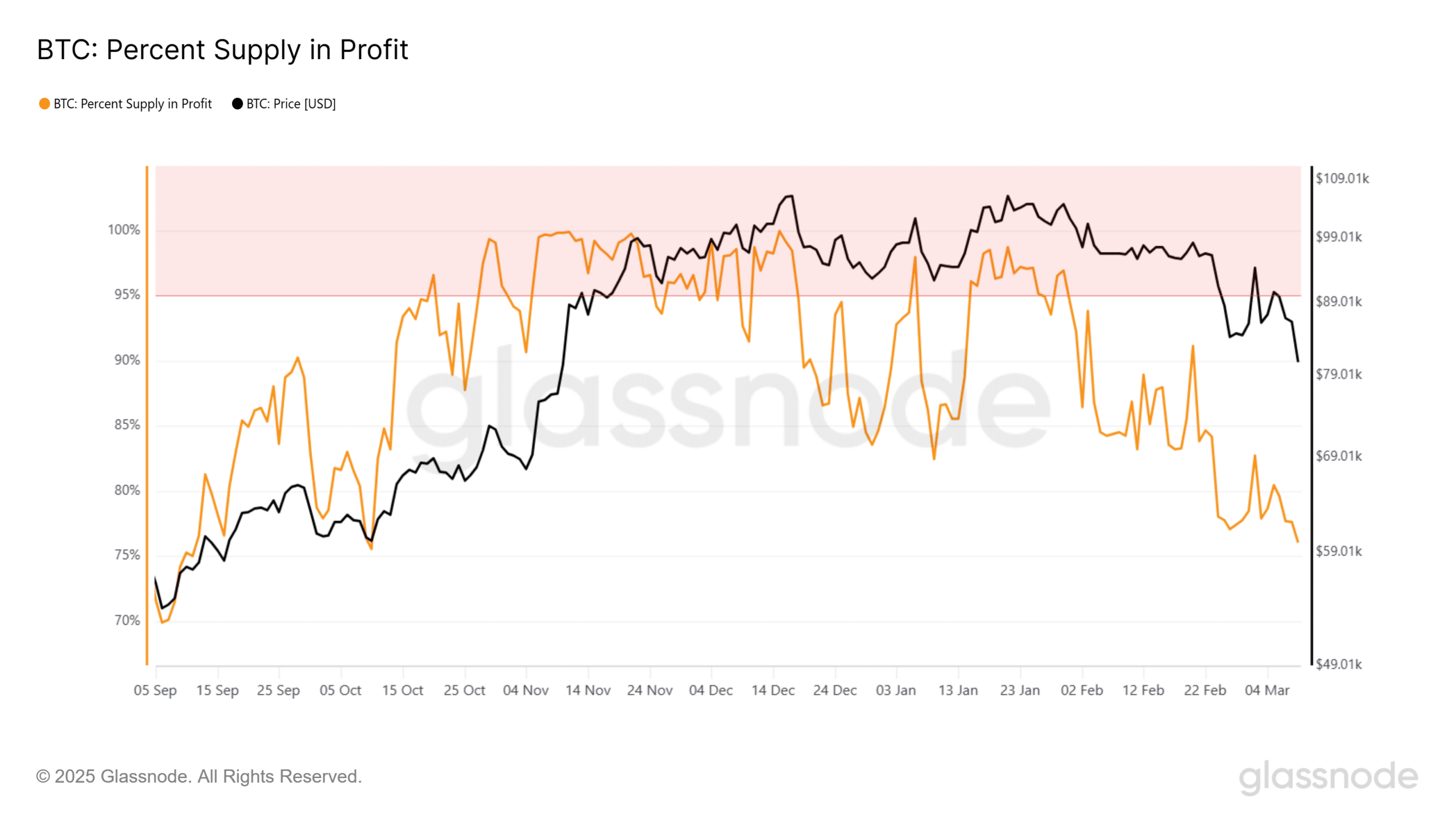

- Ah, the fickle nature of Bitcoin! Once basking in the glow of 99% profit, it now finds itself in the company of 76% of its holders, who are, alas, in the depths of unrealized loss. How delightfully tragic!

- Will this phase of profit-taking lead us into the abyss of deeper declines, or is it merely a charming consolidation before the next grand performance?

As the ever-astute AMBCrypto has noted, Bitcoin [BTC] encountered a formidable resistance at the lofty heights of $97K, only to be met with a sharp and rather dramatic rejection. The subsequent descent to $82K suggests yet another wave of profit-taking, as if the market were a stage and we were all mere players.

🔥 EUR/USD Rollercoaster Ahead After Trump Tariff Plans!

The euro faces intense pressure — shocking forecasts now revealed!

View Urgent ForecastDespite this theatrical pullback, a staggering 76.08% of BTC’s supply remains in profit—its lowest in six months—indicating that most HODLers are still basking in the green light of fortune. How splendidly ironic!

Yet, we must not forget the 23% of the circulating supply languishing in unrealized loss—around 4.56 million BTC. As more holders find themselves in this unfortunate predicament, some may choose to sell, hoping to limit their further losses. A most tragic choice indeed!

To navigate this treacherous sell-side liquidity, one must pay heed to the volume indicators, those fickle harbingers of market sentiment.

Although trading volume has surged by a staggering 178.22% to $43.12 billion, net deposits on exchanges have risen by 3.96%, revealing that sell-offs are, alas, outweighing buys across the grand stage of major exchanges.

With the buying pressure from U.S. investors remaining as low as a poet’s income amid economic uncertainty, it appears that retail buyers are not stepping forth to absorb the selling pressure. How dreadfully disappointing!

This could indicate the involvement of third-party players, perhaps institutions, pulling the strings behind the curtain, influencing the market’s next act.

High-leverage risk in Bitcoin derivative trade

In the midst of this weak spot buying, Bitcoin’s Estimated Leverage Ratio (ELR), which had recently plummeted to a three-month low, has surged dramatically, as if it were a phoenix rising from the ashes of caution.

This indicates that derivatives traders are not de-leveraging, but rather increasing their leverage to embrace higher-risk positions. A most audacious gamble!

On the 9th of March, Bitcoin experienced a 6.41% drop to $80K, resulting in a staggering $195.86 million in liquidated long positions. A veritable tragedy for those caught in the act!

Institutional “dip-buying” is gaining traction, potentially setting the stage for a short squeeze. This could drive Bitcoin to retest the $85K resistance zone in the coming days, a most dramatic twist in our tale.

However, breaking through this resistance remains a Herculean task. Escalating sell-offs could lead to further liquidations, pushing Bitcoin below $80K once more. The plot thickens!

In summary, institutional capital is absorbing sell-side liquidity from traders breaking even after Bitcoin’s 17% weekly decline. Nonetheless, the risks associated with “dip-buying” remain elevated, a precarious dance on the edge of a precipice.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Gold Rate Forecast

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2025-03-11 06:18