🚨 BEARISH TRENDS EMERGE: Is Bitcoin‘s Transaction Volume a Red Flag? 🚨

- Bitcoin’s transaction volume has taken a nosedive, plummeting to levels not seen since the Dark Ages of 2023. 🕷️

- Traders are getting nervous, and it’s not just the price that’s struggling to stay above water – it’s the whole shebang. 🌊

It’s not just the price that’s going down the drain, folks – Bitcoin’s transaction volume has taken a sharp dive, and we’re not talking about a gentle slope here. 🏔️

We’re talking about a free-fall, a plummet, a nosedive into the depths of despair. And it’s not just the volume that’s the problem – it’s the whole shebang. The Open Interest is down, the trading volume is down, and it’s all looking a bit… well, bearish. 😬

A sharp decline in Bitcoin transactions sparks concern (and a few sarcastic remarks)

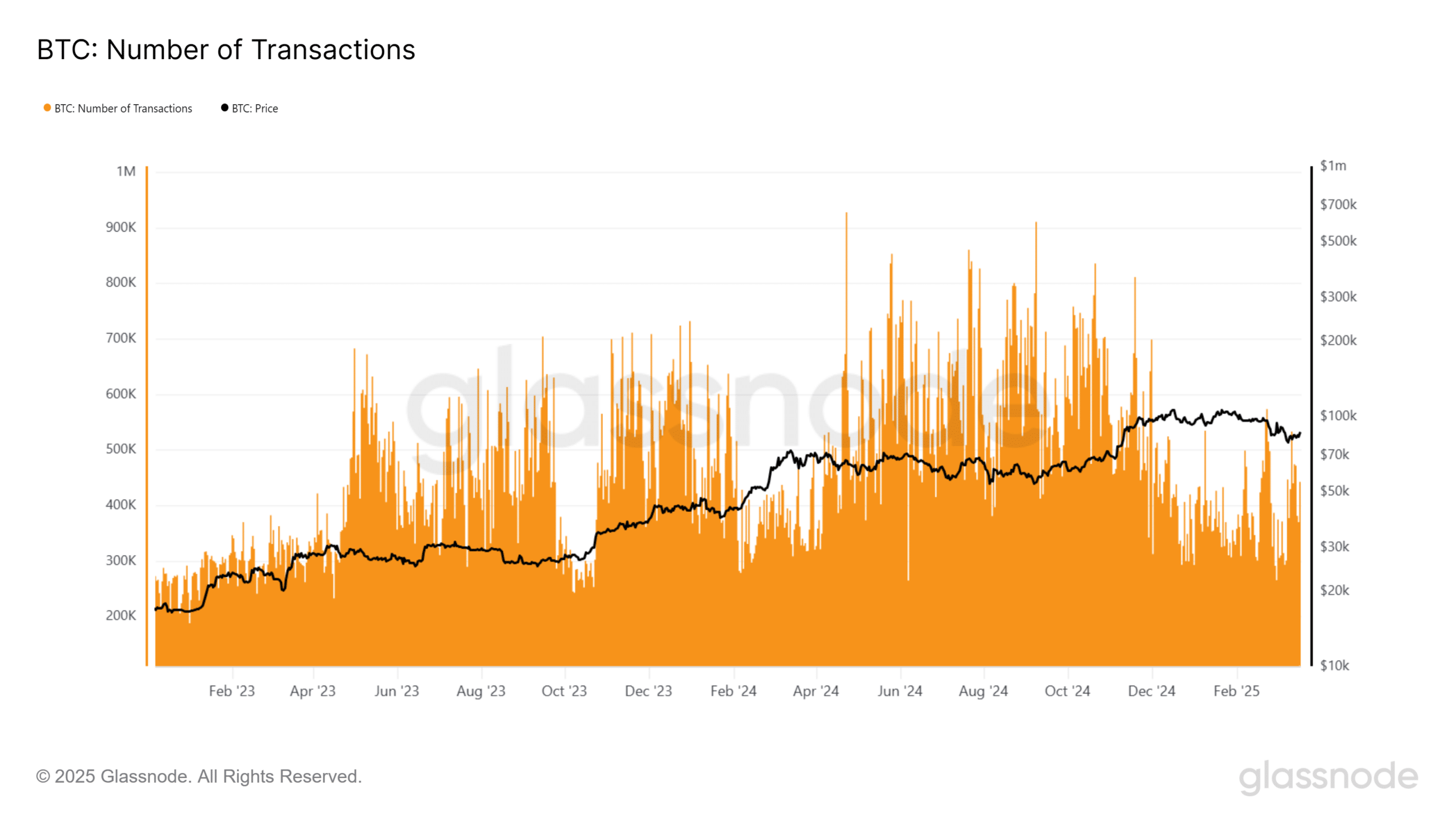

Recent data from Glassnode (those folks are always good for a laugh) highlights a significant drop in BTC‘s transaction volume. And by significant, I mean it’s gone from 700K to 400K – that’s a 43% drop, folks! 🤯

