- Behold! Bitcoin has experienced a slight dip, dropping by a mere 0.66% in the last 24 hours.

- The eternal optimists—our beloved long-term holders—are feeling particularly bullish as they gaze into the crystal ball of the coming year.

For nearly two weeks, the grand saga of Bitcoin [BTC] has unfolded like a Dostoevsky novel, with prices climbing to a dizzying high of $109k just four days prior, before the inevitable pullback. Ah, the irony! The heights of success often lead to the depths of despair.

As of this very moment, BTC is trading at $104,337, a significant decline much like our hopes after a failed investment. Yet, fear not! The luminous trend remains as unyielding as a Soviet bureaucrat clenching a little red book.

Such momentum, my dear reader, is not by mere chance but rather the machinations of long-term holders, whose steadfastness rivals the most resolute of Soviet comrades.

The Vanguard of Bitcoin: Long-Term Holders Ascend

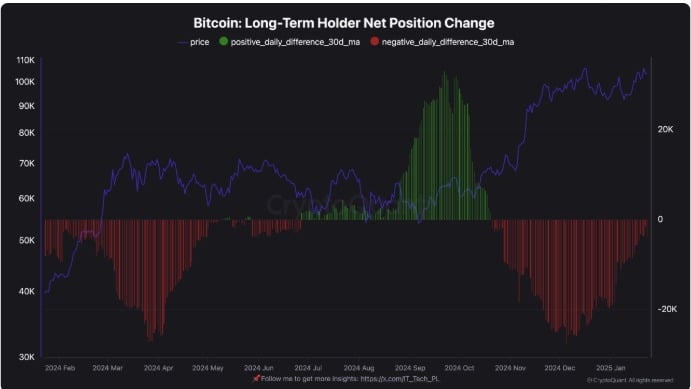

CryptoQuant has revealed a brutal tug-of-war between those with diamond hands and the frenzied crowd of speculative FOMO. What a spectacle! 🤡

With long-term holders holding fort, the supply dominance remains astonishingly high. These seasoned veterans accumulate BTC as prices wane and take profits as if they were snatching victory from the jaws of defeat. Their strategic finesse brings forth a bullish outlook—who knew financial warfare could be so tactical?

Conversely, our short-term holders—those mercurial spirits—are caught in the tempest of speculation during price rallies, their hearts aflame with dreams of instant riches.

Yet, it is their hasty retreats, like rabbits running from the shadow of a hawk, which inject volatility into the very fabric of our beloved market.

With the long-term holders commandingly asserting their presence, it appears Bitcoin’s market is evolving: a coming-of-age story the likes of which we have never seen!

The diminishing influence of short-term holders could herald a newfound stability—akin to Saint Petersburg during a well-timed snowstorm, calm amidst chaos. However, their whimsical behavior may still stir short-term price upheavals.

This juxtaposition paints a promising picture of Bitcoin’s trajectory throughout 2025. The cunning of long-term holders in taking calculated profits could create space for new troops of investors eager to replenish their ranks.

What Lies Ahead on the Bitcoin Charts?

While our previous discourse shines with optimism, we must engage in the grim dance of market indicators to decipher their true intentions. The charts are whispers of bygone days and whispers of perilous futures.

First, Bitcoin’s fund flow ratio has risen over the past week, much like our hopes as we clutched our wallets, jumping from 0.05 to 0.11.

This tantalizing increase suggests that more capital is flowing into Bitcoin’s grasp than slipping away through our fingers. Could it be a sign of purposeful accumulation, or just the haughty laughter of fate entertaining us? 🎭

the market is poised to absorb potential sell-offs without a dramatic collapse. Oh, the suspense!

Eloquently proving this scarcity, the stock-to-flow ratio has surged from 124 to an astonishing 599.03—like peasants hoarding grain just before winter! More investors keep their assets where prying eyes can’t reach: in secretive wallets or treasures buried in the proverbial backyard.

In conclusion, as our long-term holders cunningly maneuver through this volatile landscape, it seems the market is mature enough for a possible emergence of higher realms.

If the prevailing winds blow favorably, Bitcoin may well vault into the $107k region and dream of touching $110k. However, dear friends, do not be deceived; a relentless correction could plunge us to the shadowy depths of $102,770.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- SOL PREDICTION. SOL cryptocurrency

- Solo Leveling Arise Tawata Kanae Guide

2025-01-26 08:11