-

Bitcoin’s long-term holder SOPR hit 1, indicating average sells at break-even

Analysis of BTC’s key metrics and patterns suggested the bull run is still on.

As a seasoned analyst with a decade of experience in the cryptocurrency market, I find myself constantly intrigued by Bitcoin’s [BTC] dynamic behavior. The recent price action and on-chain metrics are a testament to the market’s inherent volatility and the need for vigilant observation.

Analyzing the current trends in Bitcoin’s (BTC) price movement and on-chain indicators is essential to deciphering the overall market mood, considering it leads the pack as the cryptocurrency boasting the highest market value.

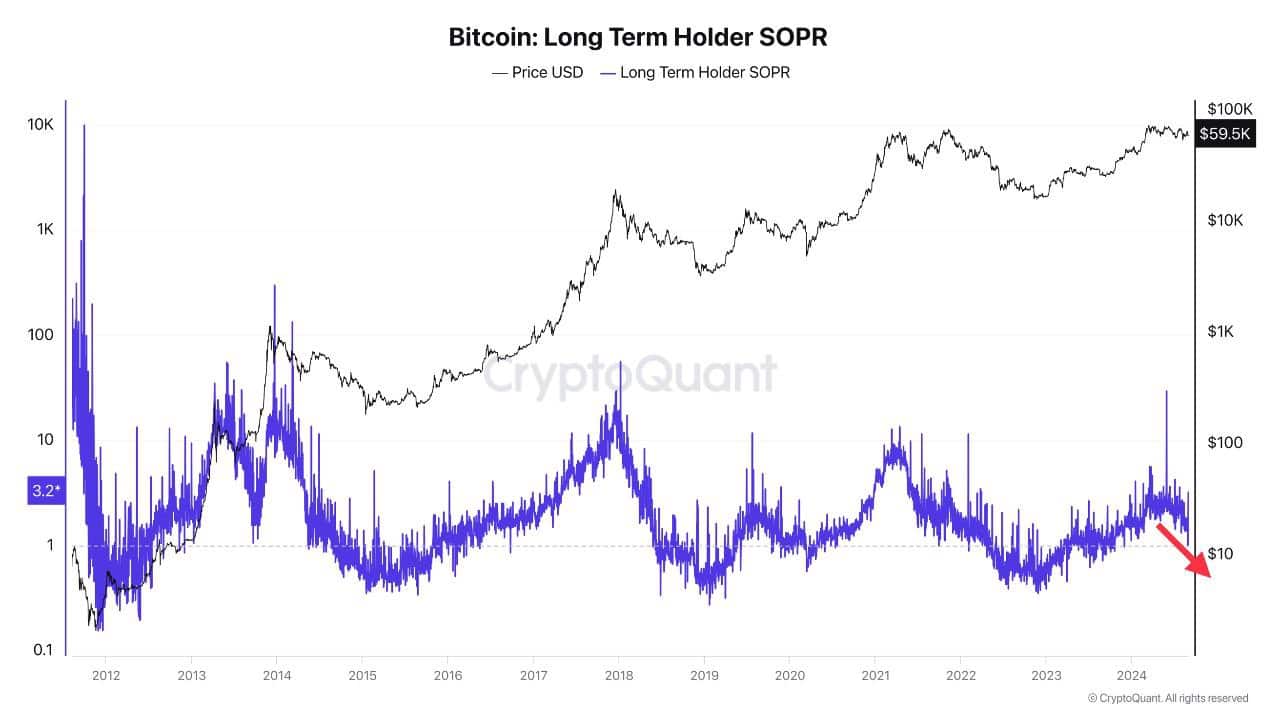

The Long-term Holder SOPR that tracks Bitcoin transactions by those who’ve held BTC for over 155 days is a key metric. When the SOPR’s value is above 1, it indicates profits, while a value below 1 signals losses.

Following the latest decline in Bitcoin’s value, the Spent Output Profit Ratio (SOPR) reached 1, indicating that numerous traders liquidated their holdings at breakeven – a hint of cautious market behavior.

