- Well, folks, Bitcoin’s halving schedule is like a magician’s trick, reducing mining rewards and making that digital gold even scarcer!

- But pray tell, how much of that shiny supply is left for the rest of us poor souls?

Now, let me tell you, Bitcoin [BTC] has a leg up on that flimsy fiat currency. It’s not just decentralized; it’s got a cap of 21 million coins, and that’s all she wrote! 🎩💰

Unlike the paper money that governments can churn out like a never-ending fountain, BTC’s supply is locked tighter than a drum. This means it’s more likely to appreciate over time, as it becomes scarcer than a hen’s tooth! 🐔

With the next Bitcoin halving just around the corner, we might see a price action that could make a bull charge look like a gentle trot. Hold onto your hats! 🎢

The countdown to Bitcoin’s ultimate scarcity

According to the good folks at Glassnode, Bitcoin has now mined 900,000 blocks since it first saw the light of day. Each block is like a new baby Bitcoin, increasing the supply.

But here’s the kicker: due to those pesky halvings, block rewards are sliced in half every 210,000 blocks. This means Bitcoin’s issuance slows down faster than a turtle in molasses as it approaches that 21 million supply limit. 🐢

Now, to put that into perspective: miners are churning out Bitcoin blocks every 10 minutes, cranking out about 6 blocks an hour—totaling 144 blocks a day. That’s a whole lot of Bitcoin, folks!

Before the halving, each block was a generous 6.25 BTC, meaning 900 new BTC were entering the market daily. After the halving, that reward dropped to 3.125 BTC per block, cutting daily Bitcoin issuance to 450 BTC—nearly half! Talk about a supply crunch! 📉

Since then, BTC has surged a whopping 47%, proving that less really is more when it comes to scarcity.

Only 1.7 million left, and it’s drying up fast

Now, miners are buzzing about the next halving hitting around block height 1,050,000 in 2028, which will slice the block reward down to a mere 1.5625 BTC. Yikes!

Do the math, and that’s just 1.5625 BTC × 144 blocks = 225 BTC per day hitting the market, which is half of today’s already-thin issuance. It’s like trying to squeeze water from a stone! 💧

With only 1.7 million Bitcoin left to mine before we hit that 21 million cap, each halving makes Bitcoin scarcer than a good cup of coffee in a cheap diner. And when you peek at the top wallets, the supply squeeze feels even tighter. 😅

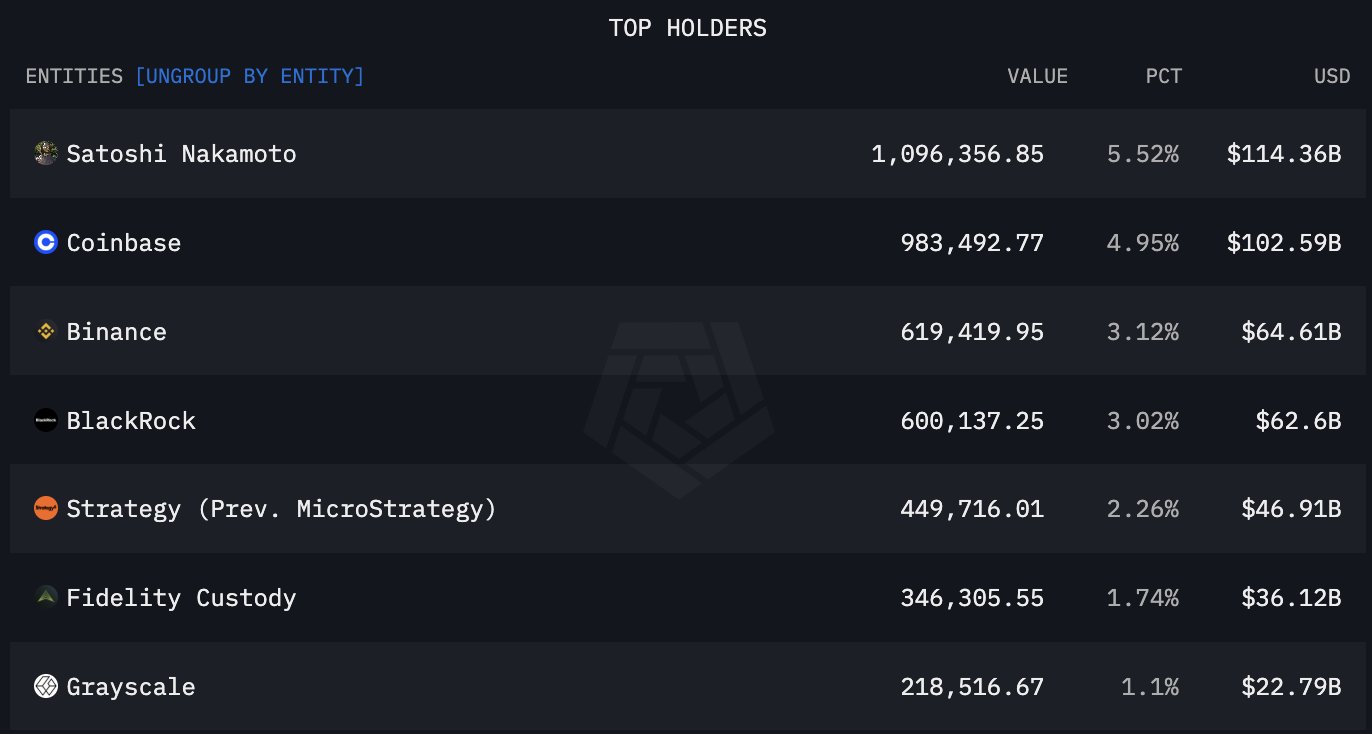

The chart below shows how the top 8 holders control 4.51 million BTC, holding roughly $471 billion. That means they’ve locked away over 21% of Bitcoin’s total supply, keeping it off the market like a squirrel hoarding acorns for winter.

But hold your horses, that’s just the opening act! If demand keeps ramping up and Bitcoin’s market cap skyrockets to $3 trillion or $5 trillion, each BTC could easily soar to $143k, $238k, or even beyond. It’s like a rollercoaster ride with no end in sight! 🎢

Of course, these numbers are rough estimates, but that’s the beauty of BTC’s design. It’s like a high-stakes auction with no reserve price: How high can the bids go? 🤔

So, with supply tightening and big players holding strong, BTC’s “digital gold” story is just getting warmed up. The stage is set for some serious gains over the long haul, folks! 🎉

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2025-06-08 09:16