patience, not leverage, is the name of the game. Or as your grandmother might say, “Slow and steady wins the race.” 🐢💨

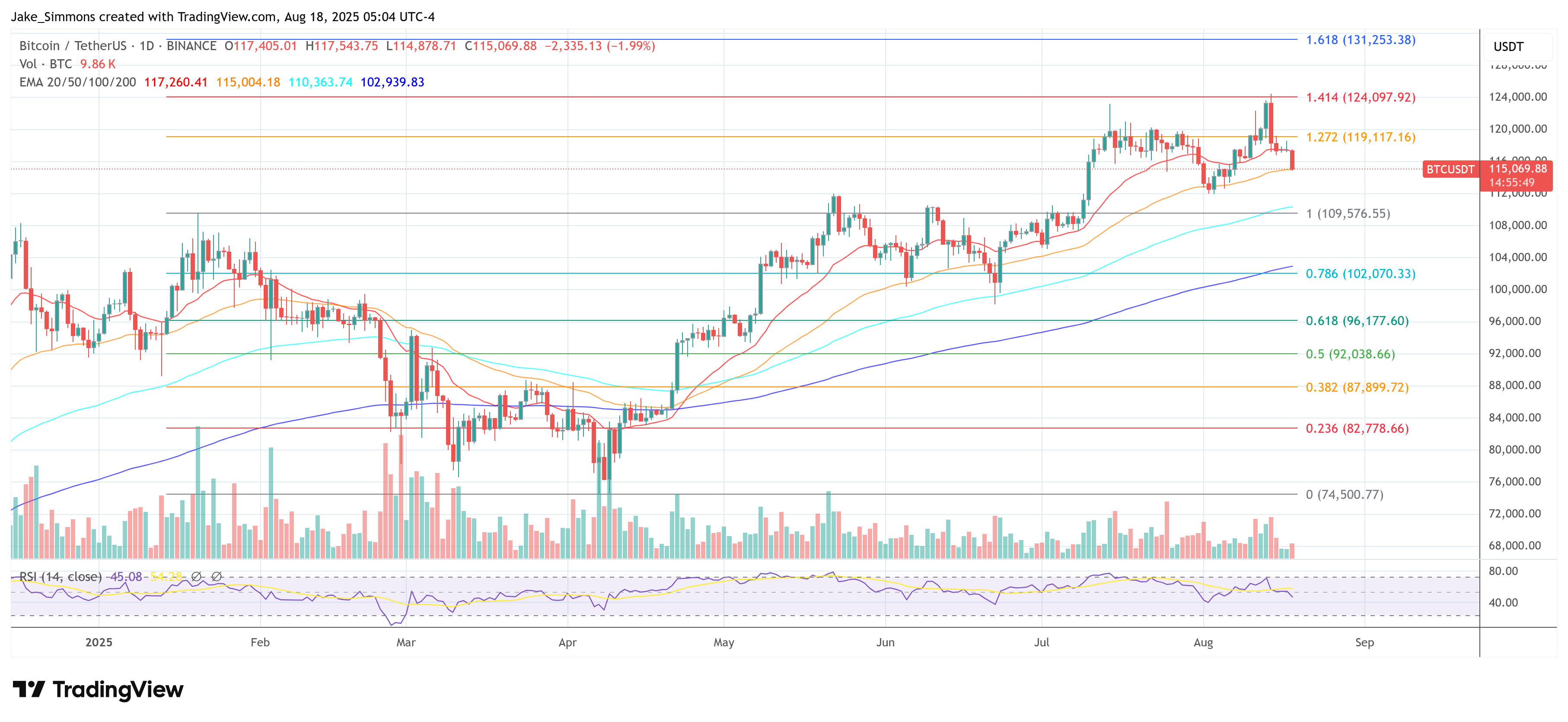

On Bitcoin’s chart, Olszewicz draws his line in the sand at $121,000-$122,000. A daily close above that level? Green light for higher prices. But until then, expect choppy seas. He warns of trouble signs like closing below the 20-week moving average ($104,000) or slipping into the Ichimoku cloud-a phrase that sounds like a mythical forest but is actually just technical jargon. Timing matters here: a September dip isn’t catastrophic, but an October breakdown could signal the end of the cycle. Cue dramatic music. 🎵💀

The Decision Tree of Doom-or Hope?

Olszewicz’s preferred method of analysis involves the Ichimoku suite, which sounds like something out of a samurai movie. His decision tree is clear: first, a bearish TK cross, then a close in the cloud, and voilà-a trade with decent edge-to-edge potential. But don’t get too excited; it’s a nuanced process, not a prophecy. As he puts it, “It’s nuanced… if this, then that.” So, less crystal ball and more flowchart. 📊🧐

Meanwhile, macro factors loom large. Friday’s Jackson Hole appearance by Federal Reserve Chair Jerome Powell could be the only near-term catalyst. A hawkish tone-more data needed, no rate cuts yet-would act as a headwind. And let’s not forget the wildcard: Trump potentially announcing his Fed chair replacement just to steal Powell’s thunder. Because why not add political theater to the mix? 🎭🔥

Waiting for the Q4 Seasonality Santa Claus Rally

Ethereum, meanwhile, gets no love from Olszewicz, who calls its positioning “horrific” despite record ETF inflows. Apparently, one week of surges does not a trend make. For Bitcoin, however, the focus remains on the power-law corridor-a fancy term for holding tight unless things go terribly wrong. There’s room for anger and downward moves, but the 20-week moving average and Ichimoku cloud serve as guardrails. A September cloud break is a warning; an October breakdown is a red flag. Until then, Bitcoin is stuck in “holding levels” purgatory. 😴📈

The takeaway? No magical setups are coming this week, and September is statistically unfriendly. The bullish path to Q4 exists, but it must be earned through either rangebound boredom or opportunistic pullbacks. The contingency plan is simple: maintain the cloud, defend the 20-week around $104,000, and close above $121,000-$122,000. Only then can Bitcoin target $150,000. At press time, BTC traded at $115,069, leaving us all to wonder: will it rise like a phoenix or remain a grounded bird? 🕊️📉

Read More

- Survivor’s Colby Donaldson Admits He Almost Backed Out of Season 50

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- Gold Rate Forecast

- Best Controller Settings for ARC Raiders

- The 10 Best Episodes Of Star Trek: Enterprise

- Resident Evil Requiem cast: Full list of voice actors

- How to Build a Waterfall in Enshrouded

- Best Thanos Comics (September 2025)

- Uncovering Hidden Order: AI Spots Phase Transitions in Complex Systems

- Fuuraiki 5 coming to PC

2025-08-18 15:06