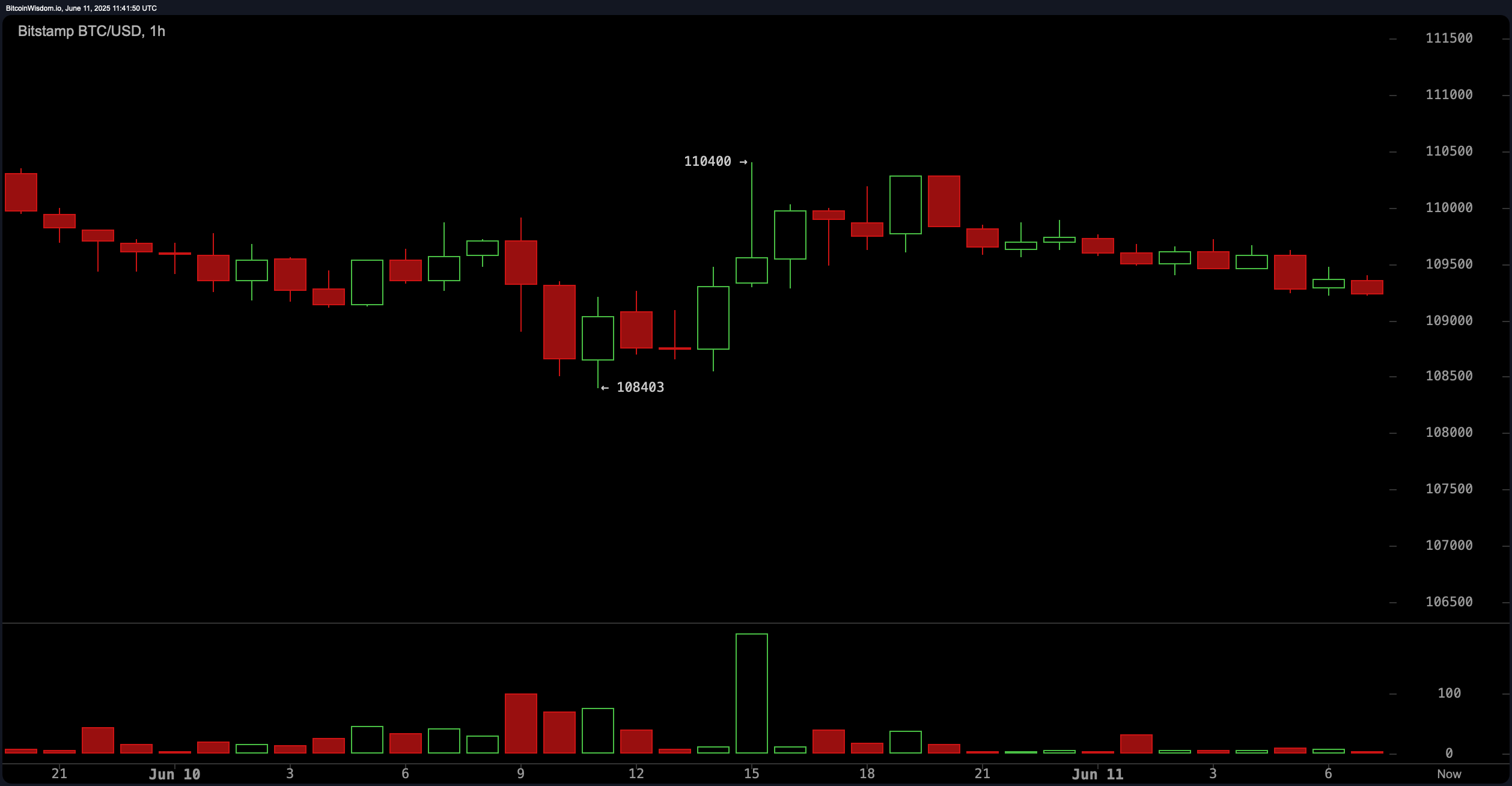

On the 1-hour chart, Bitcoin appears to be in a state of existential crisis, caught in a web of indecision after a swift rejection from the lofty heights of $110,400, which, let’s be honest, was a bit too ambitious. The price has since settled around the $109,500 mark, with trading volume so low it could be mistaken for a library on a rainy day. Entry opportunities now hinge on a breakout above $110,400 or a descent below $108,500. Given the current lethargy, only the most daring of traders should attempt quick trades with profit targets as narrow as a politician’s promise—typically within a 100–200 point range.

The 4-hour Bitcoin chart reveals a recent V-shaped recovery from $100,426 to $110,587, followed by a rather uninspired sideways consolidation. This pattern could either be a bullish flag or the market’s way of saying, “I need a nap.” A decisive breakout above $110,600 on increasing volume might just kickstart another leg higher, while a breakdown below $109,000 could send traders scrambling like cats in a room full of rocking chairs. Traders might consider aggressive entries on strength or accumulate near $108,000 if the signs of demand are as clear as a sunny day.

