- Bitcoin is showing signs of weakening demand as September, a month often associated with declining prices, approaches

- Possible interest rate cuts in the U.S and other bullish catalysts could stir volatility

As a seasoned researcher with years of experience observing and analyzing cryptocurrency markets, I find myself cautiously leaning towards anticipating a potential dip in Bitcoin prices this September. The historical data suggests that this month has often brought negative returns for BTC, and current market indicators seem to be aligning with that trend.

Last month saw significant fluctuations in Bitcoin’s (BTC) value. Initially, on the first of August, BTC was trading at approximately $63,000. However, by the end of the first week, its price plummeted to about $49,000. Towards late August, the crypto saw a recovery, reaching nearly $65,000. At present, it is trading at $59,190.

As an analyst, I’ve observed that Bitcoin has dipped approximately 8% in the last month, leading me to speculate a potential continuation of this trend in September, mirroring its historical price patterns. Following the analysis of renowned analyst Ali Martinez, such a forecast is not unfounded.

“Should you feel that August posed challenges for Bitcoin, remember that historically, September has also tended to yield unfavorable results.”

In other words, by September 2023, the value of this crypto fluctuated between approximately $24,000 and $27,000 without experiencing substantial growth. Moreover, a notable decline of around 17% was observed in its price during September 2021.

So, will history repeat itself or will Bitcoin break this pattern?

A look at key metrics

Multiple crucial indicators suggest that bears may be gaining control, preparing for a possible downturn in September.

