-

BTC’s market structure showed signs of a potential shift for the better.

Users who opted for the BTC holding strategy hit new highs.

As an analyst with over two decades of experience in the financial markets, I have seen my fair share of bull and bear runs, market cycles, and everything in between. The recent developments in Bitcoin (BTC) are reminiscent of some patterns we’ve witnessed before.

Bitcoin’s [BTC] downtrend and subsequent consolidation since peaking in March could end soon.

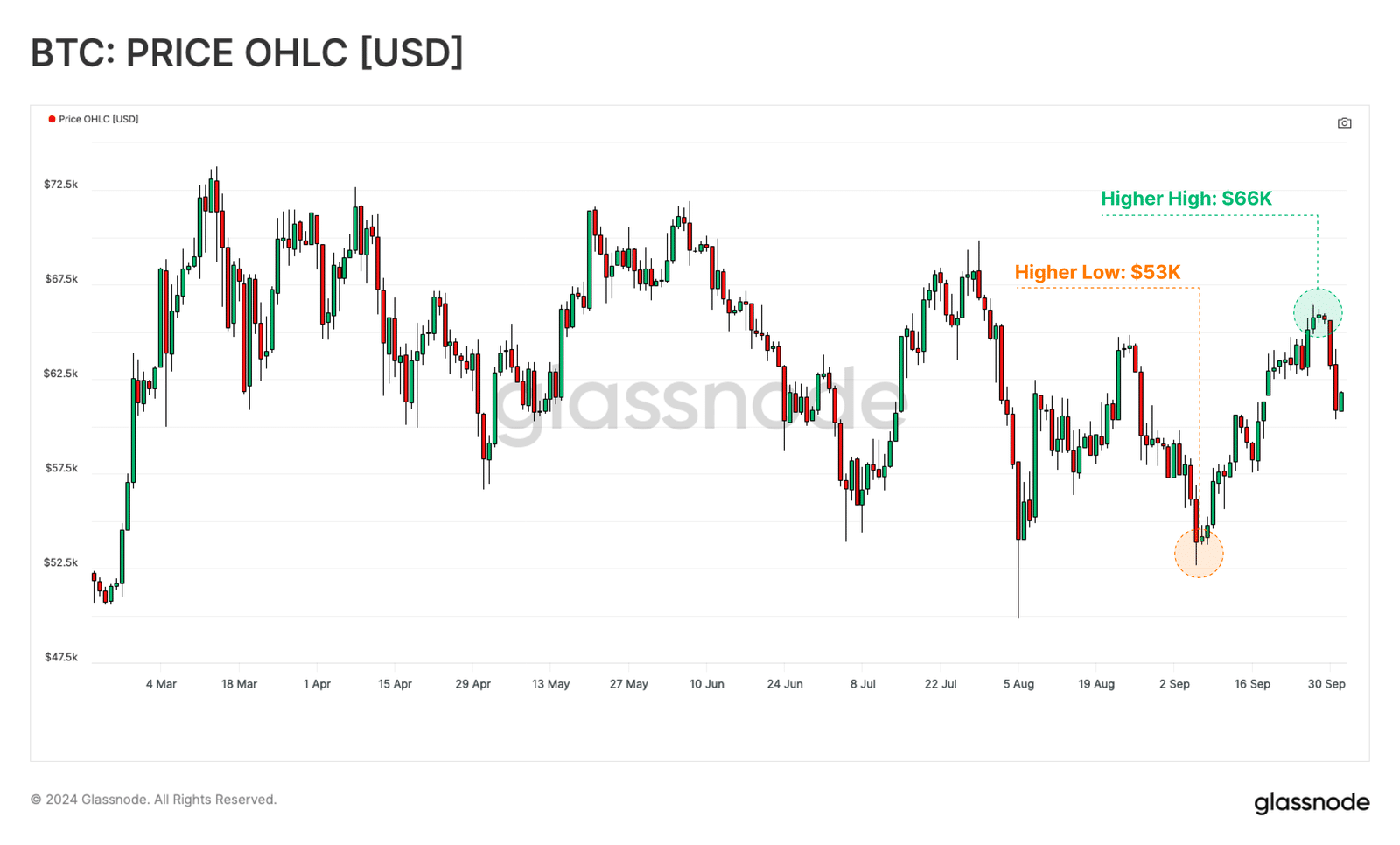

Based on data from blockchain analysis company Glassnode, the recent price increase to $66K marks the first time Bitcoin has reached a new high point since June.

Furthermore, a few on-blockchain indicators reached all-time highs as well. This analyst firm mentioned that these rising trends suggest a possible change in market structure, potentially signaling the conclusion of the extended Bitcoin accumulation period that has been ongoing since March.

The current price movements could signal the start of a change in direction for this downward trend.

