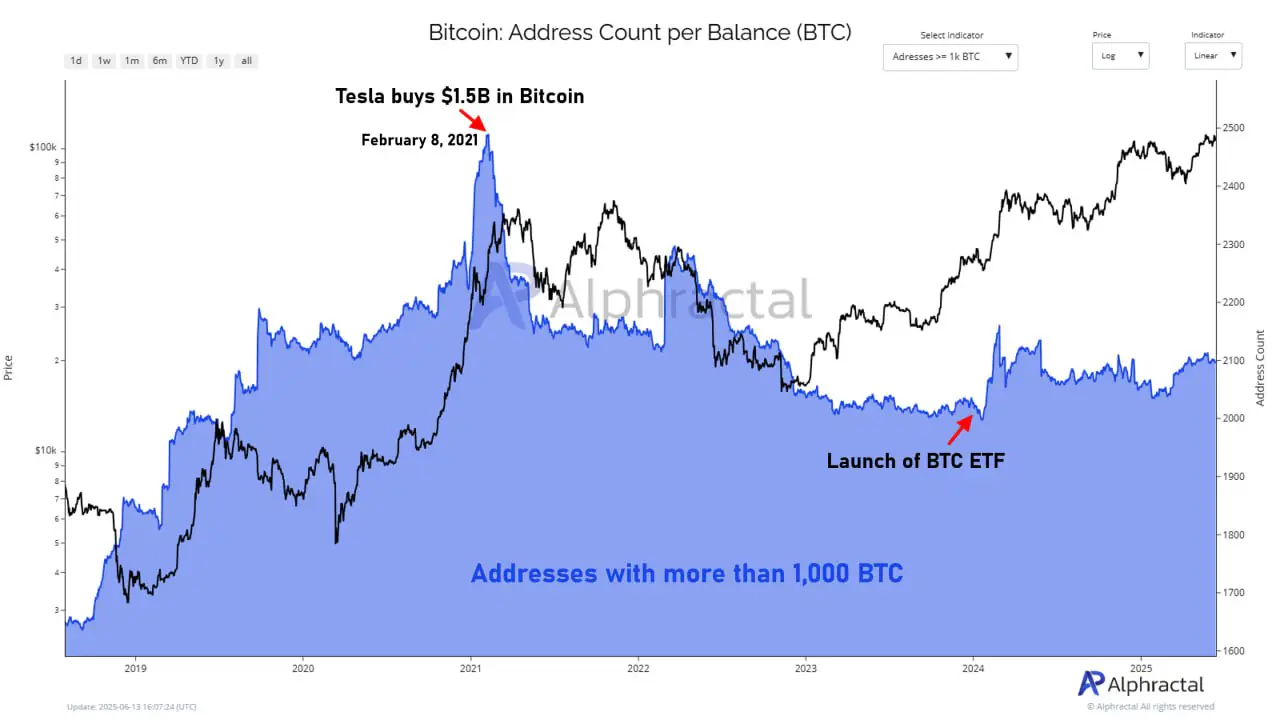

On the fateful day of February 8, 2021, the world of finance was rocked to its very core as Tesla, that audacious purveyor of electric chariots, declared its monumental acquisition of Bitcoin worth a staggering $1.5 billion. One might have expected this bold move to herald a new era of whale accumulation, yet, paradoxically, it seems to have signaled a turning point. Since that audacious proclamation, the number of wallets harboring more than 1,000 BTC—those typically belonging to the grand institutions or the crypto-savvy leviathans—has been on a steady decline. Who would have thought? 🤔

According to the report, the only notable interruption in this downward spiral occurred with the approval of spot Bitcoin ETFs in the early days of 2024. At that moment, the whale wallet counts experienced a brief resurgence, as if the great investors had suddenly remembered their love for the digital gold. But alas, this momentum was as fleeting as a summer romance. Since that initial ETF-driven spike, the number of wallets boasting 1,000+ BTC has merely shuffled sideways, showing no significant growth, despite Bitcoin’s relentless march into the mainstream and its price rallies that would make a rollercoaster jealous. 🎢

This brings forth a rather intriguing question: was Tesla’s foray into Bitcoin merely a coincidence, or did it signify the dawn of a new era in which the titans of finance engage with the market in a manner most peculiar? 🤷♂️

The stagnation in whale accumulation may well reflect a more diversified investor base, a burgeoning reliance on custodial and institutional trading services, or perhaps a growing trend among the large holders to scatter their coins across multiple addresses—like a squirrel hiding its nuts for the winter, but with a touch more sophistication. 🐿️

Yet, Alphractal’s data unveils a narrative that is both compelling and curious: while the price of Bitcoin continues to scale new heights, the composition of its most substantial holders is quietly transforming—an evolution that could very well have long-term ramifications for the dynamics of this ever-fascinating market.

Read More

2025-06-14 11:22