- Bitcoin saw leverage-driven pump as OI rose to $27.9 billion, marking a $3.3 billion hike

- Weak demand saw Bitcoin investors flash signs of caution

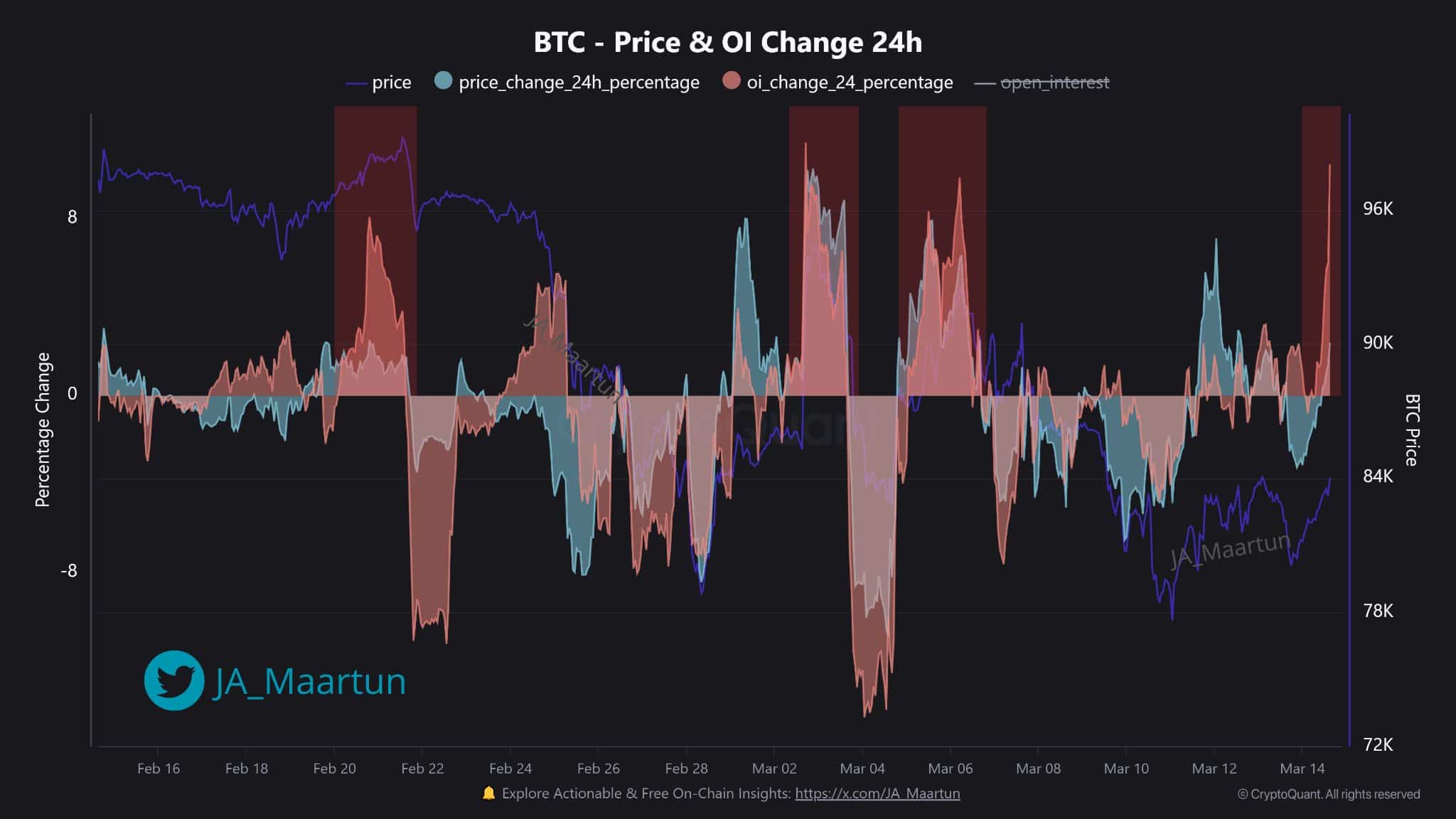

Ah, Bitcoin! The digital gold that dances on the precipice of fortune and folly. Its Open Interest (OI) has soared to a staggering $27.9 billion, a veritable feast of leveraged market actions, all thanks to a $3.3 billion pump—an impressive 13% boost! But, dear reader, do not be deceived by the glittering facade.

History has shown us that such upticks in OI often lead to unpredictable price fluctuations, much like a cat on a hot tin roof. Just ask the traders who felt the sting of market volatility on the fateful days of February 20 and March 4. The pump, it seems, was a siren’s call, urging traders to manage their risks with the utmost caution.

As of now, Bitcoin clings to a trading price of approximately $83k, but beware! Excessive leverage is a double-edged sword, and the specter of market liquidations looms large. A swift depreciation of long positions could send prices tumbling back to the $70,000 to $80,000 range faster than you can say “HODL!”

