- Ah, Bitcoin, the ever-elusive creature, is currently undergoing a deleveraging process, and yes, prices might just take a nosedive in the short term. Who doesn’t love a good plunge? 🎢

- But wait! Seller exhaustion could rear its weary head the longer BTC lingers around that tantalizing $100k mark. Talk about a dramatic pause! 😏

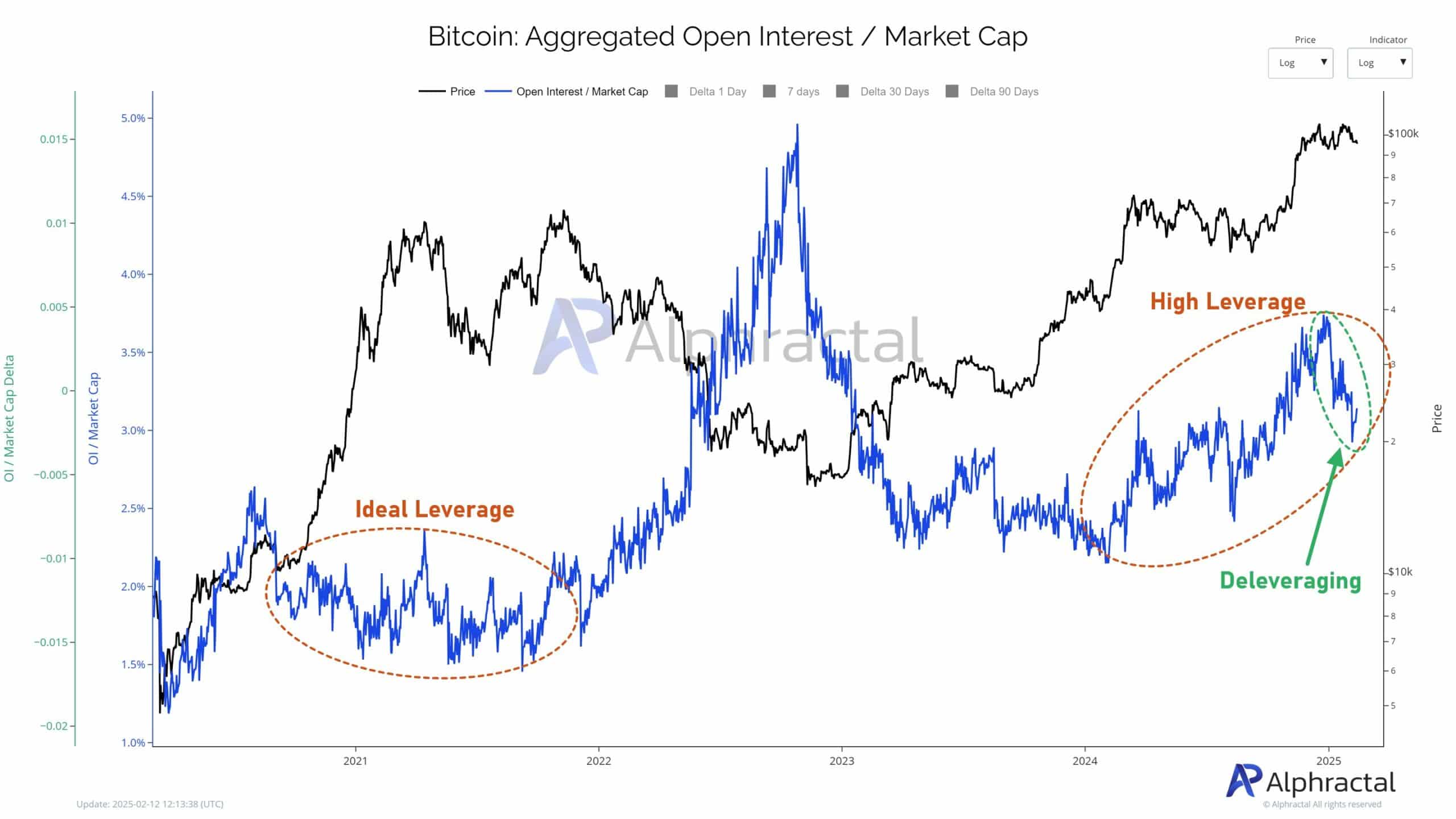

Bitcoin [BTC], that fickle friend, is presently entangled in a deleveraging process, as the 90-day Aggregated Open Interest Delta across 17 major exchanges would have us believe. A veritable soap opera of finance!

This trend, dear reader, is often followed by price drops or an extended period of sideways movement, much like a cat contemplating its next nap. Positions are closing, liquidating, and the market is left to ponder its existence.

Particularly noteworthy is the Open Interest to Market Cap ratio, which has risen like a soufflé since early 2024, suggesting that Bitcoin’s market risk is now akin to a tightrope walker without a safety net, unlike the more balanced conditions of the 2021 Bull Run. 🎪

Recent activities reveal a significant deleveraging, signaling a wave of liquidations akin to a liquidity reset—like a spring cleaning for the crypto world!

This higher ratio could elevate the risk of further price drops, impacting those poor souls caught in long positions. A tragedy worthy of a Greek play!