Now, historically, a drop in transaction volume has often preceded periods of price stagnation or corrections. But let’s be real – this is Bitcoin we’re talking about. Anything can happen. 🤪

This reduction in transaction count suggests that network activity is slowing, which could indicate reduced market participation. Or, you know, it could just be a bunch of people taking a nap. 😴

If the trend continues, Bitcoin may struggle to maintain its current price levels, as a lack of demand could weaken support zones. But hey, at least the price will be stable – in the sense that it’ll be stuck in the mud. 🌿

Open Interest and volume confirm weakening momentum (and a few more sarcastic remarks)

A broader analysis of market indicators reveals further bearish signals. Because, of course, it does. 🙄

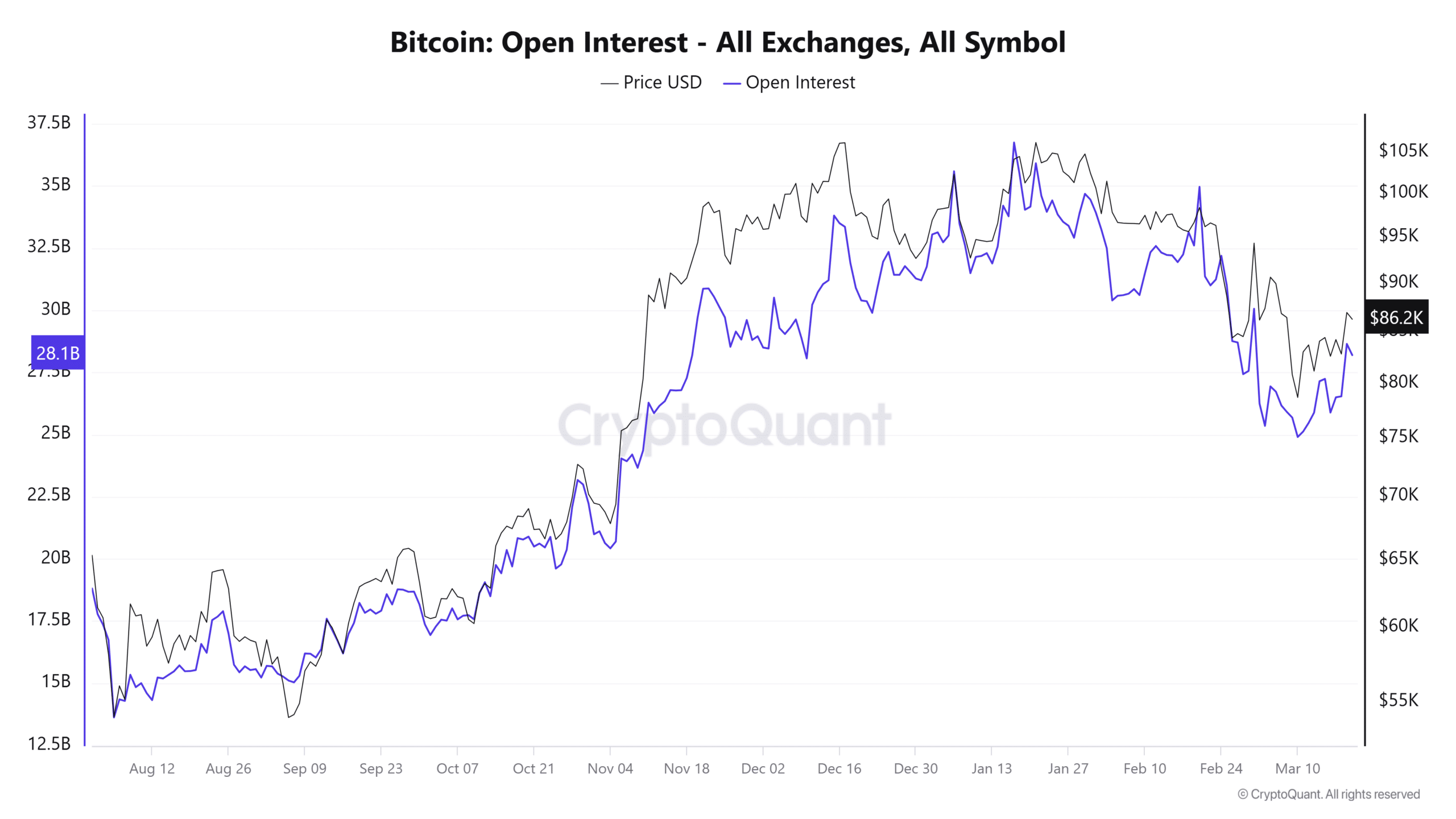

OI across exchanges was at $86.2 billion, at press time, down from highs above $100 billion earlier in the year. And by “earlier in the year”, I mean about 5 minutes ago. ⏰

