So, Bitcoin (BTC) is like that moody friend who’s just entered 2026 with a dramatic sigh. Sure, it’s all quiet on the surface, but underneath? Oh honey, it’s a whirlpool of excitement! After doing the “I’m too cool for $110,000” move, it’s now playing the field in a cozy little range. But guess what? The big spenders are out here flexing their wallets, and trading is coming back to life like it’s just had a triple espresso. This combination of calm vibes and mounting interest usually means one thing: accumulation, darling, not weakness!

Bitcoin Price Action: Compression, Not Breakdown-Get It Right!

On the daily chart, Bitcoin is caught in a symmetrical triangle-yes, a triangle, not a love triangle, but you get the idea. After saying “no thanks” to the $110,000 party, it’s compressing between some fancy descending resistance and rising support near $88,000-$90,000. So, no need to panic, folks; it’s just a classic case of declining volatility, not a meltdown.

And let’s talk momentum indicators because, let’s face it, we love a good indicator! The RSI (14) is hanging around the 50 level, chilling out after a wild bearish ride, while the Chaikin Money Flow (CMF) is slightly negative but basically flat, suggesting selling pressure is like that guest who overstayed their welcome-finally leaving. Historically, when Bitcoin gets itself into similar situations after a strong trend, it tends to explode rather than fizzle out. Think fireworks, not sparklers!

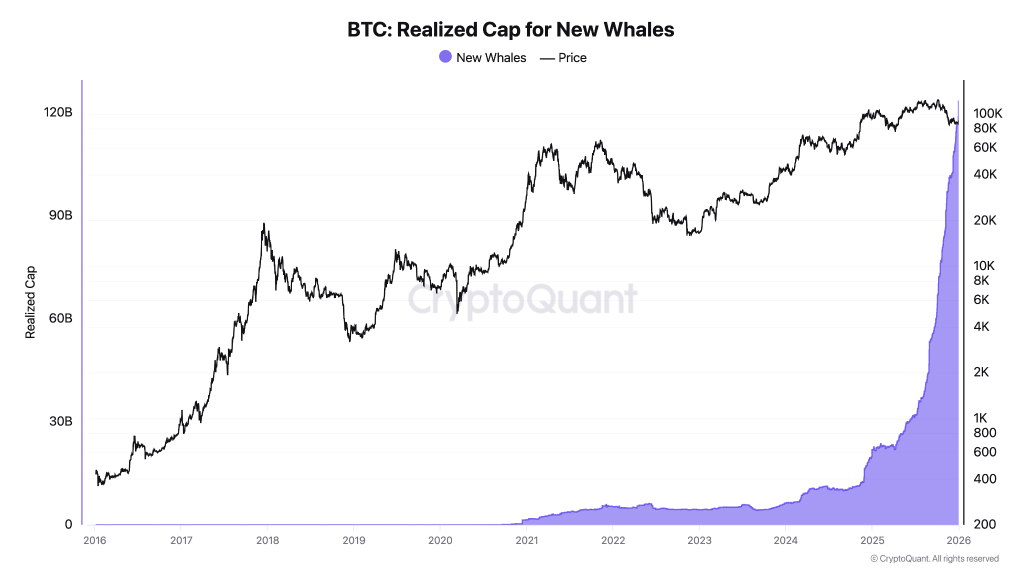

New Whales Are Absorbing Supply-Like Pac-Man, but Fancier

Now, here’s the juicy bit: on-chain data is throwing us a party! The realized cap of new Bitcoin whales is going up, up, and away to record highs, showing that these newcomers are gobbling up Bitcoin like it’s the last cookie in the jar at a family gathering. 🍪

This is HUGE because it indicates fresh capital entering the market! Not the old whales just rotating out like they’re at a dance-off. In past cycles, sharp increases in new whale realized cap during consolidation phases usually meant continuation of a trend. Picture them as the bodyguards of Bitcoin, ready to defend against any downside drama.