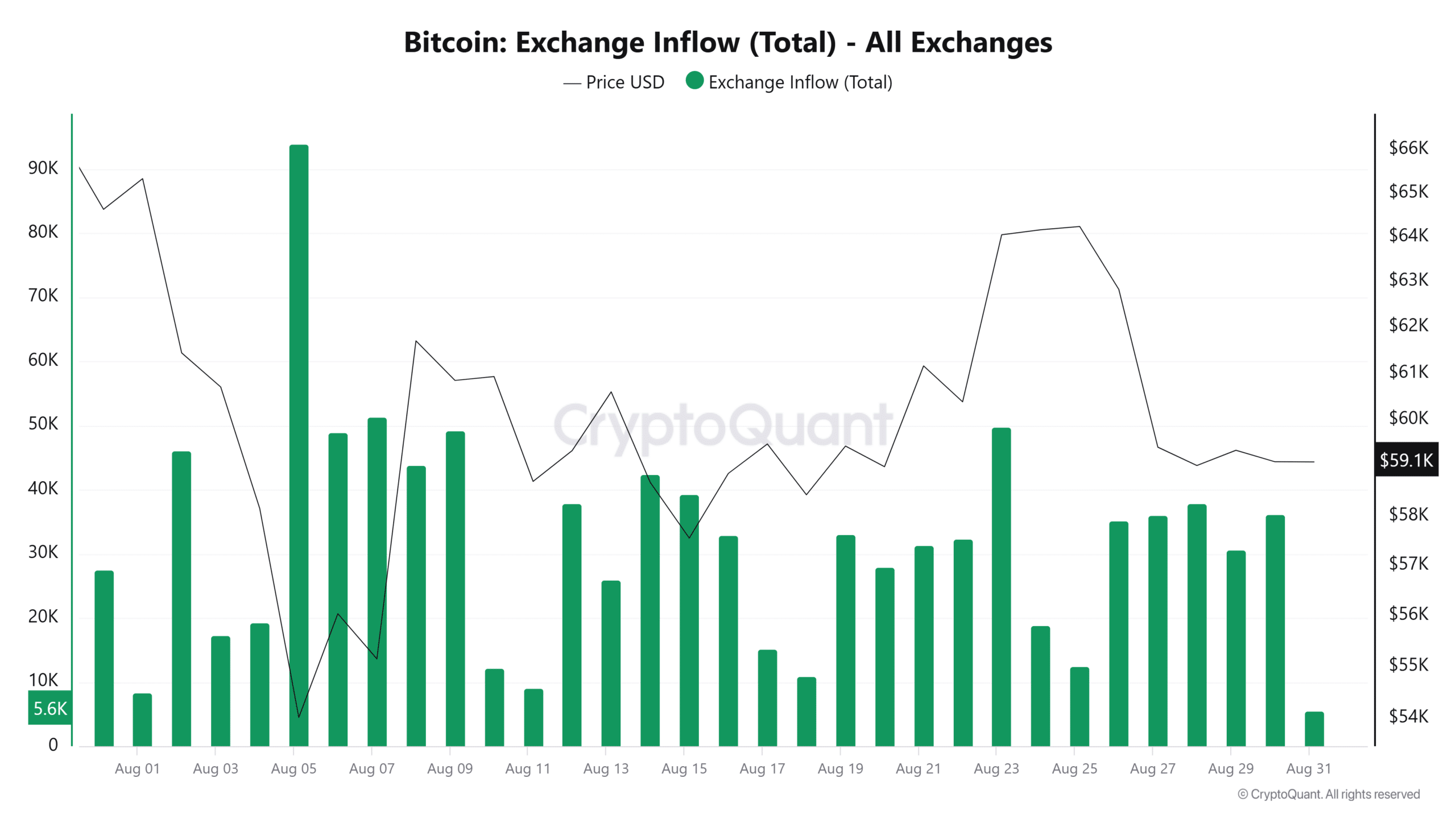

Since late August, data from CryptoQuant has shown a substantial rise in the amount of crypto being sent to exchanges. This increase in exchange inflows followed closely on the heels of Bitcoin’s price surging past $64k.

Based on my years of trading experience, I have learned that a sharp increase in prices can often lead to a wave of sell-offs as traders try to minimize their risks, especially if they anticipate further market dips ahead. This phenomenon is not uncommon and it’s crucial for any trader to be aware of such patterns to make informed decisions.

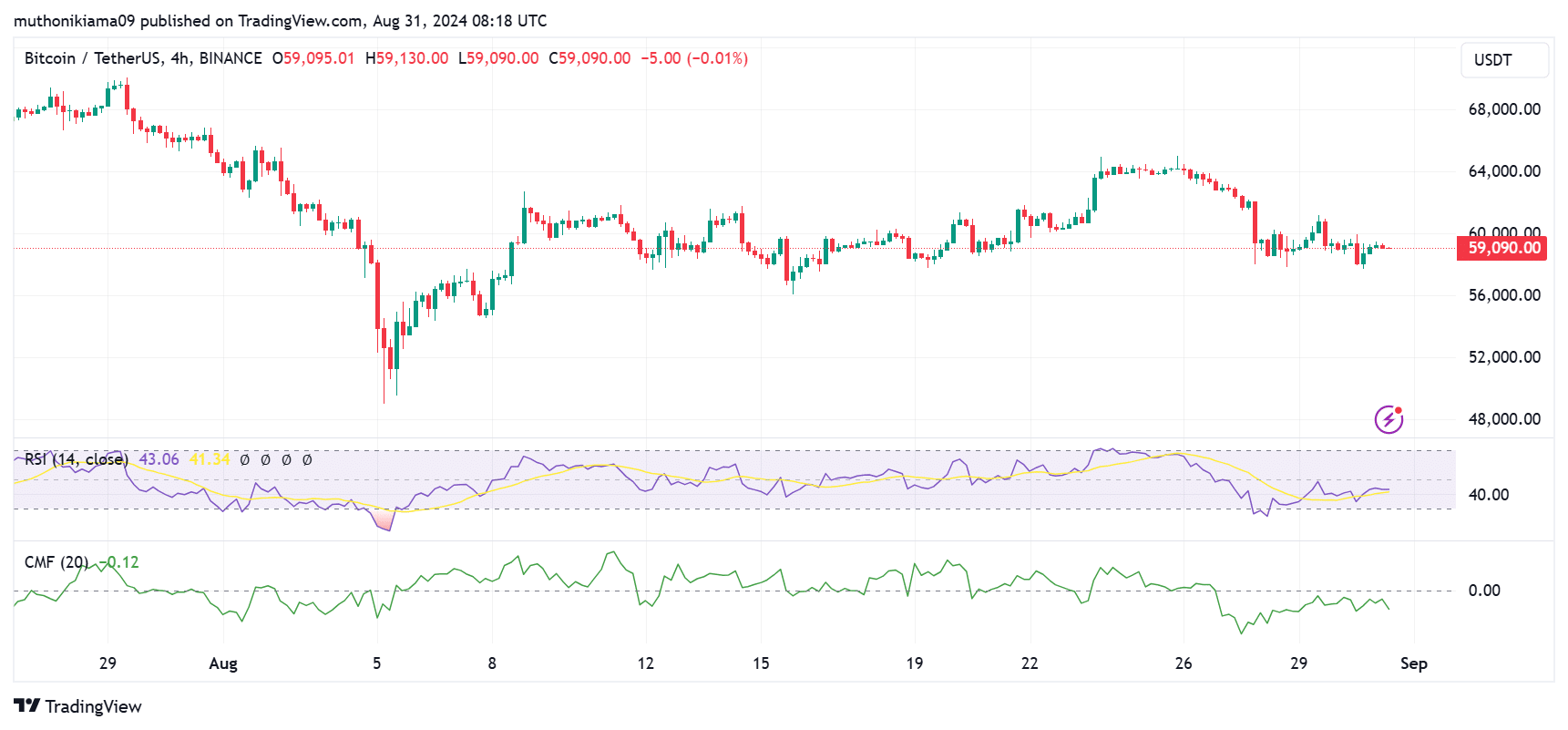

At the moment, I’m observing a hint of uncertainty among potential buyers regarding their return to the market. Two significant technical indicators, the Relative Strength Index (RSI) and the Chaikin Money Flow (CMF), suggest a weakening trend in buyer enthusiasm as we speak.

