-

Bitcoin drew closer to a supply crunch and a major rally as exchange reserves dipped lower.

A CryptoQuant analyst highlighted why BTC’s reserves and increasing stablecoin supply pointed to an upcoming major rally.

As a seasoned analyst with over two decades of experience in the financial markets, I have seen my fair share of market cycles and trends. While Bitcoin’s bull run may seem elusive as we approach the end of 2024, the recent developments in exchange reserves and stablecoin supply are too significant to ignore.

2024 was predicted to be a significant year for Bitcoin [BTC] price surge by many holders, but as the year nears its end, some are questioning whether the anticipated bull market is no longer happening.

Even before optimism around Bitcoin reaches its lowest point, there are indications that Bitcoin’s supporters (bulls) might make a comeback.

Based on Tarek’s analysis at CryptoQuant, a significant bullish surge for Bitcoin looks imminent.

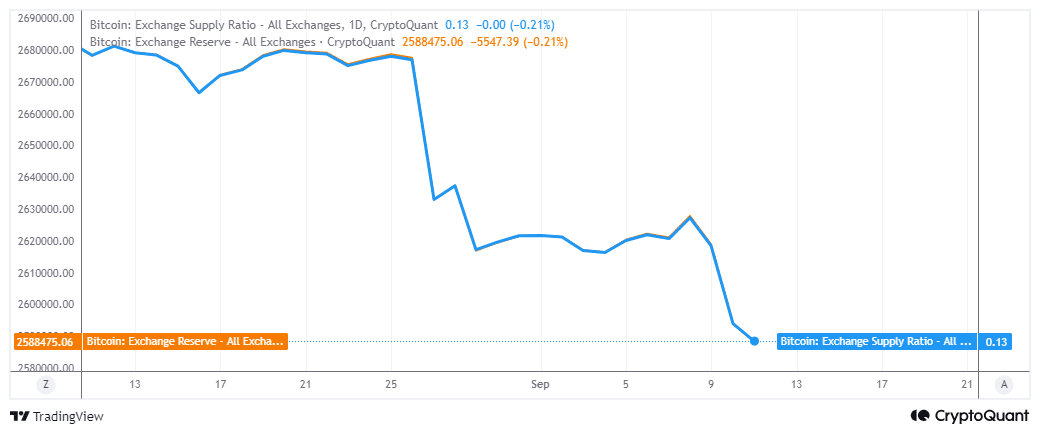

The researcher pointed out the shrinking Bitcoin holdings at exchanges as a significant initial indicator. This decrease has picked up pace over the past three days, following a surge in reserves from the 4th to the 8th of September.

Over a span of three days, reserves holding Bitcoin decreased by approximately 39,356 Bitcoins, which equates to around $2.28 billion. This reduction could potentially be the reason behind the recent surge in Bitcoin bulls’ resilience, as they managed to rebound from the recent low points.

It also coincided with a resurgence of demand from ETFs.

Stablecoin reserves recently reached new highs

The diminishing Bitcoin reserves emphasize the increasing scarcity of this cryptocurrency. Lately, we’ve seen reduced prices which have given investors, particularly the large ones known as ‘whales’, ample opportunity to stockpile more Bitcoins at cheaper rates.

Additionally, the analyst noted that increasing amounts of stablecoins could be an indicator suggesting the potential for a market surge ahead.

The total market capitalization of stablecoins based on the ERC20 standard on various exchanges has hit an all-time high surpassing $25.5 billion, as reported by CryptoQuant.

It was observed by the analyst that the increasing market value of stablecoins indicates a significant level of market interest in these digital assets. This trend typically arises as investors get ready to shift their funds into cryptocurrencies.

The decrease in Bitcoin holdings alongside an increase in stablecoins suggests that a significant price surge for Bitcoin might be imminent.

Bitcoin has shown resilience above the $50,000 mark, suggesting that any fall beneath this point could potentially be viewed as a significant reduction in price.

The above observations are also in line with the Bitcoin halving timeline. This event has historically been followed by a major rally, months after the halving.

With institutional interest in Bitcoin stronger than ever, it’s possible we might witness another robust upward price trend.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Translation: In simpler terms, what’s happening now might lead to Bitcoin reaching unprecedented price levels. Some notable investors like Cathie Wood predict that the price could go beyond $200,000.

A more reasonable forecast might reach around $90,000 by the year’s end, with potential increases to even greater amounts by 2025.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-09-12 22:15