Behold, in the year 2025, as the sun set over the digital realm, Bitcoin’s price stood at $118,629 to $118,823, a range so narrow it could fit in a teacup. Its market capitalization, a staggering $2.35 trillion, which is roughly the GDP of a small country… if that country were made of cryptocurrency. The 24-hour trading volume, $38.23 billion, a figure so large it makes your average lottery jackpot look like a penny. Yet, amid this grandeur, a consolidative pattern emerged, as if the market itself were taking a nap. 🧘♂️

Bitcoin

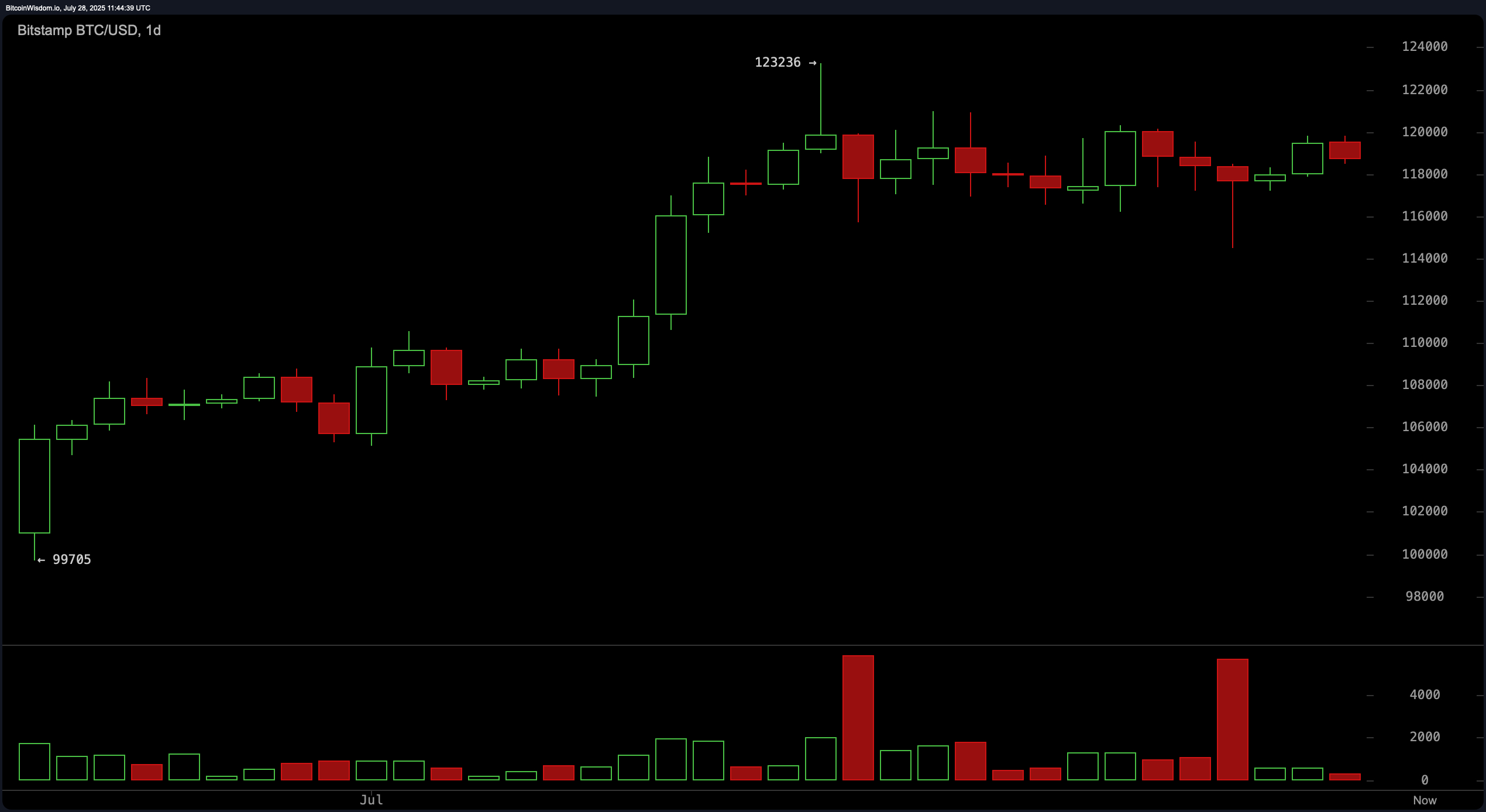

On the daily chart, bitcoin persists in its uptrend, a noble struggle from its base around $99,700. Yet, recent candles suggest a plateau, as if the price were saying, “I’ve had enough of this climbing nonsense.” A volume spike leading to a peak at $123,236, followed by a decline, hints at buyer exhaustion—a tragic tale of hope fading like a sunset. Long upper wicks on recent candles imply rejection at higher levels, as if the market were whispering, “Not today, Satan.” Traders, beware! A pullback to $114,000–$116,000 may soon arrive, with entry signals hinging on bullish reversal patterns. 🧠

