- It appears a Bitcoin bear market might just be lurking around the corner if BTC decides to play the fool and breaks below those all-important support levels.

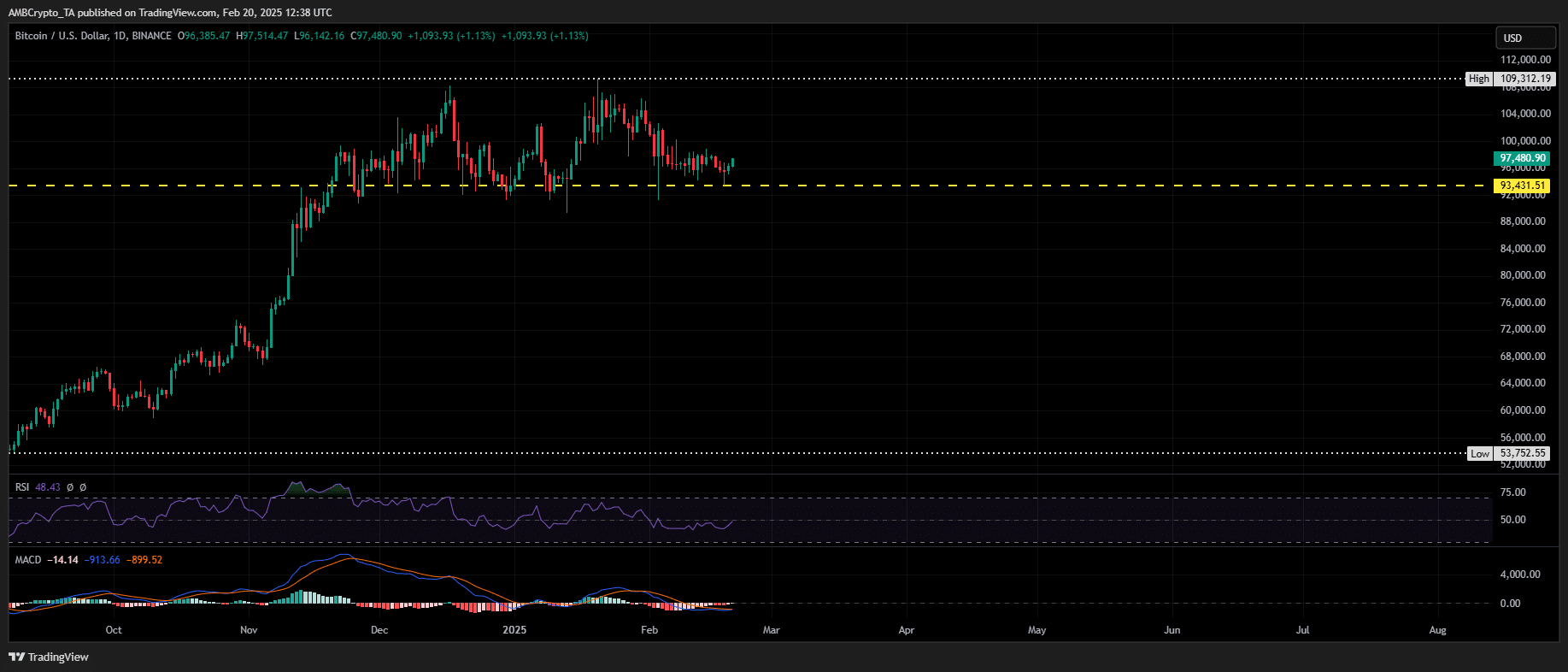

- With BTC bouncing about like a rubber ball from $94K to $96,200, one might say volatility is strutting its stuff!

In a most curious turn of events, Bitcoin [BTC] dipped its toes under $94K before springing back to $97,200, leaving volatility to do a merry jig.

In this topsy-turvy climate, the specter of a Bitcoin bear market looms ominously, especially if those key investor groups, currently lounging on their unrealized profits, decide to sell off their treasures.

