Ah, Bitcoin, that fickle darling of the digital realm, has taken a tumble, correcting nearly 4% in the past 24 hours, only to rebound with the grace of a tipsy aristocrat above $102,100. Despite a 30-day loss that would make even the most stoic investor wince (9.7%, no less), the market whispers-nay, cackles-of a possible bottom forming. Could this be the prelude to a new all-time high? One can only hope, darlings. 🤑

The structure, of course, remains as confirmed as a society divorce, but the clustering of signals is stronger than a gin and tonic at high tea. 🍸

Ascending Channel Support Meets a Fresh Bottom Signal

Since April, Bitcoin has pranced about in an ascending channel, its lower trendline acting as a reliable crutch for the inebriated bull. The latest bounce on November 4th keeps the charade intact. When bottoms form within such structures, the channel floor is usually where the first glimmer of strength appears-much like the first sip of champagne at a soiree. 🥂

Craving more of this token tomfoolery? Subscribe to Editor Harsh Notariya’s Daily Crypto Newsletter, if you must. 📩

Meanwhile, NUPL-that metric which reveals whether holders are basking in unrealized profit or drowning in loss-has plummeted to 0.44. This is nigh on the lowest since April 8th, when it touched 0.42 and marked the exact cycle bottom. Post that, Bitcoin rallied from a mere $76,700 to a staggering $116,900 by late May. A 53% surge, you say? How quaint. 📈

Now, the same farce repeats itself: a bounce from the channel floor and NUPL returning to its historical nadir. Traders, ever the optimists, believe a bottom is brewing. But, ah, the irony! Just as one gazes up at a summit, Bitcoin faces a ridge as stubborn as an old money matriarch. 🏔️

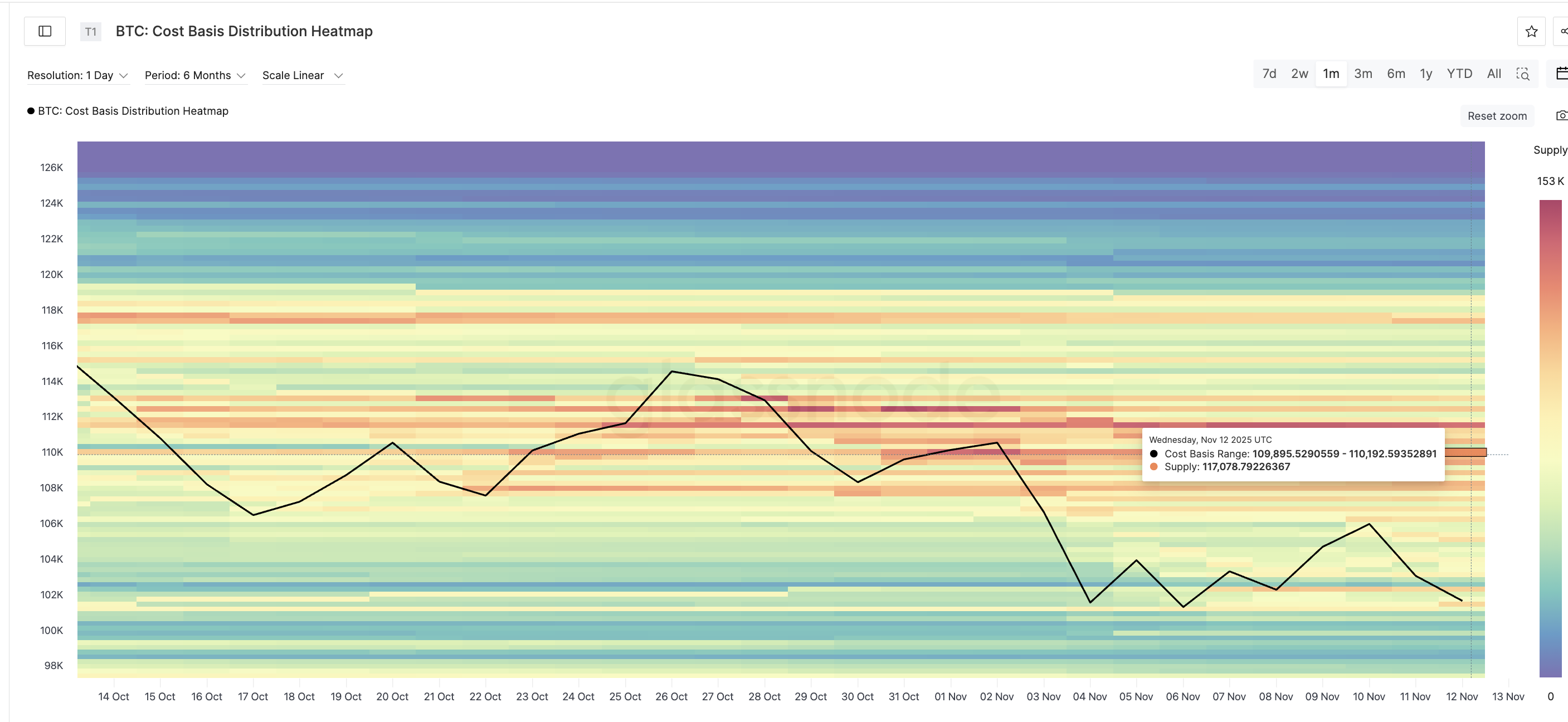

Cost-Basis Heatmap Reveals the Level Blocking the Bitcoin Price Breakout

The cost-basis heatmap, that colorful map of where the largest pockets of BTC supply reside, shows where the real drama lies. These pockets, like overbearing aunts at a dinner party, often block upside moves as holders react to their entry levels. The strongest cluster now sits between $109,895 and $110,192, backed by a whopping 117,078 BTC. Other clusters exist, but this zone is the deepest shade of resistance, particularly in the near term. 🌪️

This zone also aligns with the 0.618 Fibonacci level on the Bitcoin price chart, at $109,683-a technical resistance point as formidable as a dowager’s glare. Until Bitcoin clears this band, the bottom remains but a pipe dream. Every bounce beneath this level may well be a mere flirtation with failure. 💔

A daily close above $109,683 would be the first sign that the ridge is cracking. A stronger confirmation comes above $112,652, aligning with the 0.786 Fibonacci area. Above that, Bitcoin could aim for $116,435 and even the previous peak near $126,301. 🌟

Should BTC fail and retreat to the channel floor, the pattern holds-but if Bitcoin breaks below the lower trendline, the bottom setup is as good as a canceled engagement. In that case, the price could slide toward $98,758, or even lower, weakening the entire hypothesis. For now, the ascending channel, the fresh NUPL bottom zone, and the heatmap cluster all point to the same conclusion: a possible Bitcoin price bottom stares at a peak, but one major level still blocks the view. 🌄

Read More

- How to Get the Bloodfeather Set in Enshrouded

- Gold Rate Forecast

- 10 Movies That Were Secretly Sequels

- 32 Kids Movies From The ’90s I Still Like Despite Being Kind Of Terrible

- USD JPY PREDICTION

- Best Werewolf Movies (October 2025)

- One of the Best EA Games Ever Is Now Less Than $2 for a Limited Time

- Auto 9 Upgrade Guide RoboCop Unfinished Business Chips & Boards Guide

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- These Are the 10 Best Stephen King Movies of All Time

2025-11-13 10:35