Well, well, well! It appears Bitcoin has been galloping along at quite the pace these past few weeks, smashing through the hefty psychological barrier of $90,000 as though it were made of marshmallow. And, if you thought that was the peak, think again! On the merry Friday of April 25th, Bitcoin decided to put on a show, and in a delightful twist of fate (and possibly a dash of luck), it crossed the $95,000 threshold. Hold onto your hats, folks, this rollercoaster isn’t stopping anytime soon!

So, Who’s The Puppet Master Behind This Bitcoin Ballet?

In a delightful new post on the X platform (where the world’s greatest thinkers share their most profound insights), the ever-diligent on-chain analyst, IT Tech, took the liberty of unwrapping this recent Bitcoin surge, peeling back the layers of mystery like a cryptic onion. Turns out, the main culprits behind this meteoric rise from around $74,000 to $95,000 are none other than the traders themselves! Yes, it seems these crypto-cowboys are leading the charge, with their FOMO-fueled buying spree fueling the flames of speculation.

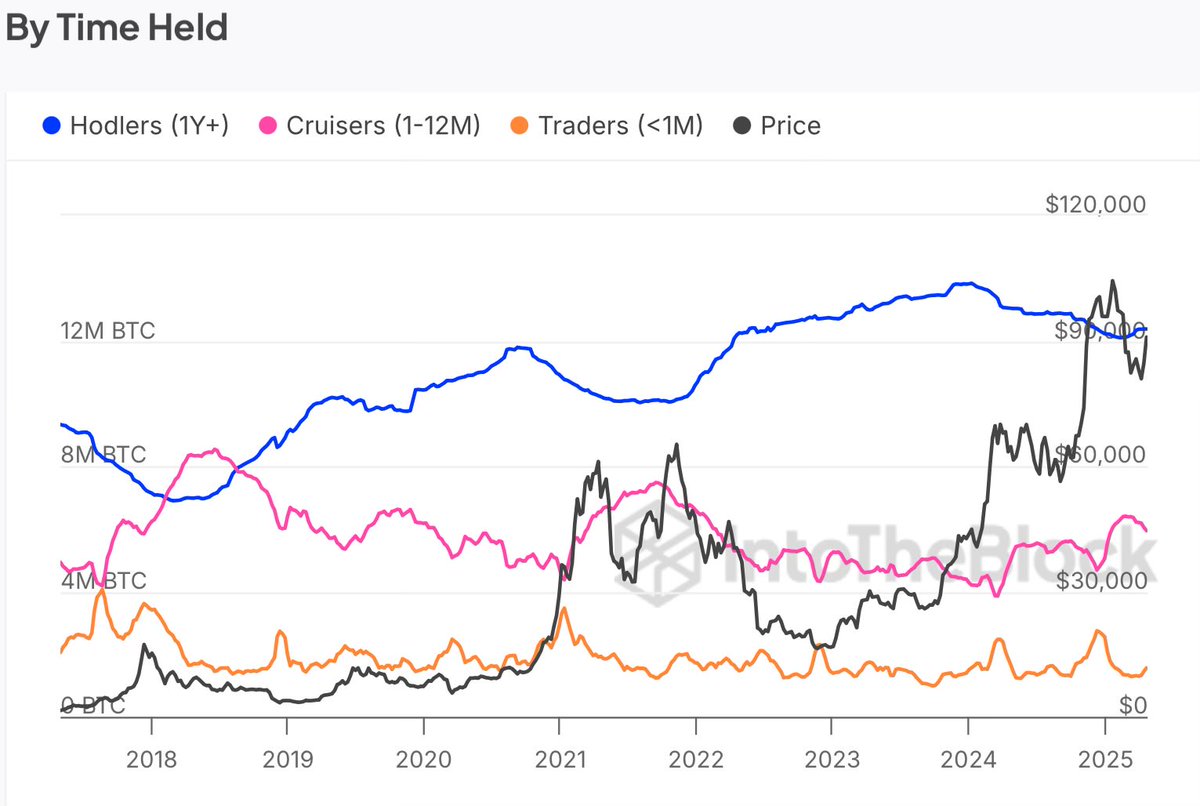

According to our techno-savant, IT Tech, a little dive into blockchain data reveals a rather interesting rotation of capital. The real heroes? The short-term holders (or traders, if you’re feeling formal), who have upped their holdings by nearly 19% in the last 30 days. Naturally, these are the very same people who, driven by the mysterious force known only as ‘Fear Of Missing Out,’ have been snapping up Bitcoin with the enthusiasm of a squirrel in a peanut factory. Yes, folks, this frenzy began when Bitcoin was lounging around the $74,000 mark, and now look where we are: above $95,000 and charging ahead like a bull on a pogo stick.

But there’s more! Long-term holders, the stalwart guardians of the crypto realm, seem to have taken a more laid-back approach recently, presumably popping their feet up with a nice cup of tea. They’ve stopped offloading their precious BTC, thus relieving the “major overhead pressure” that was once a looming presence. In fact, data from IntoTheBlock shows that these long-term holders have increased their Bitcoin holdings by a modest 0.3% in the last month. It’s a tiny shift, but a shift nonetheless.

Ah, but the plot thickens! Enter the ‘Cruisers’ — those Bitcoin holders who have held onto their assets for a quaint little period of 1 to 12 months. As it happens, their balance has shrunk by 4.4% in the past month, likely because they’re either evolving into “Hodlers” (the true, noble keepers of the coin) or, more likely, cashing in on their gains. Ah, the sweet scent of profits in the air! 🍀

Now, IT Tech rounds off the analysis by suggesting that we may very well be entering a speculative bull run, fueled by short-term capital surges and long-term stability. But hold your horses — the analyst also warns of the ever-present volatility. With short-term holders still pulling the strings, the market is likely to remain as unpredictable as a cat in a room full of laser pointers. In other words, hold onto your wallets — we may not have hit the peak just yet.

Bitcoin’s Price, In Case You Were Wondering…

As of the moment I’m typing this (and yes, I’m still working away while the crypto world spins madly on), Bitcoin is lounging around a hearty $95,210, reflecting a solid 2% bump in the last 24 hours. The future, as ever, remains uncertain, but oh, what a ride it’s going to be!

Read More

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- OM PREDICTION. OM cryptocurrency

- Disney’s Animal Kingdom Says Goodbye to ‘It’s Tough to Be a Bug’ for Zootopia Show

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- The Weeknd Shocks Fans with Unforgettable Grammy Stage Comeback!

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Jay-Z and Diddy Celebrate as Rape Lawsuit is Shockingly Dismissed!

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

2025-04-27 07:16