Well now, if it ain’t our old friend Bitcoin makin’ a return from the grave! After a spell of sell-offs that could scare a ghost, the little coin that could is strutting its stuff again. Just fancy that! After takin’ a nosedive to around $103,000 on October 10, it’s managed to bounce back and is now testin’ the waters around $111,000. Traders are feelin’ a smidgen of relief, although on-chain data has got a few folks sweatin’ bullets still. 😅

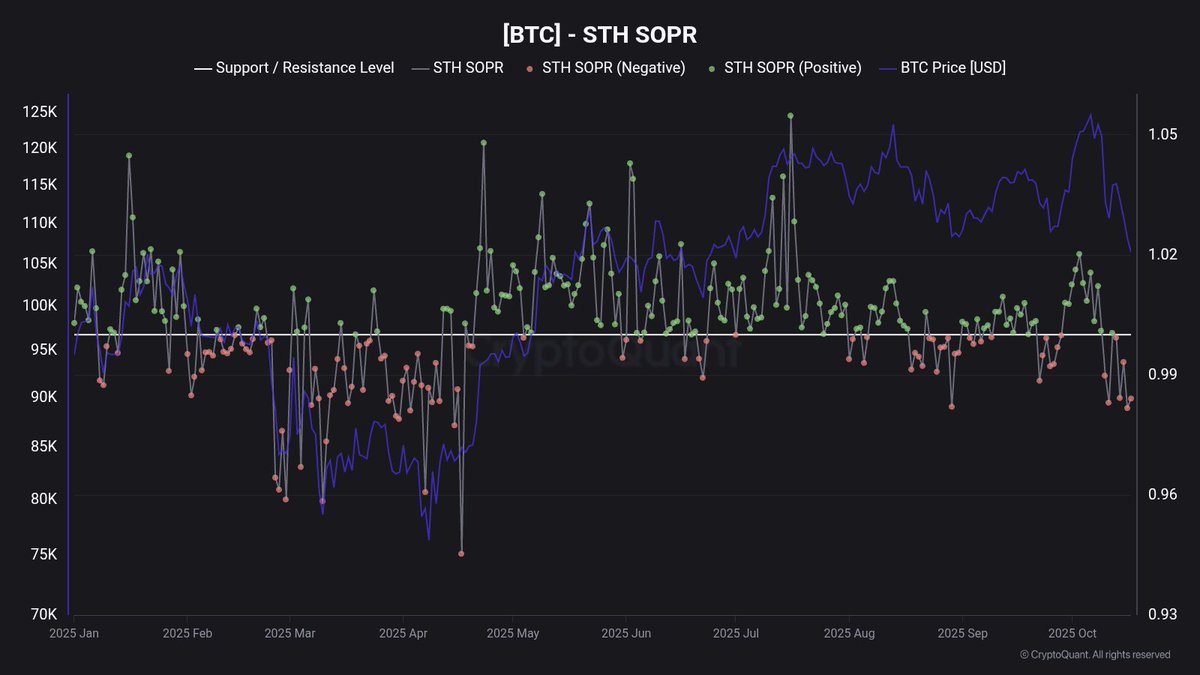

As per the good folk over at CryptoQuant, our Short-Term Holders – those who keep their Bitcoins for less than 155 days, bless their hearts – are sellin’ below what they paid. Well, slap my knee! That’s a clear sign of capitulation right there! Historically, whenever these poor souls throw in the towel, it usually means the market has hit rock bottom and the stronger hands are ready to pick up the pieces. 🙃

This might mean that Bitcoin’s workin’ its way down to a comfy spot, but hold your horses! The air’s still thick with uncertainty. The next day or two will show whether this bounce has got any grit to it, or if it’ll just get waylaid on the highway of disappointment again. 🚧

Short-Term Holders Wave the White Flag

Now, that CryptoQuant analyst, Maartunn, tells us that the Spent Output Profit Ratio (SOPR) for Short-Term Holders has drizzled down to 0.98, the lowest it’s been since April 2025! Bless their hearts-they’re losin’ money faster than a one-armed bandit on a bad day! 💔

History’s shown us that when this SOPR takes a tumble, it signals the end of a correction phase, flushing out the weak hands so the savvy ones can swoop down and grab those coins. In 2023, 2024, and early 2025, this here metric has been like a fortune teller predicting major rebounds. But don’t get too cozy-Maartunn warns us that for any recovery to be legit, Bitcoin better stick close to its realized price levels and important moving averages. 🧐

The market’s now at a crossroads of sorts. Having bounced back from that $103,000 low to play at $111,000, it’s still got a touch of fragility. If it can hold onto that range between $111,500 and $113,000, we might just see some bullish cheerleaders poppin’ up. But! If it can’t keep its grip, we might find ourselves skedaddling back toward $100,000 or lower. 🏃♂️💨

If the SOPR can settle down and start ascending again, it’ll be a sign that our dear Bitcoin is shifting gears from capitulation to re-accumulation-hello new uptrend! But if the selling frenzy keeps up and sentiment dives further, we’re lookin’ at a long, drawn-out period of boredom before we can fire up the next bullish leg. Right now, Bitcoin’s sittin’ pretty on the edge, hangin’ between recovery dreams and the harsh reality of macro uncertainty. 😬

Bitcoin Tries Its Hand at Short-Term Recovery While Resistance Lurks

With an air of tenacity befitting a stubborn mule, Bitcoin’s showin’ early signs of rebound after that October 10 tumble that sent it below $104,000. On the 4-hour chart, BTC is pokin’ around near $111,200, tryin’ to reclaim its position among short-term moving averages after days of dismal trends. This little jump is a sign of a shift in day-to-day sentiment, but the crowd is still playin’ it cautious. ⚠️

The next stop on this rollercoaster lies around $113,000-$114,000, where the 200 SMA is sittin’ like a grumpy old man who won’t let anyone through. If Bitcoin manages to break above this zone, we could be in for a wild ride towards $117,500, which seems to have more liquidity than a bar on a Friday night. But if it stumbles again, we might be trudging back toward that $107,000-$106,000 pit stop, where strong buyers were last seen makin’ a scene. 🍻

Momentum indicators are givin’ signs of improve-ment, but they ain’t exactly throwin’ a party yet. The volume’s flatter than a pancake, and funding rates are still sittin’ in the negative-like traders still got one foot in the bearish camp and one foot in a quicksand. This setup often leads to larger short squeezes, but we’re still comin’ up short on confirmation.

As it stands, Bitcoin’s short-term outlook favors a cautious smidgen of optimism. Holdin’ above $110,000 could fuel a case for recovery, while rejection at higher levels might flip the script and send mourners cryin’ back to the recent lows. The next few sessions will be as decisive as a coin toss-heads we win, tails we weep. 🤷♂️

Read More

- How to Get the Bloodfeather Set in Enshrouded

- 4 TV Shows To Watch While You Wait for Wednesday Season 3

- Gold Rate Forecast

- One of the Best EA Games Ever Is Now Less Than $2 for a Limited Time

- Auto 9 Upgrade Guide RoboCop Unfinished Business Chips & Boards Guide

- Best Werewolf Movies (October 2025)

- 32 Kids Movies From The ’90s I Still Like Despite Being Kind Of Terrible

- 10 Movies That Were Secretly Sequels

- Goat 2 Release Date Estimate, News & Updates

- Pride and Prejudice’s latest adaptation has ‘stubborn, vulnerable’ Elizabeth Bennet, reveals BAFTA winner

2025-10-21 01:44