Assessing liquidity zones and Trader Sentiment Gap

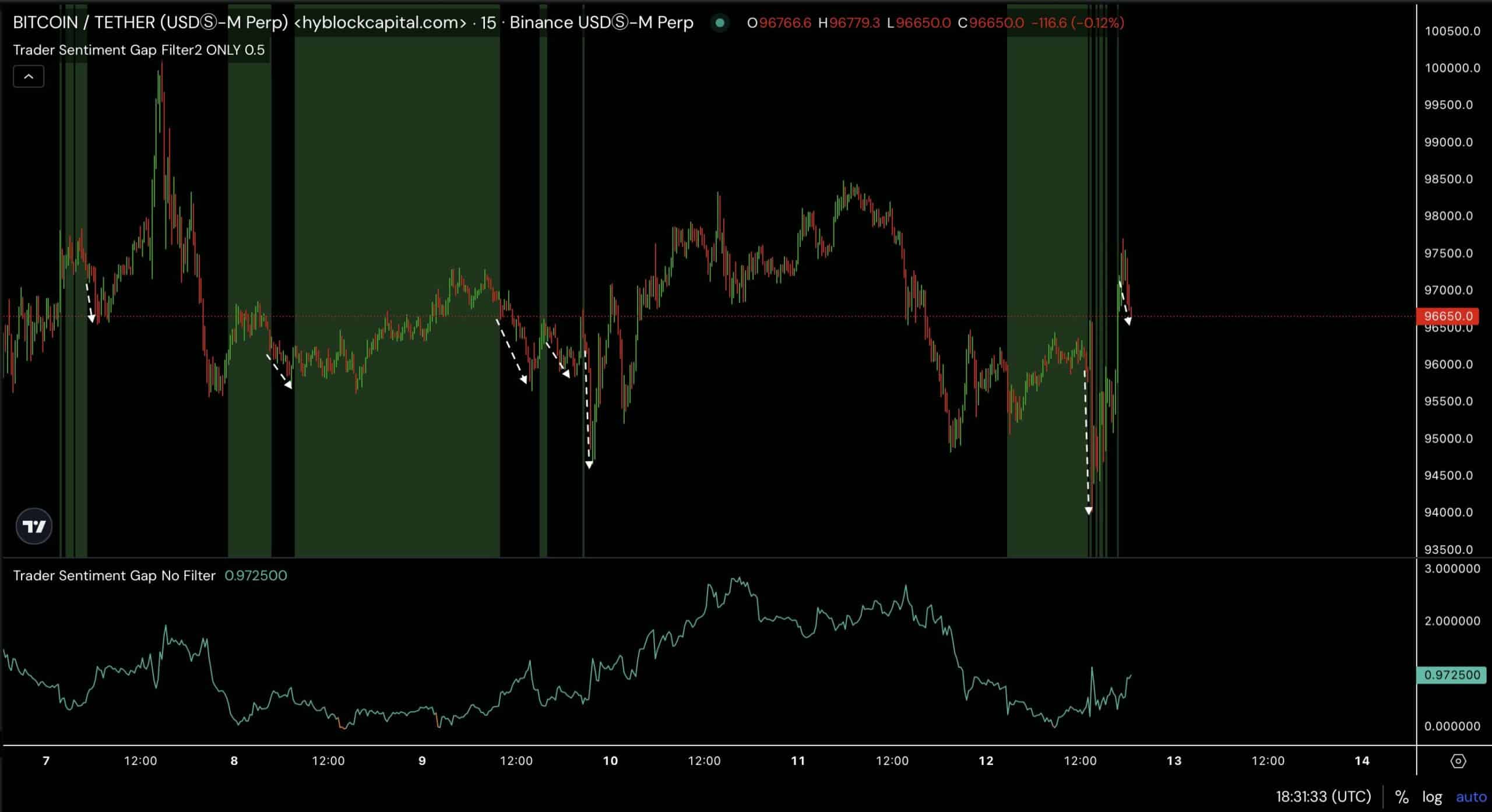

More analysis reveals that significant liquidity is pooled at $93,700 and $98,800. After yesterday’s news, BTC experienced a brief recovery, only to be followed by a decline. Classic plot twist!

This initial drop could aim for the $93,700 level to absorb this “liquid liquidity,” where buy orders are waiting like eager fans at a concert. 🎤

If BTC does not drop to $93.7K, it might signal strong underlying support or bullish sentiment, where buyers step in at higher levels, preventing a deeper fall. This scenario could lead to a quicker recovery or even a price surge—like a phoenix rising from the ashes!

Also, the Trader Sentiment Gap on the BTC has shown a notable shrinkage to a lower level, particularly when filtered at 0.5, indicative of a minimal sentiment gap between top traders and retail traders. A rare moment of unity!

Historically, such a contraction often precedes a significant price movement. On February 12, following a gap reduction, Bitcoin’s price sharply dropped from $96,650 to a low of $94,000 before rebounding. A classic case of “what goes down must come up!”

This pattern suggests that a narrow sentiment gap may lead to initial price declines, followed by a recovery, reflecting shifts in trader behavior and market dynamics. A dance of the market, if you will!

This further supports the anticipated drop as per the deleveraging signal. The market is like a moody artist, always changing its mind!

Given the current low sentiment gap, BTC might see a similar short-term volatility with potential downside followed by an upward correction. A rollercoaster ride for the brave-hearted! 🎢

Why accumulation around $100K is crucial for BTC

However, a significant trend has emerged where Short-Term Holders (STHs) now possess 4 million Bitcoin. This represents 46% of the 2017 peak and 86% of the 2021 peak, having accumulated 1.6 million BTC since September. Talk about a shopping spree!

The increasing number of Short-Term Holders (STHs) contrasts with the declining distribution from Long-Term Holders (LTHs), as seen in their decreasing share of the total BTC supply. A classic case of “out with the old, in with the new!”

This shows BTC continues to accumulate around the $90K — $100K price range. A cozy little nest for our beloved Bitcoin!

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2025-02-13 16:12