Key levels to watch

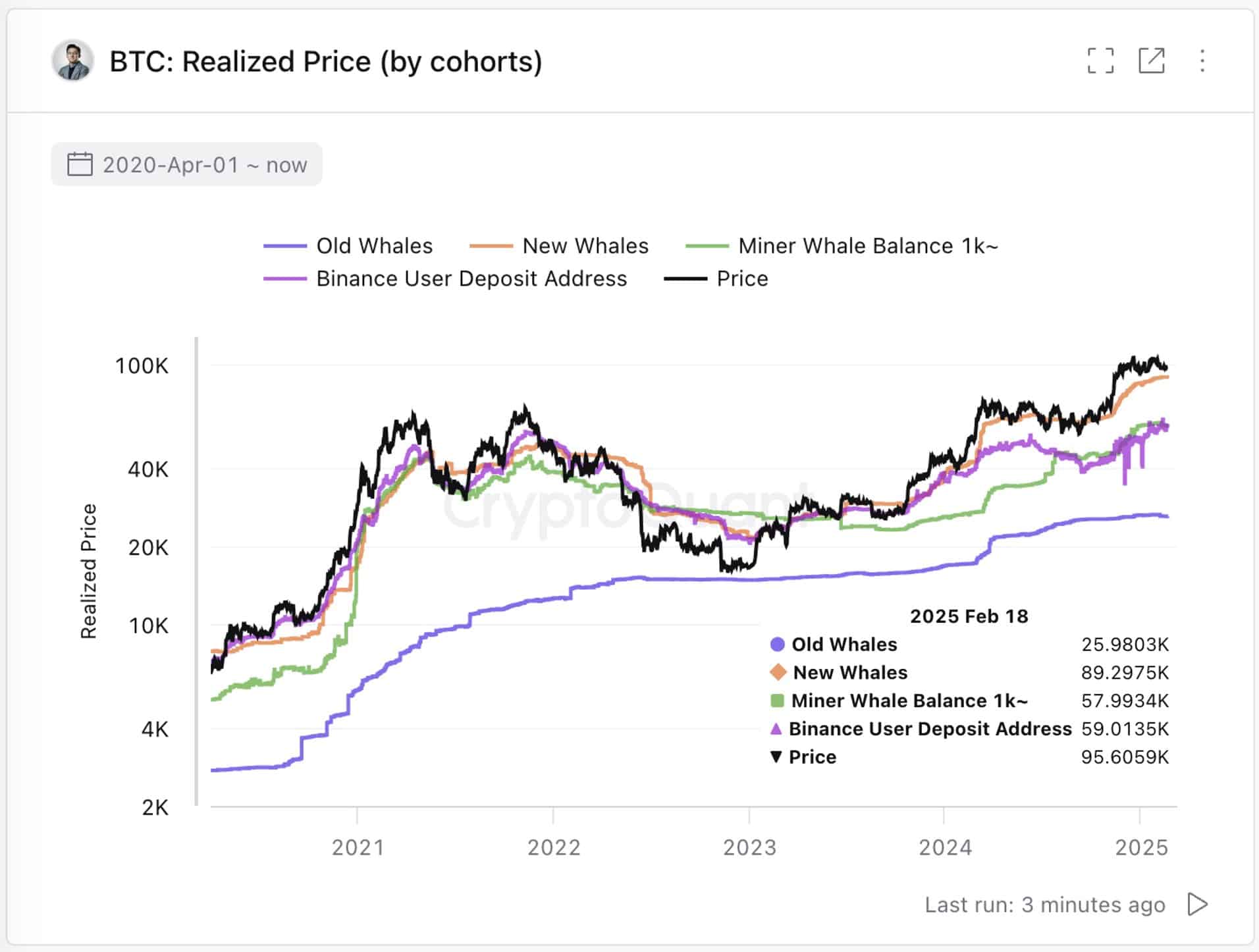

If BTC loses its pep, a tumble below $89,300 could send short-term holders (those cheeky whales with 1,000+ BTC held for less than 155 days) into a frenzy of profit-taking, thus increasing the sell pressure. Oh, the drama!

However, the level that truly deserves a monocle and a top hat is $58,000 – the realized price of our dear miner whales (those wallets belonging to mining companies hoarding over 1,000 BTC).

Historically speaking, breaking below this illustrious mark has confirmed the onset of Bitcoin bear market cycles, making it a critical long-term support. Quite the nail-biter, I must say!

While BTC is currently holding a safe margin, sustained volatility could put these levels to the test. Holding above them is as crucial as a butler at a dinner party to maintain that bullish market structure.

Will bulls prevent a Bitcoin bear market?

Despite a rather hawkish macro backdrop in the U.S., our valiant bulls have managed to stave off a Bitcoin bear market by valiantly defending the $90K level for over a month. Bravo! This signals a strong demand, indeed.

However, prolonged consolidation near resistance suggests we might be stepping into a liquidity trap. Oh dear!

If BTC decides to breach $99K without a hearty demand at the spot, those leveraged long positions could find themselves in a bit of a pickle, triggering liquidation cascades. Quite the spectacle!

A drop back to $90K would then be a pivotal test. Losing this level could send BTC tumbling toward $89,300, where our short-term holder whales may begin to offload, increasing the downside pressure. What a turn of events!

While a Bitcoin bear market isn’t yet confirmed, weak ETF inflows, fading FOMO, and declining network activity could trigger a sharp reversal, wiping out billions in leverage. A most unfortunate affair!

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2025-02-20 23:06