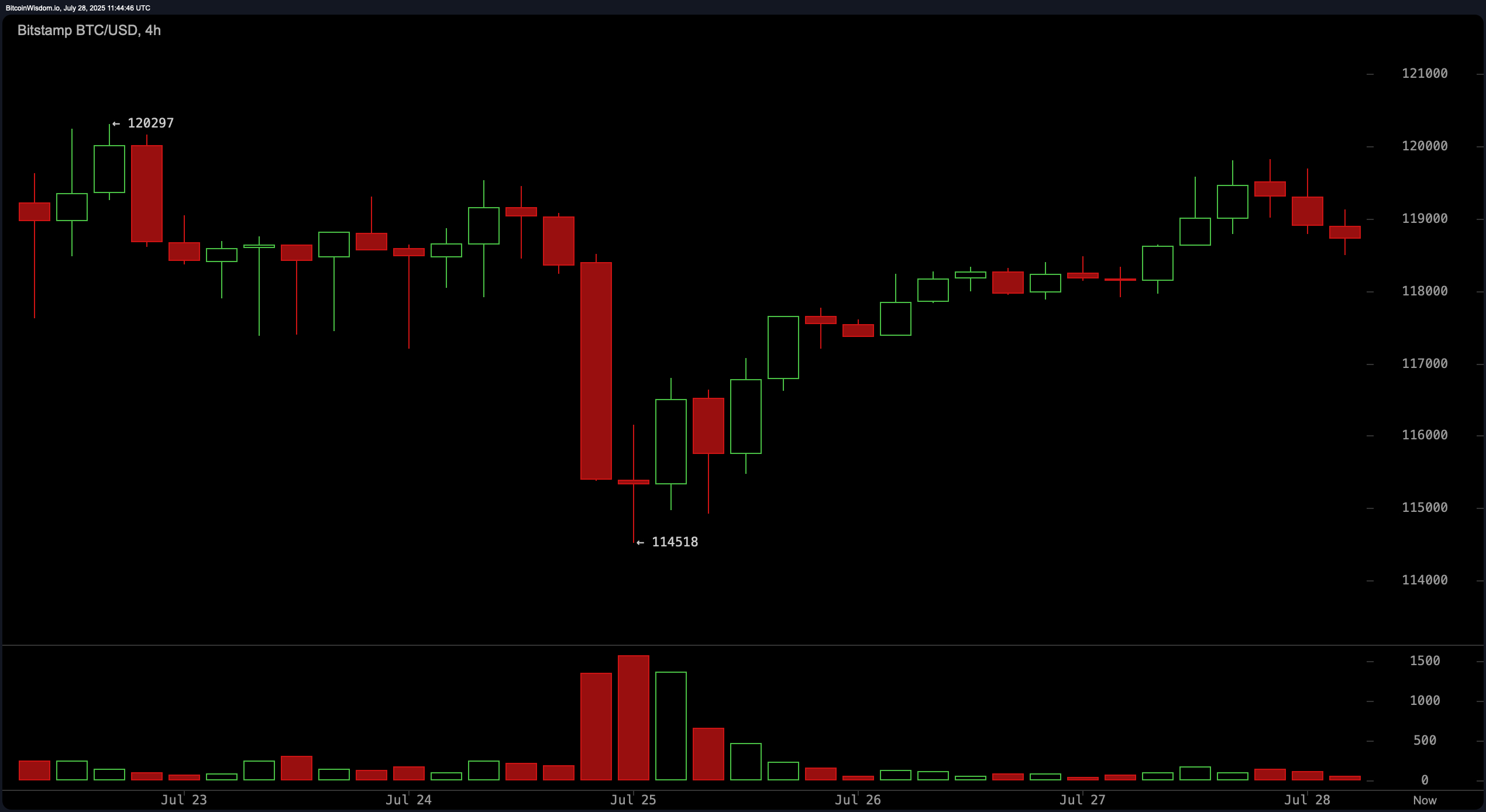

On the 4-hour chart, bitcoin experienced a sharp sell-off, a dramatic descent from $120,297 to $114,518, followed by a swift V-shaped recovery. However, the rally stalled around $119,500–$120,000, and subsequent candles show a series of lower highs, indicating weakening upward momentum. A potential entry exists if the price rebounds from the $116,500–$117,000 zone with volume confirmation. Aggressive traders may consider entering above $119,800 if strong buying volume returns. But if the price breaks below $114,000, this would invalidate bullish setups, prompting exits. A true test of patience, or perhaps a lesson in futility. 🧨

The 1-hour bitcoin chart reveals a range-bound structure between $117,900 and $119,800, with increasing bearish pressure and a sequence of lower highs. Traders should seek long positions only if the price holds above $118,000, supported by green candle volume. Short-term scalping may be viable between $117,800 and $118,000. Target exits are set around $119,800, with a stop-loss below $117,500 to guard against trend reversals. A dance of risk, where every step could lead to glory or ruin. 🕺

Oscillator readings largely remain neutral, indicating indecision in the market. The relative strength index (RSI) stands at 61, while the Stochastic oscillator and the commodity channel index (CCI) read 54 and 67, respectively—each signaling neutrality. The average directional index (ADX) at 26 confirms a weak trend, and the Awesome oscillator shows a value of 4,468, also neutral. The momentum indicator is the sole bullish signal with a reading of 747, while the moving average convergence divergence (MACD) level at 2,230 signals bearish sentiment. A market as fickle as a teenager’s mood. 😅