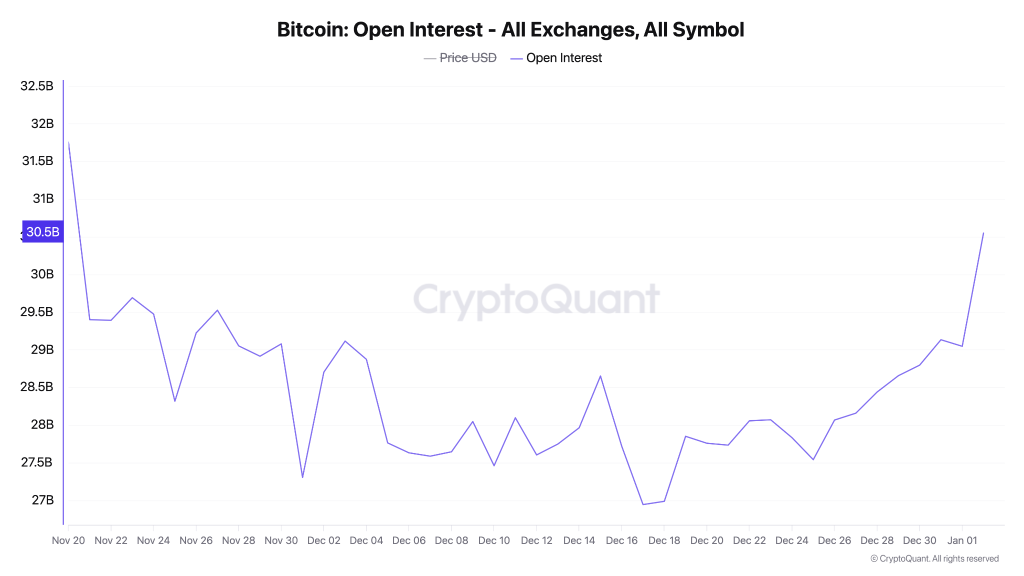

Open Interest Rises as Price Stays Flat-What a Plot Twist!

Meanwhile, Bitcoin open interest across all exchanges is bouncing back like a rubber band to $30.5 billion, even while the spot price is stuck in a narrow range-classic! This divergence suggests fresh positioning is building, instead of traders losing their minds and flushing out leverage like it’s last week’s leftovers.

When open interest rises during price compression, it typically signals that traders are gearing up for some serious action-not just aimlessly chasing direction like a cat after a laser pointer. This boosts the chances of a major move once the price breaks free of its current boundaries. 🎉

Key Levels Traders Are Watching-Because Who Doesn’t Love a Good Map?

Let’s break it down:

- Immediate resistance: $90,400-$91,000: If Bitcoin breaks out and decides to settle above this zone, it could expose $98,000-$100,600 where the previous demand is sitting, probably sipping a cocktail.

- Critical support: $88,000: If it loses this level, it might trigger a liquidity sweep toward $83,000-$85,000, where stronger demand is expected to be waiting like a bouncer at a VIP entrance.

Conclusion: Bitcoin Is Being Positioned, Not Sold-A Happy Ending!

In conclusion, Bitcoin’s current consolidation isn’t giving off those “going out of business” vibes. With new whales accumulating, open interest recovering, and momentum chilling out, it all points to absorption and strategic positioning. While the direction is still a mystery, the structure favors a big, dramatic power move rather than dragging its feet. As long as Bitcoin stays above key support, it looks like the market is gearing up for the next thrilling chapter, not ready to roll over and take a nap!

Read More

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- Best Thanos Comics (September 2025)

- Survivor’s Colby Donaldson Admits He Almost Backed Out of Season 50

- Best Controller Settings for ARC Raiders

- Gold Rate Forecast

- Resident Evil Requiem cast: Full list of voice actors

- The 10 Best Episodes Of Star Trek: Enterprise

- PS5, PS4’s Vengeance Edition Helps Shin Megami Tensei 5 Reach 2 Million Sales

- PlayStation Plus Game Catalog and Classics Catalog lineup for July 2025 announced

- Best Shazam Comics (Updated: September 2025)

2026-01-02 18:19