- Bitcoin’s surge back to $101K is fueled by large HODLers capitalizing on the dip.

- A new all-time high could be within reach, setting the stage for an exciting rally.

As a seasoned researcher with over a decade of experience observing and analyzing the cryptocurrency market, I find myself intrigued by the recent surge of Bitcoin back to the $101K mark. The market dynamics are fascinatingly complex, yet they seem to be coalescing around a potential breakout.

Currently, Bitcoin (BTC) has returned to the significant price point of $100,000, sparking lively debate about its potential future direction. The investment community is split: some interpret the recent increase as a cautious show of optimism, driven more by enthusiasm rather than robust underlying factors.

Conversely, the rising number of significant HODLers indicates a robust accumulation period, leading some to view the current price as a possible floor or lowest point.

This sets the stage for a significant breakout as the new year excitement ramps up.

Given the elevated risks, could Bitcoin live up to its potential and reach a fresh record peak before the conclusion of Q4?

Bitcoin is showing signs of undervaluation

At the moment, a few significant elements are at work. In terms of our internal analysis, the volume data indicates that Bitcoin might be slightly underpriced, whereas the Relative Strength Index (RSI) remains balanced.

The MACD lines are close to a bullish crossover, and the CMF stays positive.

On the outside, there seems to be a combination of economic and psychological factors aligning, which suggests that a potential base or recovery might be taking shape.

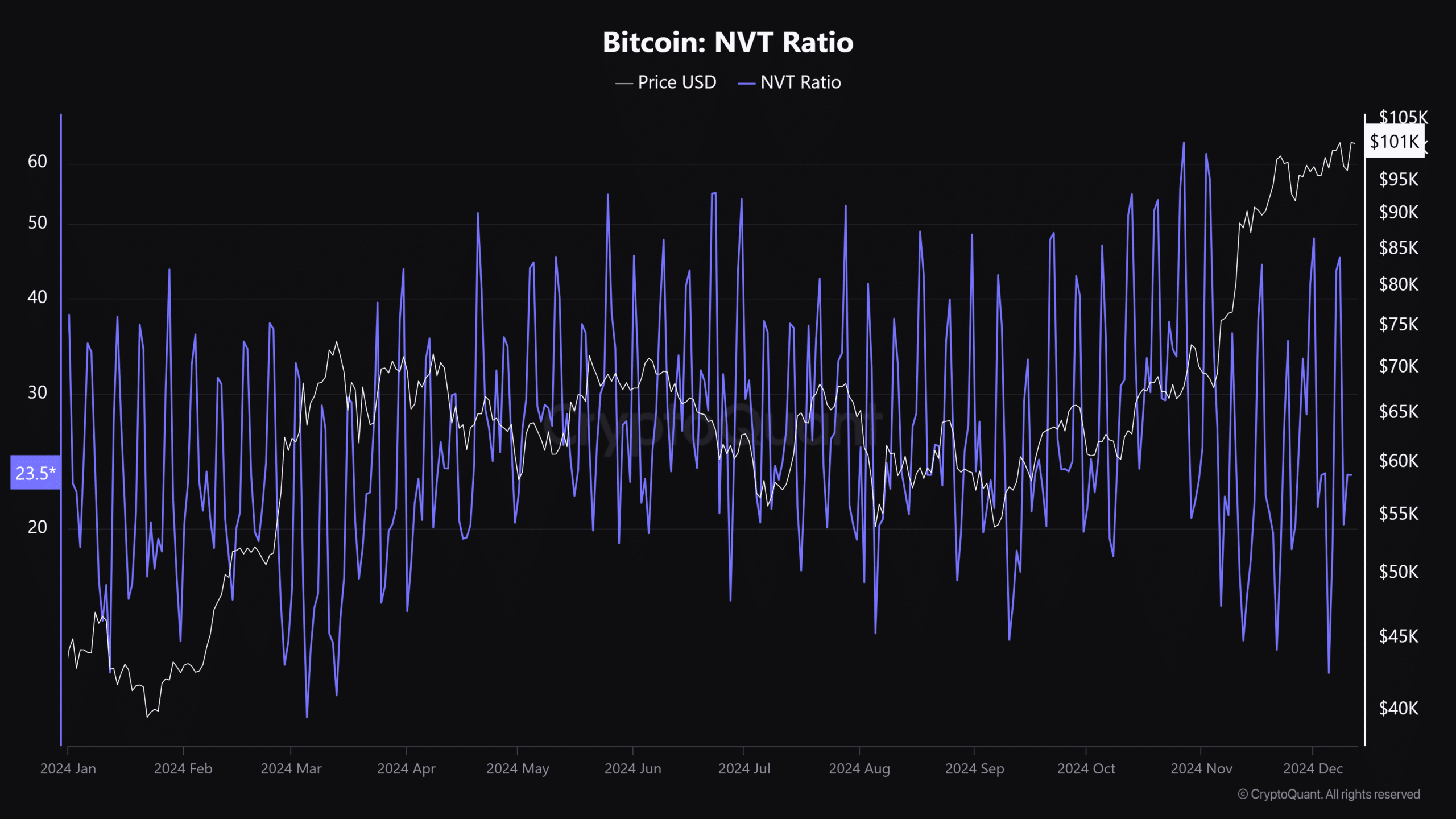

Historically, it’s often seen that a network experiences a surge or ‘breakout’ when it’s priced lower than its actual worth – and at present, the NVT (Network Value to Transactions) ratio seems to be supporting this notion.

Source : CryptoQuant

Given that the Network Value Transactions (NVT) have reached a two-month low, it appears that Bitcoin’s price is advancing faster than its corresponding network activity. This could indicate a prospective buying opportunity, particularly for significant investors who are looking to profit from this market downturn.

However, it’s worth noting that whales have been aggressively hoarding every dip over the past fortnight, thereby thwarting any substantial price drops.

Nevertheless, even with their diligent attempts, the prices have shown minimal fluctuation because the significant impact of high leverage in the derivatives market seems to outweigh other factors.

If a solid price floor is established, it may create an opportunity for a short-squeeze, but for that to occur, major investors (whales) and long-term holders must maintain their purchasing momentum.

A strategy bulls must follow for Bitcoin’s surge

Over the last day, Bitcoin rebounded and reached approximately $101,000, reversing a downward trend caused by selling activity for the past seven days. This sudden increase resulted in a significant short covering or “short squeeze.

Approximately $170 million worth of short positions were closed, with the largest transaction being a $5.31 million trade in Bitcoin (BTC) and Tether (USDT), originating from Binance.

Furthermore, the Open Interest (OI) has experienced a significant increase of close to 6%, amounting to approximately $64 billion. This rise suggests that powerful traders are wagering on Bitcoin’s growth. Given this surge, it might be an opportune time for investors to think about entering the market in anticipation of a potential recovery.

What transpired recently was a required adjustment that caused traders holding long positions to sell off. However, these large investors (whales) were able to prevent the price from sinking beneath $90K, effectively balancing out the downward force.

Read Bitcoin [BTC] Price Prediction 2024-2025

Currently, significant investors and financial institutions recognize that Bitcoin is undervalued. This situation could lead to a surge in demand, causing short positions to be forced to buy back, which is often referred to as a “squeeze.

If major market participants continue buying during price drops, it might not be long before we reach an unprecedented peak that surpasses even the most optimistic predictions.

Read More

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- There is no Forza Horizon 6 this year, but Phil Spencer did tease it for the Xbox 25th anniversary in 2026

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

2024-12-13 09:12