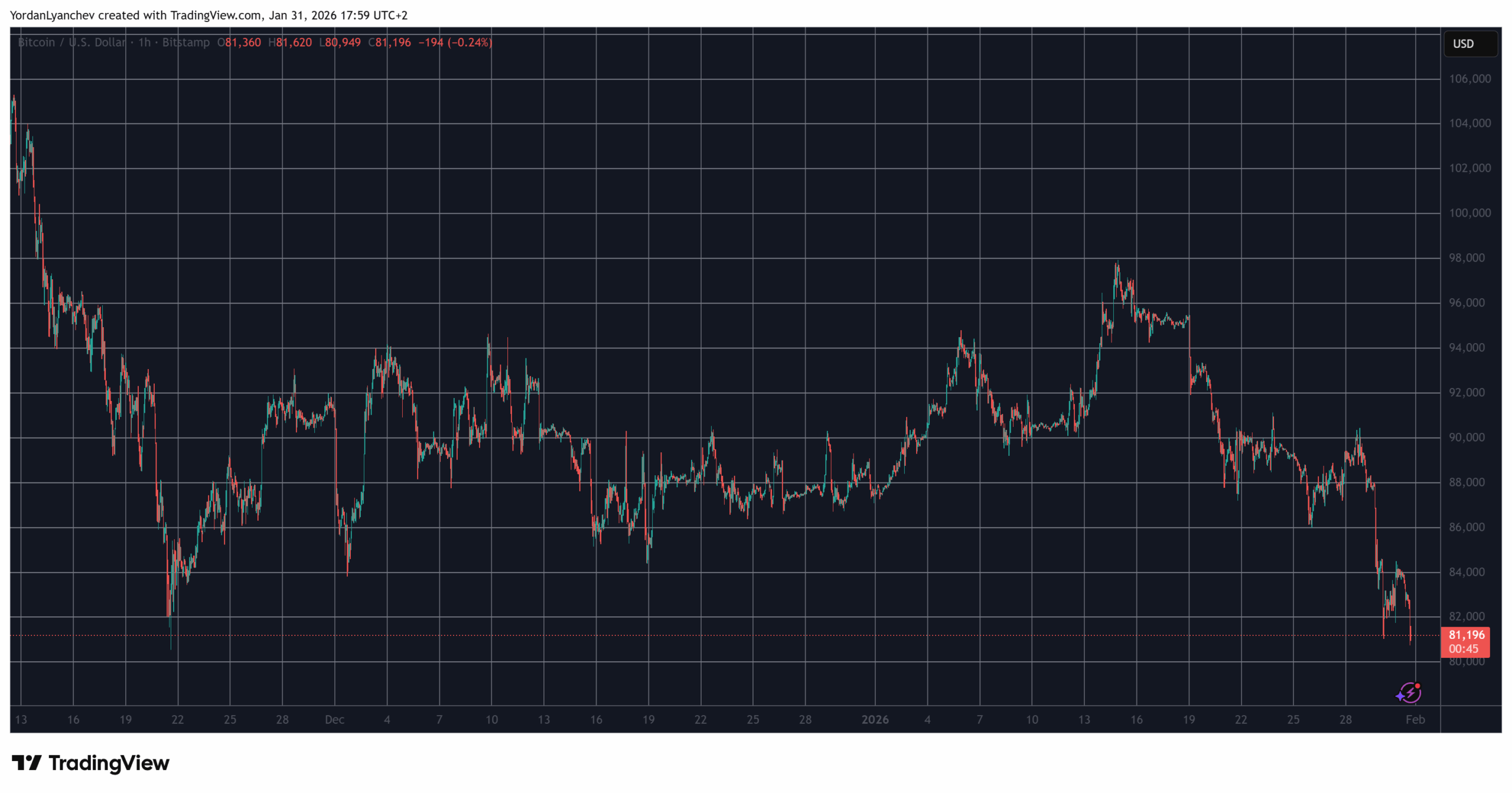

Well, butter my biscuit and call me a prophet, but it seems the mighty Bitcoin has taken a tumble that would make a circus acrobat blush. After a Friday as calm as a backwoods pond, where BTC lounged lazily between $83,000 and $84,000 while the precious metals market went belly-up, the cryptocurrency decided it was time to join the party-the wrong kind of party, mind you.

Cast your mind back to Thursday, if you will, when Bitcoin, full of swagger, tried to conquer the $90,000 peak. But, alas, it was rejected faster than a bad joke at a funeral. Within hours, it plummeted nine grand to a two-month low of $81,000. A sad tale, indeed, but one that seemed to have a silver lining when it rebounded to $84,000 on Friday. Turns out, that was just a dead-cat bounce-a fleeting moment of hope before the inevitable splat.

Meanwhile, silver and gold were having their own little meltdown, plunging 40% and 16%, respectively, and wiping out $7 billion in market cap faster than a politician can break a promise. But let’s not dwell on their misfortunes; Bitcoin’s woes are far more entertaining.

In the past few hours, BTC has slipped below $81,000, hitting its lowest point since November 21. The bulls are crying into their coffee, and the bears are doing a victory lap. Altcoins, never ones to miss a good disaster, are also deep in the red. Ethereum is down 7%, BNB and XRP are down 5-6%, and the whole crypto circus is in disarray.

Liquidations, you ask? Oh, they’re piling up like yesterday’s trash. Nearly $1 billion in positions have been wrecked in the past 24 hours, with longs taking the brunt of the pain-over $850 million, to be precise. And the number of liquidated traders? A whopping 240,000, according to CoinGlass. That’s enough tears to fill a small lake.

The crown jewel of this calamity? A single position on Hyperliquid worth over $13 million, involving ETH, which has been performing worse than a one-legged man in a butt-kicking contest. Talk about adding insult to injury.

So, there you have it, folks. Bitcoin’s wild ride continues, leaving behind a trail of broken dreams and liquidated accounts. As the old saying goes, “If you can’t stand the heat, stay out of the blockchain.” Or something like that.

Read More

- Best Controller Settings for ARC Raiders

- Every Targaryen Death in Game of Thrones, House of the Dragon & AKOTSK, Ranked

- The Best Members of the Flash Family

- The Pitt Season 2, Episode 7 Recap: Abbot’s Return To PTMC Shakes Things Up

- Battlefield 6 Season 2 Update Is Live, Here Are the Full Patch Notes

- Dan Da Dan Chapter 226 Release Date & Where to Read

- Duffer Brothers Discuss ‘Stranger Things’ Season 1 Vecna Theory

- Wreckreation Review – Burnout Lite

- 2D ‘Star Wars: Clone Wars’ Series Isn’t Canon, but It Is Great

- Good Luck, Have Fun, Don’t Die review: Clever, infectious and wildly original – AI be damned

2026-01-31 19:24