Bitcoin cycle aligns with past trends

Regardless of the extended period of stability, Bitcoin has remained at similar levels compared to previous market bottoms. However, it’s worth noting that it has increased by approximately 300% from those bottoms, implying there is potential for further price growth.

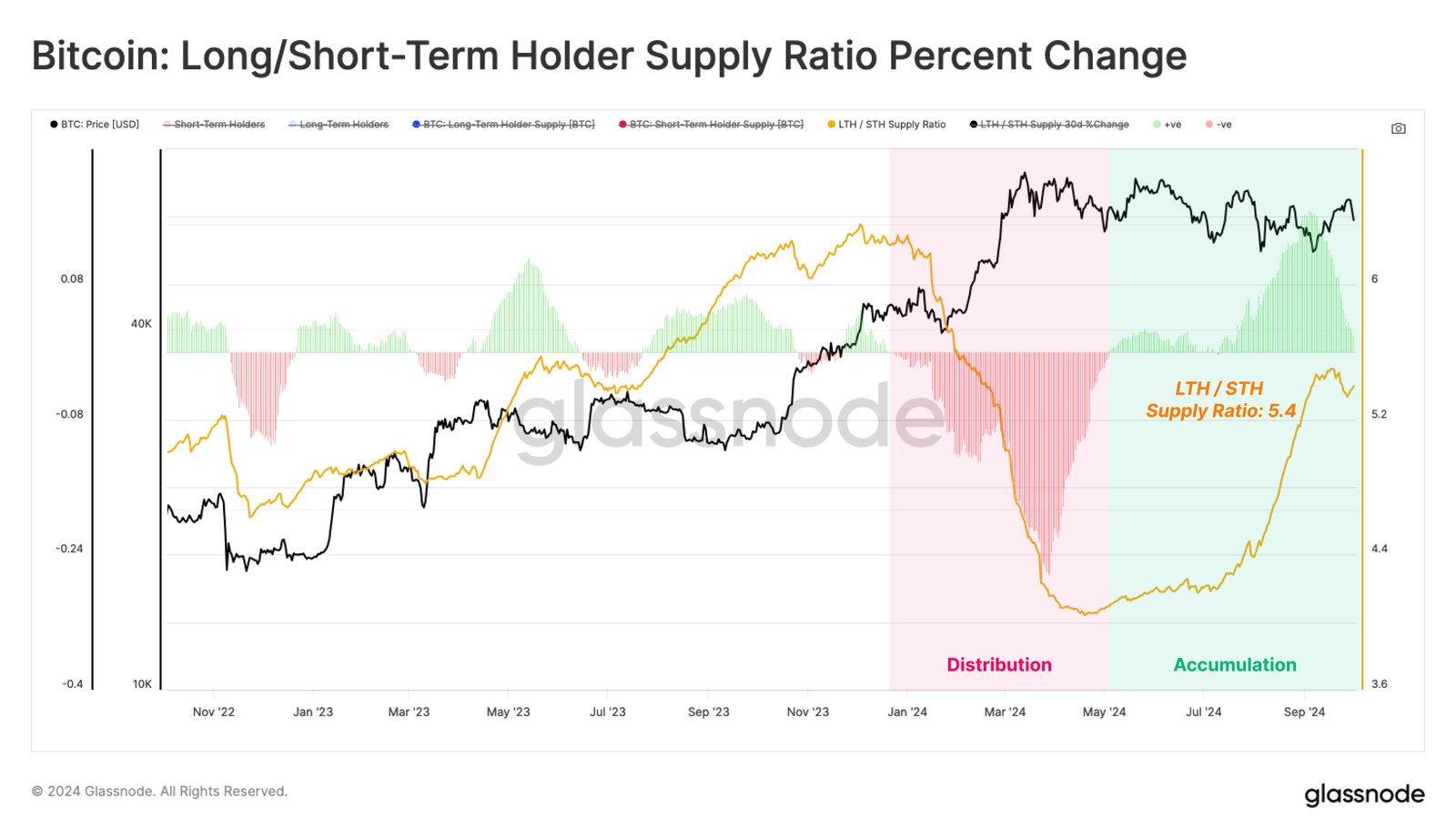

As a crypto investor, I’ve noticed a surge in the number of users and whales opting to hold Bitcoin (BTC) over the past few months. This trend is evident from the rising Long/Short-Term Holder Supply Ratio, which has climbed up to 5.4 since May. This suggests that more people are choosing to hang on to their BTC rather than selling it, a positive sign for the bullish prospects of Bitcoin.

“This suggests that HODLing persists as the dominant behaviour of Bitcoin investors.”

