-

Saylor believes the world’s largest cryptocurrency is a ‘digital power’

MSTR outperformed BTC during its most recent recovery

As a seasoned crypto investor with a knack for spotting trends and making informed decisions, I find myself increasingly drawn to the wisdom of Michael Saylor, the chairman of MicroStrategy. His unwavering faith in Bitcoin (BTC) as a ‘digital power’ and his conviction that it is the future of global finance resonates deeply with me.

As a crypto investor, I’ve noticed some TradFi analysts criticizing Bitcoin lately, dismissing its role as a hedge following a significant price drop of around 15% on August 5. However, Michael Saylor, the Chairman of MicroStrategy, remains steadfast in defending Bitcoin, the world’s largest digital asset. He views Bitcoin’s volatility as a “necessary cost” for its utility and liquidity. In other words, the price fluctuations are simply part of the package when it comes to investing in this revolutionary asset.

“Volatility is the cost involved in generating massive amounts of credit and liquidity that’s instantly accessible anytime, anywhere, for everyone.”

According to Saylor,

“No one who understands Bitcoin is afraid of the volatility.”

Saylor’s Bitcoin advice to governments

As a crypto investor, I must admit that Saylor didn’t just point out Bitcoin’s potential, but also criticized the inefficiencies of traditional finance (TradFi) when compared to Bitcoin. In simpler terms, he was saying that Bitcoin is more efficient than TradFi.

“A significant shift is happening in international financial systems, with conventional finance only functioning about 19% of the time for approximately 10% of the world’s population. This equates to a 2% solution. On the other hand, Bitcoin serves as a complete solution, transcending political affiliations and simply offering a superior concept.”

For perspective, traditional finance exchanges like the NYSE halted equities trading over the past few weeks after reported glitches. On the contrary, Bitcoin has been up and online for over 99% of its existence.

Furthermore, Saylor emphasized Bitcoin as a ‘digital force’ that governments ought to consider adopting. By this statement, he likened it to the importance of nuclear and space power.

Bitcoin strategy trend

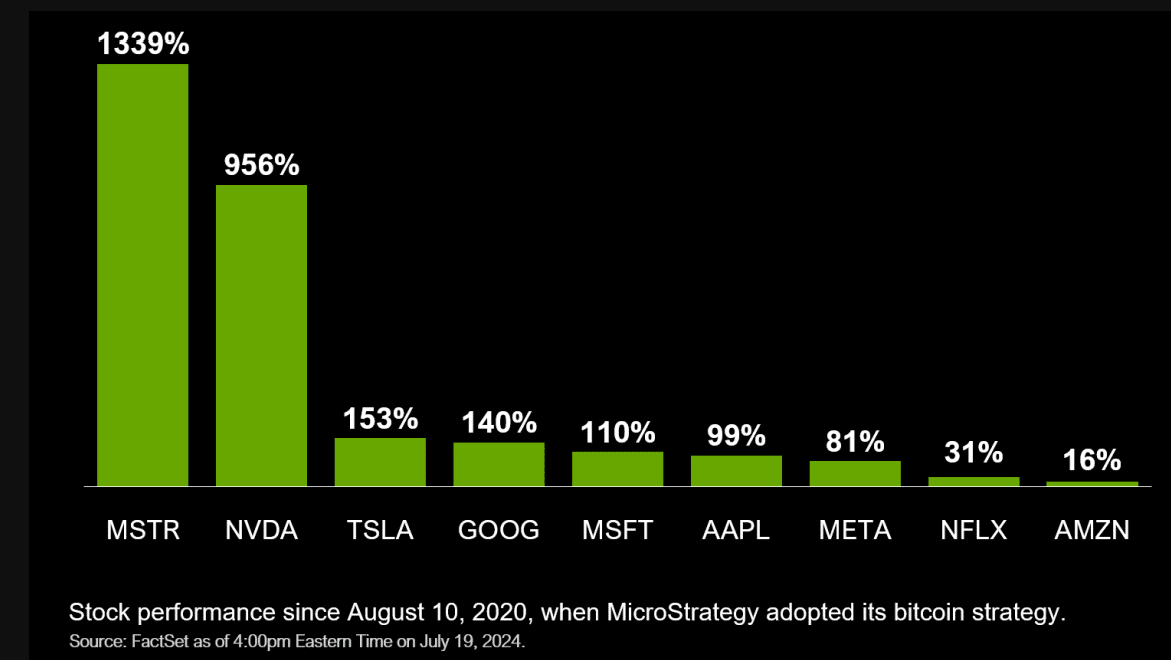

In a recent conversation with Fox Business, the leader expressed optimism that mirrored previous statements. The executive claims that their company’s stock, MicroStrategy (MSTR), surpassed all others due to its decision to implement a Bitcoin investment strategy.

“MicroStrategy is outperforming everything since they adopted #Bitcoin…It’s crushed everything.”

As an analyst, I can confidently state that my analysis shows Mastercard (MSTR) has significantly outperformed its peers, with a remarkable rally of more than 1000% since its adoption of cryptocurrencies in 2020. This impressive growth sets MSTR apart from the rest of the pack.

By the month of August, MicroStrategy had in its possession over 226,000 Bitcoins and intended to purchase an additional $2 billion worth of Bitcoin. Additionally, Saylor himself owns approximately $1 billion in Bitcoin on a personal level and is open to acquiring even more.

It’s worth noting that other companies are following MicroStrategy’s approach with Bitcoin. For example, in the U.S., Block Inc., which was co-founded by Jack Dorsey and serves as the parent company for Cash App, is among those companies implementing a strategic use of Bitcoin.

Worldwide, investment firm Metaplanet from Japan stands out as one of the most proactive companies embracing this strategy. Lately, they managed to acquire ¥1 billion to boost their Bitcoin holdings. Consequently, the value of TKO stock owned by the company has increased by approximately +600% in terms of year-to-date (YTD) performance when measured in Japanese Yen.

Over the same period, MSTR outperformed even BTC, at over 97%, against the digital asset’s 37%.

During the 8th of August, Mastercard’s (MSTR) stock underwent a 10-for-1 split to make it more accessible. This means that the number of MSTR shares increased tenfold, with each share now being worth just a tenth of its original value.

As I write this analysis, MicroStrategy (MSTR) is currently trading at $135. Over the past five trading days, it has experienced a significant surge of 27%, outperforming Bitcoin (BTC) which saw a 12% increase during the same period.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-08-11 06:16