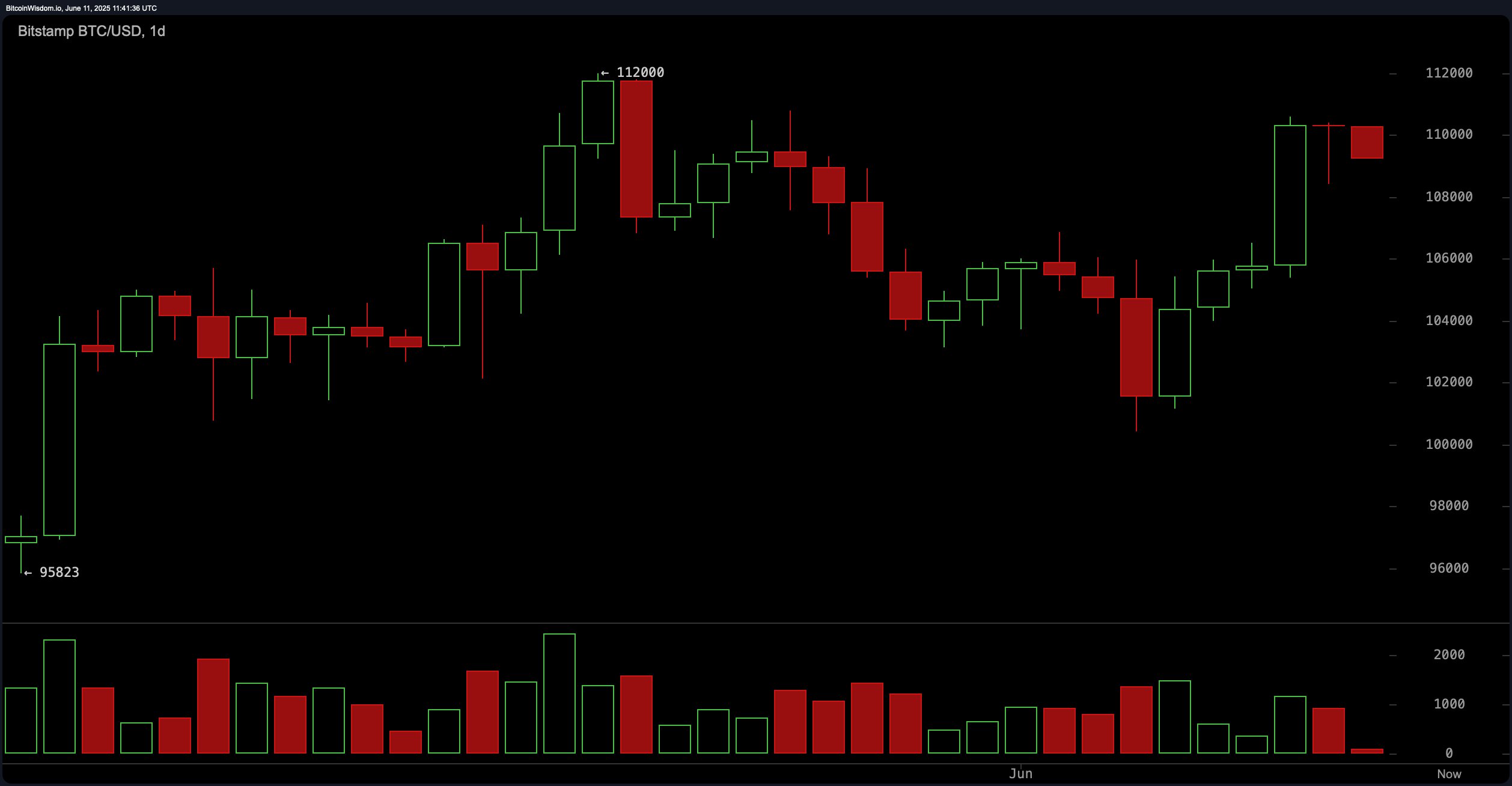

Turning our gaze to the daily chart, Bitcoin has experienced a bullish rally to $112,000, only to be followed by a correction to the $101,000 level and a half-hearted recovery. Despite this upward trajectory, recent candles are as hesitant as a cat near a bathtub—low green-day volume and a red candle post-surge suggest that buying pressure is taking a coffee break. Key support lies between $100,000 and $101,000, while resistance looms ominously at $112,000. Prudent traders may wish to wait for a breakout above $112,000 or a dip back to support, armed with a tight stop-loss below, like a knight ready for battle.

Oscillator readings across the board are as neutral as a Switzerland tourist, reinforcing the market’s current ambiguity. The relative strength index (RSI) is at 60, Stochastic at 93, commodity channel index (CCI) at 98, average directional index (ADX) at 18, and the awesome oscillator at 1,719—all signaling neutrality. Momentum, however, shows a value of 3,523 and suggests a sell bias, while the moving average convergence divergence (MACD) at 1,469 is in buy territory. Quite the conundrum, isn’t it?

All major moving averages support a bullish outlook, flashing buy signals like a neon sign in a dark alley. The exponential moving average (EMA) and simple moving average (SMA) from 10 to 200 periods are uniformly in agreement. Notably, the 10-period EMA stands at $107,307 and the 200-period SMA at $95,480, reinforcing a strong long-term uptrend. With prices well above these averages, the underlying trend remains structurally positive, despite the short-term consolidation that feels like waiting for a bus that never arrives.

Bitcoin remains structurally bullish, with strong support from all major moving averages and the potential for renewed upward momentum on a breakout above $112,000. A sustained push above this resistance could reignite buying interest and set the stage for a fresh rally, much like a phoenix rising from the ashes.

Bear Verdict:

Despite the longer-term bullish trend, signs of waning momentum and neutral oscillator readings suggest vulnerability to a short-term pullback. A breakdown below $108,000, especially on rising volume, could signal a deeper correction toward the $100,000 support zone, leaving traders to ponder their life choices.

Read More

2025-06-11 15:27