-

Bitcoin holders shift guard in favor of short-term profit-taking, contrary to recent market expectations

Such a transition could have a major impact on BTC’s price

As a seasoned analyst with over two decades of experience in the financial markets, I have seen my fair share of market shifts and trends. The current dynamics in the Bitcoin market are intriguing, to say the least.

Over the past few weeks, the mood regarding Bitcoin’s market has experienced a substantial shift. Initially, it was speculated that Bitcoin would continue its bullish trend from September into October. Yet, this optimistic outlook failed to align with the actual situation.

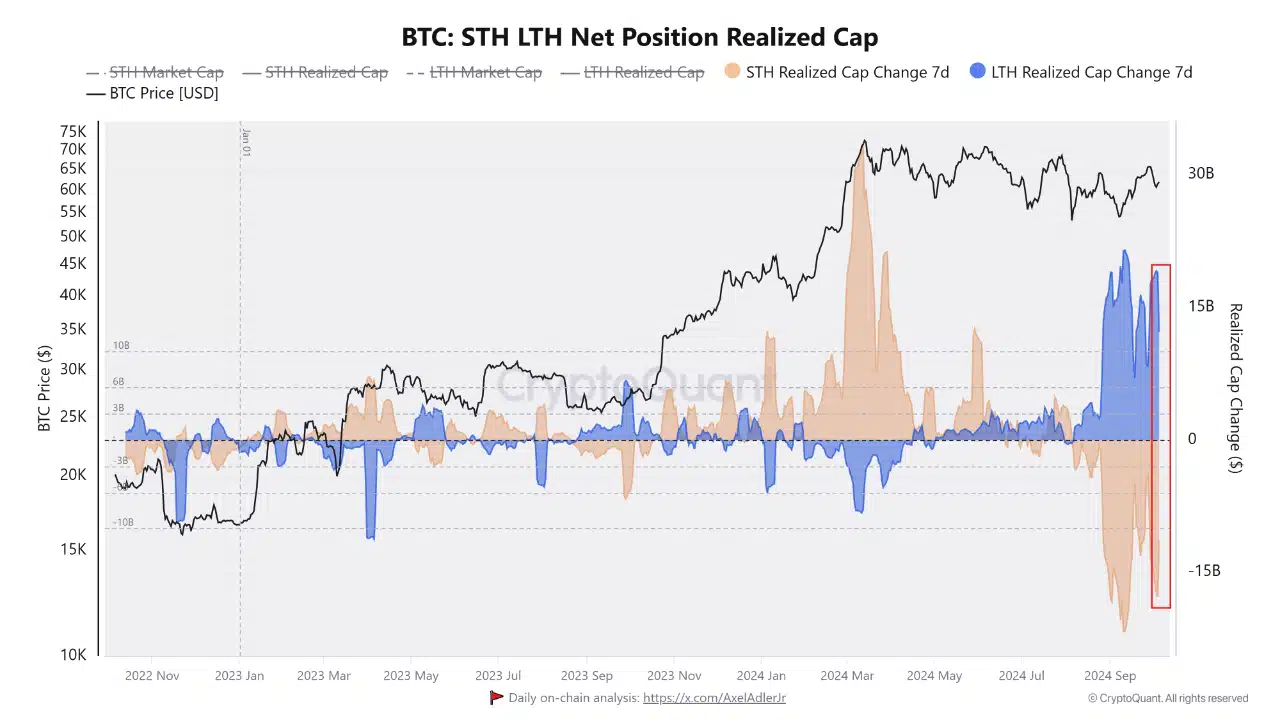

Based on current data, it seems there could be an emerging pattern that might prevent cryptocurrencies from reaching unprecedented peaks, at least for now. A recent study by CryptoQuant has pointed out this trend, focusing on shifts in the relationship between long-term and short-term holders.

Based on the latest assessment, it appears that $6 billion has been withdrawn from LTH’s (Long-Term Holders) recent realized capitalization. This could indicate that these investors are cashing out their profits. Furthermore, this might suggest that they do not foresee an immediate extension of prices to reach new record highs in the near future.

The same analysis highlighted a surge in short term holder realized cap by roughly the same amount ($6 billion). According to the analysis, this shift by STHs could mean that they are accumulating, but with a focus on short-term profits.

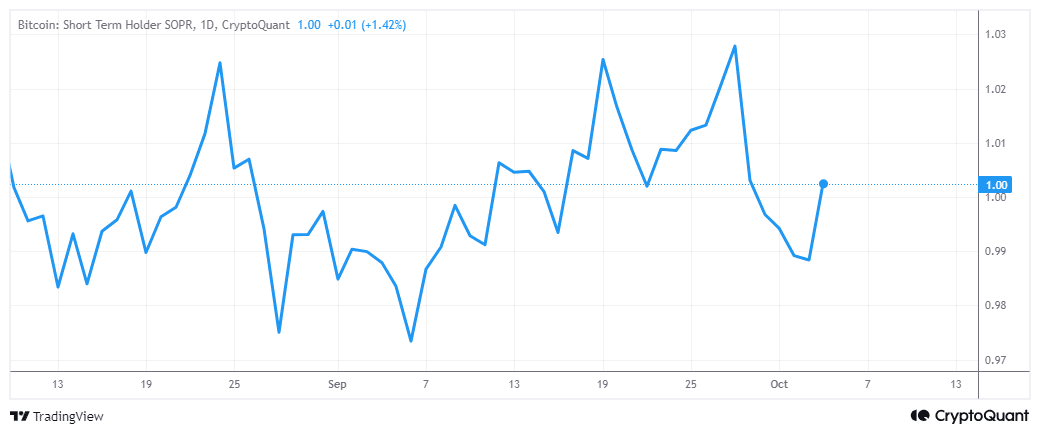

Based on the current Bitcoin trends, there are frequent small fluctuations instead of a significant surge. Translated simply, a substantial price breakout might not occur immediately, mirroring recent findings in the short-term BTC holder’s Spent Output Profit Ratio (SOPR).

Short-term investors’ Strategy of Selling Profit Ratio (SOPR) has seen an increase, suggesting a rise in short-term profit-taking. This trend is typically associated with market tops during shorter timeframes in history.

How long will this Bitcoin short term focus last?

The trend towards quick financial gains primarily hinges on the current market opinion or mood. Lately, this tendency has been influenced significantly by market happenings. At present, one of the key events that might significantly affect Bitcoin is the upcoming U.S election period.

As an analyst, I’ve observed a tendency for uncertainties to prompt a short-term perspective among investors, which seems to underpin their recent strategy of seeking quick profits. The U.S election results might generate a significant reaction, potentially propelling Bitcoin out of its current price range. This response could be either bullish or bearish, contingent upon the election outcome.

In the near future, Bitcoin traders ought to stay vigilant for liquidations. Since a strategy focused on quick profits tends to increase leverage, this could potentially result in more instances of getting liquidated.

Read More

2024-10-05 23:03