Why Are Traders Laughing at Bitcoin‘s Downfall?

- The demand for Bitcoin in the spot market is nose-diving, fostering a delightful sense of doom. Bearish sentiments are the talk of the town!

- As traders bet against Bitcoin’s future in the futures market, it’s becoming increasingly difficult to tell if it’s a market or a comedy show!

Oh, the tragedy of Bitcoin [BTC]! Once basking in the sunlight of prosperity, it is now facing selling pressure unseen since the grand failures of July 2024. What a way to celebrate the new year!

Recent on-chain data points to a significant drop in demand, proving that once enthusiastic buyers are now more like reluctant participants at a dull dinner party, leaving the asset as vulnerable as a cat in a room full of vacuum cleaners.

Meanwhile, those crafty traders have seized the moment, opening short positions left and right. With both spot demand plummeting and bearish sentiments ruling the derivatives market, Bitcoin’s price is getting more lost than a wanderer in the woods.

A Dramatic Drop in Spot Demand

Spot demand for Bitcoin is akin to a quirky character in a Chekhov play—essential yet often overlooked. While it used to maintain price stability, it now seems to be battling some existential crisis.

With fewer buyers stepping up to the plate, the risk of falling prices is rising, faster than a frightened rabbit! 🐇

Observe the chart illustrating the rapid descent of demand since early 2025, which is as dramatic as a thousand Russian tragedies. The dip mirrors the despair of July 2024 when price corrections aligned like a bad joke delivered at the wrong time.

Throughout late 2024, Bitcoin’s climb was fueled by positive sentiment—ah, the naive hope! But a recent wave of negativity reflects a declining market confidence. Should this trend continue, it’s not just the price that could fall; it could bring down the whole dinner party in the weeks ahead!

Bets on Bitcoin’s Downfall Gather Steam

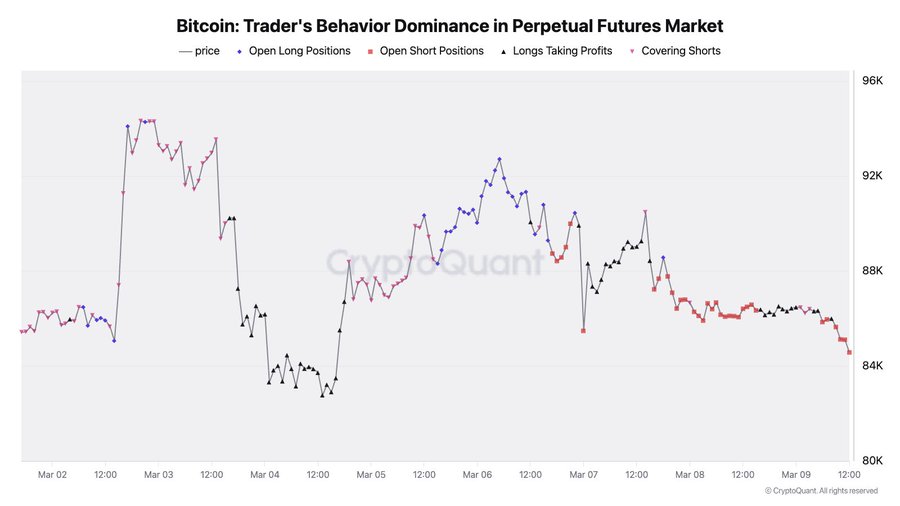

As we venture deeper into the perpetual futures market, it’s clear that traders wield leverage like an artist brandishing a paintbrush, only without the beauty—a typical scene in our grim comedy of errors.

When long positions were all the rage, we saw optimism; now, with short positions growing like weeds in an untended garden, it seems pessimism has taken center stage.

Post-March 3rd, surges in short positions have aligned perfectly with Bitcoin’s fall from grandeur, from a dazzling $96K to a dismal below $84K. Traders expect this downward spiral to continue—who doesn’t love a good crisis?

This trend reflects a collective anticipation of prices sliding further, while long-position traders are taking profits as if trying to bail water from a sinking ship. If these short traders continue to play the waiting game, Bitcoin’s price might just win the ‘most depressed cryptocurrency’ award soon.

Market Sentiment: A Gloomy Affair

There’s nothing quite like a good catastrophe to stir the market. Over the past week, Bitcoin’s price has dropped about 10.98%, settling at a woeful $82,211—one can almost hear the wailing and gnashing of teeth!

This decline aligns comfortably with a tapestry of global economic uncertainties that even an optimist might find hard to bear. Notably, President Donald Trump, with his knack for good timing, has added to the melodrama by hinting at a recession—delightful, isn’t it?

And let’s not forget the escalating trade tensions and anxieties surrounding China’s economic woes. Truly, it’s a festive season of decline for both traditional and crypto markets.

If these economic uncertainties linger, Bitcoin could continue as the somber leading act in this tragic farce. However, should a miraculous regulatory change or a new wave of institutional adoption grace our beleaguered asset, who knows? We might just see a comedic turnaround!

Read More

- OM PREDICTION. OM cryptocurrency

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Poppy Playtime Chapter 4: Release date, launch time and what to expect

- Ubisoft Shareholder Irate Over French Firm’s Failure to Disclose IP Acquisition Discussions with Microsoft, EA, and Others

- Ian McDiarmid Reveals How He Almost Went Too Far in Palpatine’s Iconic ‘Unlimited Power’ Moment

- Kidnapped Boy Found Alive After 7 Years

- Serena Williams’ Husband’s Jaw-Dropping Reaction to Her Halftime Show!

- Avowed Update 1.3 Brings Huge Changes and Community Features!

- Ryan Reynolds Calls Justin Baldoni a ‘Predator’ in Explosive Legal Feud!

2025-03-10 13:15