Although the OI has significantly increased in the last few days, the comparison suggests that traders are reducing their leveraged positions. Because, you know, they’re not stupid. 🤷♂️

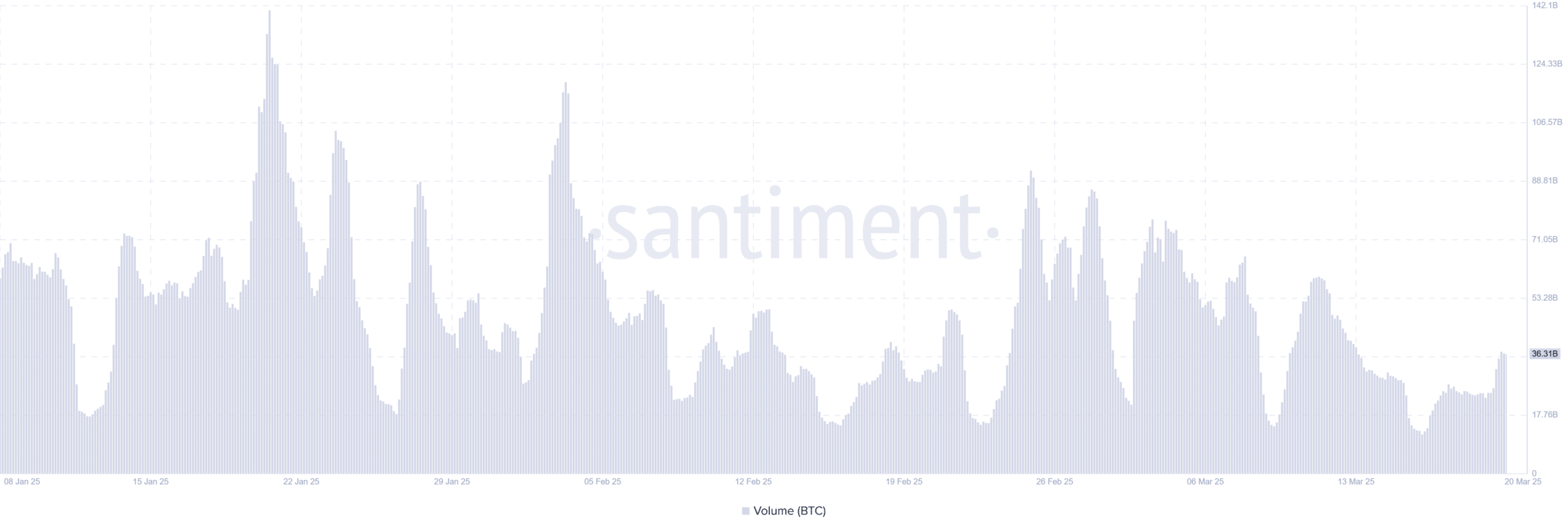

Meanwhile, as tracked by Santiment (those folks are always good for a laugh), Bitcoin’s trading volume has also seen a notable drop. BTC volume recently touched 36.31 billion, a sharp decline from its February highs. Because, you know, February was a really good month. 🤪

The lower volume confirms that fewer traders are actively engaging with BTC at its current price, increasing the likelihood of a downside move if buyers fail to step in. Or, you know, if buyers just decide to go for a walk. 🚶♂️

Key levels to watch (because you never know what might happen)

At the time of writing, Bitcoin was trading at around $85,856, facing resistance at $86,877. The 50-day Moving Average was at $85,873, acting as a crucial pivot point. Failing to hold above this level could send BTC back toward support at $80,000. Or, you know, it could just bounce right back up. 🤪

Conversely, if BTC breaks past $87,500, it could challenge the $90,000 level, which remains a psychological barrier. Because, you know, people are really good at psychology. 🤓

While a price breakdown is not yet confirmed, traders should keep a close eye on transaction volume and OI for signs of further deterioration. Or, you know, they could just go for a coffee. ☕️

Bitcoin could enter a prolonged consolidation phase or even a bearish correction in the coming weeks if network activity fails to recover. Or, you know, it could just do a little dance and everything will be fine. 💃

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Clarkson’s Farm Season 5: What We Know About the Release Date and More!

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- You Won’t Believe Today’s Tricky NYT Wordle Answer and Tips for April 30th!

2025-03-21 07:07