Moving averages (MAs) paint a broadly bullish picture across all major periods. The exponential moving averages (EMAs) and simple moving averages (SMAs) from 10 to 200 periods all indicate a bullish direction, pointing to the prevailing uptrend despite recent consolidation. Notably, the 10-period EMA and SMA hover around $118,304 and $118,372, respectively, aligning closely with current price levels and potentially providing short-term support. A beacon of hope in a sea of uncertainty. 🌊

Bull Verdict:

Bitcoin continues to demonstrate underlying strength with all major moving averages signaling a buy, suggesting that the broader uptrend remains intact. If volume returns and price breaks convincingly above $120,000, bulls may regain control, pushing bitcoin toward a retest of the $123,000–$124,000 resistance zone. A tale of triumph, or perhaps a fool’s errand. 🦄

Bear Verdict:

Despite the prevailing uptrend, declining momentum and multiple rejections near $120,000 point to potential exhaustion. If bitcoin fails to hold above key support at $117,500 and breaks below $114,000, bearish pressure could intensify, triggering a deeper retracement toward lower support zones. A warning from the shadows, where the wolves of fear lurk. 🐺

Read More

- Where Winds Meet: How To Defeat Shadow Puppeteer (Boss Guide)

- Survivor’s Colby Donaldson Admits He Almost Backed Out of Season 50

- Gold Rate Forecast

- Best Controller Settings for ARC Raiders

- Resident Evil Requiem cast: Full list of voice actors

- How to Build a Waterfall in Enshrouded

- Best Thanos Comics (September 2025)

- Best Shazam Comics (Updated: September 2025)

- The 10 Best Episodes Of Star Trek: Enterprise

- 10 Most Terrifying TV Episodes of All Time

2025-07-28 16:18