Bitcoin (BTC) has dipped below its previous high of $62k because of significant sell-offs that occurred near that price point.

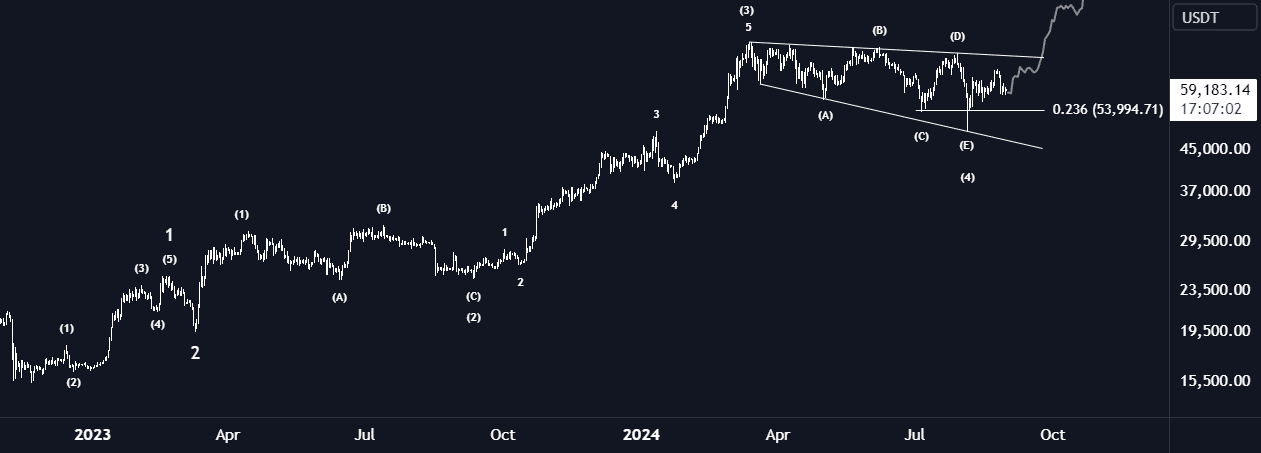

BTC’s broadening wedge at critical support level

Currently, the movement of Bitcoin’s price in the BTC/USDT market is happening inside a widening triangle shape known as a broadening wedge pattern. This usually indicates a period of consolidation, suggesting a tranquil stage preceding a possible significant shift in the market.

Currently, this pattern is positioned at a crucial point of stability, where more investors are amassing holdings while harboring doubts about the possibility of Bitcoin experiencing significant growth in the near future.

Currently, there’s a possibility that the value of Bitcoin could dip down to approximately $53,000 before potentially experiencing an upward trend, which might occur in Q4 of 2024. The fluctuation near the $59,000 mark adds to the ambiguity surrounding this crucial phase.

Further analysis of funding rates from Coinglass revealed little change over the past month. This, despite the massive market flush on 5 August triggered by Japan’s stock market crash due to rate hikes.

After that point, even though funding rates have become steady, they’ve still been quite low. This lends credence to the notion that Bitcoin is currently experiencing a period of accumulation.

BTC RSI breakout pointed to a rebound

Furthermore, Bitcoin’s Relative Strength Index (RSI) has just experienced its second substantial surge in this growth phase, potentially indicating a further upward trend may follow.

If Bitcoin’s price falls significantly below the $53k mark, it could instigate widespread selling due to fear, possibly causing a subsequent rise in value.

In a manner reminiscent of a past occurrence which sparked a significant bullish run, the RSI breakout seems to indicate that Bitcoin could potentially prepare for another upward trend.

History of last quarter’s post-halving

historically, the period after a Bitcoin halving, which is the last three months of the year, tends to be favorable for Bitcoin; this pattern may persist in the year 2024 as well.

Even though this past summer saw a slow and discouraging market for Bitcoin, it is advisable for investors and traders to stay calm and persistent. Historically, the market has shown a tendency to reward those who maintain their position during such phases.

This might be an excellent moment to gather additional Bitcoin, as we’re looking forward to a possible surge in its value during the last three months of the year.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

2024-09-01 02:15