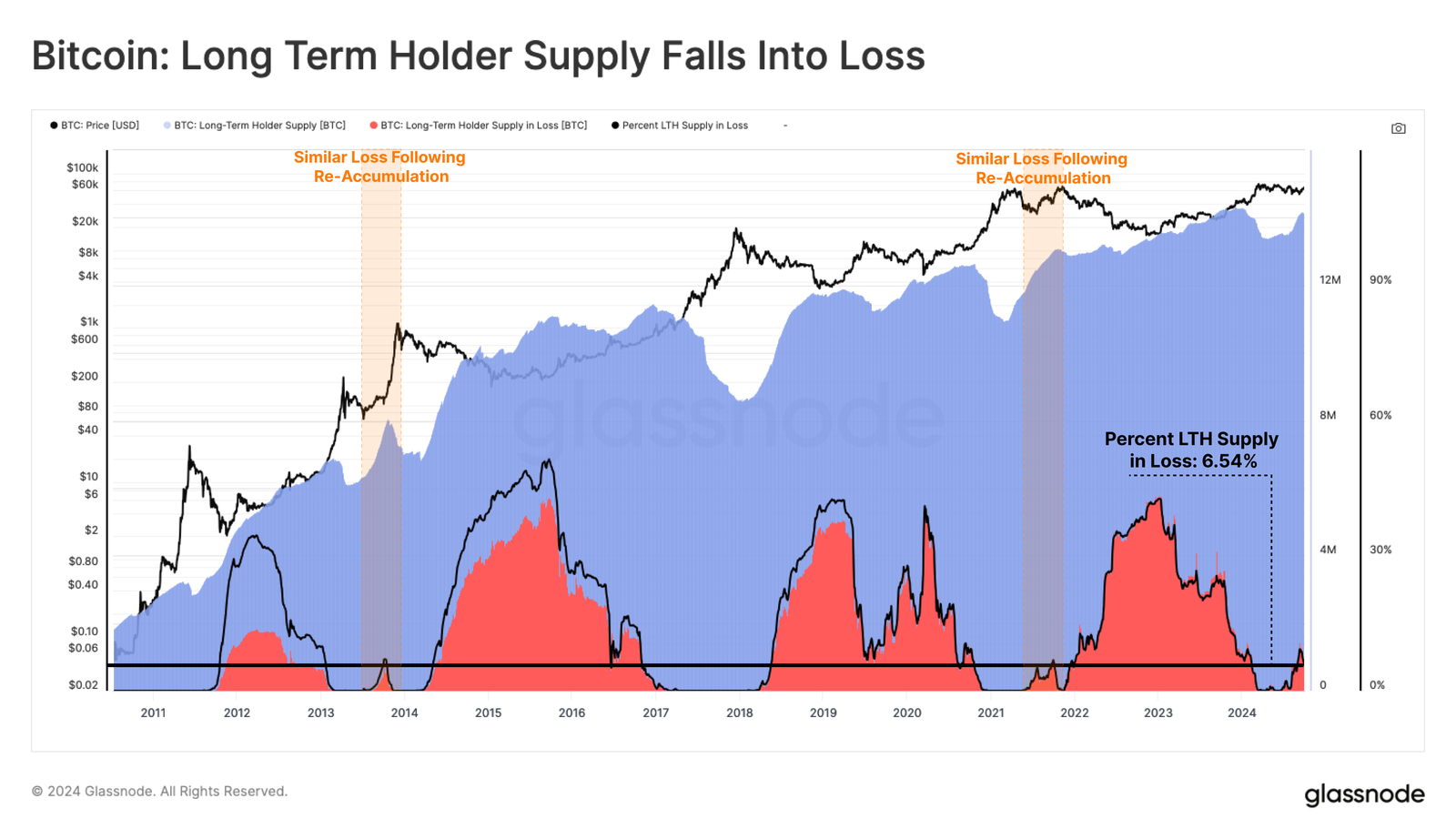

That being said, about 6.5% of Long-Term Holders (LTH) were in loss as of the 1st of October.

Yet, according to Glassnode, although the unrealized losses among long-term holders weren’t substantial, they were in line with previous accumulation periods.

The analytics company noted that the latest market rally allowed Short-Term Holders (STH) to realize their gains, which is unlike the pattern observed over the past several weeks.

Together, they strongly indicated a possibility of a change in market structure that could lengthen the phase of accumulation again.

But according to Peter Brandt, a significant change in market structure would occur only if Bitcoin’s price exceeded $71,000.

At press time, BTC weakly held the psychological level of $60K after a recent sell-off.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- PI PREDICTION. PI cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- SOL PREDICTION. SOL cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- Dragon Ball Z: Kakarot DLC ‘DAIMA: Adventure Through the Demon Realm – Part 1’ launches between July and September 2025, ‘Part 2’ between January and March 2026

2024-10-03 21:11