In simpler terms, with the Relative Strength Index (RSI) currently at 43, it indicates that sellers are still in charge and buyers are hesitant to purchase at the current prices. Additionally, the Chaikin Money Flow (CMF) has been moving into the negative zone since August 26, which suggests a predominance of bearish trends.

On August 30th, it was reported that the annual rate of increase for the main Personal Consumption Expenditures (PCE) price index was 2.6%, as compared to July. However, this figure was below the predicted 2.7%.

Typically, these favorable large-scale factors tend to boost the value of Bitcoin. Yet, this increase didn’t occur as expected yesterday.

Based on QCP’s analysis, there has been minimal impact from recent major news events on cryptocurrency prices. Therefore, it is expected that Bitcoin will fluctuate between approximately $58,000 and $65,000 in the near future.

Additionally, investments into Bitcoin-based exchange-traded funds (ETFs) have been decreasing recently. Over the past four days, there have been continuous withdrawals from Bitcoin, according to SoSoValue’s data.

Will September 2024 be different?

It seems like traders are showing signs of uncertainty about investing in Bitcoin, as they might be waiting to see if September will continue its downward trend.

In September, there are a number of optimistic conditions that might trigger an upward trend. The robust economic indicators in the United States have sparked anticipation that the Federal Reserve may lower interest rates at the upcoming Federal Open Market Committee (FOMC) gathering.

According to the CME FedWatch Tool, most investors expect the Federal Reserve to halt its tightening of monetary policy for the first time since March 2020. If this occurs, it could spark a surge in risky investments like Bitcoin.

A positive factor that could fuel further growth is the upcoming release of Changpeng Zhao, the ex-CEO of Binance, from prison on September 29th. Some speculate that this event may spark a surge in market value, often referred to as a “bull run.”

Ultimately, the ex-President of the United States, Donald Trump, is set to face off against Vice President Kamala Harris in September. Any discussion about cryptocurrency might lead to increased price fluctuations.

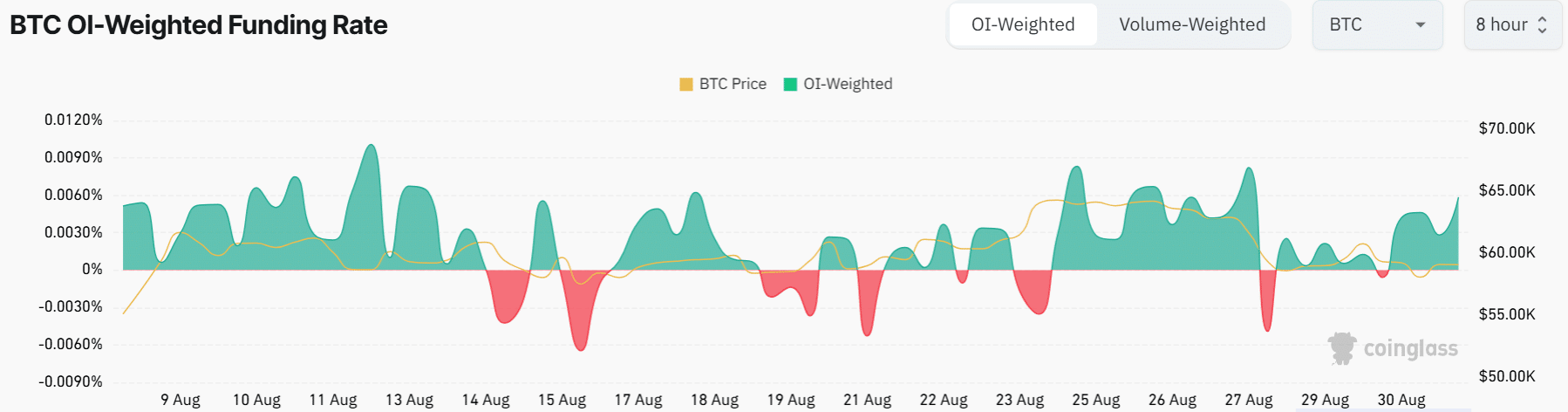

Over the past several days, the funding rates for Bitcoin have turned positive and increased noticeably. In other words, this means more people are taking on long positions, which is generally seen as a positive or “bullish” sign because it suggests traders believe that the price of Bitcoin will rise in the future.

Read More

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

2024-08-31 23:04