Let’s talk about the Fed’s recent 25-basis-point rate cut-because nothing says “trust us” like ending quantitative tightening in December. It’s like telling your kids you’re done cleaning up their room… until next week. Traders, ever the drama queens, reacted with all the subtlety of a toddler throwing a tantrum in a bakery. Bitcoin spiked, then backtracked like it was double-checking its own homework. Volatility? Please. That’s just the Fed’s version of “casual Friday.”

CryptoQuant’s latest report is the financial equivalent of finding out your neighbor’s dog made $300B in spot volume this month. October was a party, and Binance was the DJ spinning Bitcoin tracks nonstop. $174B on one exchange alone? That’s more than my life savings, which I keep in a shoebox labeled “emergencies” (read: Netflix subscriptions). Retail and institutional investors are ditching leveraged bets like they’re last season’s fidget spinner. Who knew Bitcoin could be both thrilling and boring? A real emotional rollercoaster.

The shift to spot trading is like switching from a trapeze to a tricycle-less flashy, but way safer. Darkfost, the oracle of crypto, says this trend is “healthy,” which I guess means it’s not a dumpster fire. Binance, ever the king of chaos, dominates the scene with its “deep liquidity” and “global retail base.” Translation: They’re the reason your grandma now knows what a blockchain is. And yes, she still calls it “the Bitcoin thing.”

October 10th’s liquidation event was crypto’s version of a reality TV car crash. Everyone watched, no one looked away. Traders learned the hard way that leverage is like a chainsaw: great for cutting things, terrible for your fingers. Now, folks are buying Bitcoin like it’s groceries at Costco-no frills, just bulk. Who needs 10x leverage when you can just… own the actual thing? Groundbreaking.

Spot volume leading the charge? That’s the financial equivalent of eating your vegetables before dessert. It’s sustainable, it’s organic, and it’s not a gamble. Think of it as Bitcoin’s version of a salad-healthy, if you ignore the kale. And if history repeats itself, we might just see a bull run that doesn’t end in a hospital bed. Fingers crossed.

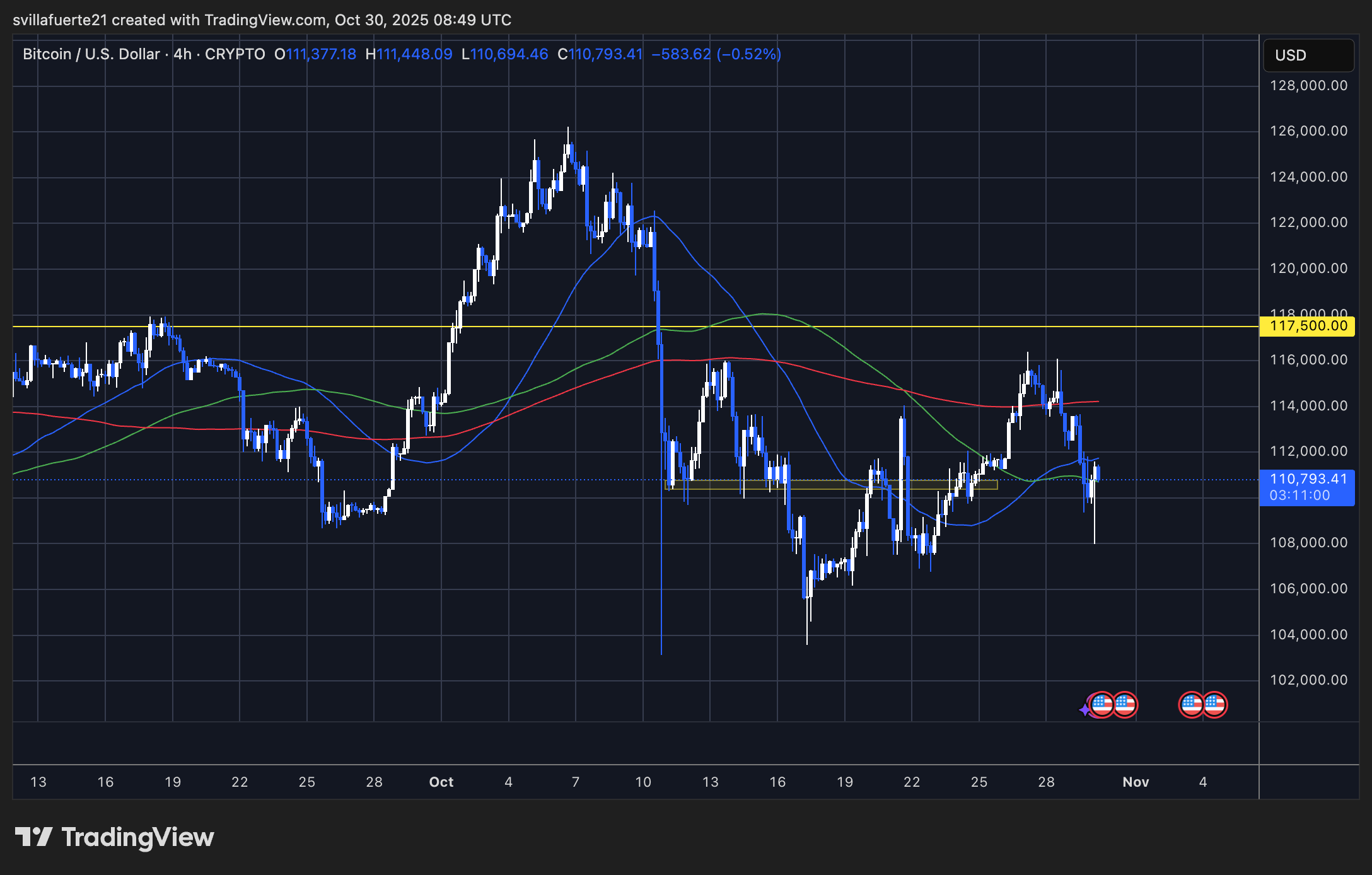

Bitcoin’s current price? Let’s just say it’s stuck in a tug-of-war between bulls and bears. Right now, it’s testing support at $110,000 like it’s trying out for a reality show. If it breaks below $108,500, we’re looking at a trip to the “$102,500 or bust” express. On the flip side, a push above $114,500 might get bulls back in the game-assuming they don’t all get distracted by TikTok dances. Either way, it’s a show worth watching, even if you’re just doing it for the memes.

Read More

- How to Get the Bloodfeather Set in Enshrouded

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- The Pitt Season 2, Episode 7 Recap: Abbot’s Return To PTMC Shakes Things Up

- Best Controller Settings for ARC Raiders

- Every Targaryen Death in Game of Thrones, House of the Dragon & AKOTSK, Ranked

- The Best Members of the Flash Family

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- Duffer Brothers Discuss ‘Stranger Things’ Season 1 Vecna Theory

- KAMITSUBAKI ACADEMY NEWSPAPER CLUB adds Switch version, launches October 30

- 10 Best Modern Slasher Movies Ranked

2025-10-30 19:42