Attention, all crypto enthusiasts and skeptics alike! Bitcoin has once again hit a new all-time high, briefly moving above $121,000 before stabilizing near $120,500. The price is up 2.54% today, continuing a strong trend that started earlier this month. But is this rally sustainable, or nearing a slowdown?

Well, grab your popcorn and buckle up, because it’s about to get interesting!

Holders Aren’t Taking Profits Yet

The adjusted Spent Output Profit Ratio (aSOPR) currently sits at 1.03, well below the early July 2025 levels, where aggressive profit-taking pushed the ratio much higher. This time, despite Bitcoin making new highs, traders appear to be holding instead of selling.

This means most coins being moved on-chain are not being sold for massive gains, which suggests the rally is not overheated. In other words, we’re not seeing a mad dash for the exits just yet.

SOPR shows whether BTC moved on-chain is being sold at a profit (>1) or at a loss (<1). Adjusted SOPR fine-tunes the metric and filters out short-term internal transactions to show whether BTC moved on-chain is being sold at a profit or loss.

Volume is Supporting the Rally

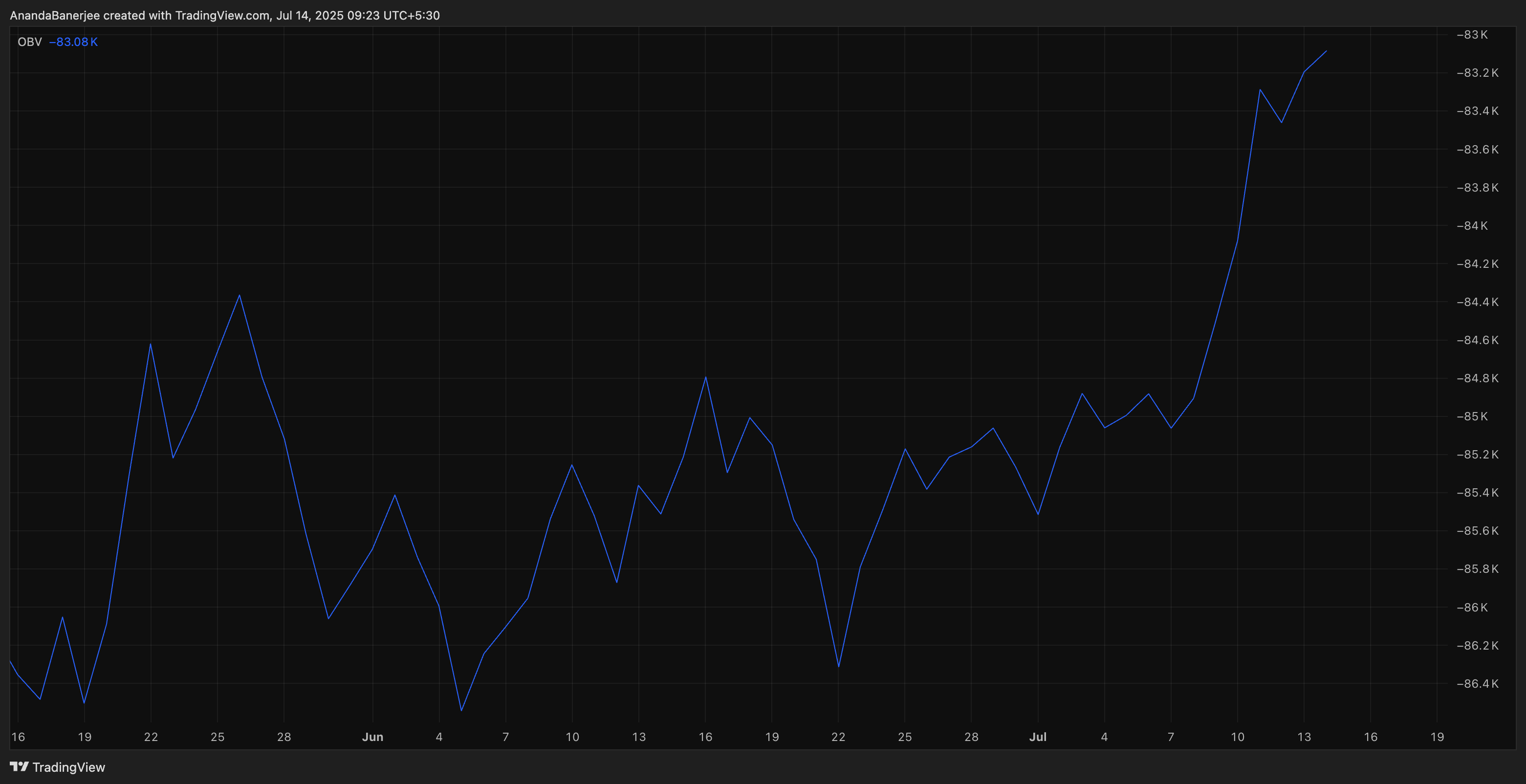

On-Balance Volume (OBV) is moving up in tandem with Bitcoin’s price, a key sign that buying volume is keeping pace with the rally. There’s no visible divergence, no breakdown in momentum.

BTC is going up, and the volume is going with it, not against it. It’s like having a parade where everyone’s marching in step, instead of a chaotic mob.

OBV measures cumulative buy/sell pressure based on daily volume direction. It is a bullish sign when it follows a positive price trend.

BTC Price Structure and Next Levels

BTC is currently holding just below $121,519, a key resistance level from the Trend-Based Fibonacci Extension. If Bitcoin closes above this level, the next extension target is $127,798, followed by $135,425. These are long-range projections based on previous trend behavior.

Trend-Based Fibonacci Extension is a tool that uses three key price points: a low, a high, and a retracement, to project future resistance levels in a trending market. It’s like having a crystal ball that tells you where the price might go next, but with a fancy name and a bit more math involved.

If BTC consolidates, near-term support sits at; $117,109, which is a prior breakout area. The bullish trend would weaken if BTC falls below $112,699, a key support level near the first all-time high, especially if exchange inflows spike or SOPR starts to rise sharply. That would suggest holders are starting to take profits aggressively, which could lead to a pullback or trend reversal. But hey, who doesn’t love a good plot twist?

Read More

- Survivor’s Colby Donaldson Admits He Almost Backed Out of Season 50

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- Best Controller Settings for ARC Raiders

- Gold Rate Forecast

- How to Build a Waterfall in Enshrouded

- The Sci-Fi Thriller That Stephen King Called ‘Painful To Watch’ Just Joined Paramount+

- Samson: A Tyndalston Story Studio Wants Players to Learn Street Names, Manage Hour-to-Hour Pressure

- Fatal Fury PS5, PS4 Will Return with a Second Season of DLC Fighters

- Battlefield Just Made a Change That Will Make Rush & Breakthrough Easier for Attackers

- Death Stranding 2: Best Enhancements to Unlock First | APAS Guide

2025-07-14 07:56