In the past, when OI exceeded 10%, the price fell by 5-8%. A pattern that has repeated itself on February 22 and March 6. The current market conditions are ripe for short sellers, who are eagerly waiting to profit from the inevitable liquidations.

Should the price manage to rise sustainably above $90k, we might witness a new dawn of market growth. But beware the OI flush, which could swiftly erase any current gains, leaving traders to navigate the treacherous waters of sudden changes in Open Interest.

How traders are reacting to weak demand?

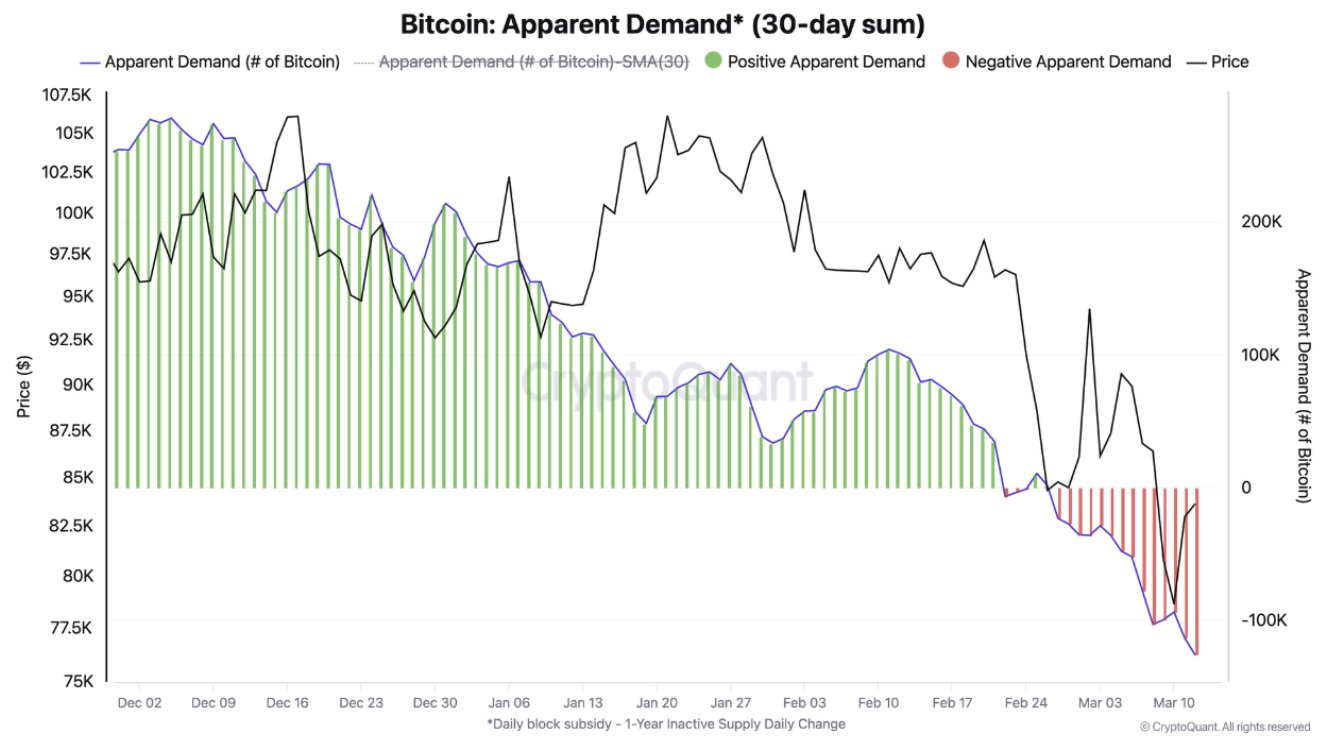

Once again, we find ourselves in a tale of woe, as a significant reduction in BTC demand has been observed from December 2024 to March 2025. A low annual demand of -100k BTC was recorded in mid-March 2025, following a peak of 105k Bitcoin in early December 2024. Oh, the irony!

The downward spiral of market value, coupled with a negative demand zone structure, has revealed a palpable sense of investor caution. The 30-day sum has kept positions under the demand line, as BTC’s price plummeted from 105k to a mere 77k. A tragic comedy, indeed!

Investors, in their wisdom, have turned to safer havens, seeking refuge in defensive assets such as metals, U.S. government bonds, and the stable digital currency USDT. A wise move, or merely a sign of desperation?

As the market shifts towards more secure assets, Bitcoin holders of long positions find themselves teetering on the edge of a bear market. The specter of forced sell-offs looms if prices dip below the $80K mark, with demand sinking to a dismal -100k.

Major losses await those who cling to the hope of BTC returning above $100k, as analysis has pointed to a bearish trend whenever demand remains below -100k since last December. A sobering thought for those who dare to dream!

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Elden Ring Nightreign Recluse guide and abilities explained

2025-03-16 00:10